What's in store for the market next year? (NOTW#24)

Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Hi reader,

The market clinched yet another week of gains. These 5 words have become something I’ve repeated quite a few times this year. The gains were driven primarily by technology-related sectors as investors continue to “rotate” their positions. With markets looking to close the year at ATHs after substantial gains, everyone is trying to forecast what’s in store for us in 2025, but can we know?

Without further ado, let’s get on with it.

Articles of the week

I published two articles this week. The first one was the last part of the last company I added to my portfolio, where I discussed how the company complies with the last 5 Best Anchor Stock traits.

The second article of the week was Zoetis’ Q3 earnings digest. The company reported yet another beat-beat-raise quarter (the third in a row) and showed confidence for continued growth going forward.

Market Overview

It was yet another positive week for the market (it feels like I’ve said this quite a few times this year), especially for the Nasdaq, which rose by more than 3%. There was a pretty substantial divergence between the Nasdaq’s and the S&P’s performance this week, probably caused by the technology sector being responsible for a good portion of the gains:

With markets on track to end the year at all-time highs after another outstanding year, most people are asking themselves the following:

What’s in store for markets in 2025?

This question has no easy answer because the future is inherently unpredictable, but can we look at the past to understand what might be in store for us next year? The answer is we can’t.

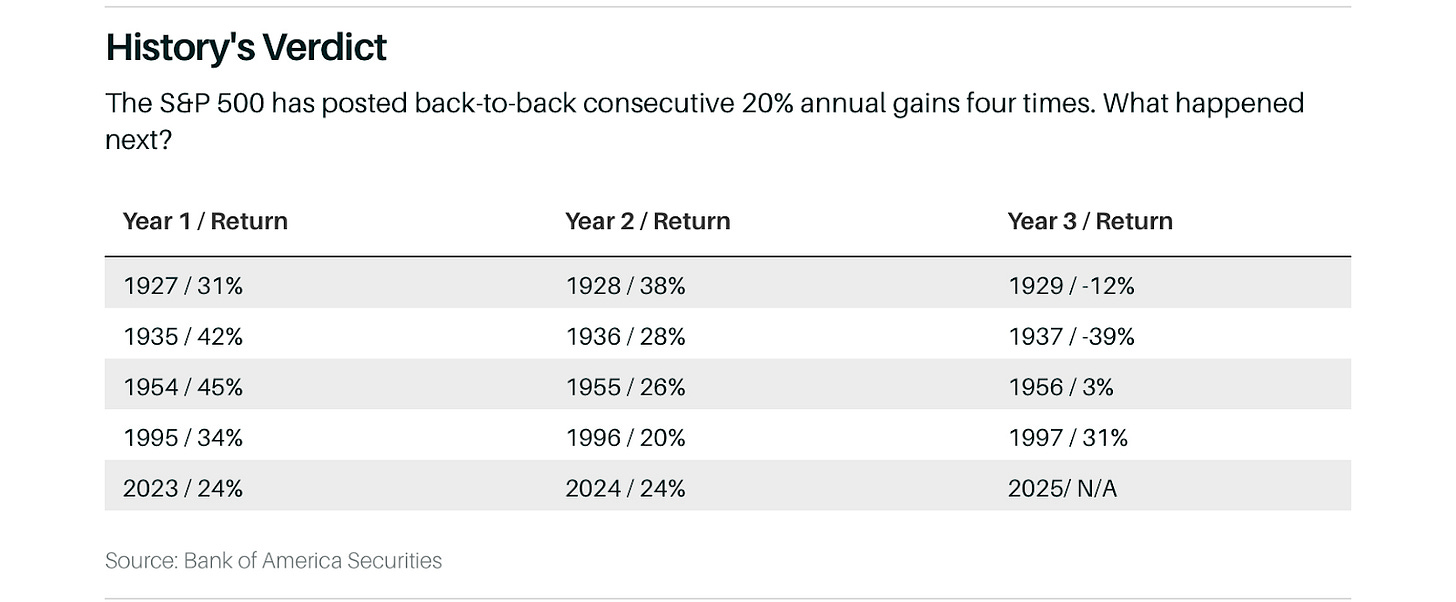

According to Bank of America, there are 4 precedents of two consecutive +20% years in the S&P 500. In two of those scenarios, the market was significantly down the following year; in one of them, it was more or less flat (+3%); in another, it was significantly up. So, the predictive power of two consecutive +20% years is limited.

To be honest, I didn’t expect anything different. Markets are forward-looking, and what has happened in the preceding years might not be the best explanatory variable for what will happen next. It’s true, though, that markets are unlikely to go up 20% forever, but if the correction comes next year or 3 years from now, we’ll only know in hindsight.

I must also add that what matters is not the next year but rather what happens after that (this is what matters for long-term investors, most of Wall Street evidently cares dearly about next year). The results in this scenario might be different than what you see in the table above. For example, the S&P 500 enjoyed a 31% gain in 1997 after two consecutive strong years, but that was one of the years preceding the dot-com bubble burst. This also teaches us that valuations can stay inflated (or depressed) for longer than we expect (one of the reasons why shorting is so difficult).

How can an investor protect or take advantage of these market swings? What works best for me is to ignore them (stupid as it seems). I acknowledge that I have no clue what will happen next year in financial markets, and even though many are providing forecasts every day, they probably also know that their chances of being right are slim.

The good news is that I don’t care what the market does next year or the year after that, I care about what the companies in my portfolio do over the next 5 years (at a minimum). While financial markets seem stretched valuation-wise, I think there are two things worth considering. The first one is that it has become a very polarized market, with some stocks/sectors carrying far higher valuations than others. The second thing worth considering is that indices today are concentrated among several very high-quality companies, so historical comparisons might be misleading (something I’ve talked about before).

So, what’s in store for the market in 2025? I don’t care, well, I do, but because I don’t know what will happen, it’s better to see it as an “I don’t care” situation.

Consistent with what I discussed earlier, technology stocks drove most of this week's gains. Everything besides technology-related sectors was pretty much down, with few exceptions:

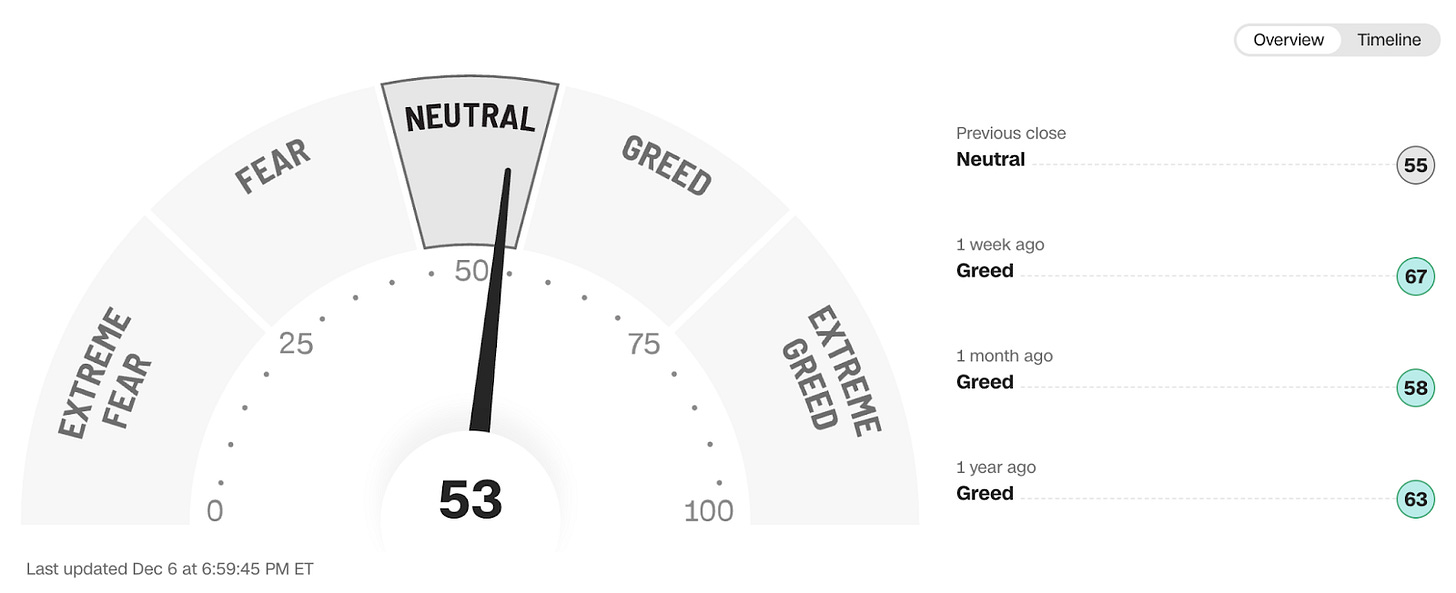

Quite strangely, the fear and greed index retraced to neutral territory. It doesn’t feel neutral to me, but this indicator is probably only useful when it’s at one of the extremes (greed or fear):

This is all the free content for this week, if you wan’t to have access to all the content you can become a paid subscriber.