What's going on at Zoetis?

Q4 earnings digest

Zoetis reported earnings last week, and the market did not like them. The stock dropped significantly after these and continued to fall in the following days. It’s now at $156, down 16% over the past year and down 40% from (albeit inflated) all-time highs:

But were Zoetis' earnings bad enough to justify the adverse market reaction? This article aims to answer this question, understand the valuation, and share what I will do with my position.

Zoetis’ earnings

Here’s the summary table for Zoetis:

The first thing worth noting is that Zoetis divested its MFA (Medicated Feed Additives) portfolio in Q4 (sold to Phibro Animal Health for $350 million). This sale impacted the numbers in several ways. Let’s recap some of these impacts…

Lower growth overall during the year, but especially in Q4. The impact of the sale will be felt on next year’s numbers (I’ll go over this more in detail later)

A positive impact on gross and operating margins due to the lower-margin nature of this business. Both the gross and operating margins expanded significantly in Q4 and are expected to expand further in 2025.

An “automatic” increase in companion animal revenue as a proportion of total revenue (the MFA portfolio was included in livestock). This point, together with the above, shows how much more profitable Zoetis’ companion business is.

An increase of $350 million to cash. Zoetis received most of this cash in 2024 but seems to have spent most of it already in repurchases.

This might be a good time to talk about guidance now that we are on the topic. Zoetis introduced a new non-GAAP metric to account for the MFA sale. The company used to report operational revenue growth, which was reported growth adjusted for foreign exchange. Zoetis’ operational growth is akin to “organic” growth in most other businesses (it’s only the name that changes).

Management has introduced a temporary metric called organic operational revenue growth (if I were to read the name of this metric with no context, it would be sort of an orange flag). This new metric is straightforward: operational revenue growth, ignoring the MFA business. Management expects growth of 7% at the midpoint for this metric in 2025. Reported revenue is expected to be somewhat flat (+0.5% at the midpoint) in 2025 due to the strengthening of the dollar (which Zoetis assumes remains for the rest of the year) and the MFA sale. Seeing a deceleration in apples-to-apples growth (from 11% to 7%) is definitely not great, but this comparison requires quite a bit of context.

Let’s start with what the market might be worried about: an increasing reliance on pricing. At the high end of the guide, Zoetis expects organic operational revenue growth to be balanced between price and volume (4% each). Pricing has been higher than history for a while now in part due to general inflation and the fact that veterinary inflation has lagged for many years, but we must not forget that there’s also a mix impact here: the company is transitioning to companion and innovative therapies which raise pricing without this being outright price increases.

One reason growth is decelerating is that pricing is normalizing. Zoetis enjoyed a one-time 1.5% tailwind to 2024 growth coming from Argentina (a hyperinflationary market). If we ignore this tailwind, 2024 growth would’ve been 9.5%. This is still evidently higher than what’s expected for this year, but we must also remember that 2024 was the first full year of Librela in the US. Under these circumstances, I would say that 7% organic growth in 2025 is pretty acceptable, especially if we take into account that the guide does not include any potential new launches.

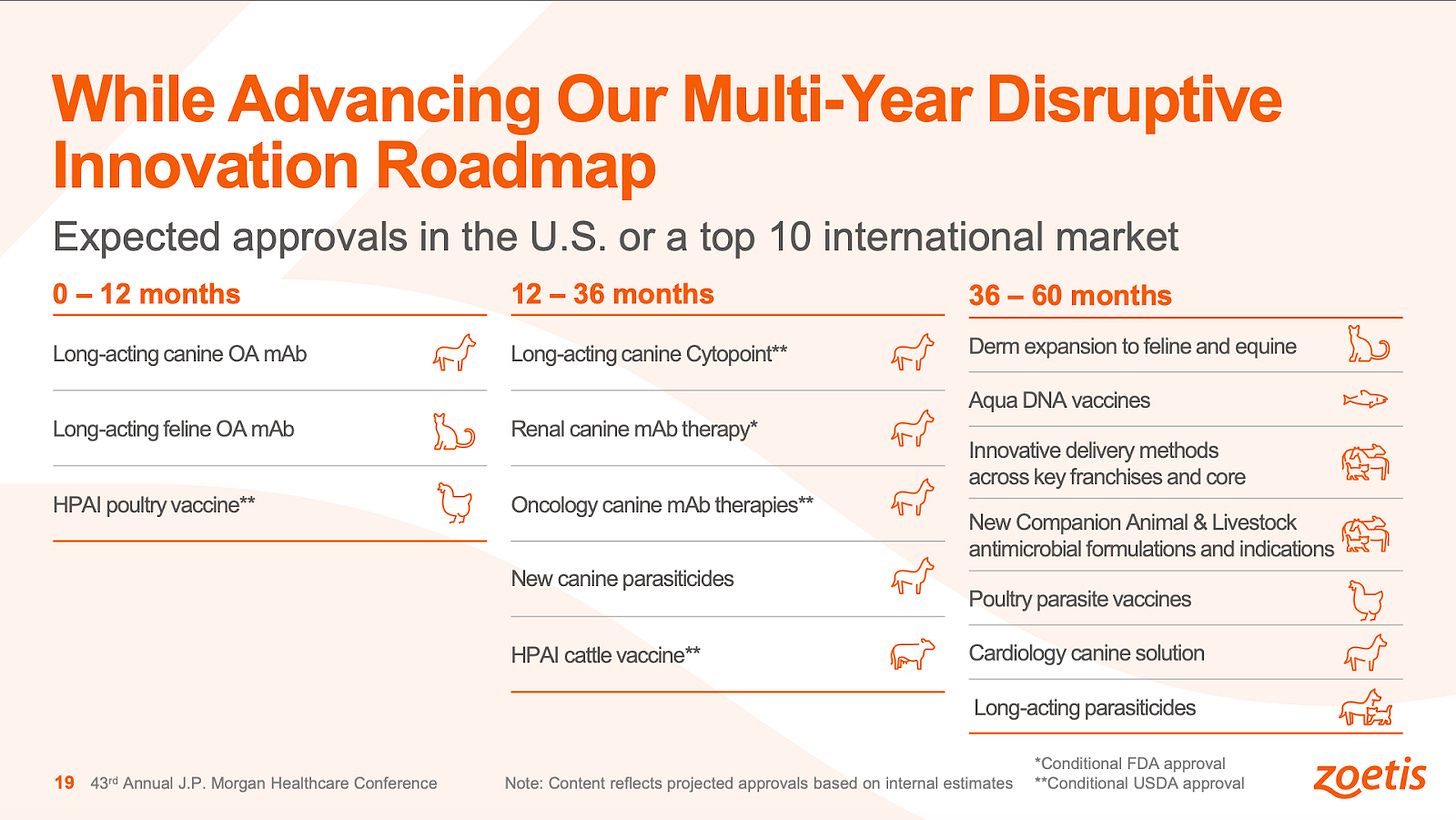

Management was pretty clear with this: any potential 2025 approvals can provide upside to the guide but are not included. They mentioned this a couple of times but not enough to avoid three questions by analysts asking for confirmation. Zoetis shared the following slide in a recent JPM Conference:

The slide implies that we should expect to see long-actings Librela and Solensia sometime this year. In all fairness, this approval could provide upside or downside depending on how one wants to interpret it. Management is convinced that long-acting OA pain Mabs will help drive compliance and, therefore, should, over the medium to long term, help offset cannibalization and increase franchise sales. One can only imagine that long-acting medications will be priced at a level enough to offset the expected volume cannibalization. We’ll only know what happens in hindsight, but what we do know is that the approval of long-acting OA pain Mabs is not included in the guide. Should it be negative this year but positive thereafter, I’m fine with this as a long-term investor.

Zoetis’ current valuation doesn’t demand much more than a 7% organic top-line growth (I’ll go over this more in-depth later). Seeing growth go from 11% to 7% might have spooked the market (you know what they say: “buy accelerating top lines”), but we must not forget that Zoetis faced pretty tough comps in 2024.

It’s also worth noting that renal is a significant opportunity that Zoetis expects to realize sometime in the next 36 months. This means that all else equal, we should see revenue growth accelerate in the future. Another key thing to consider is that the acceleration that might come from a renal MAB should also be more profitable. The reason is that Zoetis has already invested considerable amounts of money to build its MAB capacity (Librela and Solensia are also MABs), so more MABs should help increase capacity utilization and gain leverage.

Another important topic is that of margins. Even though Zoetis expects no margin expansion at the net income level in 2025, management does expect operating margin expansion (9% organic operational growth in operating income). The delta between both comes from lower interest income due to lower interest rates and taxes (should these be absent, EPS should grow at an 8-10% clip without considering repurchases). Despite the lack of margin expansion in the bottom line for non-operating reasons, the operating margin expansion should serve to prove that the transition to companion promises to be a very profitable one. There’s no denying the MFA sale has accelerated this transition, but it’s inevitable.

The good news for shareholders regarding the market’s reaction is that Zoetis remains a very cash generative business that’s returning cash to shareholders through repurchases. The company repurchased almost $1.9 billion of stock this year, the highest in its history. Since Zoetis’ stock price peaked in 2021, shares outstanding have decreased 5% (1.7% CAGR), and everything that keeps the stock price flat or down while the business continues to execute should be good for shareholders long-term:

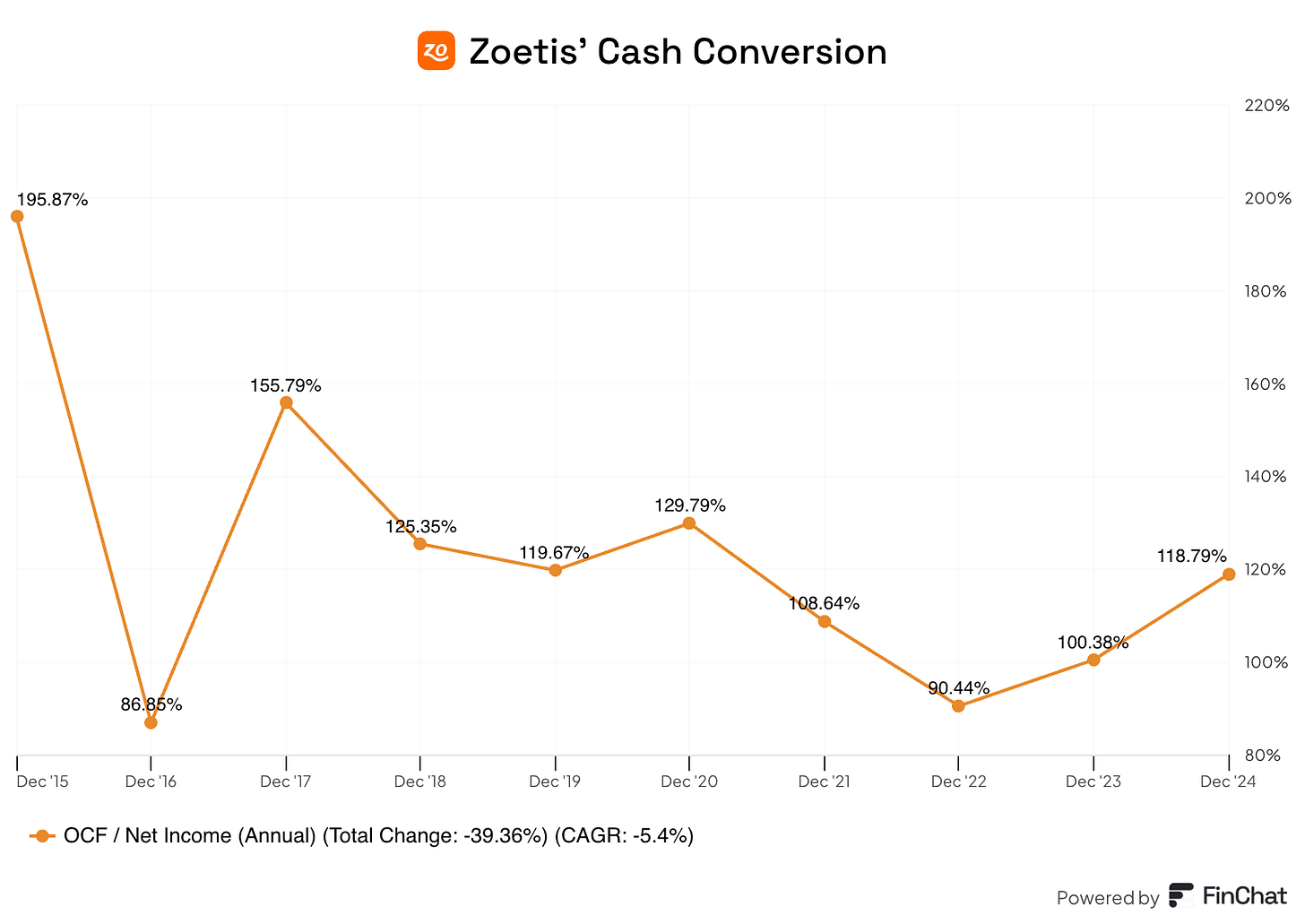

Zoetis cash generative capacity has recovered after some weak years and the board has decided to approve a $6 billion multi-year repurchase plan. Free Cash Flow grew 42% this year despite operating income “only” growing 9%. More than an unsustainable cash inflow, this seems like just a return to normal (and the reason why looking at Zoetis’ valuation on a FCF basis has been misleading for a while).

Not only did operating cash flow grow significantly, but Capex also decreased. The reason for both can probably be attributed to the same thing: Librela. Zoetis built inventory and significantly expanded MAB capacity in 2023 to prepare for the launch of its newly approved MAB therapy. With Librela now generating significant sales, cash conversion seems to be going back to where it belongs:

From 2022 (the lows in cash conversion) till today, Zoetis’ Free Cash Flow per share has grown at a whopping 34% CAGR! This is why it’s always a good idea to build a model after doing an inverse DCF; a 34% two-year CAGR would’ve appeared too optimistic with no context, but all it took was a return to normal and a bit of underlying growth.

An item that’s also normalizing is R&D. Management expects R&D expenses to be $685 million (midpoint) in 2025, which would imply no growth compared to 2024. When they got questions about whether R&D leverage was a margin expansion lever they would continue using in the future, management answered that R&D had been high for a few years and that it’s the pipeline that dictates their spending (not operating leverage). Zoetis has gone through several periods of heightened R&D spend as they prepared the pipeline and they now seem to be prepared to fully take advantage of it. Great news for margin expansion in the medium term.

The performance of the different franchises

2025 does promise to be a year where we’ll see yet again how Zoetis fares when competition arrives. Simparica Trio grew strongly this year (+28% YoY operationally) in the face of competition. The reason was that the market grew 40% over the same period, so even though Simparica Trio grew slower than the market, the new competition did indeed seem to be a net positive for Zoetis by expanding the market.

Another example here was dermatology, by far the largest, most developed, and most competitive market in animal health. Despite what has been a historically competitive market, Zoetis managed to grow its key dermatology franchise (Apoquel and Cytopoint) by 17% operationally during the year. Growth in the animal health industry seems appealing even in the face of competition so long as one manages to get to market first (which Zoetis excels at doing).

Librela and Solensia were also a highlight. They continued their impeccable trajectory, growing 80% operationally in 2024. Librela became the most successful launch in US history, growing 197% operationally this year. The best news, however, came from Europe. As you might know, Librela received an updated label last month, which mirrors that of the European and Canadian labels. Many people are questioning how this will impact sales, but if Europe is any guide, it seems that the long-term performance shouldn’t be impacted much: Librela grew 33% operationally in Europe in its fourth year and continued to penetrate mild and moderate cases. The growth runway for Librela is very significant even after the updated label.

Management believes that key dermatology, Simparica Trio, and OA pain MABs will grow double digits in 2025. They didn’t specify how much, but my gut here is that growth will be comfortably above 10%, or else they wouldn’t have made this claim. I’m almost sure that OA pain MABs will grow north of double digits, but the highlight here is that Apoquel + Cytopoint (Key dermatology) and Simparica Trio will post double-digit growth in a new year of increased competition. Maybe there’s some truth to the fact that there’s a first-mover advantage in the industry!

Is the decline in vet visits a structural issue? (and what it means for Zoetis and IDEXX)

Something I discussed in my Zoetis report is that the industry seems to be experiencing a channel shift as pet owners are increasingly relying on retail and e-commerce channels to meet their needs. Many believed this was a consequence of the labor crunch the industry has been suffering and that vet visits would eventually recover, but what if the decline in vet visits is somewhat structural?