T.A.C.O! (NOTW#45)

Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

The market was up this week despite a reporter firing up Trump. There’s one word that Trump will most likely be remembered for (I briefly discuss both things in this article).

Without further ado, let’s get on with it.

New podcast episode coming out soon…and you won’t want to miss this one

I recorded a new podcast episode this week, which I plan on publishing next week. I won't provide many details, so it’s a surprise, but I can tell you it was about a topic I’ve recently written about with a guest who has dedicated their professional career to the subject.

If you don’t want to miss it when it comes out, feel free to follow the show on your preferred platform:

Articles of the week

I published two articles this week. The first one was Copart’s earnings digest.

The Market Punishes Copart

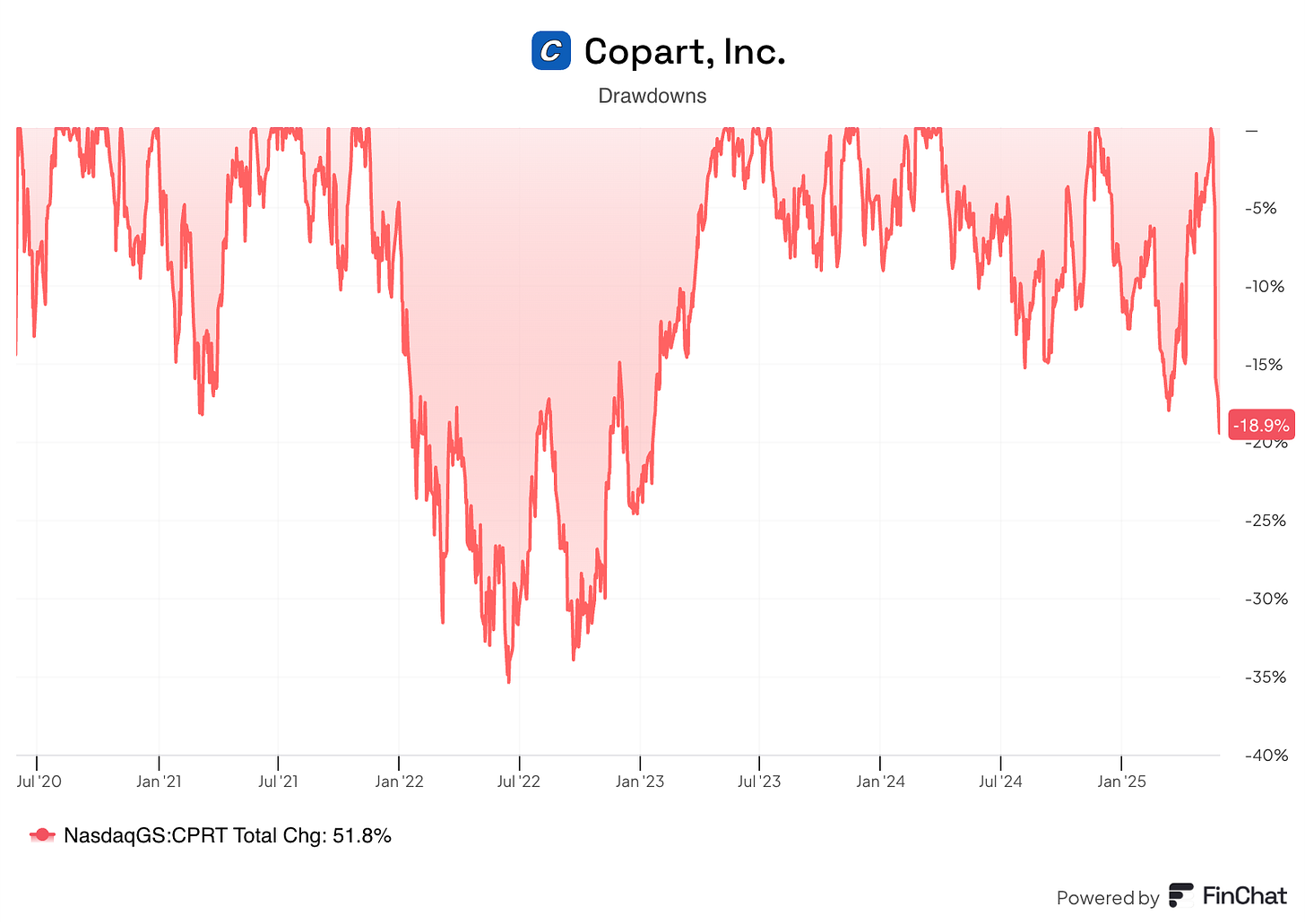

I am not used to saying this for Copart, but the company reported a relatively poor quarter. The market also didn’t seem to be accustomed to this and heavily punished Copart, with the stock dropping more than 11% on Friday:

The company reported one of the weakest quarters since I’ve followed it, although not all is as negative as it seems. The market tends to shoot first and ask questions later, and the company’s stock suffered its most significant one-day drop in over a decade (excluding the COVID-19 pandemic). The stock is now down almost 20% from highs…

…but does this make it cheap? I discuss this in the article too.

The second article of the week discussed five of my investment mistakes.

Don't Make These Investment Mistakes

I’ve been thinking about writing this article over the past couple of weeks. I’ve made many mistakes investing through the years, and this is not the first (or last) article where I’ll talk about the…

I was surprised to see the engagement it received, not only in terms of likes but also in the quality of comments, where many people shared their own stories.

Market Overview

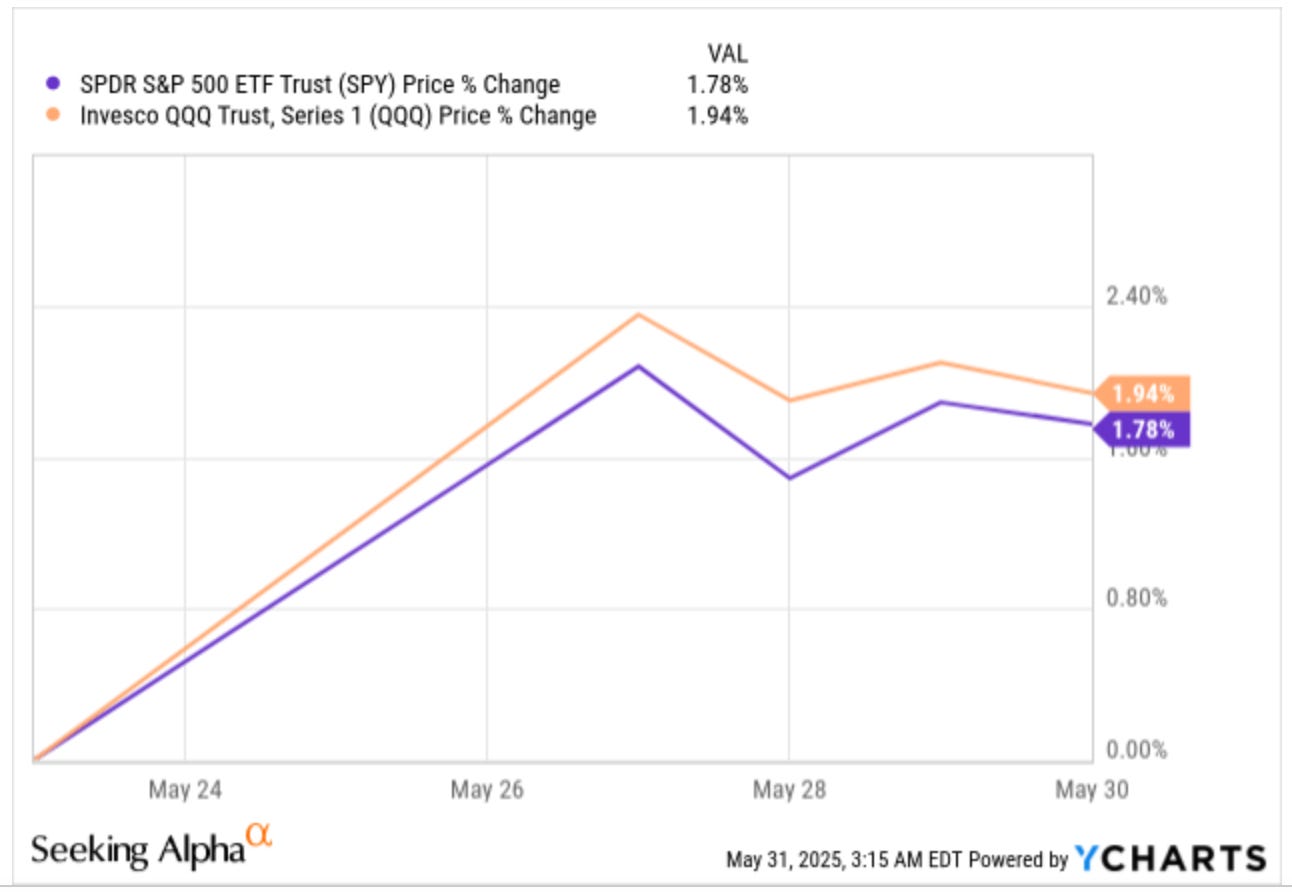

Both indices were up this week, even though Trump was made aware of the nickname Wall Street has given him (more on this later):

A reporter asked Trump on Thursday (I think it was on Thursday) about what he thought about his new nickname: TACO. TACO stands for ‘Trump Always Chickens Out,’ and it was given to Trump due to his strategy around tariffs. As Trump is an individual with a large ego, investors began to think that making him aware of this nickname would become the beginning of a new tariff rant — and they were not wrong! On Friday, Trump accused China of violating the Trade agreement with the US:

The market reacted somewhat negatively, but it has become pretty evident that the market is a “TACO believer”, or what I mentioned last week: that Trump is the boy who cries wolf. The market was proven right again, as Trump said later during the day that he would speak with Xi and work something out (chickened out again!):

Investors and the market know one thing for sure: Trump is entirely unpredictable, and uncertainty is likely to remain high as long as he remains in the White House. As money tends to avoid uncertainty, we can expect a period of heightened volatility during his mandate. I usually speak about an interesting topic that comes to mind in the NOTW, but I have no intelligent ideas to discuss this week (I hope to be more inspired next week).

The industry map was pretty much green this week:

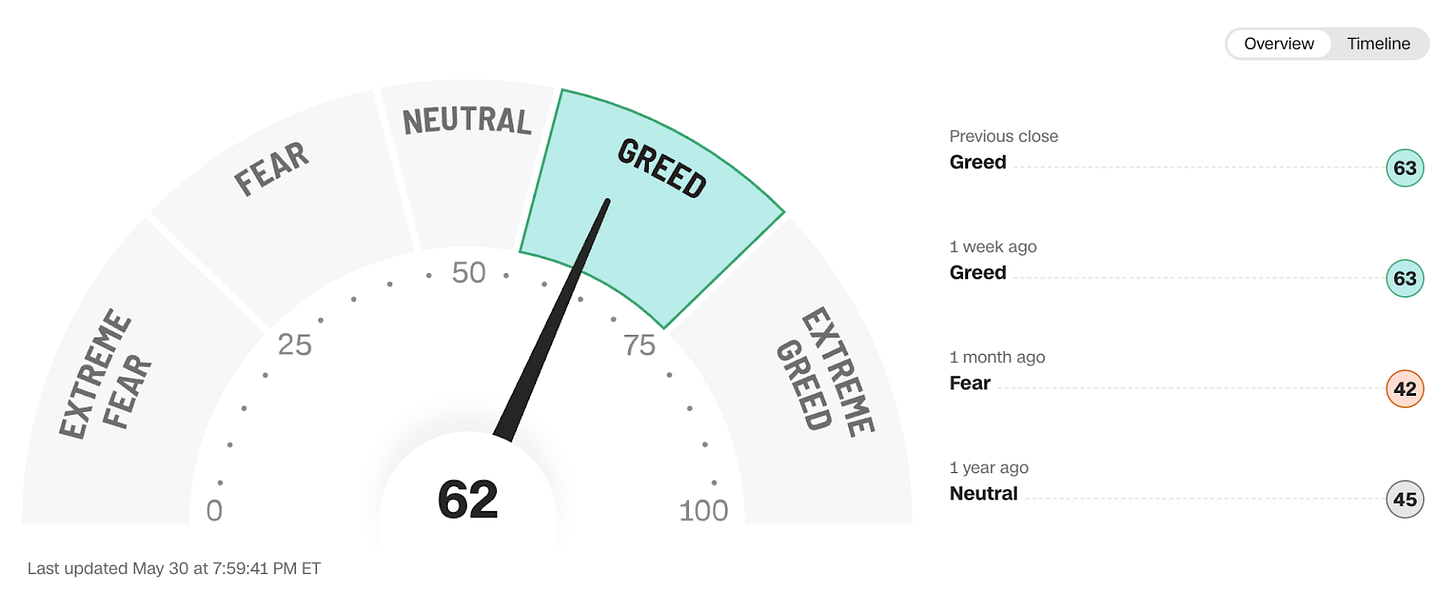

The fear and greed index remained in greed territory:

The rest of the content where I share my transactions and the news of the week is reserved to paid subscribers.