A down week, what Trump might mean for markets, and more (NOTW#21)

Don’t forget that Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Hi reader,

Both indices were significantly down this week after a spectacular prior week. This obviously got speculators speculating again, just like they were doing last week (speculators be speculating, you know). Most continue trying to forecast what the Trump administration means for their portfolios, but I believe many tend to overestimate two things (discussed in the market overview).

Without further ado, let’s get on with it.

Articles of the week

I published three articles this week. The first one was Constellation’s Q3 earnings digest. The company reported excellent earnings again, portraying how the trade-off between profitability and capital deployment works. I explain what this means in the article.

The week's second article was part 3 of the last company I added to my portfolio, where I discussed three relevant topics: management and incentives, capital allocation, and valuation. This is a somewhat special company in this regard because it doesn’t have a track record in public markets.

Lastly, I published an article about ASML’s Capital Markets Day 2024. The company reaffirmed 2030 guidance and shared some content on several interesting topics (all of which I discuss in the article).

Market Overview

It was a pretty volatile week in financial markets. After an outstanding last week, both indices were significantly down this week. The S&P 500 dropped 2%, whereas the Nasdaq dropped more than 3%:

It’s tough to pinpoint a reason behind this week’s decline, but it’s also tough to identify a reason behind last week’s frenzy, so there’s that. I think Jeff Bezos’ famous quote illustrates to perfection how a long-term investor should feel about these short-term market swings:

When the stock is up 30% in a month, don't feel 30% smarter -- because when the stock is down 30% in a month, it's not going to feel so good to feel 30% dumber.

Markets are inherently volatile, probably more so in modern times where there’s an increasing flow of information and algos dominate daily trading. At the risk of sounding like a broken record, I would recommend reading this book to understand what moves indices and stock prices every day (spoiler: it’s not fundamentals):

When things like these happen, it’s also worth zooming out. The Nasdaq and the S&P 500 are still close to all-time highs and came back on Friday to levels not seen since (*checks notes*) last week!

Investors keep trying to gauge what will happen to the economy and financial markets during Trump’s administration and how it might impact their holdings. There’s no denying that a new president promises to impact financial markets and any portfolio, especially considering how polarized politics have become. A President change nowadays can probably have a greater impact than it might have had 50 years ago, but I think many people also tend to overestimate two things:

The amount of promises during the campaign that will actually come to fruition

How hard it is to change the status quo

A President can be in office for a maximum of two terms (8 years) according to the 22nd Amendment to the US Constitution. This means this would be Trump’s last 4 years in office, and it is no small feat to make significant and drastic changes to an entire country in just 4 years. I am not saying that changes will not be implemented, just that these will probably be less drastic than people think. To the extent that people believe these drastic changes will completely end with today’s status quo, that’s better for long-term investors as opportunities will probably abound. This is, of course, just my opinion, and things might turn out very differently. It’s normal, though, to see the market shoot first and ask second. If history has demonstrated something, it is that the market dislikes uncertainty.

Another thing that history has demonstrated is how terrible humans are at forecasting the future. From what I’ve seen/read, there are two lines of thinking regarding the Trump administration:

He will be extremely inflationary due to tariffs

He will be extremely deflationary through cuts in Government spending

These two demonstrate how forecasts tend to differ even across the auto-denominated “experts.” I am currently reading “Contrarian Strategies” and found this table interesting. It shows that, from 1988 to 2006, analysts and economists got their estimates of S&P earnings growth wrong by an average of 12% annually:

Forecasts and forward-looking statements give us confidence in how the future might unfold, but our ability to forecast variables with thousands of underlying growth drivers is limited. This doesn’t mean we should not aim to forecast (investing is all about the future), but it does mean we should acknowledge our limitations when doing so. Being conservative and investing in companies that are more in control of their destiny should help protect investment returns against the uncertainty of the future.

The industry map was pretty much what you could expect during a week where indices were down more than 2%. The only “safe” place was financials:

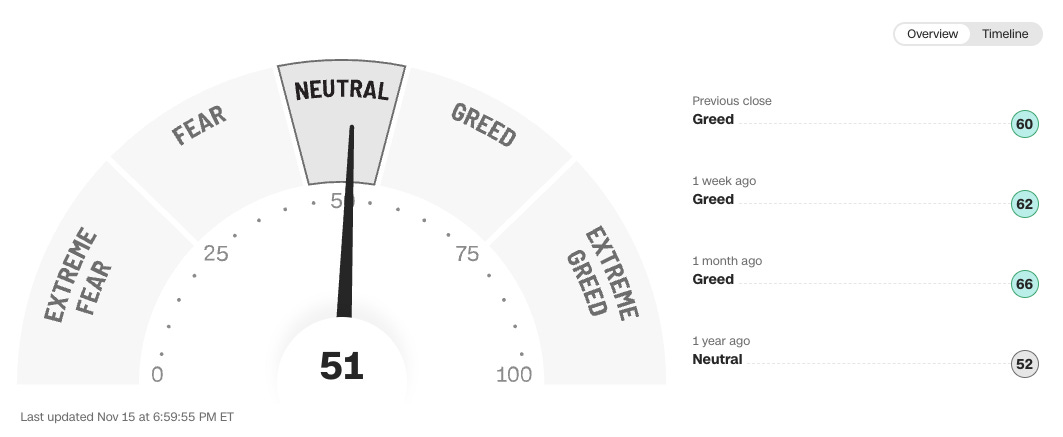

The fear and greed index decreased considerably and dropped from greed to neutral:

We already know sentiment can change very fast in the market, but it’s honestly surprising how fast investors’ moods change after a minor setback in their portfolios. The toughest part of investing is being prepared to weather periods of significant underperformance while holding conviction in the companies in your portfolio. It might be appealing to change your strategy during such periods of underperformance to “things that are working,” but this honestly seems like a bad idea that might lead to underperformance over the long term.

The rest of the content is reserved for paid subs.