ASML: Quarters Don't Really Matter

Q3 Earnings Digest

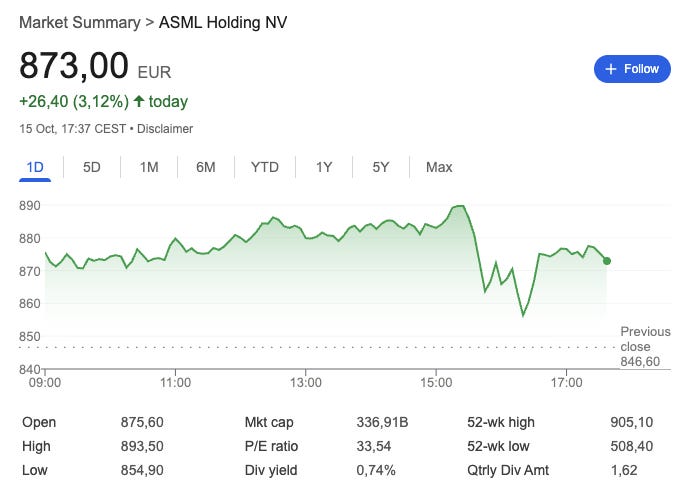

ASML reported Q3 earnings today, and kick-started my earnings season (yay! Actually…not yay! When is Trump moving forward with the 6-month reporting? Asking for a friend). Contrary to past results…surprise, surprise, the market seemed to like these this time. You might have noticed there’s a sharp drop in there. It took place during the earnings call, and I’ll explain what I think it’s related to later in the article:

Even though I could focus on the quarterly numbers and whatnot, this would most likely be a waste of your precious time. The main reason is that ASML’s supply has been fully booked for most of the last 5 years, making quarterly numbers pretty much useless. Quarterly numbers are fine (albeit not the best) for judging demand trends because demand tends to change relatively fast, but ASML has not had a demand problem for a while. Therefore, its quarterly numbers are a result of shipment timing and revenue recognition more than anything else.

It’s also interesting that, while I have seen a lot of people claiming that ASML missed revenue estimates (€7.52B vs estimates of €7.73B), I have not seen many pointing out that ASML’s beat on its Q4 outlook (€9.5B midpoint vs €9.3B expected) made up almost entirely for the shortfall (also portraying that it was mostly a timing issue). What happened this quarter was exactly what management said would happen: a weak Q3 followed by a monster Q4. My thoughts and prayers are with the sell-side here. If we consider the supply chain and revenue recognition dynamics along with the high price tag of certain of ASML’s systems (mainly EUV), the company pretty much becomes unforecastable on a quarterly basis. No matter the case, sell-siders get paid for quarterly forecasting and therefore have no choice but to continue to chase the dream of making the unforecastable “forecastable.”

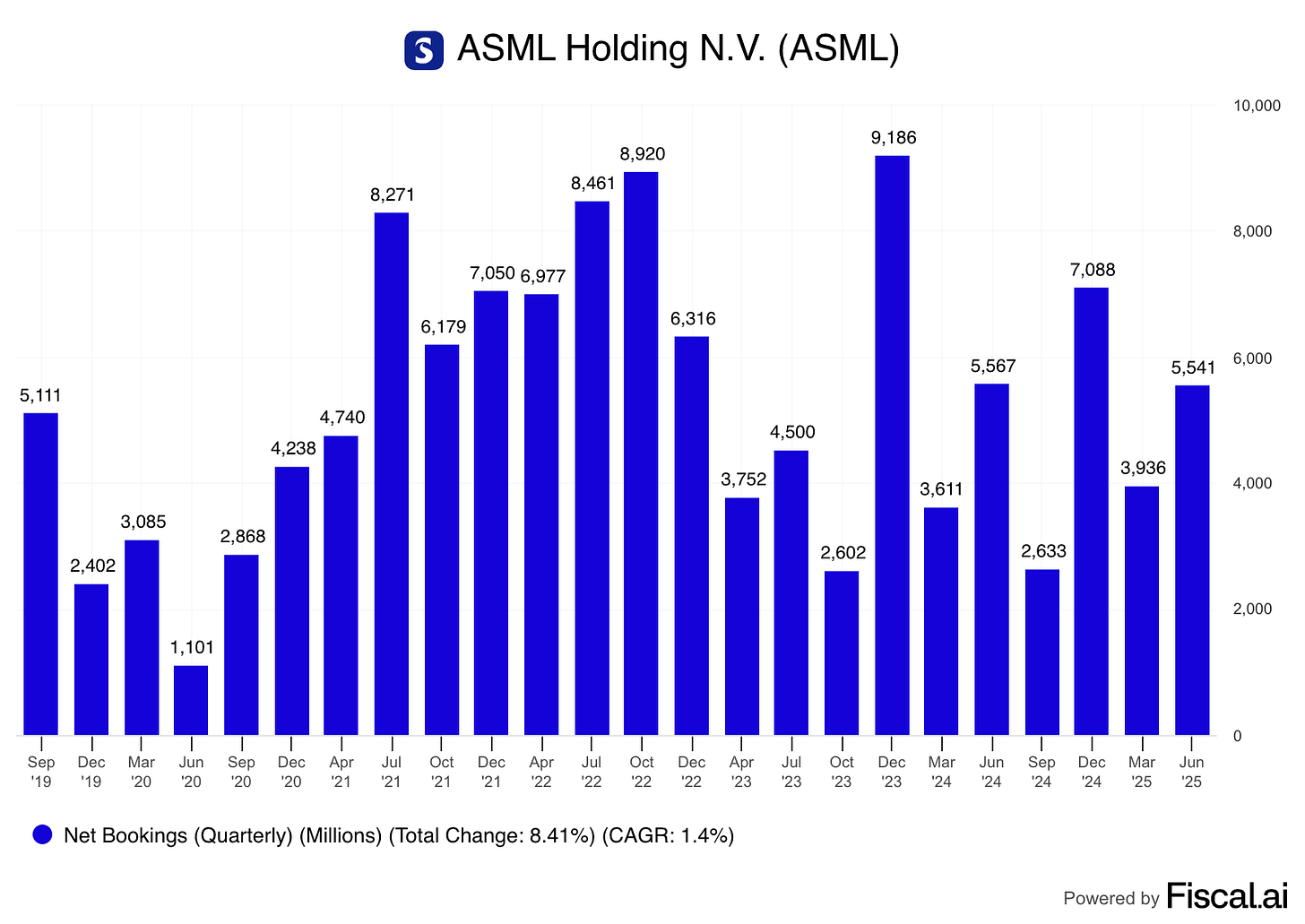

Now, you might be thinking that, even though revenue and EPS numbers might be “noise,” bookings are not. Well, it turns out that quarterly bookings are also noise (to an extent). ASML beat bookings estimates this quarter by €200 million (€5.4B vs estimates of €5.2B), but this alone doesn’t tell us much about the business’s development because, again, it might be a timing issue. We must focus on the long-term trends, and management will simplify this by not disclosing quarterly bookings starting next year. ASML’s bookings have beaten estimates for several quarters and have been above €5 billion for two consecutive quarters (good news). (The graph doesn’t show Q3 numbers, but you can imagine them!)

This positive development in orders led management to claim (as you would expect from a European non-promotional management team) that they now expect 2026 net sales “not to be below” those of 2025 (weird way of framing that they expect growth in 2026). While there’s not much detail in this claim, it’s in stark contrast to management’s Q2 commentary (“we cannot confirm growth for 2026”). Regardless of what happens in 2026, all eyes should be on 2030 numbers. This said, management shared some interesting info to contextualize 2026 growth.

First, the “positive developments” that Christophe Fouquet cited as the source of less uncertainty have not yet translated into bookings. Management expects this positive news to “partly” impact 2026 but to primarily impact post-2026 numbers. This, along with the fact that a “healthy portion” of the current backlog is for post-2026 business, explains why ASML expects 2026 to be a transition year despite the excellent positive developments (recall that EUV lead-times are long). There are, however, certain sources of upside to 2026 numbers, with the main one being China, primarily because it is a DUV business with shorter lead times (I’ll discuss this in a bit).

What, in my view, was more interesting were the mix and growth drivers of 2026. Management mentioned that China will “drop considerably” in 2026, but that the ex-China business should counter this decline. There’s material for both the bulls and the bears here. For the bulls, this can be interpreted as good news because it should alleviate the “front-running export bans” overhang that ASML was suffering (“what will happen when China demand normalizes?). Many argued that ASML was reporting good numbers for the sole reason that China was “double-ordering” to front-run geopolitical issues and that numbers would look much worse post-China normalization. While the temporary nature of heightened demand in China was evidently a reality, the 2026 “commentary” demonstrates that ASML is much more than China (especially as it becomes a more EUV-centric company).

The bears also have something to chew on. As China is expected to decrease considerably in 2026, some might continue to argue that China is becoming a headwind. Duh! This is evidently true, but as shared above, ASML is much more than China. Based on some comments I received when I published this article, some bears might even go as far as to claim that SMEE is about to gain significant share in the DUV business in China! Now, what’s interesting is that management claims that their view on 2026 China demand is based on the heightened demand over the last couple of years, but that this was also their view coming into 2025 (which was eventually proven wrong). This is what Christophe Fouquet said in Q4 2024:

For 2025 and beyond, we expect our China business to go back to a more normalized percentage of our sales.

China did not normalize in 2025 as expected, but management has once again taken the conservative route. This means that bulls have something to “celebrate”: China has gone from a potential headwind to 2025 numbers to becoming a potential tailwind or source of upside to 2026 numbers (although I would not count on it).

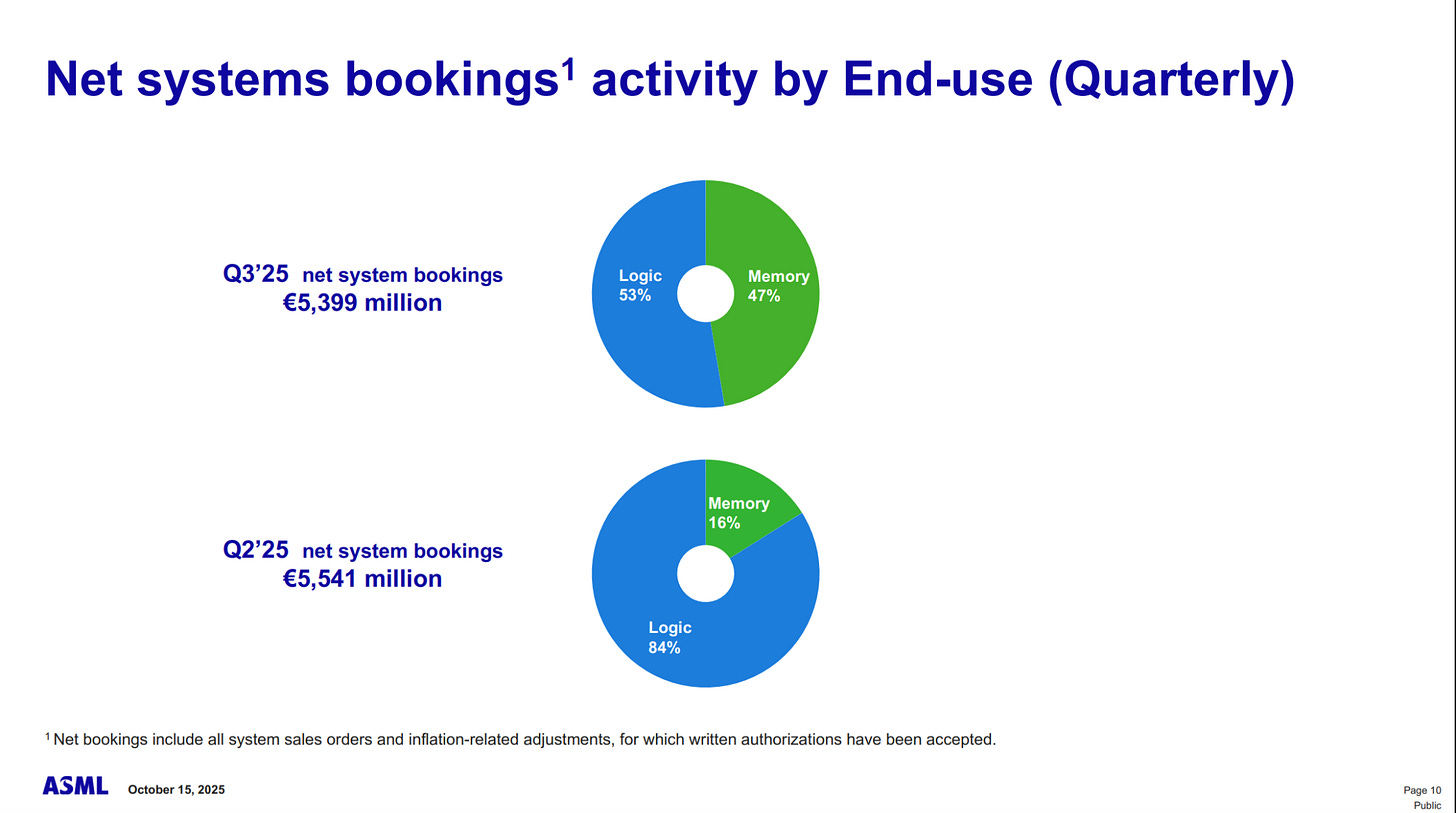

Another interesting data point was the share of memory in the order book. Memory customers made up almost 50% of net bookings in the quarter. This might, to an extent, confirm that they are leaning on EUV as they prepare themselves to face the AI-driven memory supercycle (although it doesn’t add up to management’s comments of “recent news still not being included in bookings”):

Many investors link ASML’s fortunes almost exclusively to logic (TSMC, Intel, and Samsung), but it’s pretty evident that ASML is increasingly becoming a memory company as well. This is great because it’s a source of upside, diversifies the EUV customer base, and (very importantly) positions ASML as an AI beneficiary!

Memory customers were slower to adopt EUV, but the adoption has accelerated thanks to HBM (High Bandwidth Memory). This comes on top of TSMC (and logic in general) ramping up a new “EUV-heavy” node in 2026/2027. So, EUV gets two tailwinds. In logic: 2nm supposedly brings around 2-3 additional EUV layers, with some of these being high-NA EUV layers in the future. In memory: customers are quickly transitioning to HBM (High Bandwidth Memory), where EUV becomes increasingly important for differentiation. ASML has gone from being an “AI-laggard” to an AI-centric company. This is, of course, a tongue-in-cheek comment as ASML has always been at the core of AI.

There was some good and “bad” news related to high-NA EUV. The good news is that the technology roadmap continues to do great. Some examples here:

Already 300k wafers run through high-NA

Maturity level above that of low-NA EUV at the same stage of development, according to customers. The reasons that they struggled with low-NA EUV are not present today

SK Hynix taking its first delivery of high-NA EUV

The bad news (and probably the reason why the stock dipped during the call) is the timing. The next wave of high-NA orders is expected when qualifications are over, so these are most likely to happen in H2 2026 or 2027. This is as far as orders, but shipments are not expected before 2028. If you were expecting an earlier high-NA EUV ramp-up, then this is not great news for you; if you are focused on 2030 numbers, then it’s a nothing-burger.

An ongoing concern regarding ASML is that the future of the semiconductor industry focuses more on materials and 3D structures than on shrinkage, translating to lower litho intensity. Even though I’ve discussed this topic in other articles, I thought it would be a good idea to touch on it briefly here. First, it’s not only about process steps (i.e., how many steps are litho, how many steps are etch…) but also about the value those steps add and who captures the value. In short, litho steps might decrease as a percentage of total manufacturing steps, but they are most likely to remain high value, and that value will accrue to just one company (ASML).

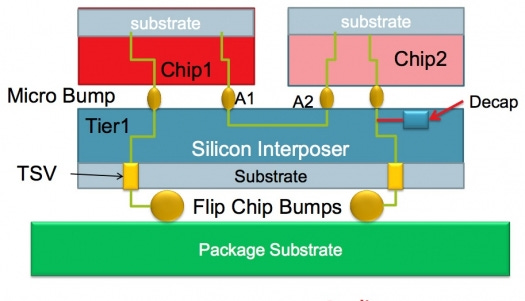

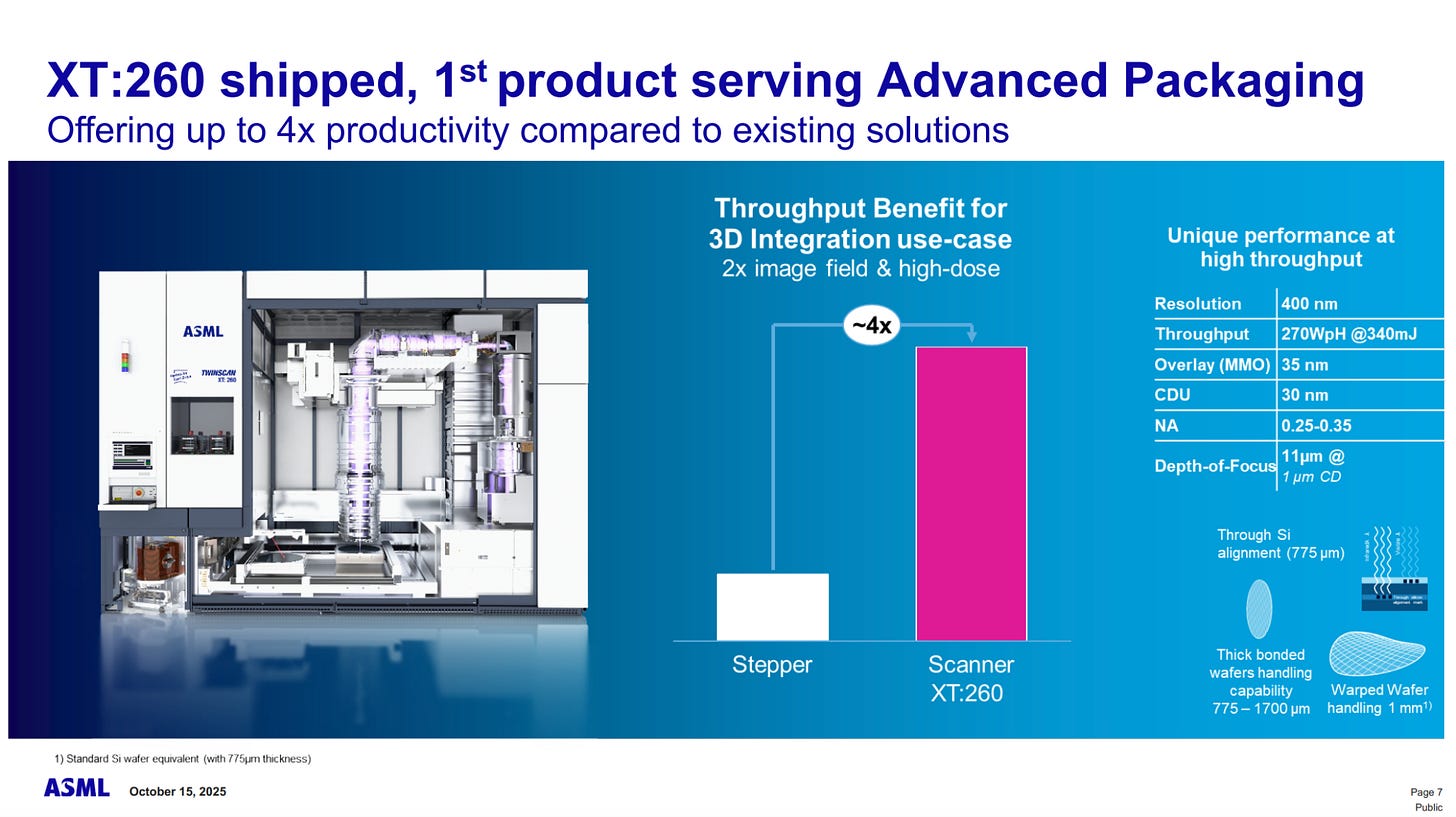

Despite all this chatter around litho intensity, ASML has hinted that there’s business to be made in the “3D shift”, both in the front and back end. During the most recent Investor Day, management explained how holistic lithography can be helpful in front-end 3D integration (essentially helping customers align wafers and stacking them together more precisely). Around the same time, management also announced it would release a new system to take advantage of the growing litho share in advanced packaging: the XT:260. The primary use for litho here is that when different chips are packaged together, it requires some sort of interposer layer that requires lithography (although not at the same resolution as front-end patterning):

ASML shipped the first system of this kind in Q3 and mentioned that they’ve seen significant customer demand:

The market ASML is targeting with this system is relatively small (somewhere around $2 billion) and is currently served by competitors like Canon. It’s a much more competitive space than DUV/EUV (not a high bar, I must say), but ASML wants to grab a piece of it. The attractiveness comes from its rapid growth and ASML’s several competitive advantages to offer holistic lithography. Considering the significant tool commonality between the new system and its DUV platform, ASML is not really risking much by trying to capture a piece of this market.

The transition to 3D DRAM being cited as a bear case for ASML is interesting because management mentioned that, based on conversations with all their customers, they remain confident EUV layers will increase as DRAM transitions from 4F2 to 6F2. Orders by SK Hynix and other memory players might portray this to be the case.

All in all, ASML reported a solid quarter. Like pretty much every quarter, what matters for ASML are the qualitatives, and they’ve been getting incrementally better…

TSMC continues to operate with tight supply

The US Government is not interested in TSMC staying a monopoly forever (good for ASML’s leverage in the logic business)

Memory players are scaling EUV orders

…

Another good news is that the “AI boom” continues in full force, with OpenAI partnering with every company in the world and trying to secure gobs of capacity. Christophe Fouquet took a prudent approach to how this future unknowable demand impacts ASML:

Well, so first, I think we wish we had a formula to translate all the announcements into what it means exactly for us in the next few years.

But I think no one has that. So I think that, you know, the experience also of 2022, has mostly taught us a lesson to be ready and to have maybe more flexibility because we know the market can swing. So we’ve done a lot of work on that in the last few years, we have prepared building, as we discussed before, which are usually the longer lead time items. And for the rest, when it comes to define exactly, I mean, the tool we want to produce, I think the lead time is a lot shorter, so we have more flexibility. After the announcement, at least we have the flexibility.

The other think I would like to add is, of course, well, our customers, at the end of the day, tell us what they need. And I think that’s a constant dialogue, a dialogue we try to always reflect with you on a quarterly basis. And I think we continue to do that. So we are prepared. I think we stress a few times we were preparing for growth.

And, you know, this was also in light of some of these activity. We have seen, and you know, come January, we will be more fully knowing even more about what’s happened then. And then we’ll continue to monitor the market. I would say we are a lot more prepared than we were a few years ago.

I think there’s a lot of good news in here for shareholders. The first point is that the 2030 guidance is not based on recent AI announcements, so these can be considered a source of potential upside, regardless of how likely they are to materialize. The second point is that ASML is preparing in case this becomes a source of optionality, allowing it to theoretically benefit without building a massive backlog (which did happen during the pandemic).

The stock has re-rated significantly since last quarter, so let’s take a look at the valuation.