Texas Instruments’ 2025 Capital Management Update

Texas Instruments hosted its 2025 Capital Management Update yesterday. In this event, TI’s management openly shares their capital allocation priorities with investors in what I feel should be a requirement for any publicly traded corporation. There were not many changes compared to the off-cycle update the company hosted in August 2024 (probably as a consequence of Elliott Management’s letter/involvement), but I wanted to write a short article to recap some interesting points and take another look at the valuation.

The first thing I wanted to highlight is this quote:

In the 10-year period spanning 2015 to 2024, we have allocated about $100 billion of capital. Given that magnitude, you can appreciate why capital allocation is a job we take quite seriously and one that has a significant impact on owner returns.

Capital allocation is the main driver of shareholder returns over the long term, and Warren Buffett has a quote that ties this activity to management and, therefore, shows why management is so important:

After 10 years on the job, a CEO whose company retains earnings equal to 10% of net worth will have been responsible for the deployment of more than 60% of the capital at work in the business.

TI’s CEOs tend to be in the role over a long period, and therefore, this quote is very applicable. Note that many people believe (maybe due to a quote by Peter Lynch) that any business should be able to be run by a fool and, therefore, that management is not important. I believe this is far from true and management matters a lot, especially if they are going to be allowed to operate for a relatively long period.

Management shared the chart I’ve shared so many times showing the evolution of semiconductor market units shipped. We can clearly see how slowly but steadily the industry seems to be recovering from the current downcycle:

This chart also portrays that the current downcycle has been one of the worst in the industry’s history. What became apparent in the call is that many analysts and investors are having a tough time envisioning a fast snapback from the bottom. I believe they suffer, to an extent, from recency bias. So does Texas Instruments’ management:

When, of course, when you're hovering around a trough, it feels that the sun will never shine again, but it does, and usually it comes out quickly, okay?

I published relatively recently an article on my ideal investment scenario and one of the characteristics I discussed that I find appealing is short-term cyclicality combined with long-term secularity. Texas Instruments’ capital management update call is a good illustration of why I believe this characteristic might offer attractive opportunities. There will be a moment when most investors will think that it’s “impossible” for the company to reclaim its prior highs (in fundamentals) because this would mean that go-forward growth will be above average. In short: it’s tough to envision a 20%+ growth rate for a company that has historically grown mid to high single digits.

I understand why this is tough to grasp, but this line of thinking completely misses that the growth CAGR was not achieved uniformly. We just have to look at Texas Instruments’ past to see that it’s definitely possible. Over the last two decades, the company’s industry has gone through three downturns (2009, 2017, and 2023). Texas Instruments has always achieved double-digit growth coming out of these cycles (3/3), so the historical data would suggest that a quick snapback is definitely possible:

Is this time different? I wouldn’t say so. Texas Instruments guided for 7% year-over-year growth at the midpoint for Q1 despite automotive and industrial (which make up 70% of revenue) still being immersed in the downcycle. If both of these markets recover, I believe it’s perfectly possible to see revenue accelerate materially.

The current cycle might not seem the deepest in the industry’s history based on TI’s revenue chart, but we must not forget that the 2021 peak was achieved in a supply-constrained environment and that the actual peak could’ve been higher if these supply constraints had been absent.

What’s interesting about all of this is that we are already seeing signs that a quick snapback can definitely be possible this time around. China, Personal Electronics, and Enterprise are three “segments” that are already snapping back strongly (HDD growth rates) after several quarters of weakness. This means that not only might the past be a good proxy for the future, but that the present might already be demonstrating that it is!

What many analysts and investors don’t believe is that after two weak years, Texas Instruments will be able to achieve the “low end” of its revenue scenarios ($20 billion in revenue) by 2026. $20 billion in revenue in 2026 would result in a 13% 2-year revenue CAGR. Purely based on recent performance, such a CAGR definitely seems optimistic (and the company might well fall short of it). However, as we saw, it’s definitely doable, considering we are coming off the bottom of one of the most severe downcycles and that tailwinds are as strong as ever.

Recency bias is a bias that’s tough to overcome (I struggle with it sometimes), but it’s precisely why there tend to be opportunities in cyclical but secular companies. As Jerome Dodson rightly pointed out…

Many of our biggest winners have been companies that operate in cyclical industries with secular growth drivers. When their business cycle turns down, investors become overly pessimistic and extrapolate the current negative conditions. They forget the cycle will eventually turn, throw in the towel on the secular growth drivers, and engage in panic selling, pushing the stock to bargain-basement levels. But eventually the cycle turns, and the stock soars higher. It's difficult to have the courage to buy when everyone else is selling, and this has been an important part of our success.

I am not claiming that $20 billion is the floor to TI’s 2026 revenue, just that if history is any guide, getting to that level is definitely doable. According to management, they “just need this (the recovery) to proliferate into industrial and automotive.” I’ll talk more in detail about the revenue and free cash flow expectations in the valuation section.

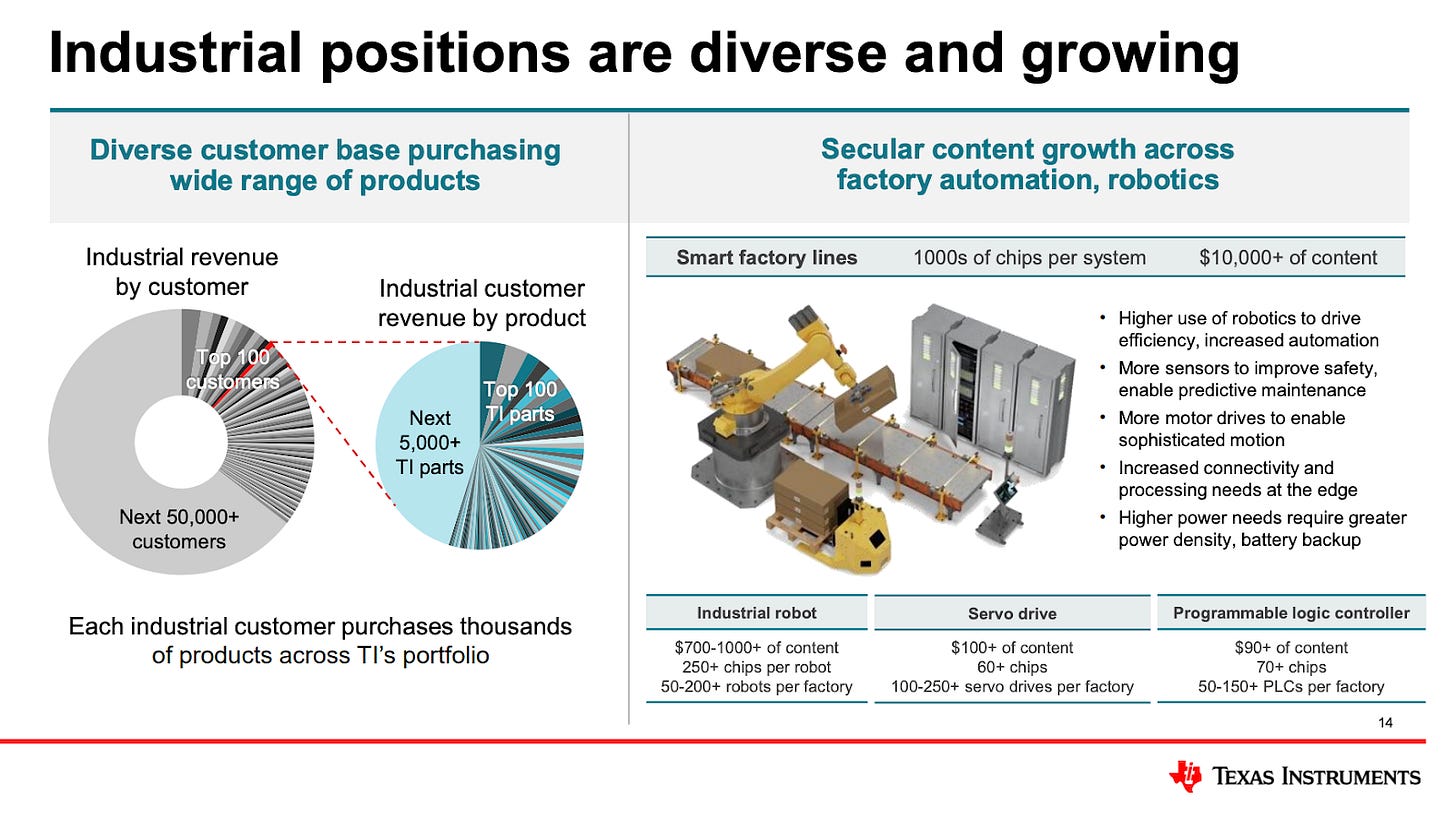

Another thing that stood out to me from the Capital Management Update was the diversity of the industrial business. The top 100 industrial customers make up around 30% of revenue. Management mentioned a customer that currently purchases 5,000 (!) SKUs from the company:

TI continues to expect strong growth in industrial as factory lines increasingly automate (this is also good for Atlas Copco’s industrial technique business) and grow their semiconductor content per application. Management believes the trend is underway but that there’s a lag right now between the trend and end demand. The reason is that the inventory of older systems at their customers has yet to be depleted before there’s inventory growth of new systems (which carry more semiconductor content):

The new systems are already completed in our customers’ benches. They are getting through qualification, and once the inventory of the older systems gets depleted, that new system will go into production together with probably building some inventory once you depleted everything you had before.

Another highlight from the call was TI’s in-sourcing:

In 2024, about 80% of our revenue was transacted directly, compared to about a third of our business in 2019.

This is a significant improvement that brings significant advantages to TI, primarily the ability to be close to customers and understand their needs, and an improved customer experience.