The Cracks in the "AI trade" and Adobe's Acquisition of Semrush (NOTW#69)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

It was a very interesting week in financial markets, with sentiment going from peak optimism to peak fear on a dime (who said narratives take long to change?). I discuss what happened in financial markets in the market overview and also share some thoughts about the healthcare industry (yes, again!). For those interested in Adobe, in the news section (reserved for paid subscribers), I also discuss the recently announced acquisition of Semrush (SEMR) and why it has little in common with the (failed) Figma acquisition.

Without further ado, let’s get on with it.

Articles of the week

I published one article this week: ‘Judges Scientific: Time to do something.’

Judges’ Scientific (JDG.L): Time to do something

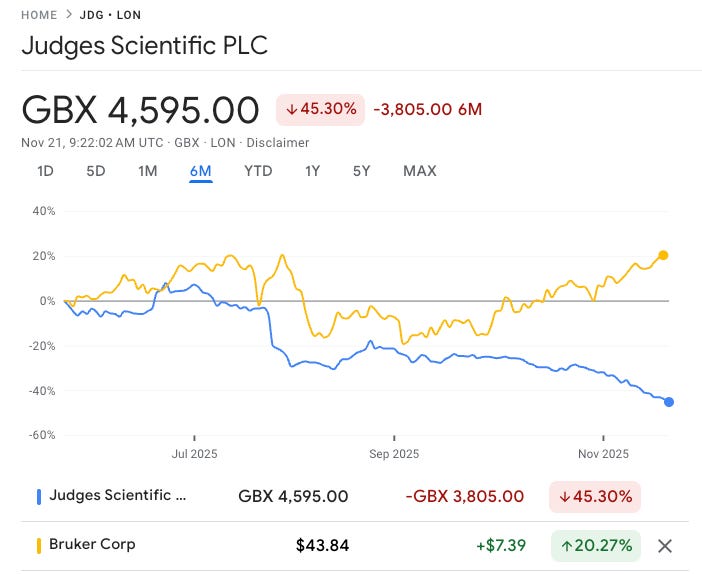

You might have noticed that Judges’ stock is considerably down over the past few months. Despite already being somewhat cheap at the beginning of the year, the stock has taken an additional 45% haircut:

The company has been heavily sold off lately, and after being pretty overvalued during the pandemic, I’d say it’s now getting to pretty cheap territory. Now, one thing to be aware of is that the company has gone “no bid” and keeps going down in the face of no notable news. Another thing to be mindful of is that the selloff hasn’t been entirely unjustified, as the academic and government segment in the US has faced significant headwinds (which are expected to persist for a bit), and capital allocation has been weak. Both things might point to a “broken compounder model,” but I’d say it’s still too early to make this call.

The divergence between Judges and Bruker (BRKR) lately has been interesting, especially since they are both exposed to similar drivers and headwinds/tailwinds:

In its most recent earnings call, Bruker also mentioned that the US ACAGOV (academic and government) segment had remained weak but stable, while they were surprised by the segment’s strength ex-US. We’ll see.

Without further ado, let’s see what the markets did this week.

Market Overview

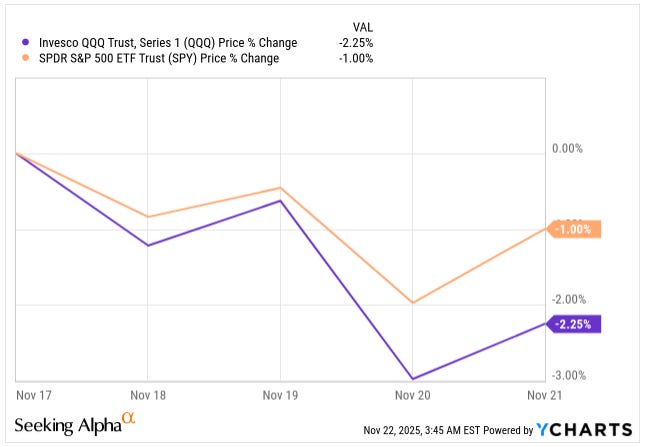

It was a very interesting week in financial markets (it always is, isn’t it?). Both indices were down, with the Nasdaq down somewhat significantly:

Markets started the week in negative territory, awaiting Nvidia’s earnings on Wednesday. Many took these as a way to gauge whether the AI trade was doing well, and Nvidia’s earnings did not disappoint. The company reported again spectacular numbers (credit where it’s due) and was initially up 5% the following day, driving the Nasdaq up around 2%. Many jumped to claim the AI trade was far from over and that the “bear market had been called off”, but then markets posted an extremely impressive intraday reversal. Just a straight line down:

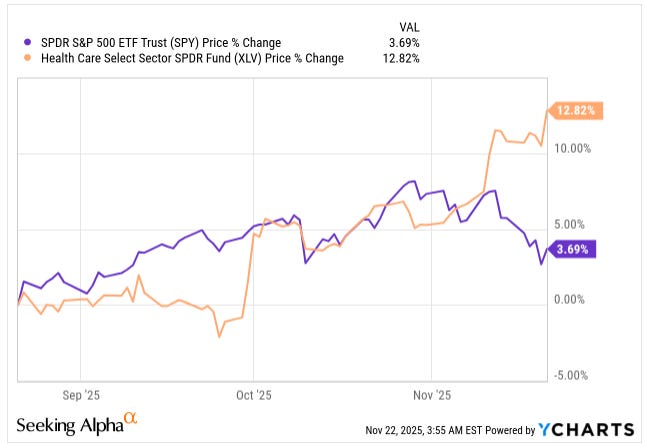

The following day was also an interesting one. Indices rebounded sharply but Nvidia and many AI stocks did not (i.e., early signs of a rotation?). Regardless of whether you think this is the beginning of a rotation, what happened this week is interesting (albeit it likely doesn’t change anything over the long term). I’ve been saying for quite a while that if the AI-trade ever rolls over (still too soon to tell), we might see some punished sectors starting to recover. Healthcare is a good example here. Take a look at what the XLV (the healthcare ETF) has done vs the S&P over the last 3 choppy months:

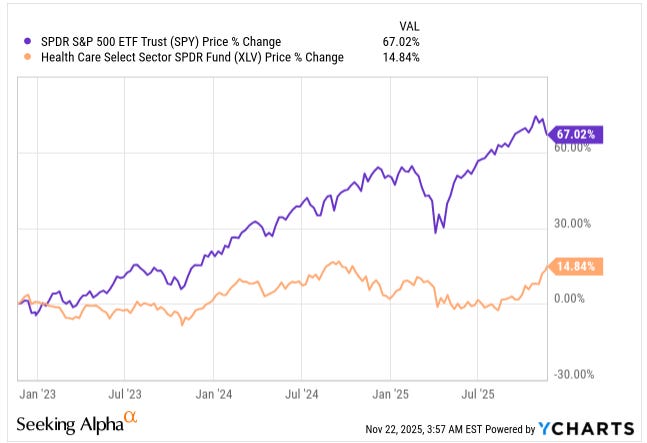

The healthcare sector suffered through the pandemic boom-and-bust and has had a terrible performance relative to the leading indices. Just for context, the XLV was pretty much flat for three years (before the recent “run” with the S&P 500 up more than 60%:

This led me to take a look at the weight of the healthcare and technology/IT industries in the S&P 500. The second derivative was to examine how much these weighed in relation to their “earnings power.” Here are the results:

Healthcare weighs around 9.6% in the S&P 500, but is responsible for around 12-13% of earnings

Technology/IT weighs 32% in the S&P 500, but it’s responsible for 25% of the earnings power

What does this tell us? Probably not much because there are a couple of caveats. First, the technology/IT sector is expected to grow faster than healthcare, so it’s normal to see it weigh more even though it contributes a smaller share of earnings.

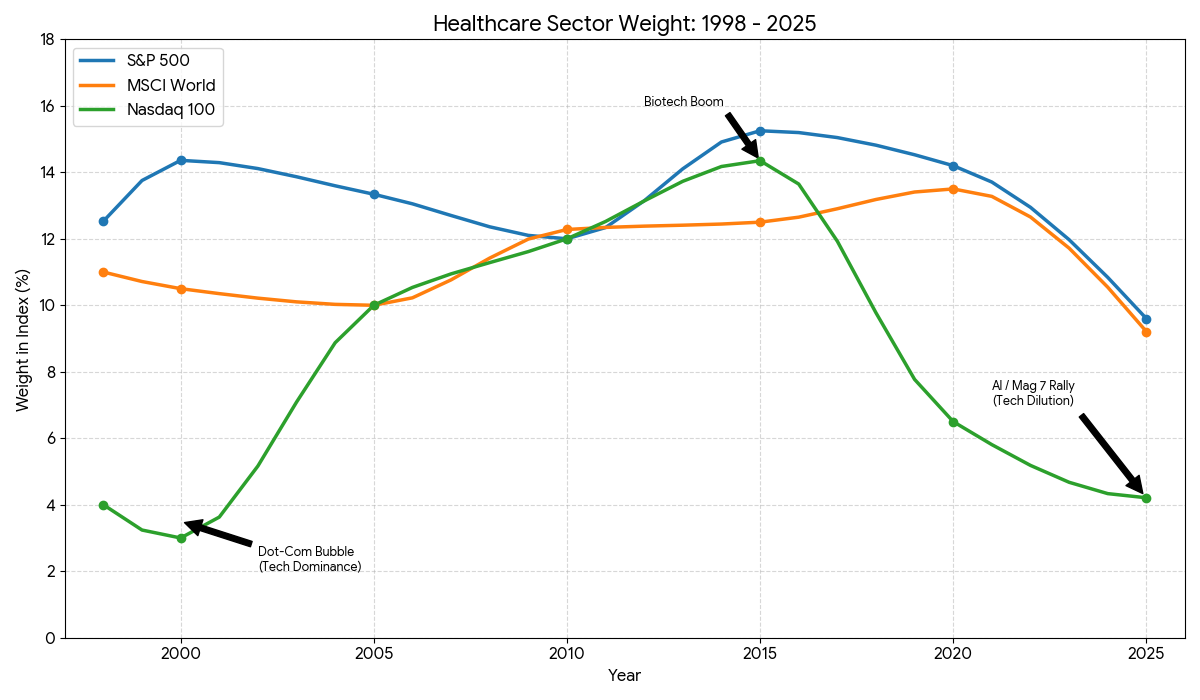

Secondly, I don’t want to portray that everything in healthcare is attractive; there are literally companies I would never touch with a 10-foot pole. That said, it’s interesting to see that healthcare is underweight in the indices, given its growing relevance as the population ages. In case you are curious, here’s how the weight of the healthcare industry has evolved over time across the leading indices:

Technology and healthcare moved somewhat in opposite directions when things got extreme (for example, during the dot-com bubble), with healthcare eventually making a comeback when things got less extreme. Now, I am not claiming that we are in an extreme scenario today, but it does seem plausible that healthcare will see increased flows IF (big if) the AI trade continues to experience weakness. I don’t think the AI trade is in a bubble, but I also think many healthcare companies are trading at multi-year valuation lows despite their top lines starting to accelerate after the pandemic bust. We’ll see, but I am definitely overweight “healthcare” compared to the indices.

As for what the market will do from here, I have absolutely no clue, to be honest. Sentiment changes so fast that it’s almost impossible to gauge what will happen the next day. We had virtually “peak fear” on Thursday, as people believed the AI trade was screwed, only to have extreme optimism on Friday as things recovered. I remember reading in a book that the only thing you can count on in financial markets is that sentiment can get extreme at times, but later return to more normalized levels, as people can’t live in emotional extremes for long.

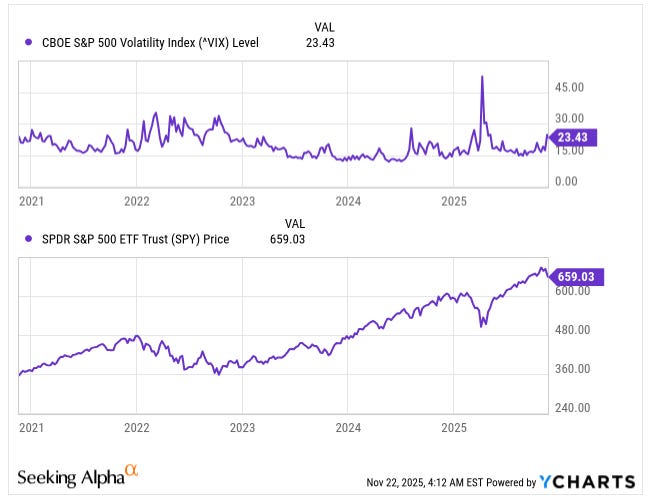

When I read this, I thought: how can I test whether this is right? And the answer could be found in the VIX (the volatility index). Note how the S&P 500 bottoms amid huge volatility spikes but later slowly recovers as sentiment normalizes again. Human psychology is a very relevant piece of financial markets (arguably one of the most relevant pieces!):

The industry map portrayed somewhat what I discussed above: money flowing out of the AI trade and into defensive sectors. We’ll see if this is the beginning of a new trend or just a bump along the way (honestly no clue):

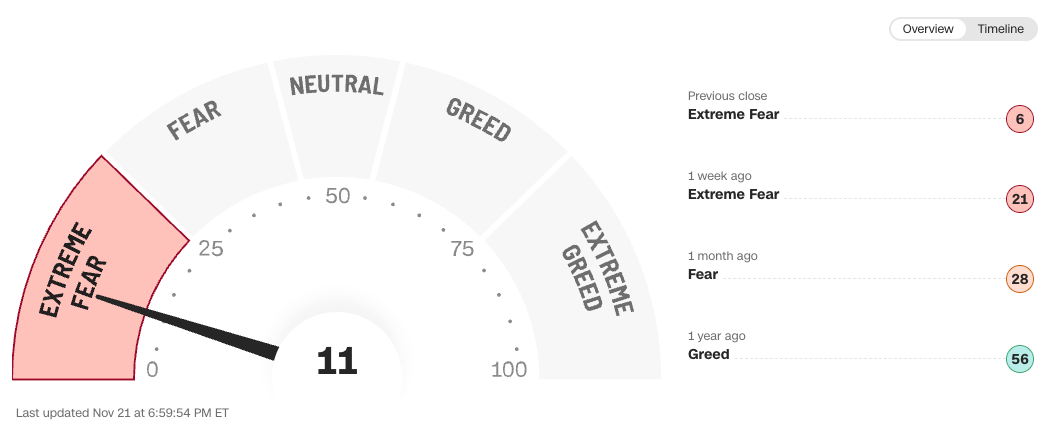

The fear and greed index made a low of 6 on Thursday but slightly recovered on Friday:

I’ve read a lot of people claim that “they’ve never seen it this low.” This is interesting because it portrays that most people have a very short memory: the fear and greed index was lower just in April this year, during all the tariff tantrum!

My transactions this week

I added to several positions this week: