Trupanion (TRUP)

Applying the Amazon model in the Pet Insurance Industry

Welcome to a new Best Anchor Stocks in-depth report. This month I decided to look into Trupanion (TRUP), a pet insurer that operates primarily in North America and has multiplied its revenue by 36 over the last 14 years (31% CAGR). The most interesting thing of all is that the business has achieved this growth while its core market remaining widely underpenetrated.

Free subscribers get access to the introduction and a portion of the first section, whereas paid subscribers get access to the full report both here and in PDF format (shared later).

Without further ado, let’s jump right into the report.

This is not the first time (and probably won’t be the last) that I will discuss the animal health industry. I explained in my Zoetis report why I believe the animal health industry is attractive from an investment perspective, but let me reinforce the point by sharing a brief summary. The Animal Health Industry is…

Large and underpenetrated

Becoming mission-critical in people’s lives due to the humanization of pets

More appealing than human health due to its inherent characteristics, while enjoying a relatively similar resilience level

The goal of this in-depth report is to delve into pet insurance, the fastest-growing subsegment of the industry and arguably the one with the most significant growth opportunity, and Trupanion, the only listed pure-play pet insurance company (in the US, that is). Although pet insurance is a relatively nascent industry in the US, its origins date back to 1890 when he world’s first livestock insurance policy was written in Sweden. Some 34 years later, Sweden would also be a pioneer in writing the first pet insurance policy.

Due to proximity and/or other unknown reasons, the UK followed Sweden in issuing its first pet insurance policy 23 years later (in 1947) and both geographies went on to pioneer and dominate pet insurance as we know it today. It wasn’t until 1982 that pet insurance arrived to the US, when Veterinary Pet Insurance (VPI) issued the first-ever pet insurance policy to the famous TV dog Lassie. Lassie was not insured because its owners couldn’t afford unexpected veterinary costs (they could), but rather as a marketing tool to grow the category in the US (spoiler: the strategy didn’t work well).

VPI was later acquired by Nationwide, which remained the only player in the industry for decades as pet insurance struggled to gain traction. Trupanion became one of the first companies to start competing with Nationwide in the US. Founded in 1998 by Darryl Rawlings in Canada as Vetinsurance International (changed its name to Trupanion in the year 2000), Trupanion issued its first policy 2 years after being founded to a dog named Monty (owned by Darryl). The idea to found the company, however, was born much, much earlier…

My vision for Trupanion began in my hometown of Vancouver Canada when I was just 14 years old.

The insatiable love I have for animals started early in life. As a child growing up in Vancouver, our family had a beautiful black dog named Mitzy who brought immeasurable joy to our home. I cherished every moment spent petting her soft fur and taking her out to play through the scenic Pacific Northwest landscapes.

Tragedy struck when we had to rush Mitzy to an emergency veterinarian, where we discovered she had a twisted stomach. Though only two years old and facing a relatively routine procedure, my family simply couldn't afford the thousands of dollars needed for her life-saving surgery. This heartbreaking experience would forever change my perspective on pet healthcare.

Trupanion expanded into the US market in 2008, grew significantly in this market throughout the 2000s, and eventually IPOed in 2014. Revenue is up 36x (31% CAGR) since 2011 despite the pet insurance market in the US remaining grossly underpenetrated today. Trupanion’s historical growth trajectory and future opportunities are undeniable, but not all that glitters is gold. Trupanion has (by far) the best value proposition in the pet insurance industry, but does this make it the best model or even a good investment? This is the question I will answer in this report. I will do so by discussing the following topics:

Section 1: The Pet Insurance Industry

Section 2: What Trupanion does and what makes it unique

Section 3: The Financials and Growth Drivers

Section 4: Competition, Moat, and Risks

Section 5: Management, Capital Allocation, and Valuation

Concluding remarks

Section 1: The Pet Insurance Industry

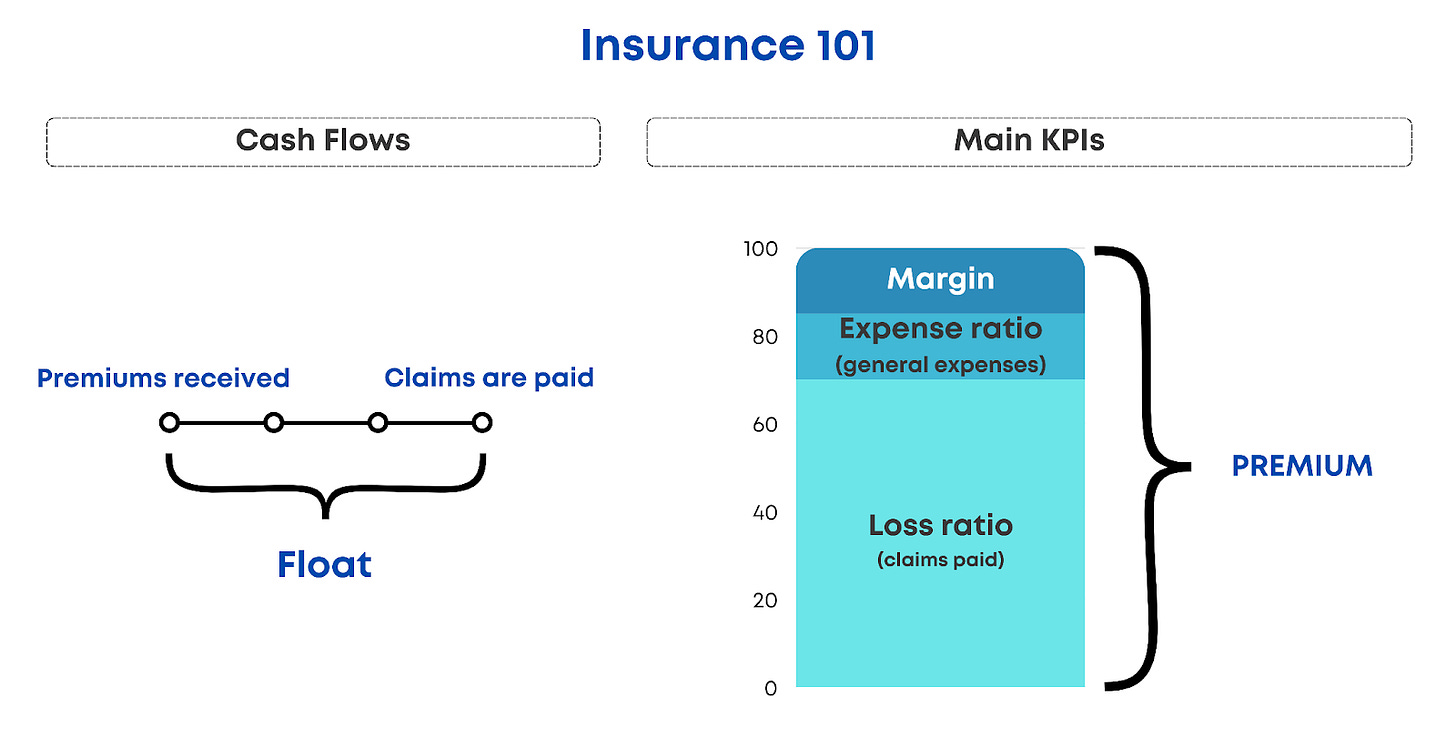

Before going into pet insurance in detail, I thought it would be helpful to briefly review how insurance works (in case there are readers unfamiliar with the business). Insurance is considered one of the most ancient businesses in the world, and what insurers ultimately do is price risk. An insurer will use data to determine how much it must charge (called “premium”) for taking on a risk off someone’s back and will make money through (primarily) two means:

By setting the premiums at a level that will allow them to pay the expected claims, cover variable and fixed expenses, and make a profit

By investing their float. Float refers to the money insurers hold between the time they charge the premium and the time they face a claim (i.e., there’s a mismatch of cash flows)

There are three relevant ratios in the insurance industry. The loss ratio, the expense ratio, and the combined ratio. The loss ratio measures how much of the premiums an insurer is spending on paying out claims, the expense ratio measures how much of the premiums are being spent on administrative and operational expenses, and the combined ratio is the sum of the two. The “ideal” scenario is for an insurer to have a low combined ratio together with a high loss ratio, as this would theoretically make it the low-cost producer in the industry while at the same time offering the best value proposition to policyholders.

Even though what I have discussed above is applicable to all types of insurance, pet insurance has some particularities that make it unique. First, unlike many other types of insurance that individual consumers are familiar with, pet insurance is not a legal obligation. This means that pet insurers also face competition from self-insurance (i.e., budgeting for unexpected costs). While self-insurance has historically been a headwind to penetration, it should become less of a headwind as veterinary inflation continues to rise and the range of potential unexpected costs widens. The only caveat here is that, as veterinary inflation rises, so does the cost of insuring a pet. While the humanization of pets is a well-documented phenomenon, one can only wonder when the demand becomes elastic again. This is especially a relevant topic for Trupanion, as I’ll explain later on in the report.