Things I Have Learned and What I Bought This Week (NOTW#58)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Despite a good stream of news this week, markets were relatively flat. This is the first news of the week I write since taking a week completely off from markets, so I discuss why this is something that serves me very well and also some lessons I have learned through the years that have improved my decision-making process (albeit I will only know this in hindsight).

Without further ado, let’s get on with it.

Articles of the week

I published one article this week, and it was one that I believe is very interesting for both ASML and non-ASML holders. The company has historically faced the “China will copy this” bear case, but I believe this concern has been largely driven by ignorance. The article aims to explain why I believe this is the case and outlines the “real” bear cases (this last part reserved for paid subscribers).

ASML’s China “Risk”

If you are a long-time reader of Best Anchor Stocks, you’ll know that I’ve been following (and have owned) ASML for several years now. Throughout these years of owning ASML, I have encountered a primary and widespread bear case: it’s currently an EUV monopoly, but

Next week, I will bring Copart’s earnings analysis (the company reported on Thursday). I also plan to start working on my next in-depth report, which I plan to publish sometime this month. It’s the first time in a while that I am actually quite positive both in terms of fundamentals and valuation on a company (probably a sign that markets might not be particularly cheap).

Without further ado, let’s see what the markets did this week.

Market Overview

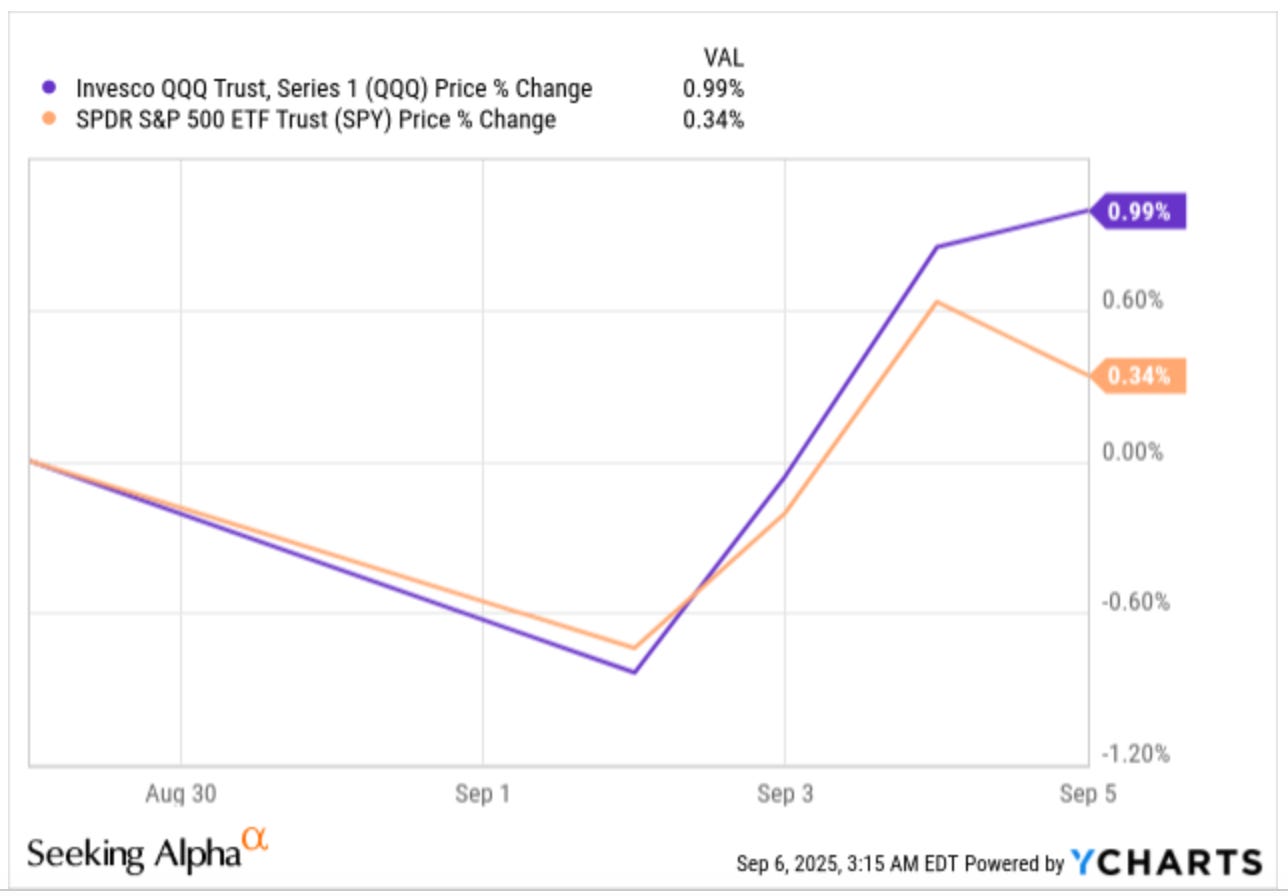

The market was slightly up/flat this week:

After a week of being (almost) completely disconnected from markets, I am back with recharged batteries. I occasionally take breaks from financial markets, and I come back with the feeling that I should take them more regularly. No matter if you are a long-term investor or a short-term speculator, financial markets are designed to bombard you with information and noise, which will most likely make the decision-making process much more challenging (never forget that the industry thrives on action, whereas long-term investors thrive on inaction). Even though there will always be some signal in that noise, the reality is that the continuous flow of daily information is likely to be more of a negative than a positive when investing long-term.

Note that many people believe that more information makes markets more efficient, but what seems to be true is that more information, coupled with faster distribution and faster acting (algos), arguably leads to more market inefficiencies. Markets are used to shooting first and asking later, and it seems that if you give faster guns to more people, then it’s likely that they might take too many shots!

Over time, I have learned not to care about certain things, and this has improved my quality of life substantially. These are the things that I (try) not to care about…

What my stocks do on any given day

How much money others are making

What uninformed investors think about my holdings

Let’s take a quick look at each one of these individually. Starting with the first, I have learned not to care what my stocks do on any given day. While there might be a signal in the daily stock price moves, the reality is that stocks trade up or down every single day, but don’t receive information that changes what the company is worth every day. One can obsess with trying to explain why a given stock moves up or down, but the reality is that there’s usually no fundamental explanation. Something that helped me understand that daily price moves are typically not driven by fundamentals is the book ‘Flash Crash.’ I recommend reading it because you’ll understand that many people who move stock prices daily might not even know what the underlying company does.

The second point stems from assuming that someone is always going to be making more money than you. In the world of social media and engagement-driven algorithms, the probability of encountering such a person is pretty high. Investing is not a game of winning every year but a game of winning over the long term, and even if you are not the investor that has the best LT track record, the goal should be different: to achieve your objectives. One thing to also consider is that there are many ways to achieve a given return, and people with extraordinary short-term records may well be taking too much risk. If someone is up 10x YTD, they are likely making more money than you, but it’s also likely that they are also operating with a very different risk profile. Focusing on others is honestly just a distraction.

The third point is one that I’ve come across on X a couple of times. You post something about a company, and suddenly you get an army of people parroting the most well-known bear cases. Granted, said bear cases can be very real, but most of the time, you’ll find that the people parroting these have done little actual work on the company and that they are just “bearish” because the stock price has recently gone down. Just a little back and forth in the conversation is enough to find out that the other person doesn’t really know what they are talking about. This might come across as “cocky,” but the reality is that I try not to comment on companies that I have no clue about because it’s not a great look. Worrying about what these uninformed investors think is a waste of time. This said, I have had great conversations with informed bears about my companies, but it quickly became obvious they had done their fair share of work. If you get triggered when said uninformed investors bring up bear cases, it might be a sign that you don’t have enough conviction.

The three things above, even though apparently minor, have significantly improved my decision-making process and my quality of life. They are tough to master, but I am slowly but steadily working towards that goal.

The industry map was mixed this week:

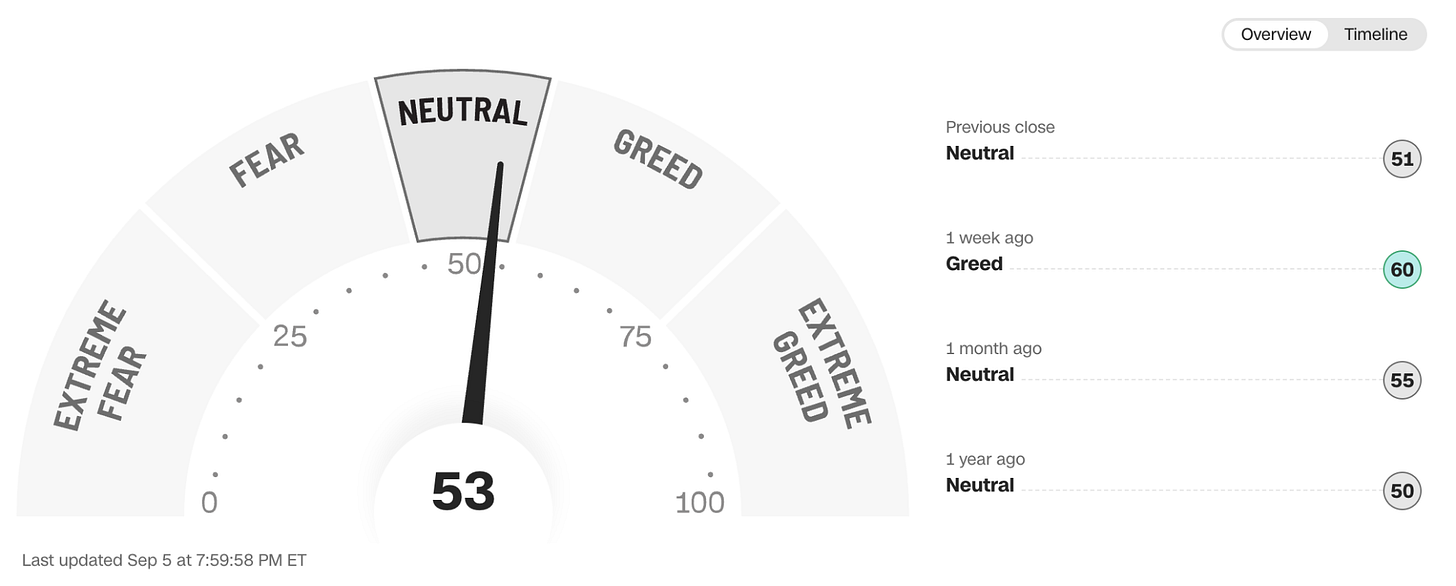

The fear and greed index dropped and is now in neutral territory:

What I bought this week

I added to several positions this week. Although I believe that not a lot of pessimism is baked into broad-market valuations, I do feel this is the case for several companies in my portfolio. It’s always important to consider that a high broad market valuation doesn’t mean that “everything is expensive,” although it will definitely be tough to enjoy stellar performance if the broad market is faring poorly. This is what I bought…