T.A.C.O, Bank Earnings, and plenty of company-specific news (NOTW#64)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

It was a relief week as tensions between China and the US relaxed a bit (TACO trade all over again!). There was plenty of (mostly) good company-specific news this week from portfolio companies.

Without further ado, let’s get on with it.

Articles of the week

I published two articles this week. The first one was ASML’s earnings digest.

ASML: Quarters Don't Really Matter

ASML reported Q3 earnings today, and kick-started my earnings season (yay! Actually…not yay! When is Trump moving forward with the 6-month reporting? Asking for a friend). Contrary to past results…surprise, surprise, the market seemed to like these this time. You might have noticed there’s a sharp drop in there. It took place during the earnings call, and I’ll explain what I think it’s related to later in the article:

The company reported an okay quarter, but in my view, people continue to overobsess with the quarterly numbers. I explain why investors shouldn’t spend too much time on the quarterly numbers and highlight what I believe are some very positive signs.

The second article of the week outlined why I have added a new position to my portfolio.

A new addition to my portfolio

I will add a new position to my portfolio today. For the first time, I will not write a comprehensive report on the company. The reason is straightforward: the thesis is pretty much identical to that of another company in my portfolio

It’s a company that I’ve been following for years, and I decided to pull the trigger now that two things have happened:

The stock price has come down significantly (it’s down 30% from its highs)

The company has continued to execute

Without further ado, let’s see what the markets did this week.

Market Overview

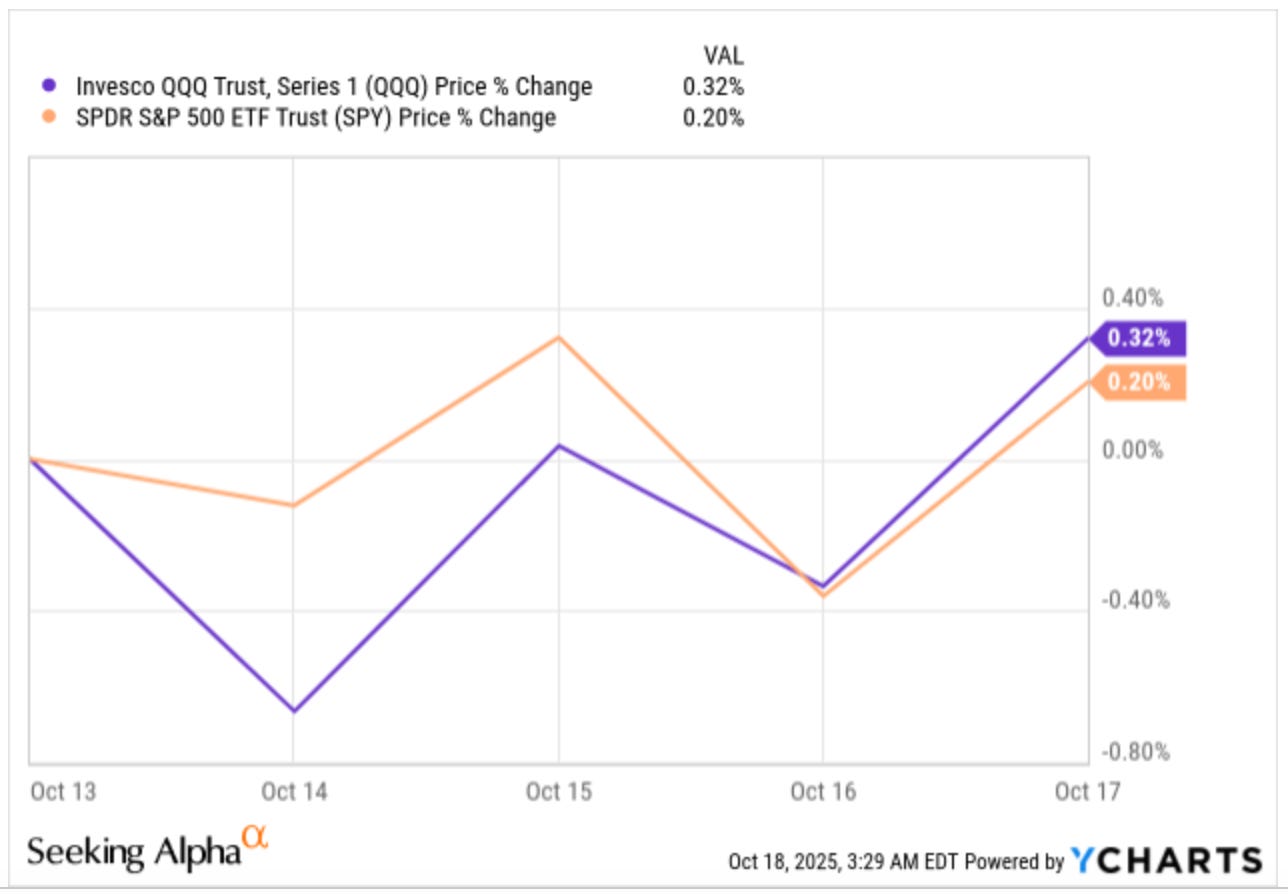

After last week’s volatility, both indices were slightly up this week:

Last week, I wrote the following regarding the “new” tariff war between China and the US:

Let me share some brief thoughts here. Some things have changed compared to the situation we experienced several months ago, while others have not. Let’s start with what might have changed. The main “difference” is that many companies are much better prepared for a tariff war today than they were in April. We’ve evidently not seen a full “decoupling” from China in such a short period, but there’s no denying that the pandemic and the first Tariff tantrum in April have made supply chains across the board much more flexible.

The things I believe have not changed are several, but they can be summarized in one: the outcome of the tariff threats is likely to be negotiations. The reason I claim this is that Trump has set a 20-day deadline from today, which likely indicates he is open to negotiation (or else this would’ve been with immediate effect). The fact that China also set its deadline on November 1st likely signals a similar predisposition to talk. We’ve seen this before, just a few months ago, and I believe it’s likely that both countries will end up reaching a deal (who knows, maybe this is the first time the T.A.C.O trade doesn’t work!). I plan to be pretty aggressive, taking advantage of the opportunities, which I will discuss in more detail later for paid subscribers.

This week, both countries lowered the tensions a bit, claiming that everything will be “fine” and that an outright decoupling doesn’t benefit anyone (the TACO trade worked again!). This said, I don’t think this marks the end of the uncertainty. Over the next couple of weeks, I believe it’s likely we’ll see more of this tug of war unfold. We’ll see!

To this we must add that it’s currently earnings season and therefore we can expect more volatility. A lot of financial institutions reported this week, and some of these earnings “spooked” the market and made investors worry about the state of the economy. Note that the economy has been a source of concern since at least 2022, and markets are up significantly since then (thanks to the economy holding up strong). Does this mean that the economy can never worsen? Not at all, economic cycles are the norm (not the exception) through history, and it’s unlikely to be different this time. Now…what this does mean is that nobody has an edge on macro forecasting. Of course, some people will claim that they were right when it happens, but what they will not tell you is that they’ve been wrong for a good part of the past 5 years!

It’s interesting to note that some economists (or so-called “experts”, and I say so being an economist myself) have claimed that more than half of GDP growth during the first half of the year has come from AI-related investments, not consumer spending growth. I have no clue how these experts are making the calculations, but I would somewhat agree that both the stock market and the US economy likely need AI to “work” to do well from here (I might be very wrong, though). Whether AI is a bubble or not is an entirely different topic, too long to discuss here. If you’d like me to write an article on the subject, feel free to let me know by liking this article.

The industry map was mostly green this week:

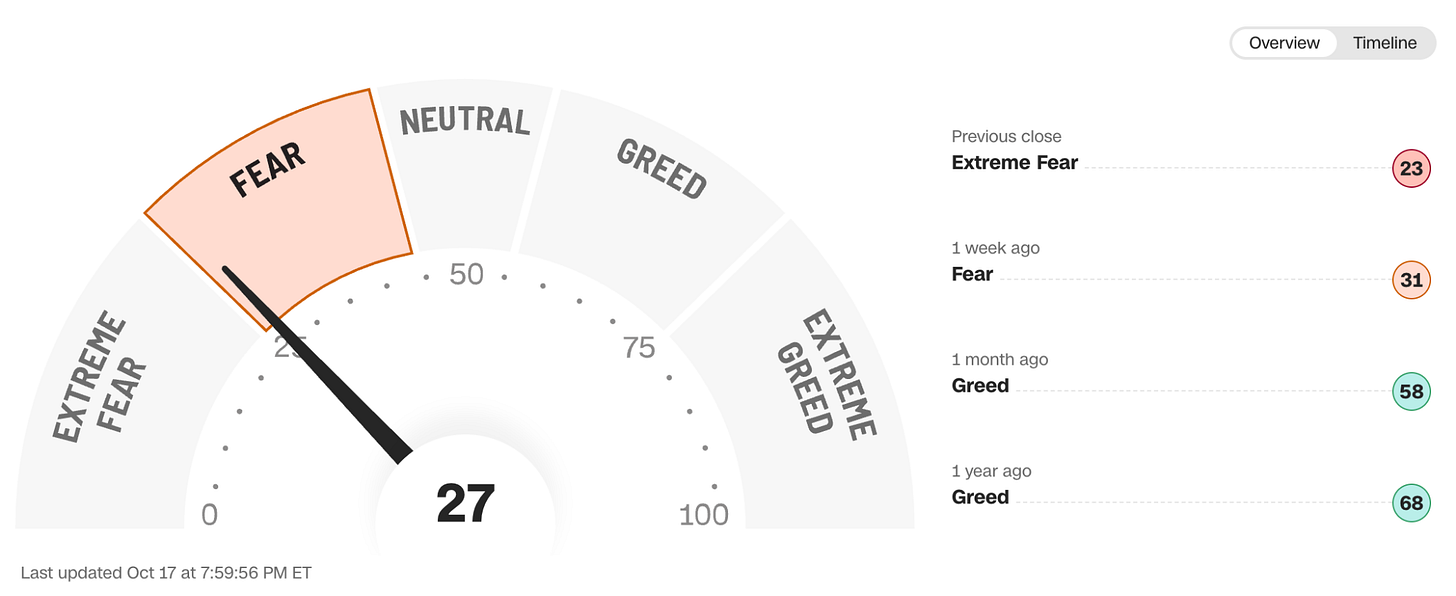

The fear and greed index dropped a bit more but remained in fear territory: