More Information for a lower price

Stevanato's Q4

(This post is free to read, and remember you also have available the Stevanato in-depth report for free as a model deep dive. You can read that here.)

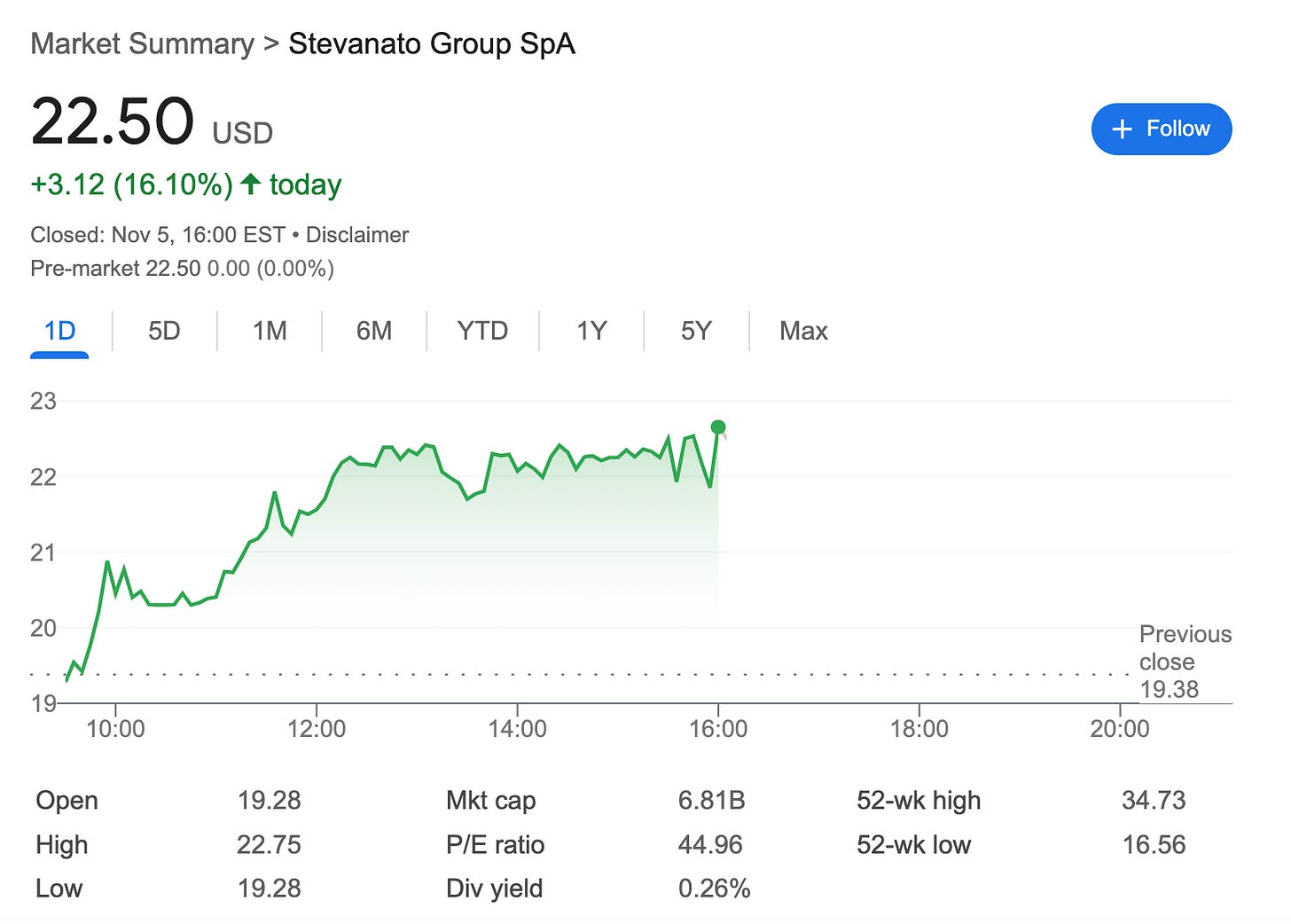

Stevanato reported Q4 and 2024 earnings this week. The stock enjoyed a positive reaction to earnings even in a day in which the leading indices were down significantly:

Stevanato has demonstrated its volatility over the past few months, but I was honestly very surprised to see the stock up less and trading at a lower price than after reporting Q3 earnings (here’s the image I used in my Q3 earnings digest):

I’m surprised because Q4 confirmed that the vial destocking is over and that Stevanato is back on its growth and margin expansion path. I still believe the market has not woken up to this story but that it will in due time (reason why I have been building my position lately).

Stevanato’s earnings

Stevanato reported a very solid quarter, ending the year on a better-than-expected note. The company managed to beat expectations in both the top (+3% beat) and bottom (+5% beat) lines:

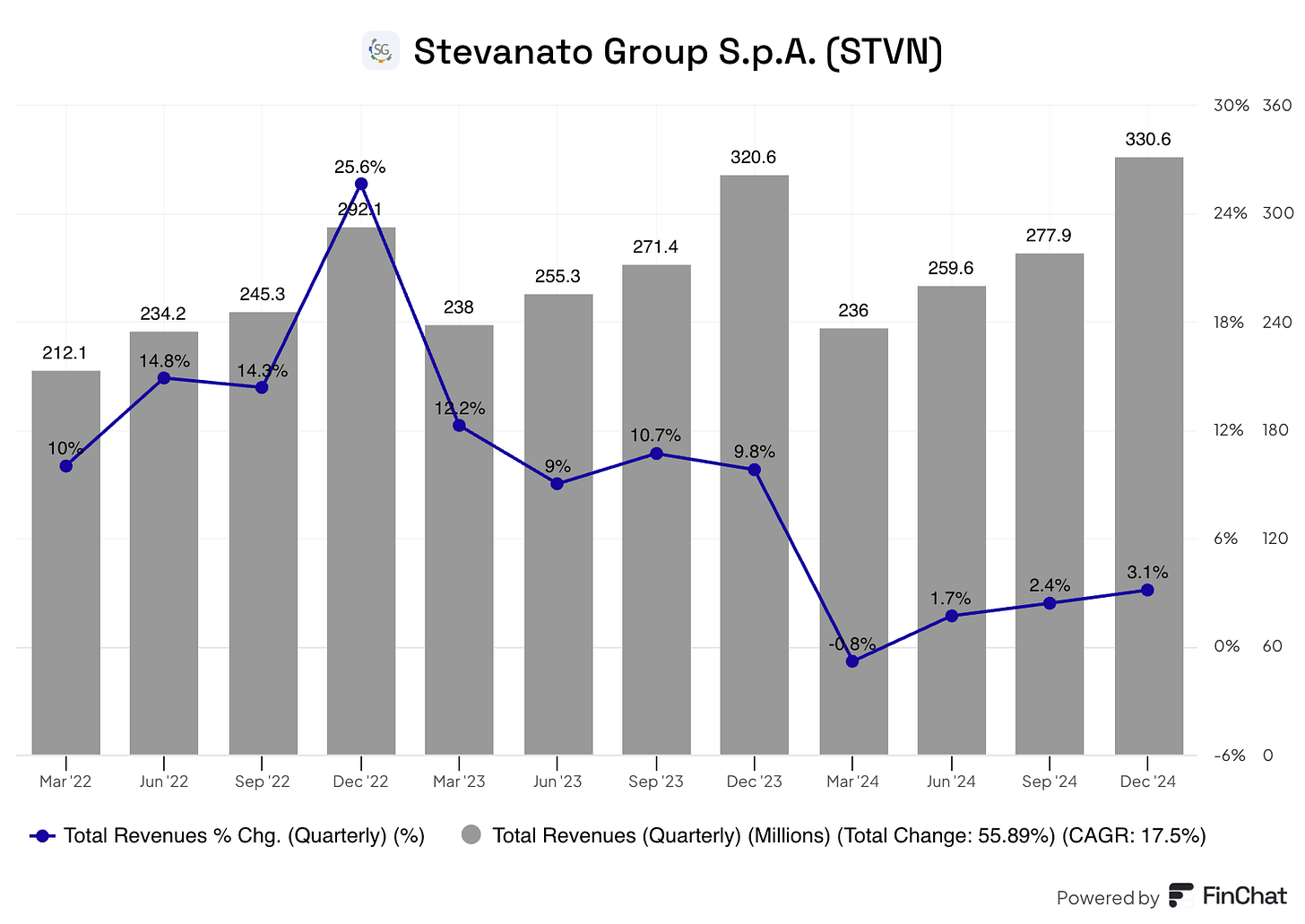

Q4 revenue grew 3% and accelerated through the year. Revenue in 2024 rose 2% year over year, slightly above market expectations of 1% growth:

There’s no denying that the trend is favorable, and what were previously headwinds will start to become tailwinds in the form of easy comps! Despite all the weakness and negative sentiment, Stevanato reported its strongest quarter ever!

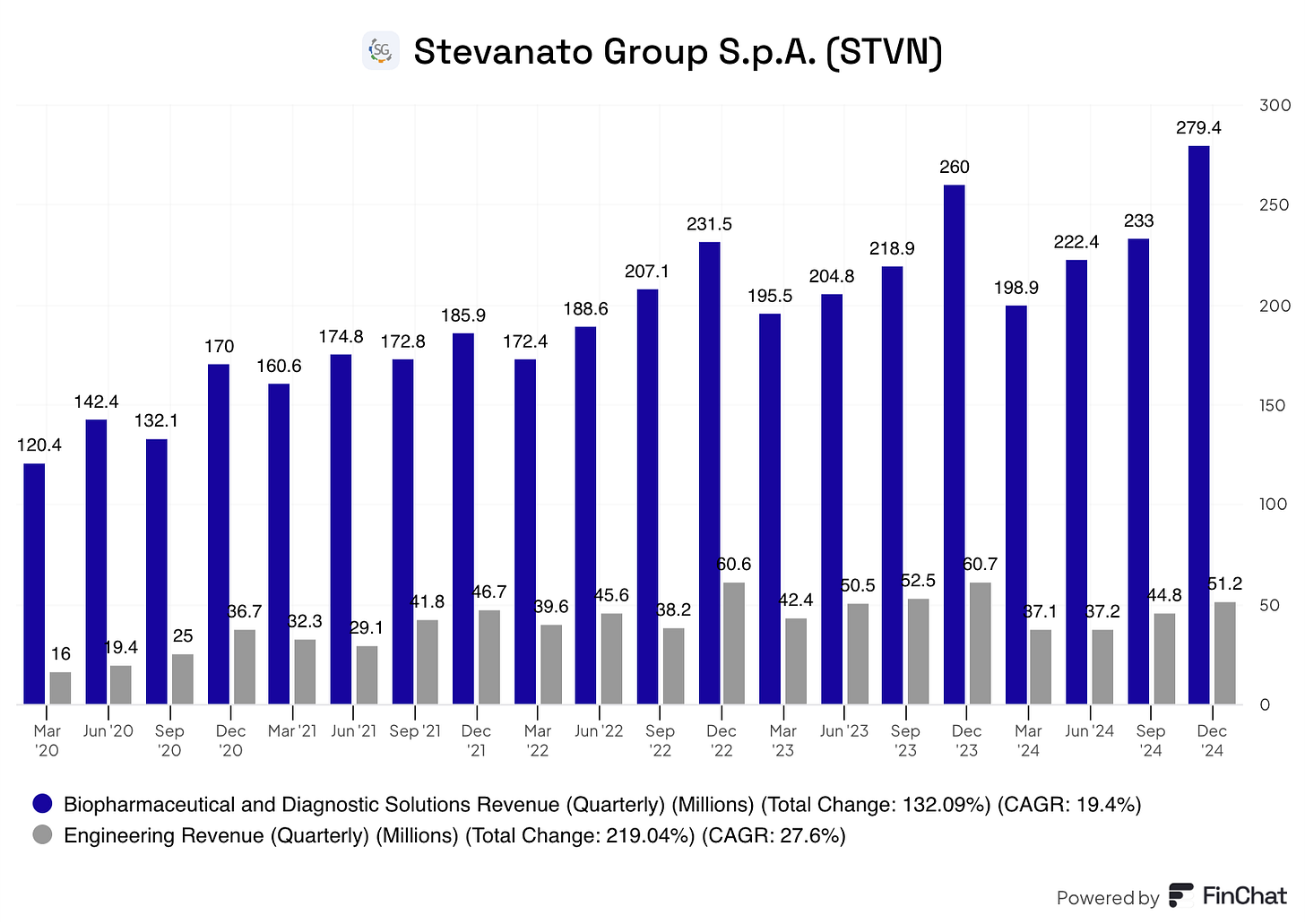

Looking at growth across the different segments (BDS and Engineering), we can see more of what we’ve seen throughout the year: good growth in BDS offset by the ongoing weakness at engineering. BDS grew 7% in Q4 whereas Engineering reported a 16% decline:

There were several highlights in both segments. First, Stevanato argued that the vial destocking is over. Vial revenue was down a whopping 34% in 2024 (-14% in Q4) but management expects vials to return to mid-single-digit to high-single-digit growth in 2025. Note that BDS revenue grew 6% in 2024 despite this headwind, meaning that normalized growth of the segment is arguably much stronger.

High Value Solutions were also a highlight. Revenue from HVS grew 15% in 2024, demonstrating that the industry-wide shift to HVS continues. Recall that HVS products can carry up to a 10x ASP (Average Selling Price) and double the gross margins of bulk products. This transition is what makes Stevanato very appealing: Stevanato can grow profitably at an excellent pace just by replacing its current volumes. High Value Solutions made up 38% of total revenue in 2024 and the runway to continue taking share of bulk is significant. The underlying driver of this transition is growth in biologics. Biologics are much more sensitive pharmaceuticals and they continue to grow faster than overall injectables, accelerating the transition to HVS. Revenue from injectable biologics grew 24% year over year in 2024, so it seems like the thesis is playing out.

Engineering also showed some highlights despite the persistent weakness. Management confirmed that most delayed projects will be completed by mid-year and that they expect flat to single-digit growth in the segment next year (i.e., it has bottomed). The turnaround in engineering is going just fine, and margins are already recovering despite the optimizations being far from done. Let’s not forget that even though it’s less appealing that BDS, Engineering is not a “shitty” business. The segment makes good products that are valued by its customers and increases Stevanato’s visibility into their operations. Management argued that regulation will be a tailwind for this segment and that they still believe this is a high-single digit growth business:

The product we are serving to our customer from engineering point of view are very well perceived because there is a big growth in biologics and there’s a high demand for assembly technology on the industry because of this device trend. Maybe more from a regulatory point of view, there are more and more requirements for new sophisticated inspection lines. It’s exactly where we want to focus the division the next years.

Margins enjoyed/suffered several tailwinds and headwinds in Q4 that were overall negative. The tailwinds were a strong mix of HVS and the continued ramp-up in Fishers and Latina (Stevanato’s two most significant Capex projects). The headwinds were vial destocking and the problems of the engineering segment.

Considering that the two margin tailwinds are “permanent” (HVS will continue gaining share of bulk and Latina and Fishers will continue ramping up) and that the headwinds are fading (vial destocking is over and engineering has troughed), one can only think that the margin expansion opportunity is very significant at Stevanato.

Management expects a 120 basis point (midpoint) gross profit margin expansion next year despite the continued dilutive impact of Latina and Fishers on company-wide gross margins. Latina should end 2025 with a normalized gross margin, but Fishers is around three or four quarters behind in terms of ramp-up and is a more significant project, so their combined impact is actually negative.

Adjusted EBITDA margins are expected to expand 200 basis points to 25.5% (midpoint) in 2025 despite Stevanato growing below its long-term potential. This margin expansion opportunity and its appealing growth make Stevanato’s growth algorithm much more attractive and its non-normalized valuation metrics misleading.

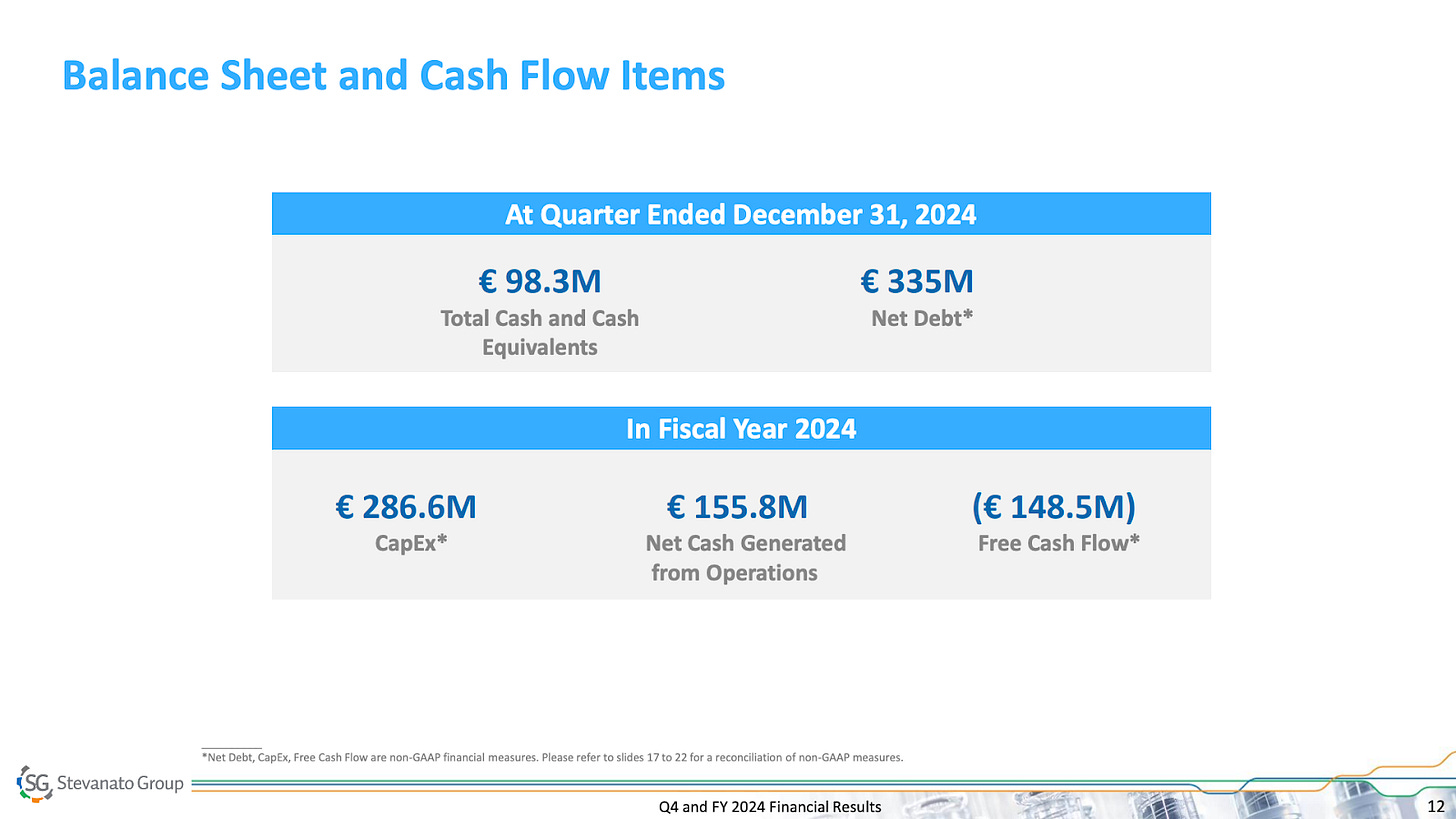

Operating Cash Flow improved significantly in 2024. Operating Cash Flow grew 48% year over year to €155.8 million (strongest year on record for Stevanato). The flipside was that Capex continued to be elevated and therefore Free Cash Flow was negative for the third consecutive year:

Management expects Capex to remain elevated in 2025 (guiding for €265 million in net Capex at the midpoint), but also expects the drop in Free Cash outflow to moderate significantly to €50 million. The Free cash outflow will moderate significantly because Operating Cash Flow is expected to improve and Stevanato will receive more Capex prepayments from its customers (discussed in more detail later).

Cash Flows are not what a Stevanato shareholder should be worried about right now. Stevanato is undergoing a massive investment cycle, and certain characteristics make it a very appealing investment cycle. First, this Capex is primarily being invested in HVS capacity, which should come with significantly higher margins. Second, Stevanato enjoys a lot of visibility because customers are already putting their money where their mouth is (i.e., committing capital upfront). Let’s discuss this in more detail.

Investments are getting validated

Many Stevanato shareholders (or industry watchers) are slightly worried about a potential risk of overcapacity. Many fill-and-finish companies are indeed building capacity, but certain things should help tame overcapacity fears (at least for Stevanato):

Stevanato is building HVS capacity, meaning that much of its capacity expansion will “simply” replace existing bulk volumes as biologics take share of the injectables market. Note that HVS include washing and sterilization, which makes Capex intensity increase, but also comes with higher ASPs and margins

Stevanato’s build-out is modular, so the company can somewhat adjust it to the demand environment

Customers are validating and paying the Capex buildout. Gross Capex for next year is expected to be €60 million higher than net Capex, and its customers are paying for this difference beforehand!

Management said several things during the call that confirm #3. First, management noted that an Anchor customer that already had a commitment to build Ez-Fill Cartridges capacity asked for an acceleration of this capacity build-out (i.e., Capex is being pulled forward):

Our 2025 plan reflects an acceleration of Capex related to the build out for Ez-Fill Cartridges at the request of a large customer.

This means that the decision to expand capacity in this particular case came from the customer, not Stevanato. Management also noted that cartridge demand is stronger than anticipated. Why is this important? Stevanato is the market leader in pen cartridges, meaning that a good portion of this demand will accrue to the company.

We got yet another example of a customer putting their money behind their mouth this quarter. Stevanato announced that an US-based Anchor customer had made a capacity commitment in Fishers:

Construction is underway on the build out of our device manufacturing operation in Fishers. This effort is supporting a large customer with multiple device programs across a range of biologic treatments. We will support this US Global customer with a fully integrated solution with both our Nexa syringes and our device manufacturing. Commercial activities related to this new contract manufacturing work are expected to begin sometime between late 2026 and early 2027.

Management pointed out that this is not “new Capex” but rather a pull forward in Capex they expected to spend down the road. I believe this news is great for several reasons:

It validates the company’s investment cycle: there indeed seems to be ample demand for Stevanato’s HVS and this demand might present itself sooner than management expected. This, imho, significantly mitigates the overcapacity risk at the expense of delaying Free Cash Flow generation to future years

It validates Stevanato’s vertically integrated strategy. This contract confirms that Stevanato’s value prop of being able to provide the containment solution and the delivery device might be resonating with customers

This second point is more important than it seems because delivery devices aren’t a great business to be in (very competitive) unless you can also manufacture the containment solution. Stevanato does both, which seems like a differentiation point in the delivery device industry.

This increasing request from our biologic customers that’s looking not only for glass containers, not only for cartridges, but also like a holistic partner where they can buy the glass and the devices.

Note that Fishers was not supposed to support delivery device manufacturing, but it will now do to support the large customer. Something worth noting regarding capacity is that Stevanato is significantly ahead of peers in building capacity, which means that the sooner the incremental demand arrives, the better positioned Stevanato is to win that demand.

A quick look at guidance

Guidance was also a highlight, albeit it seems conservative. Management guided for revenue growth between 5% and 8% for next year and significant margin expansion:

Note that this guidance portrays the attractiveness of Stevanato’s growth algorithm. With 6.5% revenue growth at the midpoint, Adjusted Diluted EPS are expected to grow 10.5%. If management beats the high end of its guidance, Adjusted Diluted EPS are expected to grow 14.5%. And all this despite the business running considerably below normalized margin levels even after 2025.

The market expected 7% growth in 2025, but if we take the outperformance achieved in Q4 and the high end of this guidance (which seems beatable), 2025 revenue should end up around 3% higher than what analysts expected. This is something that I don’t believe is incredibly important for the long-term but that shows that analysts might be a tad pessimistic here (maybe recency bias?). Stevanato remains a long-term story despite the bumps and the huge investment cycle, but it’s great to start to see some green shoots in the thesis this early on.

What’s interesting about all of this is that Stevanato is trading at a lower price than it has for a while despite investors now having more information on which to base their decisions. As a long-term shareholder who will continue to build his position, I must say that I am not complaining!

Have a great weekend,

Leandro