Zoetis: Building Markets

(Reading time: 58 minutes)

Zoetis made its debut in public markets in 2013 but its origins date back more than 70 years. In the 1950s, a company developed the drug Terramycin which would open a world (literally) of possibilities; the company was Pfizer.

Terramycin was the first drug to be commercialized in the US under the Pfizer label, the drug that started Pfizer’s international expansion, and the drug that marked the first foray of the company into animal health. Terramycin set the foundations of Pfizer’s Animal Agriculture division in 1952, which would be renamed Pfizer Animal Health in 1988. Back then, the animal health division was seen more as an adjacency to human health, but this was about to change.

Pfizer’s Animal Agriculture Division was just the start of what would turn out to be a very profitable franchise. It all accelerated in the 1980s and 1990s when Pfizer started to develop drugs exclusively for this division. The company launched Liquamycin in 1980 to treat several cattle diseases, but more relevant were the product developments of the 1990s; the company launched Dectomax, Rimadyl, Clavamox, and Revolution, which marked its entry into the companion animal segment.

Pfizer’s management knew the company needed to develop its companion animal segment to lead the industry, so they decided to go the inorganic route and acquired SmithKline Beecham’s animal health division in 1994. Pfizer paid $1.45 billion (14x EBIT) to a “forced seller” (the multiple would not suggest it was one!) that wanted the proceeds of the sale to focus on human health. This acquisition turned Pfizer into the number 1 player in the industry, surpassing Merck. Just for context, the animal health industry had a market size of around $12 billion back then, of which Pfizer would retain a post-acquisition 10% share:

This acquisition further builds on our strengths by adding SmithKline Beecham’s excellence in animal vaccines and companion-animal products.

The combined businesses are complementary in products and in the animal species and geographic regions they serve.

Source: Pfizer’s Chairman at the time

Pfizer continued developing its animal health franchise through the 2000s, making several acquisitions (Pharmacia Corp and CSL Animal Health), launching new products, and establishing a presence in China.

It was in the year 2012 when the company made a decision that would end up reshaping the animal health industry: it spun off the animal health division as a standalone company that would be named Zoetis. The goal of the separation was the most common goal for any spinoff: to create a more focused company:

Both Animal Health and Nutrition are strong businesses with attractive customer bases and solid fundamentals, but distinct enough from our core businesses that their value may be best maximized outside the company.

Source: Ian Read, former Pfizer CEO

Zoetis was generating $4.56 billion in annual revenue when it was spun out of Pfizer. This meant that Pfizer’s animal health division had achieved a revenue CAGR of 7.3% over 19 years.

The spin-out did not occur all at once. Pfizer first IPOed 20% of the outstanding shares for $2.2 billion in 2012 (≈$11 billion valuation). Later, in 2013, Pfizer sold off its remaining stake in the company (80%), claiming that it would be “accretive to earnings” in its first year (this IMHO signals that the goal here was not to create a more focused animal health division but to improve Pfizer’s numbers, surprise!).

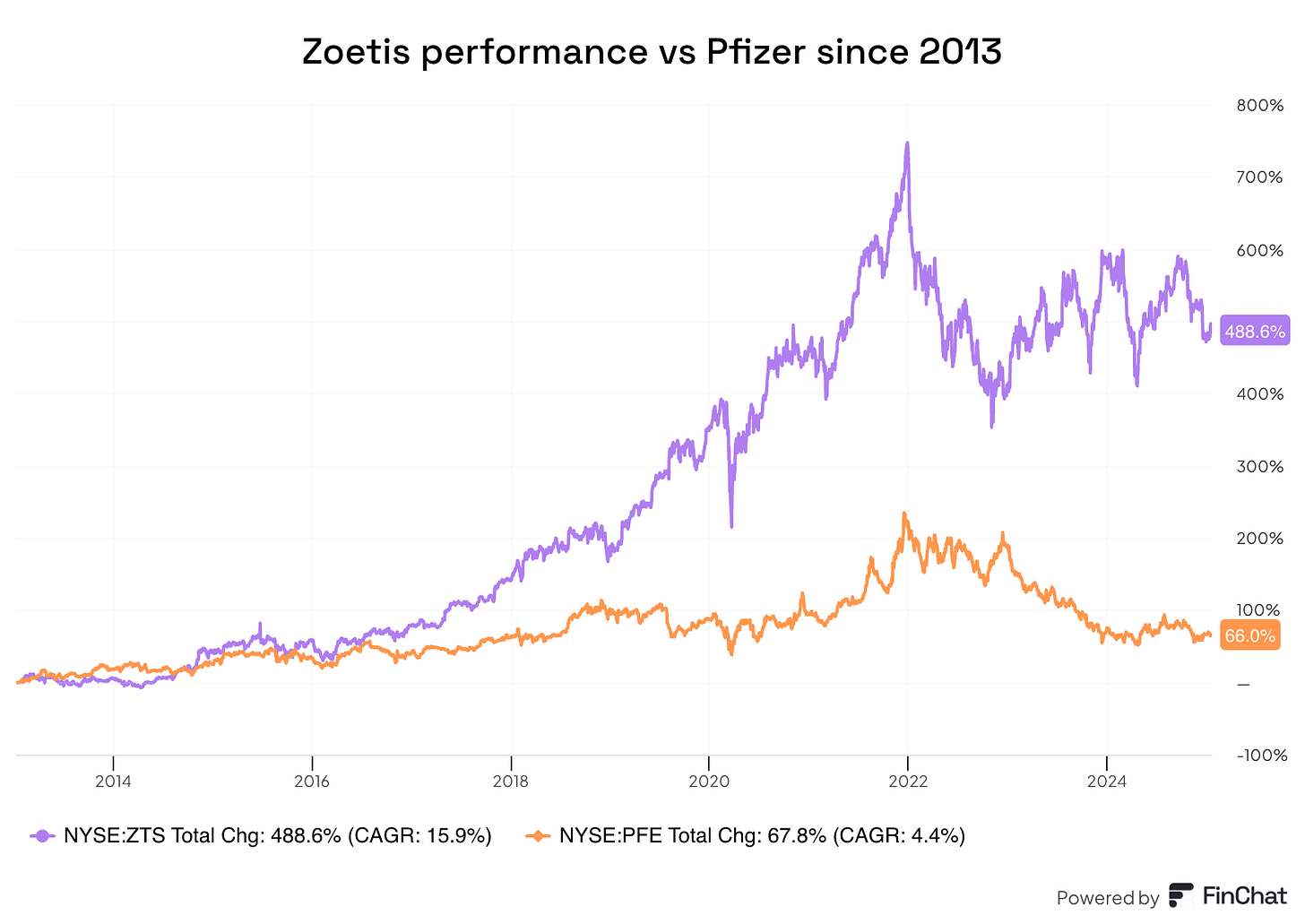

What’s interesting is how the divestiture was structured. Pfizer offered its existing shareholders a discount to purchase Zoetis stock; they could exchange $100 worth of Pfizer stock for $107.52 of Zoetis stock. This 7% discount was meant to encourage shareholders to purchase Zoetis’ stock, and those who felt encouraged ended up making a good decision. Zoetis has delivered ≈7x higher total returns than Pfizer since the time of the IPO:

Through this two-pronged IPO, Zoetis became the first standalone publicly traded animal health company, helping to shape the future of the industry. Elanco followed Zoetis’ step in 2018 with a different outcome (thus far).

When Zoetis IPOed, Wall Street analysts really had no clue what animal health was all about. They even ignored how customers paid their bills!

For example, many were surprised when Alaix described the animal health business as having nearly zero involvement by third-party insurance payers. “Our customers are veterinarians and livestock farmers, and when they make the decision to buy, they are also paying for their purchases.”

Juan Ramón Alaix turned Zoetis into a very profitable franchise on the back of companion animal growth. The company generates today north of $9 billion in revenue, it’s growing faster than when it was spun out of Pfizer, and it's much more profitable (the operating margin has expanded more than 1,300 bps). The runway still remains long.

In this report, I’ll go over the following…

Section 1: What Zoetis does

Section 2: The Animal Health Industry

Section 3: The Financials and Growth Drivers

Section 4: Competition, moat, and risks

Section 5: Management & Incentives, Capital Allocation, and Valuation

If you want to have access to this report and prior reports, feel free to subscribe: