Webinars coming to Best Anchor Stocks! (NOTW#71)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

It was a relatively calm week in financial markets, where we once again saw the constant narrative shifts we’ve seen over the past few months/years. I’ll talk about this in the market overview and also have several important news items to share (quite detailed) about two healthcare companies in the portfolio.

Without further ado, let’s get on with it.

Webinars coming to Best Anchor Stocks!

I have been thinking about how to make the Best Anchor Stocks subscription more valuable, and I believe occasional webinars will help achieve this. Paid subscribers will be able to attend webinars where I will share thoughts on specific topics and answer any questions you might have. These webinars will be recorded and made available for those who can’t attend.

I am thinking about doing the first webinar the week of the 15th to the 19th (will share some slots with subscribers), and it will have two goals:

I will discuss how I calculate ROIC, ROIIC, and cash on cash returns, and the importance of each

I will answer any questions that you might have

If you want to attend these webinars from now on (in addition to all the perks the paid subscription already offers), don’t hesitate to become a paid subscriber:

Articles of the week

I published one article this week: ‘Resmed (RMD): The Sleep Monopoly.’

Resmed (RMD): The Sleep “Monopoly”

ResMed’s roots can be traced back to 1989 in Australia (g’day mate). Peter Farrell sought to address a condition that affected (and still affects) millions of people. The initial objective was to mon…

Even though you only tend to see the research I share on companies I invest in, I have also decided to start publishing research on companies that I analyze but that (for one reason or another) don’t end up included in my portfolio.

The thing is that I have no clue when I will find a company that’s a good fit for my portfolio, but there’s a lot of research that goes into what I do, and I thought you could also find some value in it. I don’t expect Resmed to be the only company I profile in Best Anchor Stocks that doesn’t end up making it into the portfolio.

Without further ado, let’s see what the markets did this week.

Market Overview

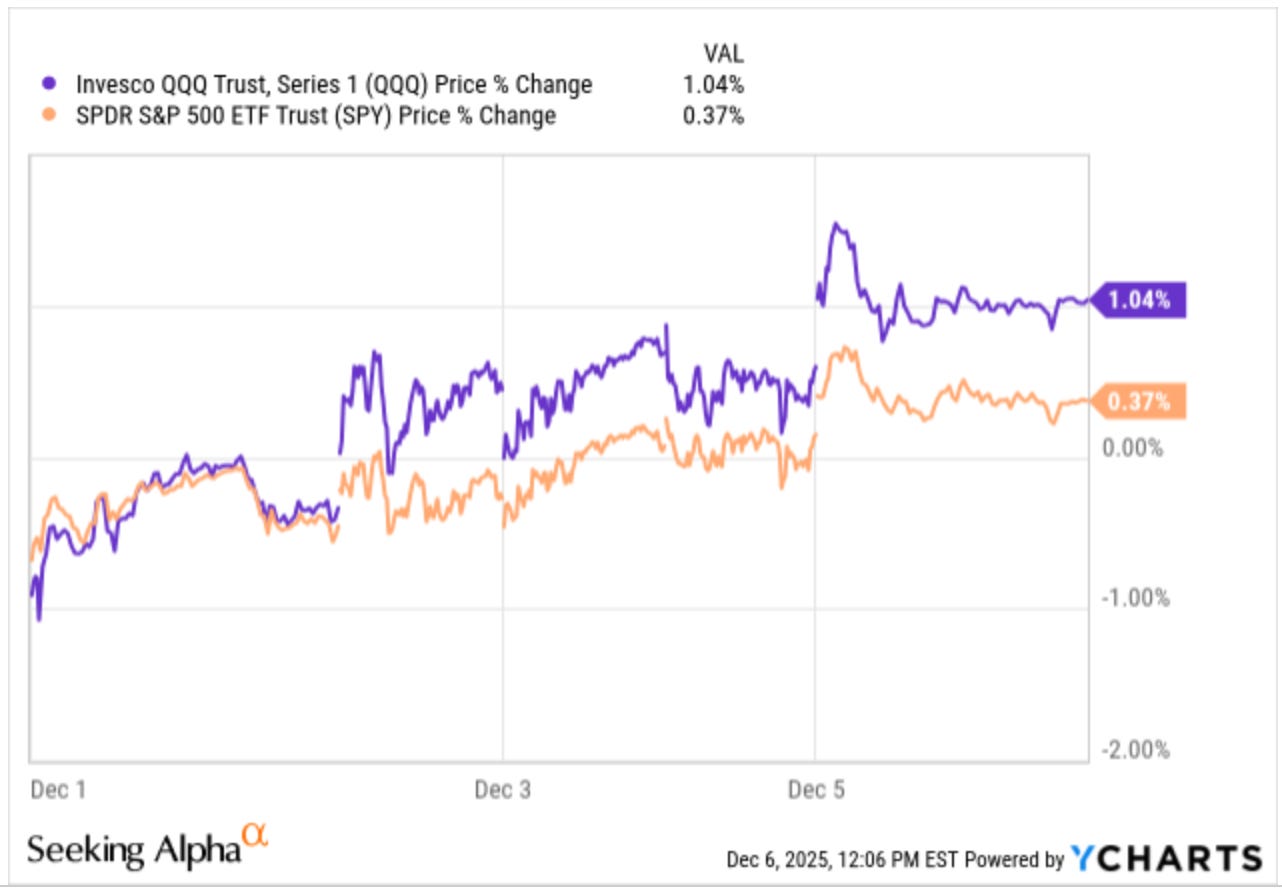

Both indices were up again this week:

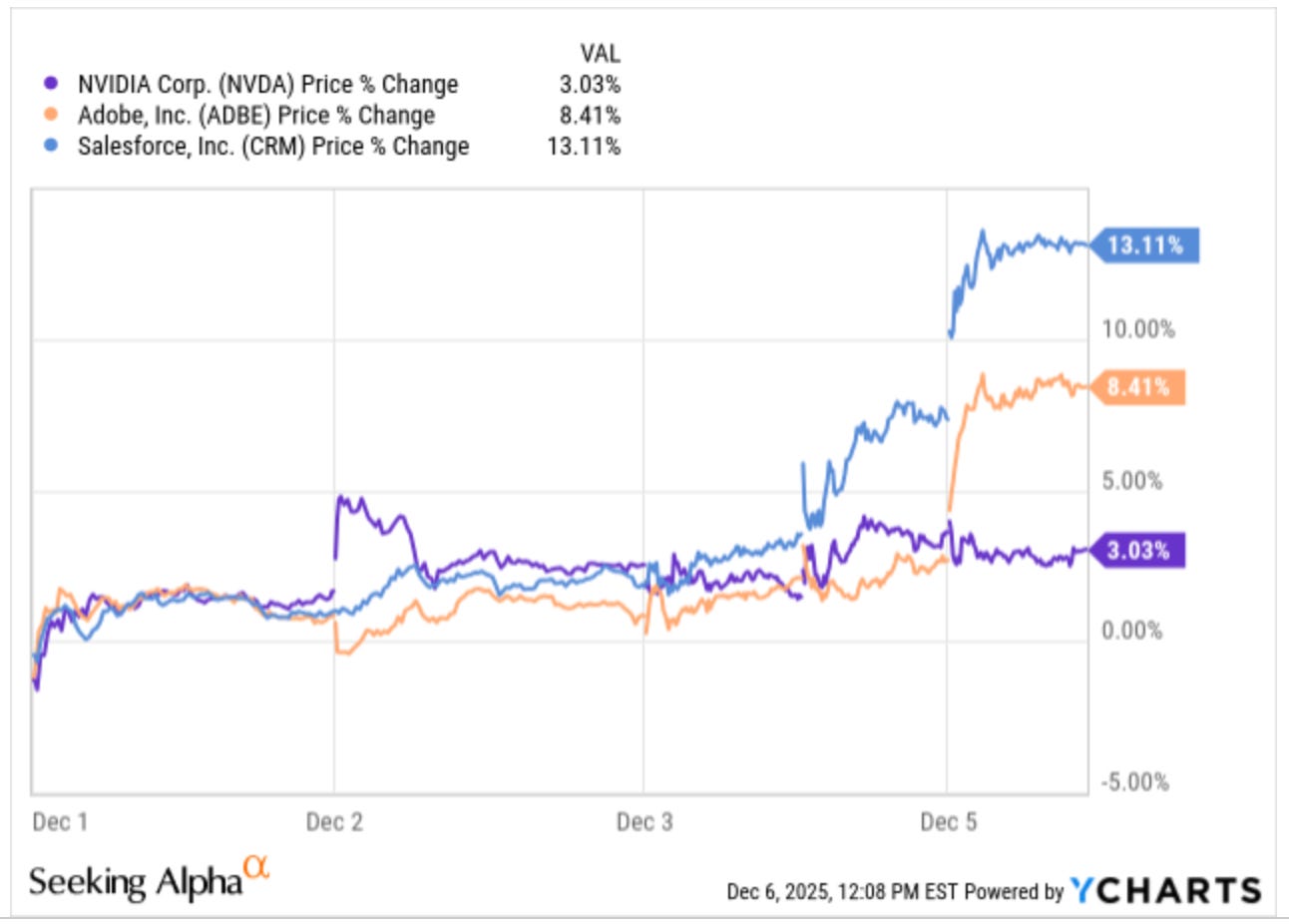

The market topic this week was similar to what we have been seeing over the past few weeks: Is the AI trade still alive? Nvidia was up significantly this week, but so were the stocks of some software companies that the market considers “AI losers”:

Is the market starting to realise that AI can prosper without that meaning that software/healthcare is dead? It’s probably too soon to tell, but it’s definitely encouraging to see that certain groups of stocks are decoupling. Note that the market has categorized certain companies as AI winners and others as AI losers, regardless of whether they are directly or indirectly affected by AI. In my view, the idea that AI will allow everyone to “vide-code” their own software is ridiculous, because there’s much more to the software moat than just development costs. I have positioned my portfolio appropriately in line with my beliefs.

On the contrary, some pockets of the AI trade are made up of questionable business models that will probably go bust (or suffer significantly) when the AI trade cools down. It wasn’t my intention to include a pun, but cooling infrastructure might be one of said pockets. Cooling infrastructure companies are definitely enjoying the current demand/supply imbalance, but competitive advantages are nowhere to be seen, and the large customers (i.e., the hyperscalers) are already working on their own solutions to disintermediate them. We’ll see what happens going forward, but it’s undeniable that the market holds a significantly different view from mine, and I am okay with that (lots of fish in the ocean).

The only thing we can take for granted in the current market is that narratives change quickly. I remember as if it were just a few weeks ago (because it was) that OpenAI was leading the AI race (now that seems to be Google) and that Microsoft was winning the “hyperscaler” war. With the change in narrative around OpenAI, Microsoft’s stock has also taken a steep turn, down more than 10% from its highs. I wish I knew what the following change in narrative would be so I could put all my money behind it, but unfortunately, I don’t.

The industry map was mixed this week:

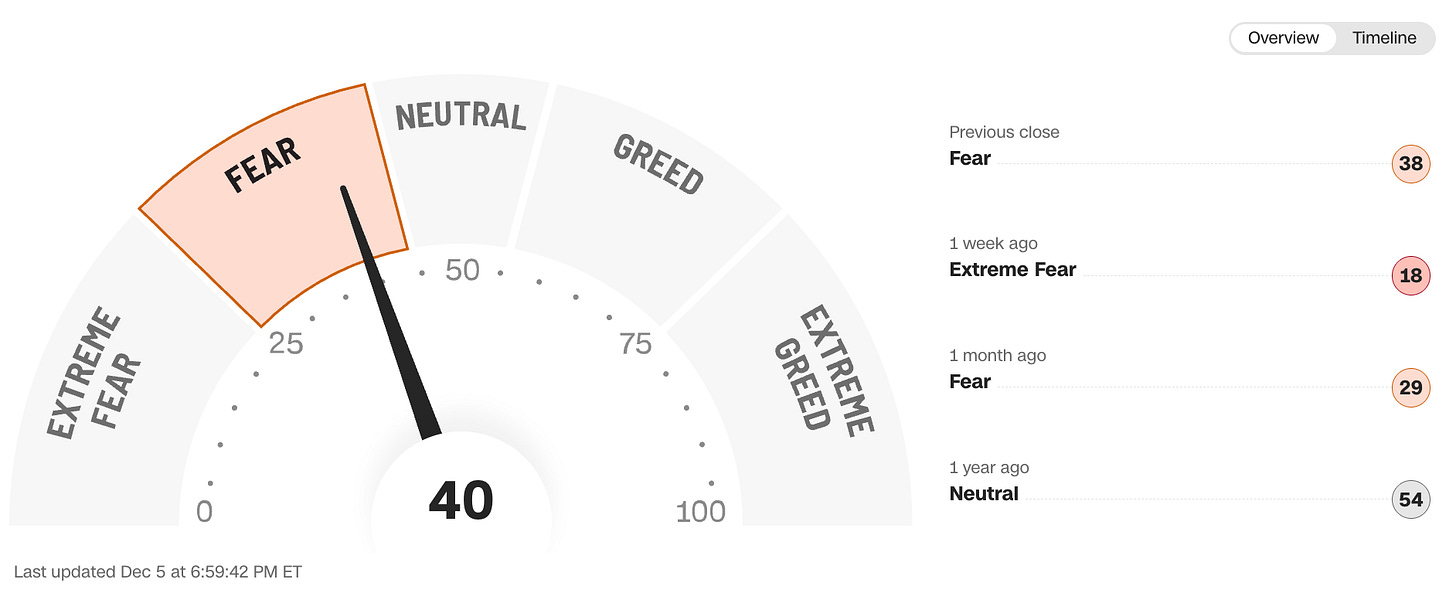

Narrative changes bring sentiment changes (or maybe it’s the other way around!). The fear and greed index improved to fear territory and is now close to neutral, despite being close to 6 a couple of weeks ago!

Company-specific news

This week, we had news from…