Nintendo’s Memory Woes

I’m back with an update on Nintendo, this time it’s about its “memory risk.” For those of you who might be unfamiliar with the topic, I strongly believe Nintendo has gotten swept into a narrative that (currently) makes little sense. The goal of this article is to explain why I believe so. Let’s first contextualize what’s going on.

Nintendo’s stock has not performed well as of late. It’s still beating the indices this year, but it’s down 32% (the ADR that is) from highs set this year despite news around the SW2 just getting incrementally better:

This begs the question:

What’s going on?

Although it’s pretty much impossible to know for sure what drives the outperformance/underperformance of any given stock at any given time, I believe Nintendo’s reason can be traced back to the recent evolution of memory chip prices.

Unless you’ve lived under a rock for the past couple of months, you are probably aware that AI has caused a memory chip shortage. This shortage is evident in two places. First, in the fact that 3 out of the 5 best performing stocks year-to-date are memory chip makers (you don’t see this often):

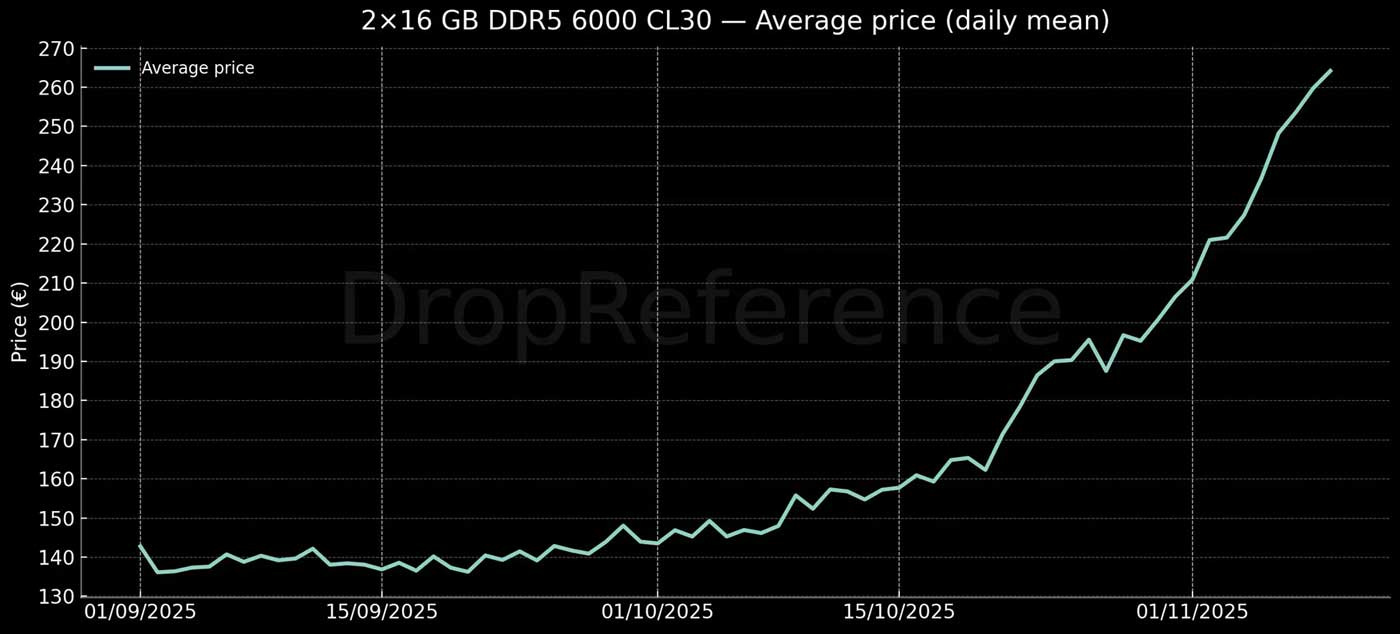

Secondly, in the evolution of DRAM and NAND prices. DRAM prices started skyrocketing in October and have not looked back:

The market is worried that the current chip shortage might impact one of two things, or both:

The ability of Nintendo to manufacture the SW2 due to unavailability of components (i.e., memory chips)

Nintendo’s hardware margins (if they are indeed able to get their hands on components)

The market’s worries probably stem from what happened during the SW1 cycle. Back in 2017-2018, Nintendo was unable to secure enough components (NAND flash chips, that is) due to a chip shortage. This eventually trickled into Nintendo’s ability to supply existing demand during the early stages of the cycle.

The problem back then was that Nintendo was competing for NAND flash chips with Apple (which was ramping the Iphone 7 and the iPad). Apple, as a significant customer of memory chip makers, had much more leverage than Nintendo. Let’s not forget that the success of the SW1 was all but a given back then; Nintendo was effectively coming out of a failed hardware system (the Wii U).

I believe things are VERY different from that period despite the market believing that both scenarios are equivalent. Let’s begin.

1. Management’s comments and a different “leverage” profile

The first thing that should stand out is that management raised the guide for hardware units from 15 million to 19 million during the most recent earnings released on November 5th. This is a pretty significant increase, but its relevance goes beyond the raise: DRAM prices had already increased significantly when management decided to raise the guide. The most interesting thing of all is that management was asked about higher component prices potentially impacting hardware margins during the call, and this is what they replied:

We believe that we’ll be able to maintain the current level of profitability for hardware for the time being unless there are significant changes in external factors, such as a shift in tariff assumptions, or other unexpected events. While we are aware that the costs of various materials are rising, we also anticipate some areas where cost reduction may be achieved for Nintendo Switch 2 through ongoing mass production efforts. Therefore, currently we do not expect the recent rise in material costs to greatly impact profitability. We will continue our efforts to maintain the same level of profitability as we currently have.

So not only did they not seem worried about the availability of memory chips…but they were also not concerned about their impact on profitability either. Are they bluffing? Or are there reasons to believe that they really do believe this? Let’s see.

The first thing worth mentioning is that nobody knows the specific terms of Nintendo’s contract with SK Hynix and other memory providers. Some rumours state that the contract is fixed-priced at least until the first half of 2026 (and then you also have to consider existing inventory, which I’ll go over later). These are just rumours and we will never know unless management tells us, BUT I believe it’s fair to assume that Nintendo’s expected volumes probably gave the company significantly more leverage than they had when the SW1 was launched (i.e., Nintendo might “be Apple” this time). After going through the SW1 shortage, management has not slept at the wheel and has done two things to protect the rollout of the SW2:

They have probably signed somewhat LT agreements with these companies with favorable terms (as discussed, this was probably possible thanks to the leverage from the SW1 installed base and SW2 volume forecasts)

Has probably stocked components in advance

We’ll never know the extent to which the first thing is true, but the second is demonstrably true.

2. Nintendo’s inventory situation

Nintendo’s annual reports give us the key to understand whether the company has prepared better (or worse) for the SW2 launch than it did for the SW1 launch. Everything seems to point out that management learned their lesson.