The Market Punishes Copart

Is it justified?

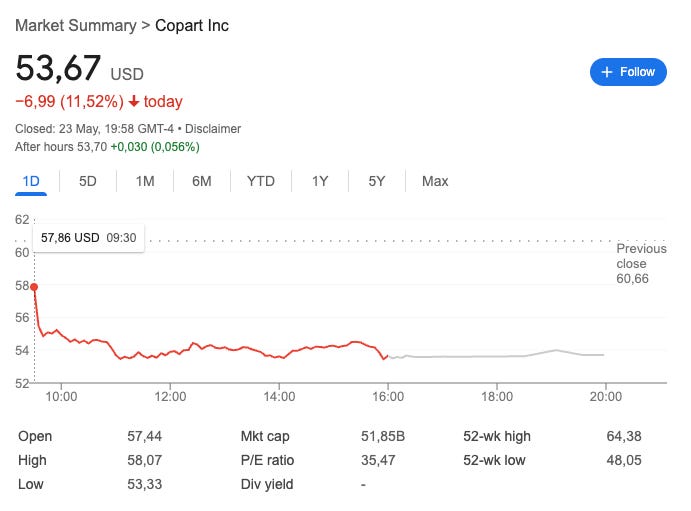

I am not used to saying this for Copart, but the company reported a relatively poor quarter. The market also didn’t seem to be accustomed to this and heavily punished Copart, with the stock dropping more than 11% on Friday:

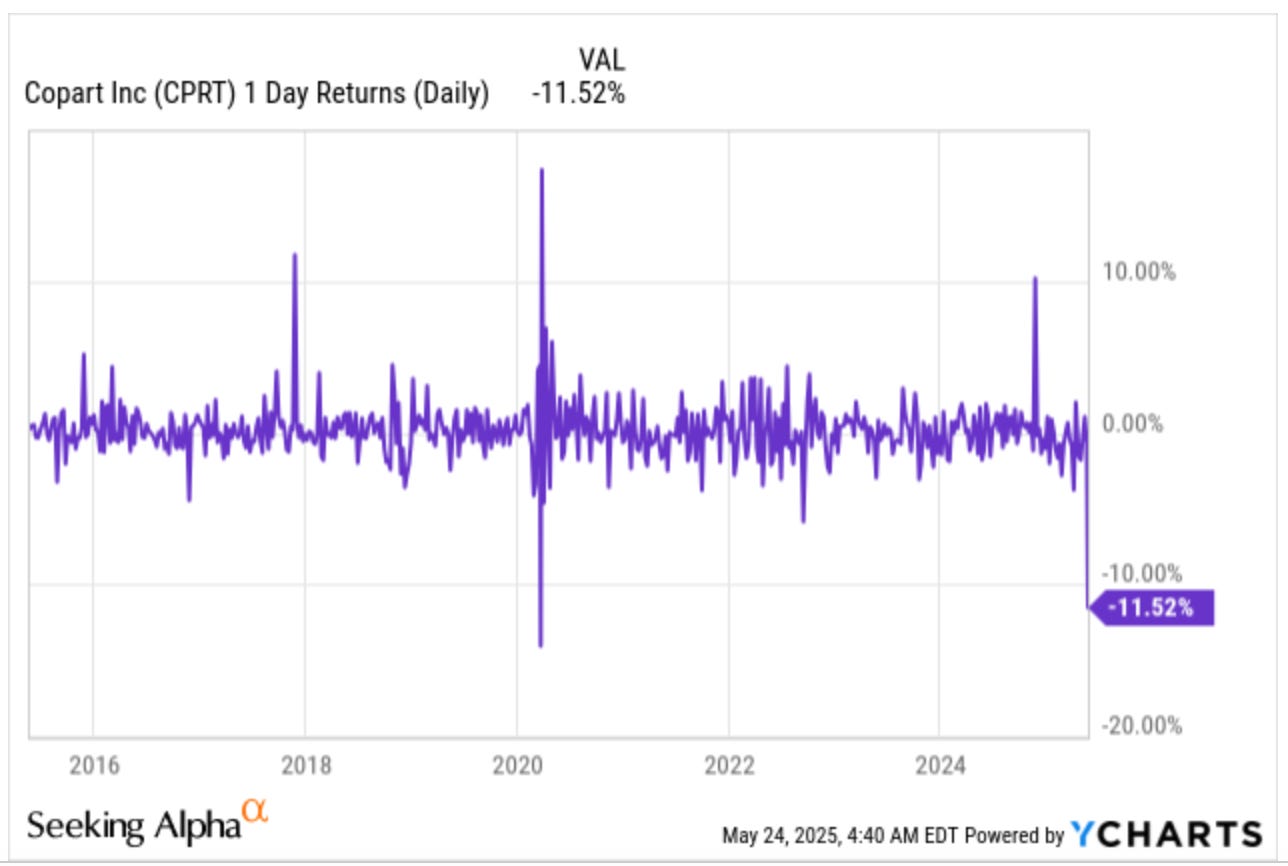

This is a significant one-day drop for any company, but more so for Copart. If we look back, we can see this was Copart’s most significant one-day drop over the last decade (excluding the pandemic):

While, as I’ll explain in this article, earnings were definitely not great, reporting on a down day in the market didn’t help.

Without further ado, let’s take a look at the quarter.

Copart’s earnings

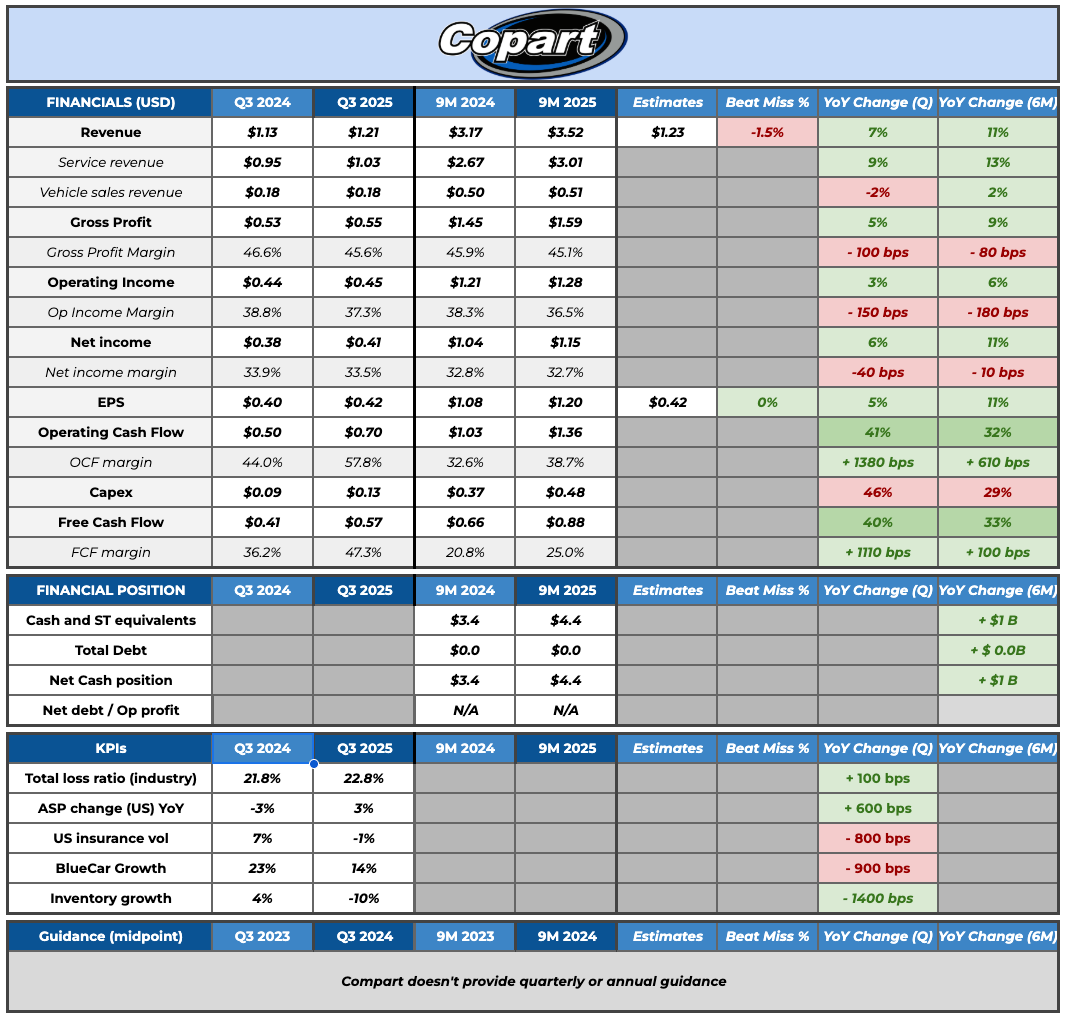

Here’s the summary table for Copart:

Copart has grown investors accustomed to not having many red figures in the summary table, but this was not the case this quarter. I have decided to focus this article on three main topics:

Revenue and market share

Margins

Cash flow and inventory turnover

Let’s start with revenue and market share. In last quarter’s earnings digest, I praised Copart’s revenue growth, writing the following:

Copart continues to grow at a pace that few expected it to (myself included). If you were to go back in time to 2017 when Copart was growing at a 14% clip and were asked to forecast the growth in 2025… it’s improbable you would’ve arrived at the 14% figure Copart reported in Q2.

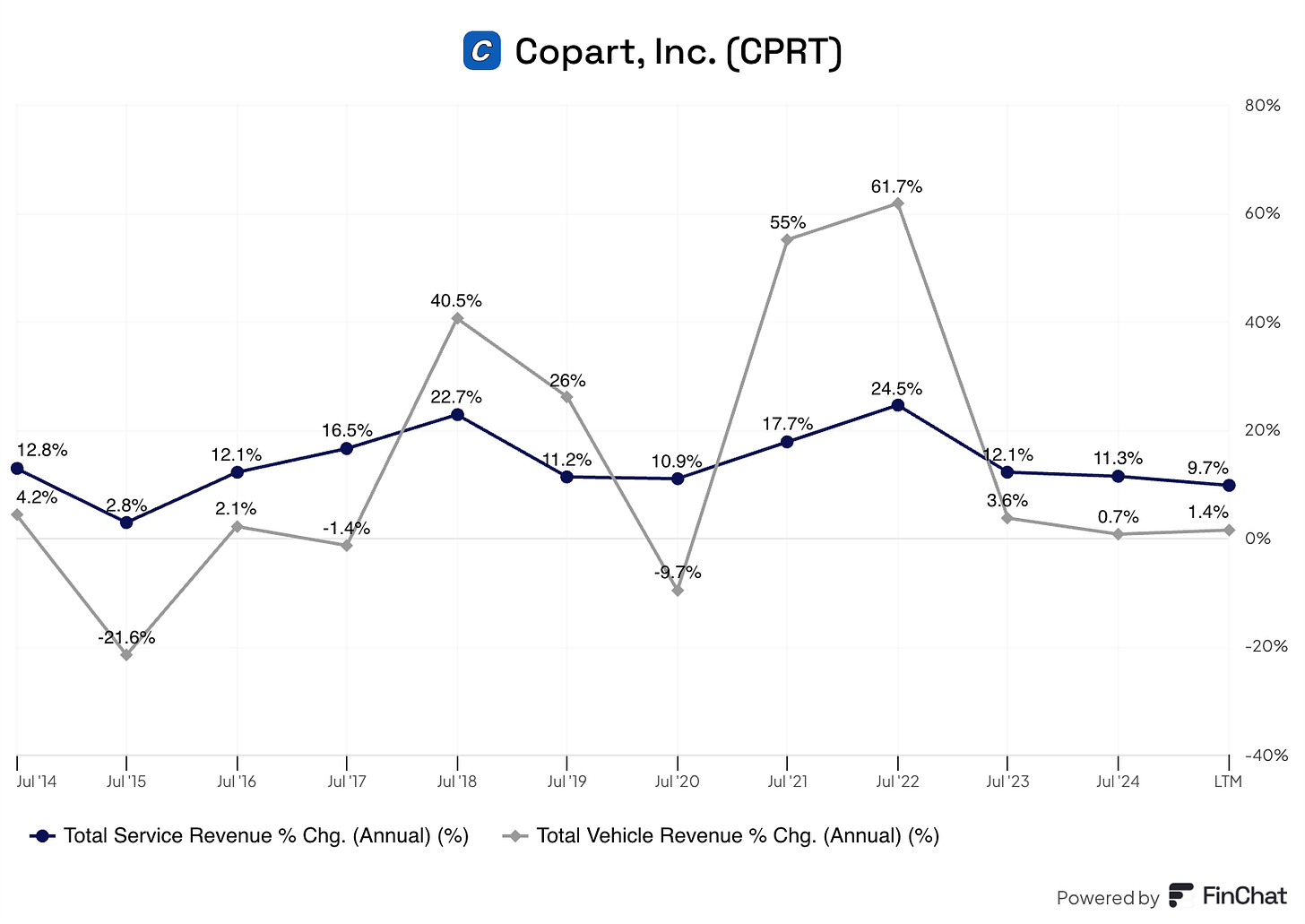

While revenue still grew at a good pace in Q3 (+7% YoY), there’s no denying there was a sharp deceleration. Let’s look at the positives before delving deeper into what might have caused this. One positive is that service revenue continued to outpace purchased vehicle revenue.

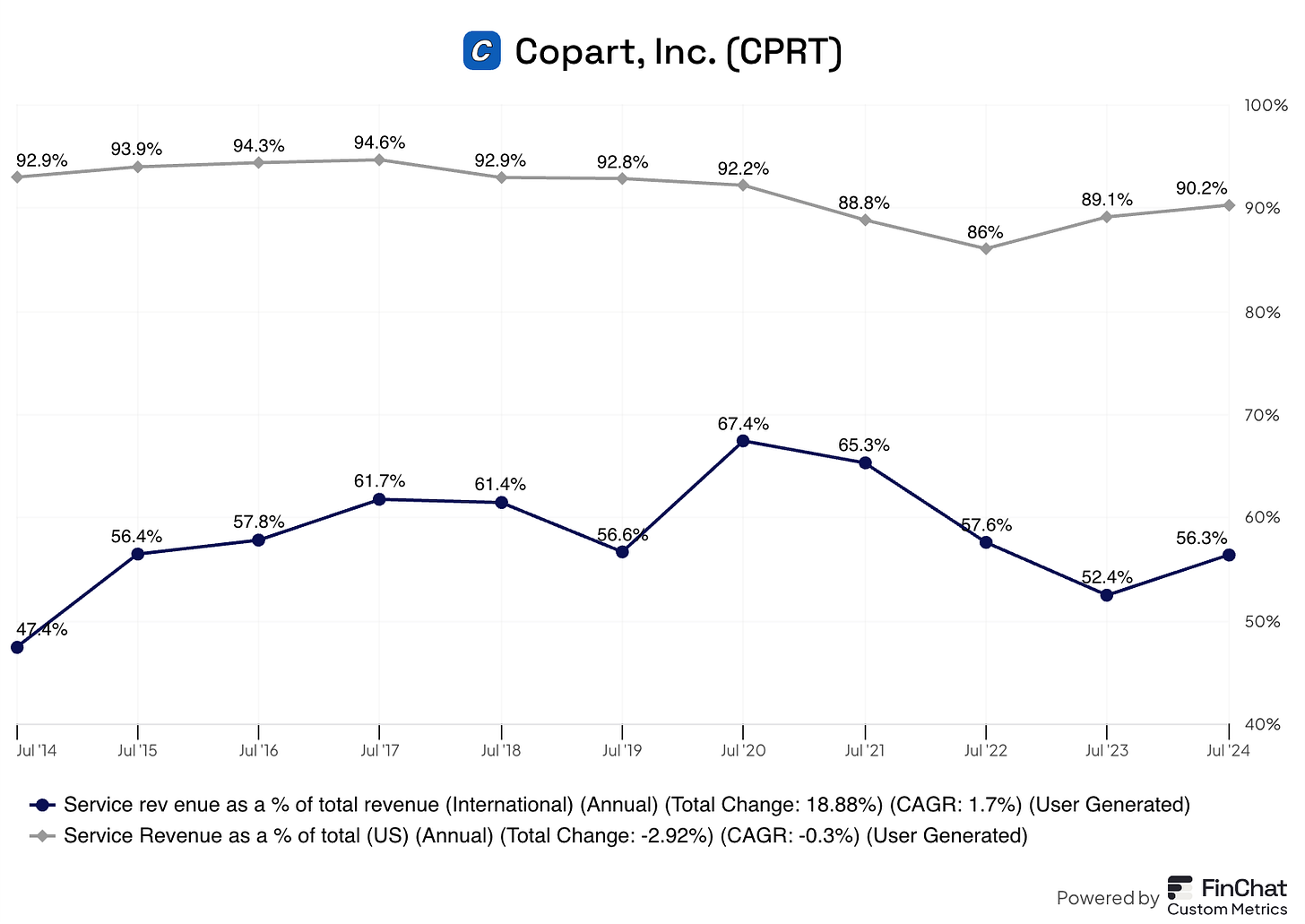

This was partially caused by the development of the international business, where insurers continue to transition to a consignment model, a model that is much more profitable and less risky for Copart and a better deal for insurers (i.e., a win-win):

The reduction in international purchase vehicle revenue accompanied by an increase in gross margin continues to be driven by higher ASP insurance vehicles in Germany, which have transitioned from a purchase contract to a consignment model.

An essential part of the Copart thesis is that most vehicles will eventually transition to the consignment model, therefore closing the international business’ margin gap with the domestic business to an extent:

If and when this happens, Copart’s current gross margins (45%) should converge to the domestic gross margin (49.4%). While this is what theoretically should happen, it’s not happening currently:

Copart’s international service revenue doesn’t seem to be evolving up and to the right. It seems stagnant below 60%

If #1 doesn’t start to play out, then international growth is likely to be a headwind to gross margins as the segment is growing faster

As I’ll discuss later, margins for Copart are not normalized, even if the international business ends up being of the same margin profile as the domestic business. Now let’s take a look at the negatives regarding revenue.

Management attributed the revenue slowdown to a cyclical phenomenon related to the uninsured. According to management, when the macro environment gets more challenging, more people opt for no insurance or an insurance with lower coverage. This leads to a lower total loss ratio and, therefore, less volume for Copart.

What that means in practice is that drivers with coverage of that type may never bring their vehicles into the traditional insurance claims settlement pathway in the first place. We would expect over time, as has been proven over the decades, that these typical forces will reverse.

Management alluded to this phenomenon also being present during the Global Financial Crisis, and that they have no reason to believe it’s not cyclical. Let’s take a quick look back at that period.

Copart’s revenue decreased 5% in 2009 after posting strong growth (+40%) in 2008. The reason for the weakness in the post-GFC period was indeed an increase in the non-insured population. As per management in the 2010 call:

We've seen double-digit growth in non-insurance volume, and the insurance volume is slightly down, specifically because of the economy. Unemployment leads to uninsured motorists.

The other thing we've got is there are just less insured vehicles out there. So the insurance industry as a whole and we've got additional cars. We're processing more cars as compared to what we were in prior quarters. What we've got, though, is a situation where the insurance industry as a whole is shrinking right now, and it's shrinking because of all those factors. More unemployment leads to more uninsured motorists.

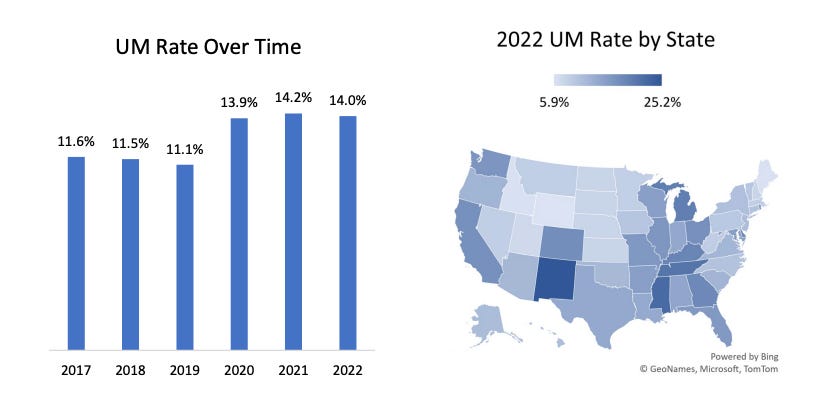

If we look at the data from the Insurance Research Council, we can actually see this has been a headwind for Copart for almost 5 years now:

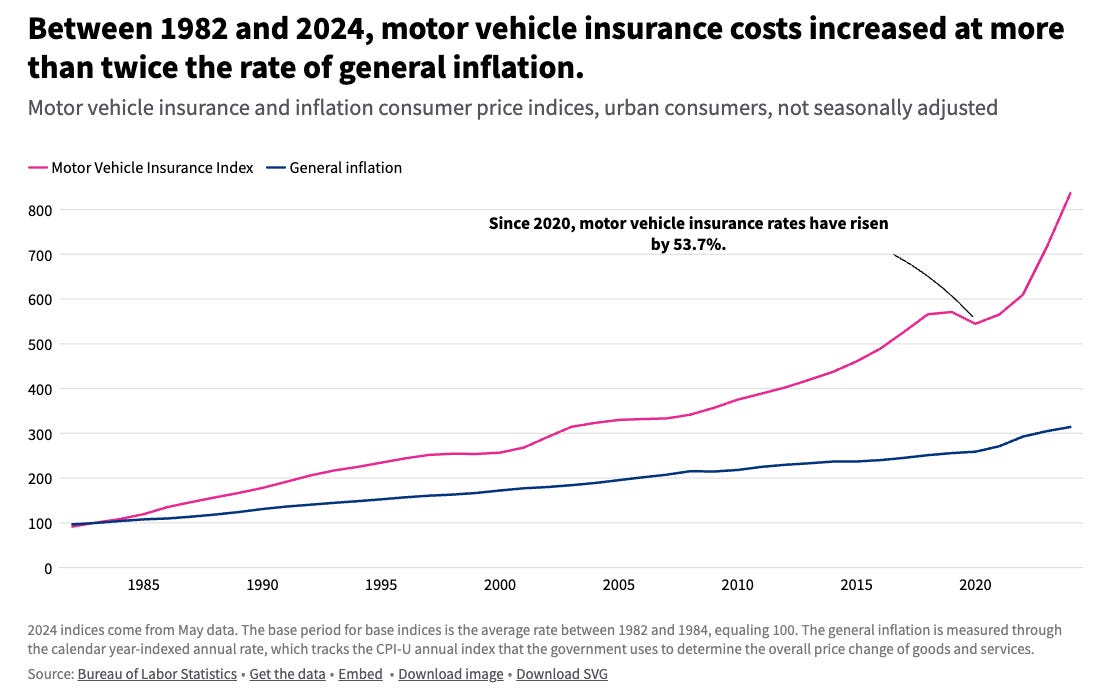

While Copart’s management alluded to this being a consequence of the current macro just like in 2010, I believe it has more to do with insurance rates than the economy at large. Vehicle insurance rates have risen more than 50% since 2020, precisely the moment when the uninsured motorist population started to rise:

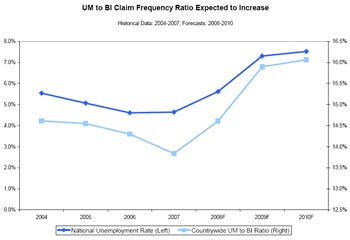

The context in 2010 seemed different because this metric was closely correlated to the unemployment rate (sorry for the pixelated image, it was the one I could find from IRC):

Another headwind that Copart suffers is that IAA is gaining share under RB Global’s tenure. While Copart has been a share gainer for some time due to the mismanagement that was taking place at IAA, this mismanagement seems to have somewhat corrected itself under its new owner (RB Global, previously Ritchie Bros), and IAA is recouping some of its lost share.

While I would prefer Copart to be a monopoly and continue gaining share forever from IAA, it’s normal to see some sort of share shift after a period of significant market share gains. Insurers likely don’t want to rely exclusively on Copart, so as long as there’s a credible competitor (which IAA seems to be under its new owner), it’s normal to see a duopoly market structure. I wouldn’t take this trend as a proxy for what will happen in the future. Copart has significant advantages compared to IAA, allowing it to have the highest auction liquidity, eventually resulting in better outcomes for insurers. This said, it’s undeniable that it’s a headwind to growth today and that it’s something worth monitoring closely.

To this, we must add Purple Wave’s poor performance. Management argued that Purple Wave’s sector (heavy used machinery) is not doing great with all the uncertainty (consistent with RB Global’s commentary), but Purple Wave has gained share over the last twelve months. This means that Purple Wave is currently yet another headwind to growth. Copart’s non-insurance business has also decelerated but continues to grow at above-average rates. While this business is a massive opportunity for Copart, there’s no denying it’s a lower quality business than the insurance business, and we don’t really know how much it currently makes up of the entire company.

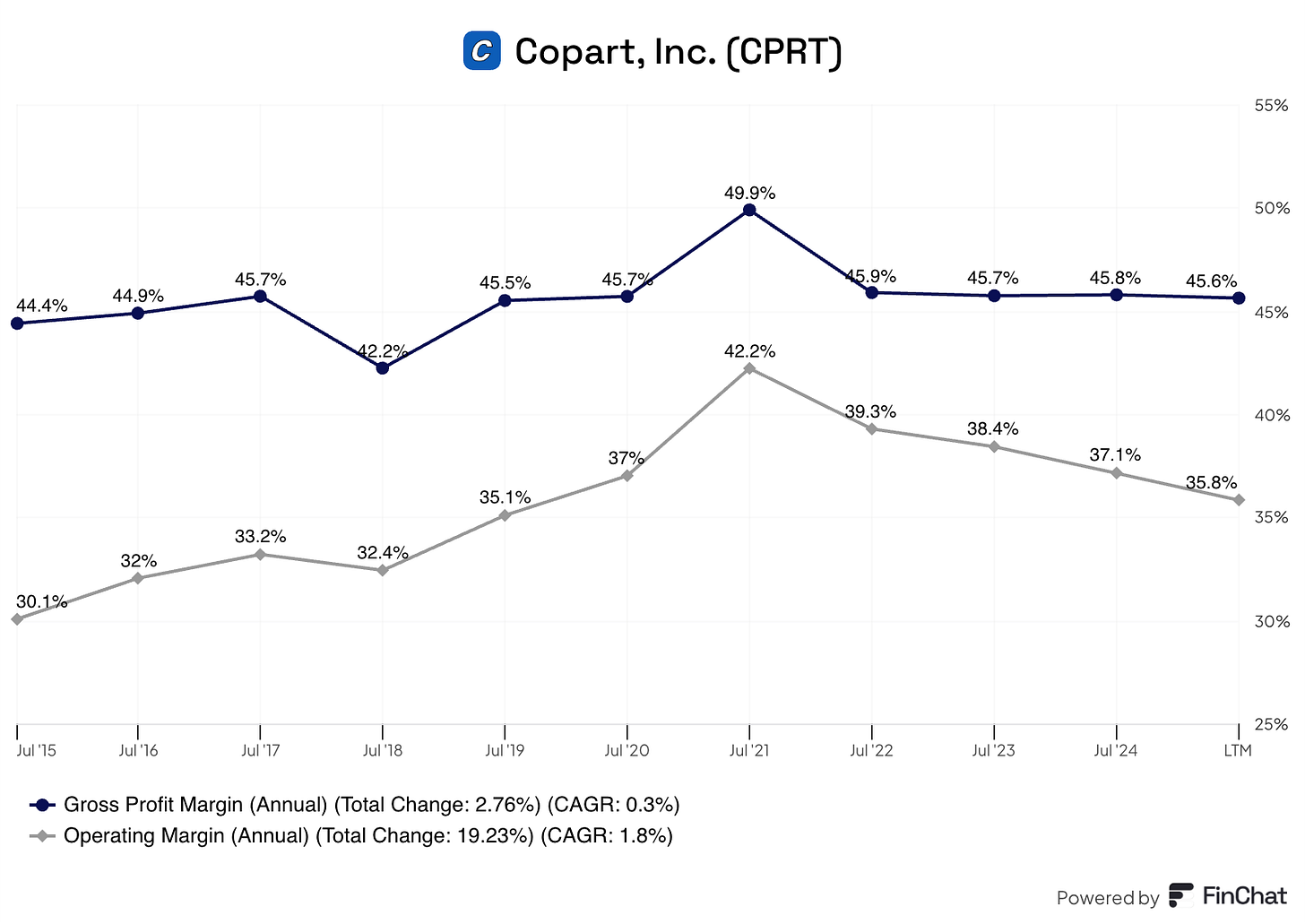

Let’s talk about margins. While Copart’s margins should, over the long term, converge to the domestic gross margin, they have been under pressure for some time. The reason has been twofold. First, Copart relied more on purchased vehicles in the post-pandemic period as used car prices rose and put downward pressure on insurance volumes (through a lower total loss ratio). Secondly, Copart acquired Purple Wave not long ago and is investing aggressively in building its workforce. At the same time, Purple Wave’s industry is going through a softer period, meaning that these investments are not yet met with increased sales.

To this, we must add that Copart’s margins are not really normalized because management continues to invest significantly ahead of demand. There was a pretty good example of this dynamic this quarter:

One tangible example is our acquisition of Hall Ranch, a property located in South Florida, which offers nearly 400 usable acres of vehicle storage for a storm. With this addition, we now have the physical footprint to handle a storm more than three times the size of the largest Florida storms on record in Copart history.

This ultimately has three implications:

Most of Copart’s capex is growth Capex

The company’s land is underutilized

Copart continues to build significant land assets

While I don’t know to what extent margins are lower than they should be, there’s no denying that Copart is not enjoying its full margin potential.

One topic that’s somewhat related to margins that I want to touch on is cash flows. In last quarter’s earnings digest, I wrote the following:

Copart has embarked on a trip to help insurance companies turn their salvage vehicles faster. The company has undertaken several initiatives to do this, like Title Express and AI-enabled image recognition tools. The ultimate goal of these tools is to help insurers make a decision faster and, once they’ve made this decision, help sell these cars faster. Both play in Copart’s and the insurers’ favor.

Copart benefits from more volume and faster cycle times. The faster Copart can auction a car, the less time it spends on its land and the less land the company needs to sell the same number of cars (i.e., it increases land efficiency). For insurers, a faster process also translates into significant economic gains because the less time money is tied to a salvaged car, the better. It’s basically a win-win.

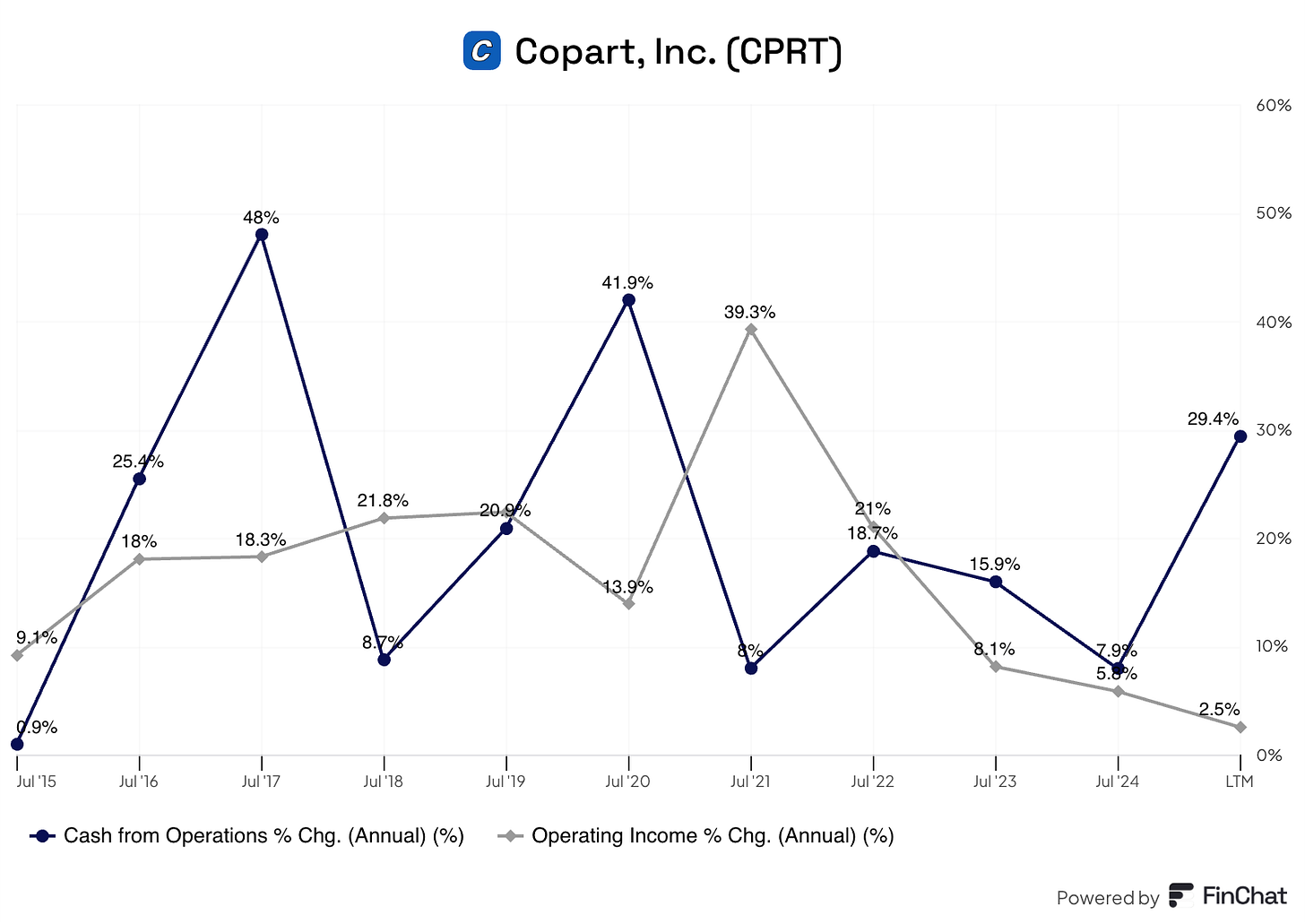

This strength in cash flows continued in Q3: Copart's operating cash flow and free cash flow grew 40% and 41%, respectively. While I would like to say that better inventory management has caused this surge in cash flows, the reality is that it was caused primarily by a significant drop in accounts receivable. Over the last year, some of Copart’s customers took more time to pay the company, and this seems to have corrected itself. I wouldn’t take it as a structural change (although I do believe Copart can structurally improve its cash conversion), but rather as a cyclical swing inherent to the company’s cash conversion:

Management did mention, though, that inventory turnover is improving thanks to solutions like Title Express:

Our continuous focus on reducing our operational cycle times has reduced inventory levels. For example, deploying our Title Express solution to a number of new carriers has reduced in-yard cycle times and physical inventory.

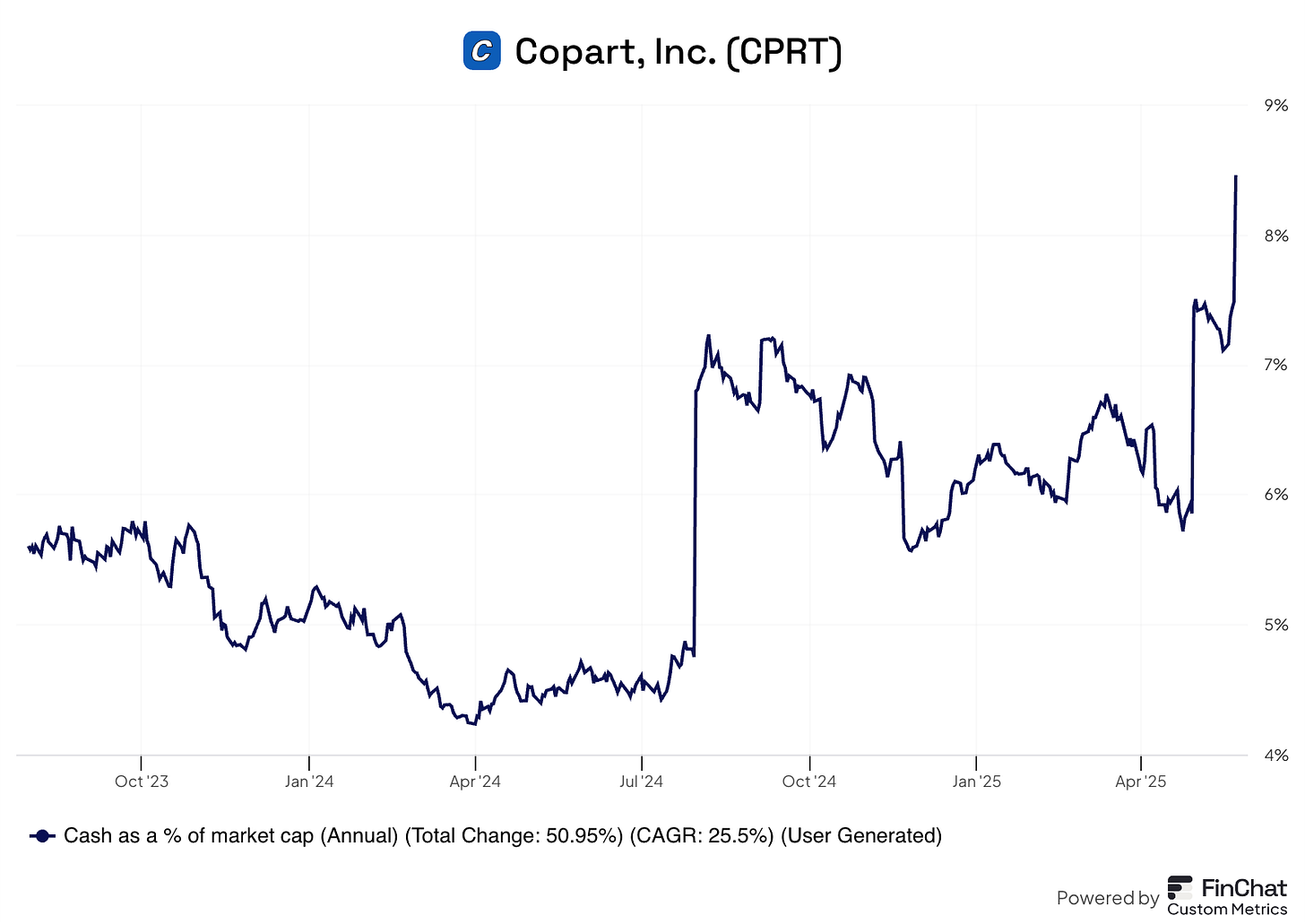

These strong cash flows helped Copart increase its cash position, which now stands at $4.4 billion. The company’s cash as a percentage of market cap has now grown to more than 8%, its highest level in a couple of years (both the high cash flows and the drop of the stock on Friday helped):

Even though management has argued that this cash is there to preserve the durability of the business, investors are already wondering what level is appropriate to keep on the balance sheet. I doubt Copart will repurchase shares at this level or that the company will conduct a significant acquisition, so I believe the probability of a special dividend has increased considerably. Copart has never paid one, but we’ll see.

Is Copart a good buy now?

I added Copart to my portfolio in June 2022 and have added several times since then. The stock is now up 93% from my cost basis for a 25% CAGR. With such a strong appreciation in under 3 years, one can only wonder whether the stock is expensive today.

I would be careful looking at Copart on a market cap basis (due to its high cash position) and on a net income basis (due to the company enjoying a benefit from interest rates due to its large cash position). As always, the best thing to do is to look at Copart on a Free Cash Flow basis, although we must not forget that the company is investing significantly for growth, and therefore, Capex should drop materially once growth slows. Let’s look at Copart’s valuation through two lenses: a reverse DCF and an IRR table using multiples. Let’s start with the former.