The Market Hates Uncertainty (NOTW#35)

Best Anchor Stocks has a long-standing partnership with Finchat (I use it for my research) and I would like to share with you this week what I believe to be a game-changing feature: custom metrics.

With custom metrics, users can create their own metrics to better understand the companies they analyze. This is an excellent feature by itself, but what makes it even better is Finchat’s KPIs. The combination of KPIs (which are not found elsewhere) and custom metrics now allows investors to build metrics that not many providers offer. The resulting metrics from custom metrics and KPIs are evidently non-accounting metrics, but if you’ve read the book ‘The End of Accounting’, you’ll understand why they are so useful.

Let me show how custom metrics work using some companies in the portfolio. For example, you might want to know the average revenue per EUV and DUV system for ASML. We know the average price of DUV should be significantly lower than for EUV, but with Finchat’s customer metrics we can now know by how much:

The gap between them is very significant and has been increasing. As high-NA EUV becomes part of the mix, we should expect this gap to increase further.

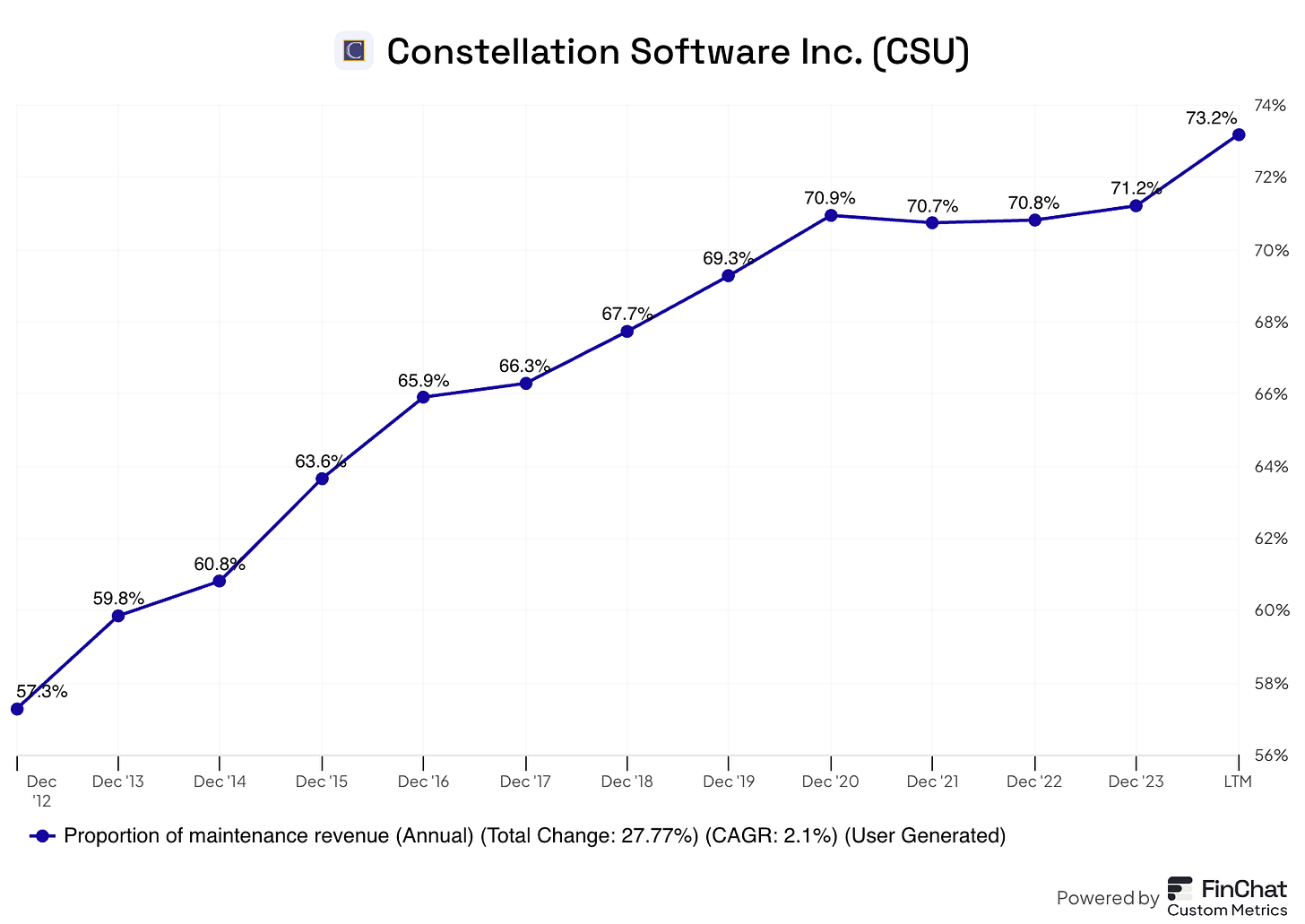

Another interesting custom metric we can build is maintenance revenue as a percentage of total revenue for Constellation. Constellation favors this revenue source over all others because it’s the most recurring. Building the custom metric, we can quickly see that maintenance revenue over total revenue has increased substantially over the past years:

I don’t want to share too many examples here, but you get how this works but I just want to remind you that you can become a Finchat Plus or Pro user at a 15% discount. You just have to use this link to sign up.

Let’s jump right into the News of the Week.

The indices were down again this week in what has been a rocky start to the year. Understanding the underlying reason behind the decline is challenging, but it all seems to have a common denominator: uncertainty. I talk about this in the market overview.

Articles of the week

I published two articles this week. The first was an in-depth report about Judges Scientific. I discuss everything there’s to know about the company.

The second article of the week was Stevanato’s Q4 earnings digest. The company reported an excellent quarter and demonstrated that it’s back on its growth and margin expansion path. Stevanato was up around 20% this week.

More Information for a lower price

(This post is free to read, and remember you also have available the Stevanato in-depth report for free as a model deep dive. You can read that here.)

I will be traveling next week (sort of on a holiday), but I plan to publish an article on a general investment topic. I also plan to bring the earnings digest of FRP Holdings if I have time.

Market Overview

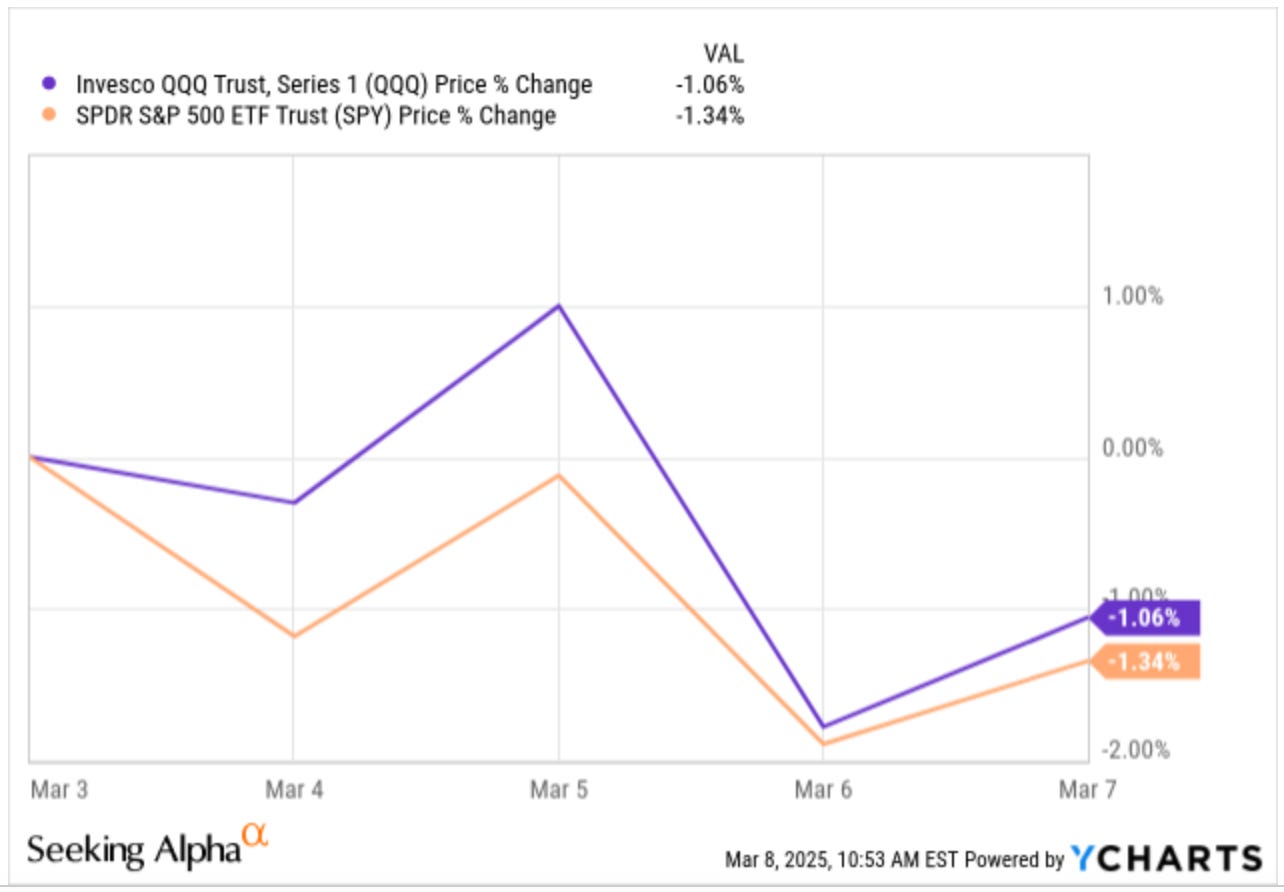

Indices were down again this week. Both the Nasdaq and the S&P 500 were down more than 1%:

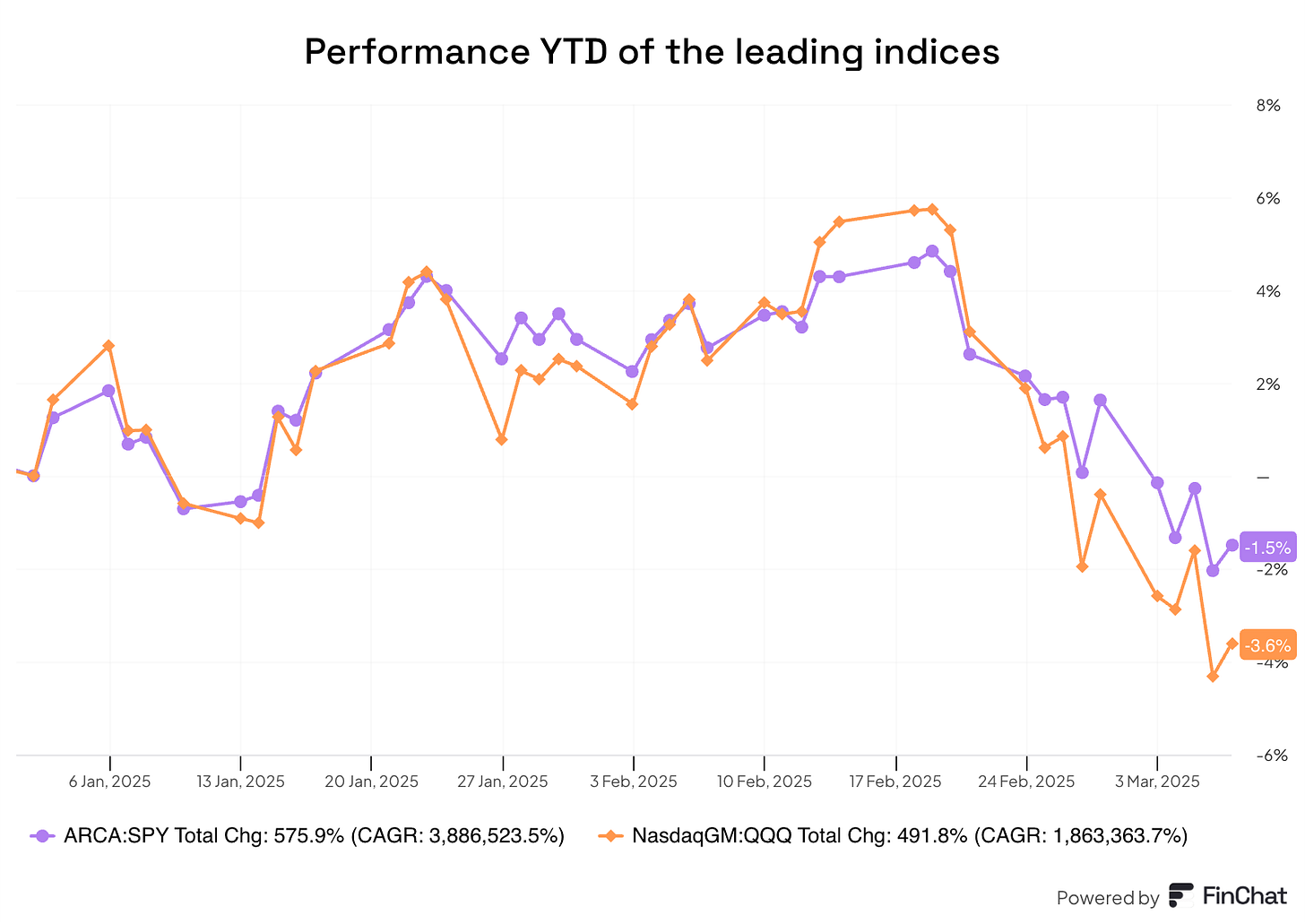

The last time I wrote so many consecutive news of the week saying indices were down was in 2022. It’s undeniable that it’s still not as “severe” as 2022, but we definitely hadn’t had a run with so many negative consecutive days for a while. The market always has a way to remind investors that this is not an easy game and that when one believes that making money is easy, it is precisely when the market will tell us that it’s not so easy. After two very strong years, both indices are negative year to date:

I honestly don’t know the exact reason for this week’s drop, but it seems there’s a common theme emerging in the economy: tariffs. I’d say that the market fears the uncertainty surrounding tariffs more than the tariffs themselves. If there’s one thing money hates, that’s uncertainty, and seeing the government announce tariffs only to delay them later and say that they’ll only apply to certain groups of products is not precisely what the market likes to see. Every time we go into periods with so much uncertainty and noise, I try to imagine what I would think of this in 5 years. Most of the time my conclusion is that what’s happening today will not matter much in 5 years. Noise is always extremely high over shorter periods but tends to smooth out over longer periods.

Another thing that I always remember during these periods is this anecdote of a fund manager who kept a copy of the Financial Times publication for every day of the last year. The first thing he’d do when coming into the office was check the paper published exactly one year ago to see what was in the media back then. Most of the time, what was in the Financial Times a year ago was not being discussed today, meaning it was noise. Of course, there will be some signal in all the noise, but it’s much more rare than what many people believe.

Bears always look more credible when things start to go down because the trend is on their side. This happens at the macro and company-specific levels. I could come up with a very credible bear case for any of my positions today, but there’s no denying that these bear cases become more credible as stock prices go down (this is why investing is tough!).

The industry map was mostly red this week:

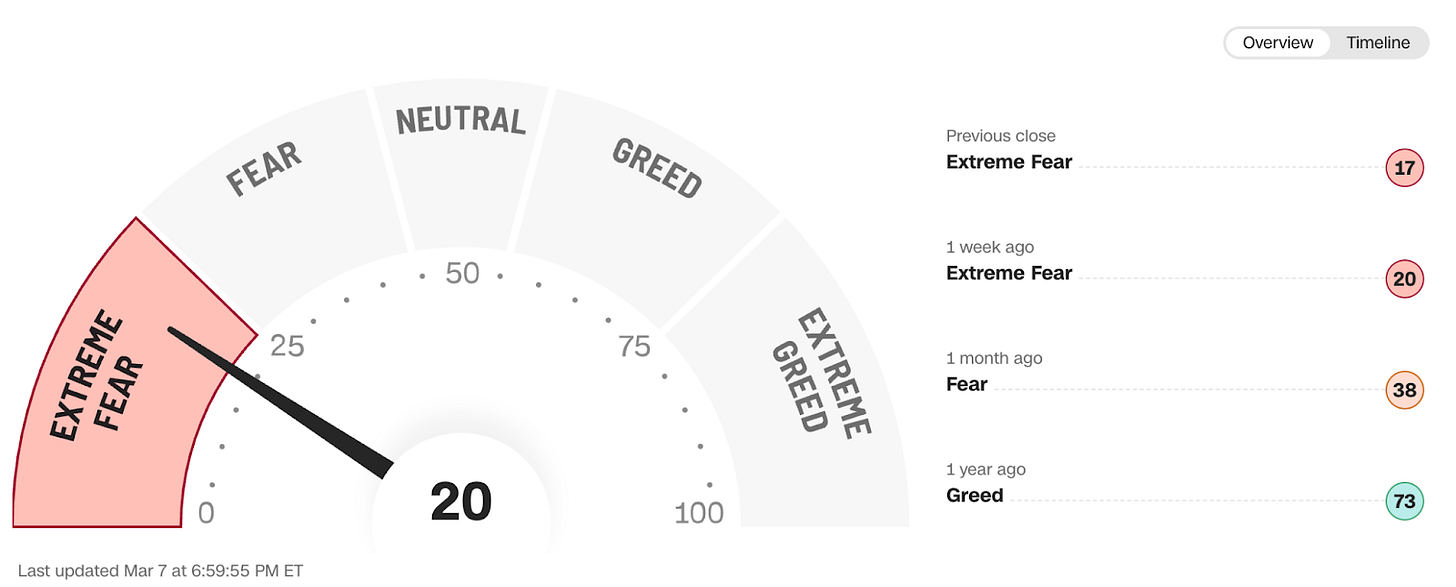

The fear and greed index remained in fear territory:

The rest of the content is reserved for paid subscribers in which I share my transactions and the news of the week.