Hermes’ and Atlas Copco’s earnings, Adobe’s "resurrection", and many more news (NOTW#65)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

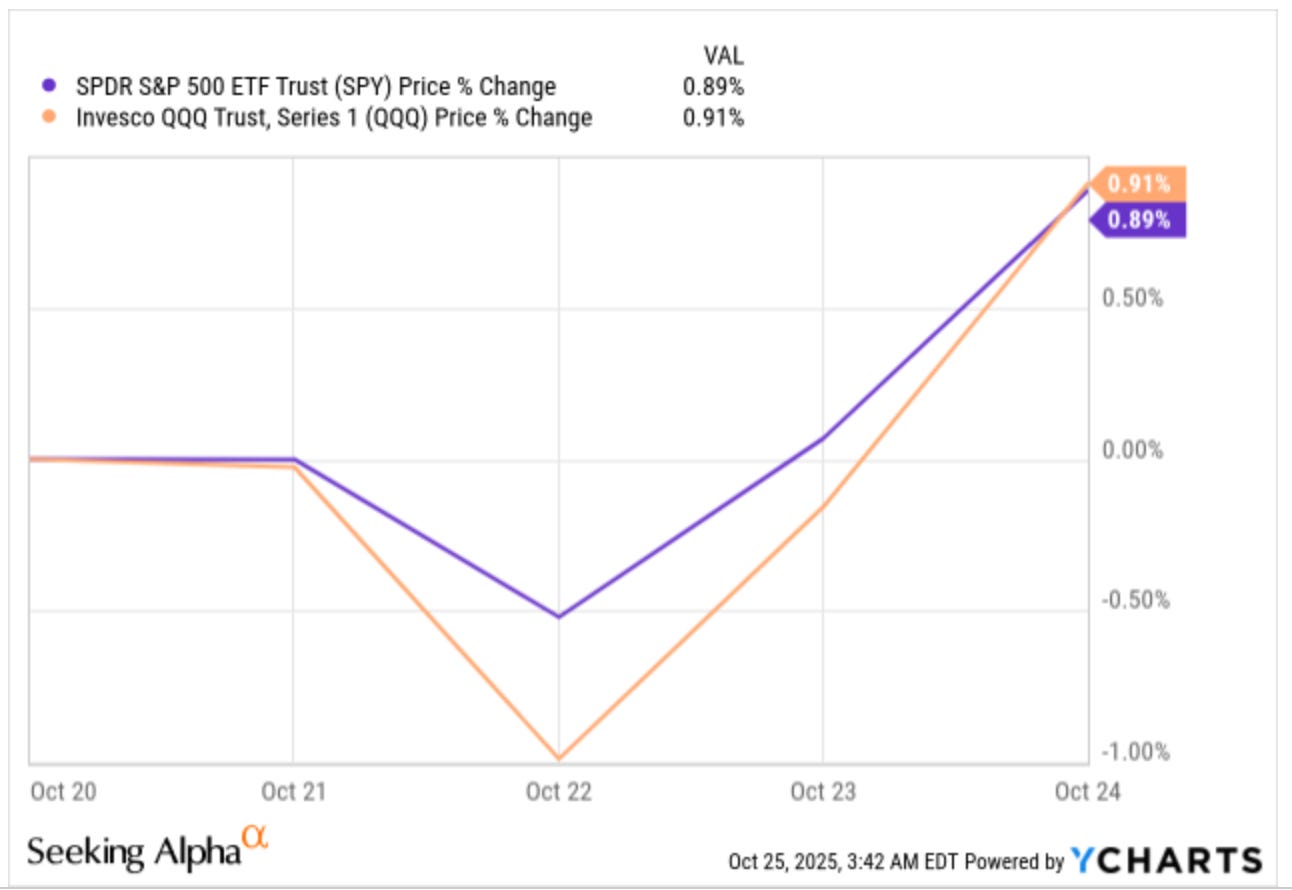

Both indices were up again this week, signalling that the US-China trade war has been short-lived (or so the market thinks so, we’ll see). There was plenty of company news this week. Besides going over these, I also share a brief recap of Hermes’ and Atlas Copco’s earnings in the company-specific news section.

Without further ado, let’s get on with it.

Articles of the week

I published three articles this week, all of them earnings digests. The first one was Danaher’s Q3.

Looking Ahead

Danaher reported Q3 earnings today, and after several quarters with little positive news on the horizon, this might have finally changed. My idea in this article is to briefly go over the quarterly numbers (which were fine) and then focus on the

The company reported once again a beat-beat quarter and provided some preliminary comments on 2026. While the expected revenue growth in 2026 is nothing to write home about (albeit there is upside to the numbers provided), EPS growth will likely be quite strong and portrays the power of Danaher’s operating model (the Danaher Business System). The stock initially enjoyed a good reaction but it’s still significantly off-highs and, in my honest opinion, remains undervalued.

The second article of the week was Texas Instruments’ Q3 earnings digest.

Texas Instruments’ Q3

Texas Instruments’ Q3 was similar in some ways to its Q2: the company reported strong quarterly numbers (that significantly beat expectations, if ignoring some one-offs) only to follow these with somewhat “weak” guidance

The company reported okay earnings but disappointed again on guidance (due to timing more than anything). The stock sold off but a lot of what needs to go right in 2026 to get to a decent FCF per share figure is under the management’s control. I explain what I mean by this in the article.

Finally, the third article of the week was Medpace’s Q3 earnings digest.

Another WOW! for Medpace

This was the second earnings release I’ve owned Medpace for, and the company again reported outstanding earnings. The stock initially jumped 20% in after-hours trading but ended normalizing after the call:

For the second quarter in a row, the Cincinnati CRO significantly beat the market’s expectations. There was one very interesting and “thesis-changing” highlight during the call which I explain in detail in the article. I also go over the valuation to explain why, despite a 100% run in 5 months, Medpace might not be as expensive as many believe.

Without further ado, let’s see what the markets did this week.

Market Overview

Both indices were up again this week:

Being completely honest, I don’t have much to discuss this week. As my lack of inspiration has taken place in a week in which there was a lot (and I mean it) of company-specific news, I will not try to force a topic and bore you with my random rambling!

The industry map was mostly green this week, albeit it had a few pockets of red:

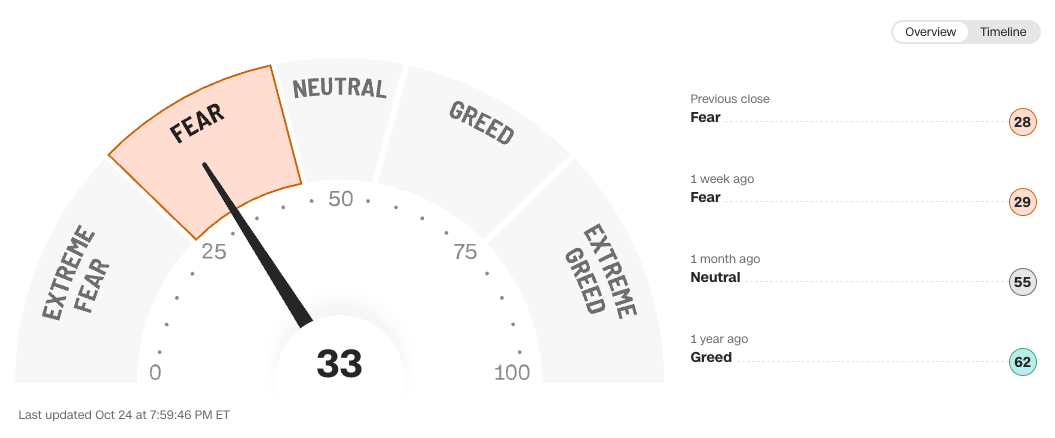

The fear and greed index improved slightly but remained in fear territory: