Three Reasons to be Optimistic

Danaher's Q4 Earnings Digest

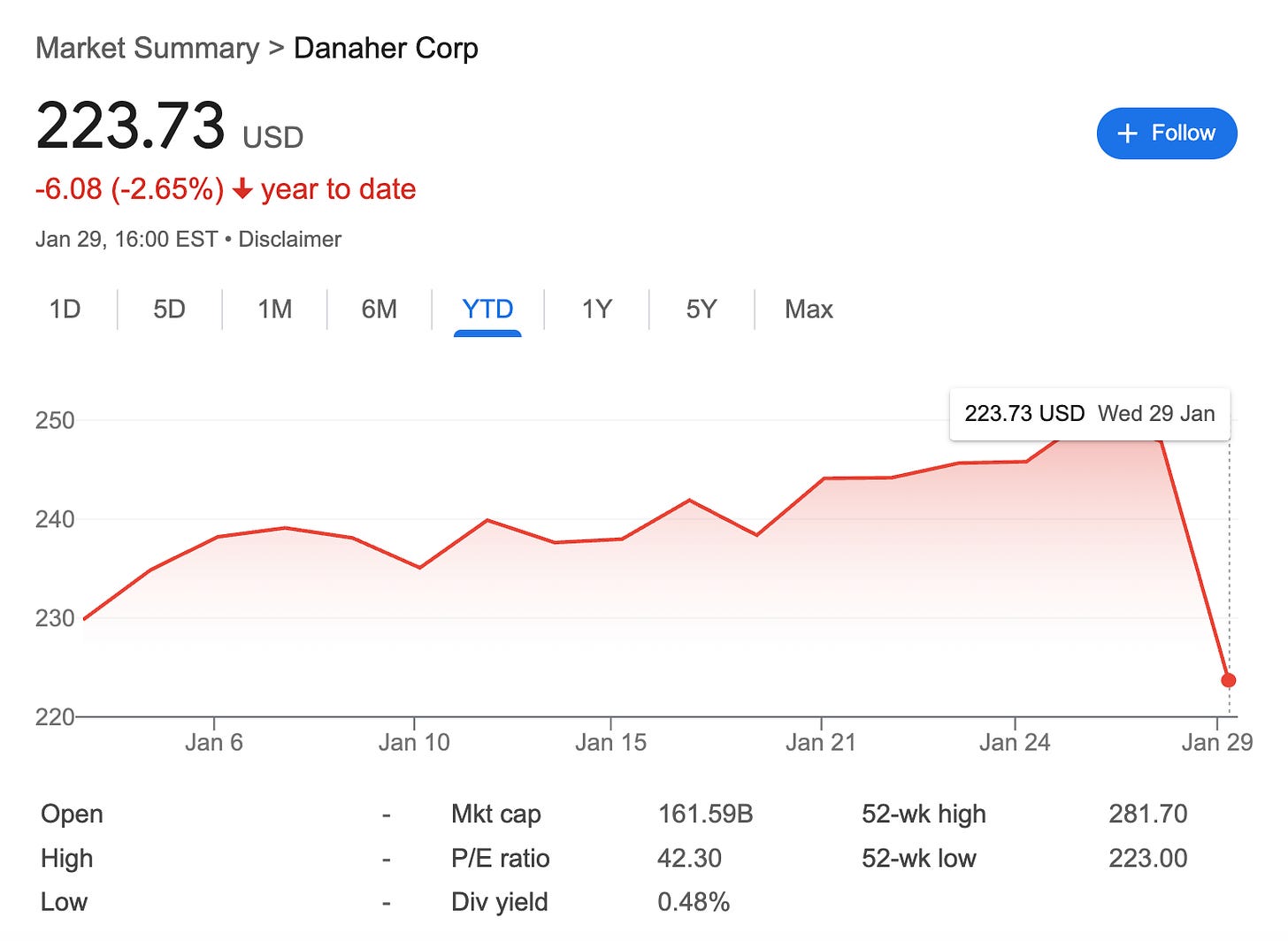

Danaher did not report good earnings last week, and the market punished the stock for these. The stock dropped more than 9% and lost all the ground it had covered in January. Healthcare as a whole (and bioprocessing in particular) had had a strong start to the year in the hope of a recovery from the headwinds suffered in 2024:

Many people have claimed that Danaher’s earnings and post-market reaction are signs that the bioprocessing cycle is not over yet, but this is not an accurate description of what is actually happening. The weakness came from places other than the company’s biotechnology business. Diversification has pros (it can be more defensive) and cons (the strength of different franchises might hide behind the weakness of others). Danaher is suffering from the latter.

I’ll try to talk a bit about everything in this earnings release (including the “puzzling” buybacks), but let’s start first with how Danaher performed during the quarter.

Danaher’s quarterly performance

Danaher did not perform terribly against estimates, beating top-line estimates but slightly missing those on the bottom line:

Missing/beating quarterly estimates is not in and of itself worrying, but estimates for Danaher have been going south for a while. This is what an analyst said during the earnings call:

So if you go back and look at how 2025 EPS expectations have progressed over time, if you go back to the beginning of 2023, the street was at 11.20. At the beginning of last year, the street was at around 8.80. Yesterday estimates were at 8.09. And if I'm doing the math right, I think you essentially guide it to around 7.60. So it's hard for a stock to work, when the estimates keep moving in the wrong direction.

The fact that analysts thought that 2025 EPS would be $11.20 is maybe more a consequence of their recency bias than anything else, but there’s no denying that estimates have kept creeping down:

Against this backdrop, the stock is down 20%+ since the 2021 peak. So, yes, the company's poor performance justifies (to an extent) the stock's poor performance, and there’s no sugarcoating this. Danaher’s performance is evidently tied to the pandemic’s boom and bust, but this doesn’t change much as stock prices don’t just react to company-specific performance but also to the environment. Maybe some analysts are starting to get a little bit “fed up” with Danaher’s weak guidance, but I’ll explain later on why there might be a good reason behind the weak guidance.

If we look at Danaher’s performance, we can see that revenue barely increased over the period. It was $22.3 billion in 2020 and ended 2024 at $23.9 billion, an increase of 7.2% over four years or a 1.7% CAGR. FCF per share has fared even worse; it was $7.5 in 2020 and ended 2024 at $7.2, so it decreased.

Below you can see a summary of the company’s quarter:

Danaher ended 2024 on a good note, although it has been a transition year for the company. Core revenue (akin to “organic”) was down 1.5% in 2024, driven by the poor performance of the Biotechnology Segment and aided by Diagnostics:

As I’ll discuss later on, the performance of the different segments is expected to be markedly different in 2025. It wasn’t a good year either from the POV of profitability. GAAP EPS was down 6.3%, whereas non-GAAP EPS was down barely 1.3%. The difference between both stems primarily from the amortization of intangibles and impairments:

Note that Danaher is an acquisitive company. This means we should be careful when examining GAAP EPS (and the P/E multiple, for that matter). The reason lies in accounting rules. Danaher tends to record goodwill (the difference between the price paid and the fair value of the acquired assets) when it makes an acquisition, and this goodwill needs to be amortized over a given period.

Everything makes sense until here. The “trick” comes from the fact that accounting rules assume that this goodwill is losing value over time (recorded as “amortization of intangibles”) and that the goodwill will eventually lose all of its value unless the company does something to change it (similarly to when a company reinvests into Capex to cover Depreciation and to maintain its physical assets productive). There’s a difference between both scenarios, though.

Intangibles don’t always have to be replaced and can “wear off” much slower than accounting rules might portray. In other cases, the investment necessary to keep the value of these intangibles intact is already accounted for in the income statement (for example, through R&D or SG&A investments). The latter can be the case for brands or for software-like businesses that are aquisitive, like Constellation Software. Constellation Software has to amortize the intangibles it acquires, but the expenses to “replace” these (if any) will probably already be included under R&D expenses in the income statement. This means that Constellation can potentially suffer the same expense twice (R&D and amortization) on the same income statement, making the EPS number and the P/E misleading. Depreciation and Capex are different because physical assets do depreciate, and their counterpart is Capex, which appears in a different financial statement (cash flows). This means that there’s no double counting in the income statement.

One easy way to circumvent the “problem” created by the amortization of intangibles is to focus on cash flows. Danaher is famous for having achieved a FCF conversion rate of 100%+ for over 20 years. This sounds great, but we should be aware that it’s the result of its acquisitive nature more than its business model. I don’t doubt that management is proficient in driving cash flow conversion through DBS. I am only saying that cash conversion is not apples to apples when comparing Danaher to a non-acquisitive company. That, and that Danaher shouldn’t be viewed on an EPS or P/E basis but rather on a FCF or EV/FCF basis.

Cash flows were a highlight in 2024. Despite the drop in revenue and earnings, Operating Cash Flow was up 3% and Free Cash Flow was up 3.5%:

This means that Danaher managed to post a 22% FCF margin despite suffering a bad year. This is great because it allows the company to be countercyclical (either with repurchases or M&A) and is one of the characteristics I mentioned in a recent article: ‘A fertile ground for the individual investor.’

Let’s talk about the most pressing topic of the release.