Questionable US policy, Timing Inflections, and Judges' Earnings (NOTW#60)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Both indices were up again in a week as the Federal Reserve made the first (who knows if there will be more) rate cut of this cycle. Several things happened throughout the week that allowed me to discuss some interesting topics in the market commentary. I also go over Judges’ earnings and more news in the NOTW section (reserved for paid subscribers).

Without further ado, let’s get on with it.

Articles of the week

I published two articles this week. The first one is about Texas Instruments and the news the company received from China on Saturday. I explain what this news is and whether I think it changes the investment thesis.

China fires against Texas Instruments

You might have noticed that Texas Instruments’ stock is falling in the pre-market, together with those of its analog peers. Their Chinese peers, however, enjoyed quite a different market reaction in …

The second article of the week was Adobe’s earnings digest.

Why isn't Adobe's stock working?

Not much has changed for Adobe over the last 3 months. Despite delivering yet another beat-beat-raise quarter, the market remains skeptical regarding the company’s role in an AI-driven world. After i…

The company reported (again) good earnings last week, but the market seems to simply not care as the AI-narrative continues to take hold. I also share what I believe might be the turning point (or some will call it “inflection”) for Adobe.

Judges Scientific also held its H1 2025 call on Thursday. Although I considered writing a separate article, I don’t think there was enough content for one. For this reason, I have decided to share some quick thoughts in the News of the Week section (reserved for paid subscribers). If you are interested in Judges Scientific, I released an in-depth report in March this year:

I have also been working on the next in-depth report which I will publish next week or the week after that (most likely the latter). The company I am writing about has several similarities with three companies in my portfolio (not surprising) and definitely seems cheap (I know I am saying this while markets breach ATHs, it can happen!):

Without further ado, let’s see what the markets did this week.

Market Overview

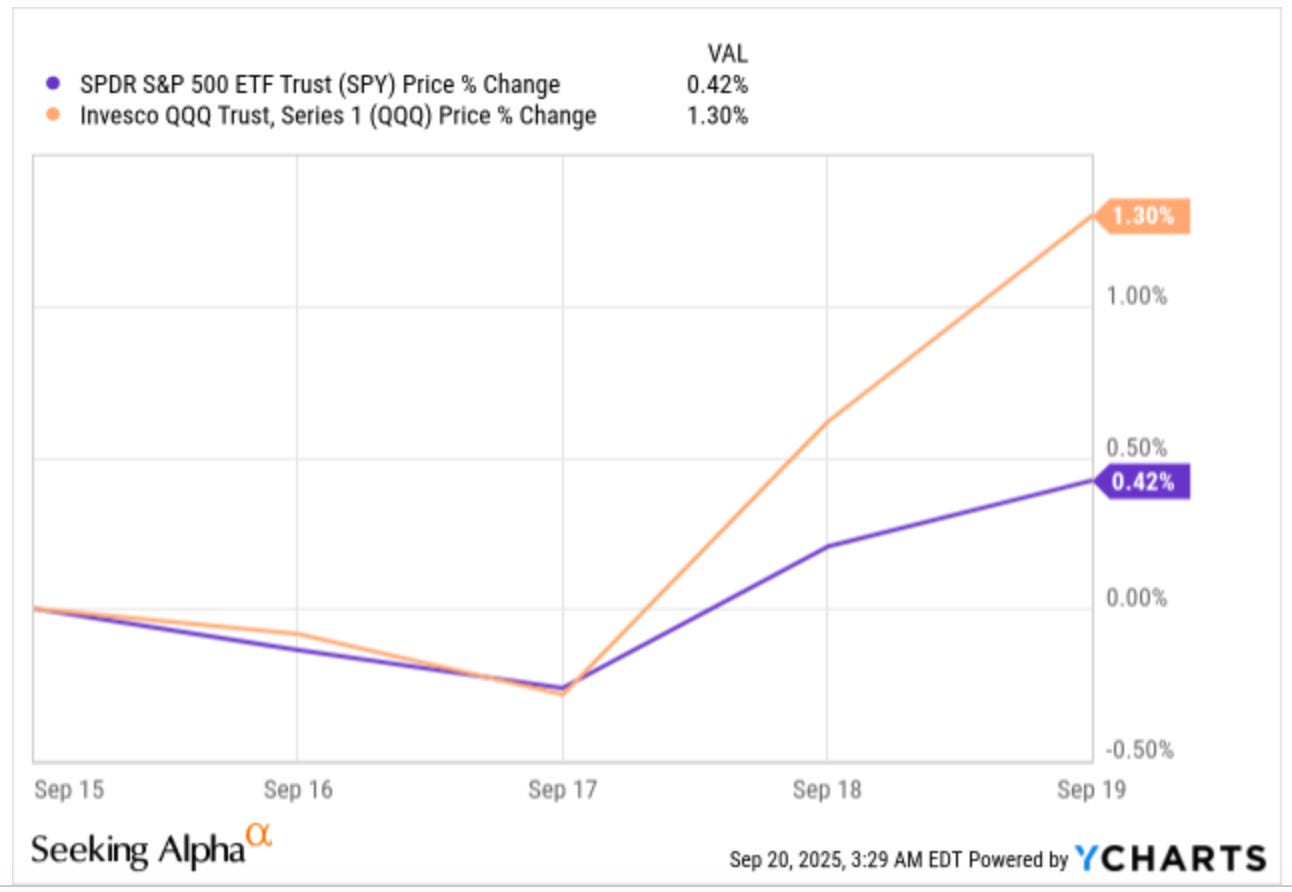

Both indices were up in a week when the Federal Reserve made the first rate cut in a while (albeit expected by the market):

Markets are at all-time highs just as the Fed starts to lower rates. Bulls will say it’s just the start of the next leg up, whereas bears will say that this is when things start to go downhill. Market-neutral people like me will say that there are cheap and expensive stocks in the market, but that it will be tough to do well if markets crater. Pick your fighter!

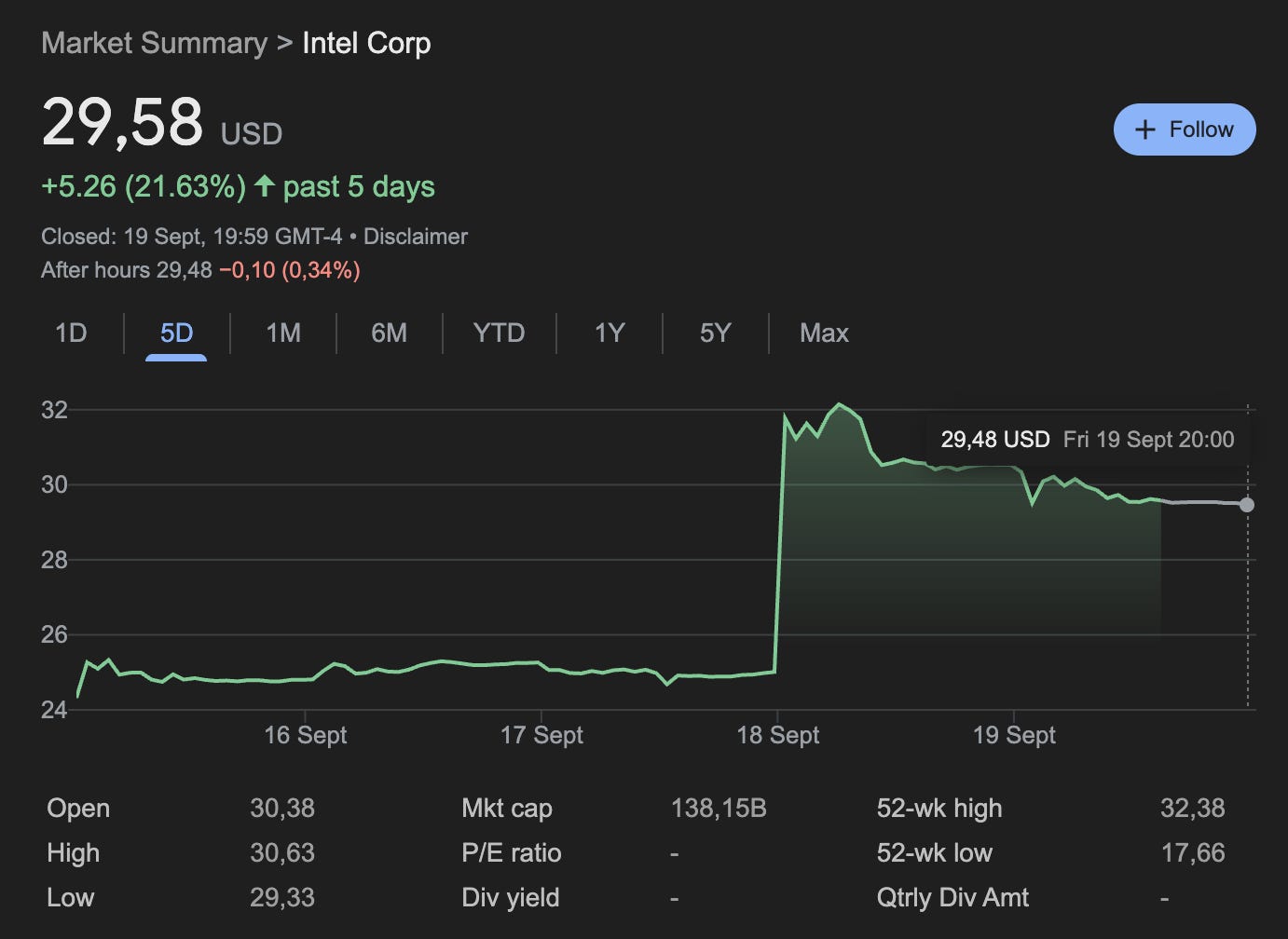

It was a week packed with news (I don’t know if this is the most appropriate name for the things that happened this week, tbh). In an incredible turn of events, Nvidia (NVDA) disclosed an intention to invest $5 billion in rival Intel (INTC) to co-develop chips. Intel soared more than 20% after the announcement (free money for Nvidia?):

This not only provided Nvidia with an immediate great ROI, but also the US government. Recall that the US government announced a couple of weeks back that it had taken a stake in Intel (using as funding a portion of the grants they had previously announced but not paid!).

I tend to think that not many things are coincidences, and seeing a US company invest in another US company where the US Government has a stake definitely doesn’t seem like a coincidence to me! This deal was likely politically motivated, which is understandable, but it probably means the US is not far behind countries like China in terms of political intervention in markets. This is obviously a sort of tongue-in-cheek comment, but food for thought nonetheless. Note that Trump allegedly had a stake in Intel, and he probably made a lot of money from this deal while being the President of the country. I will never understand why it is acceptable in the US for politicians to trade stocks while they tell you with a straight face that you can’t trade on insider information.

This week, I gave some thought to the concept of stock price linearity. Two things (among many) make investing challenging. First, stock prices don’t always go up. In fact, it’s more likely than not that you are holding an underperformer rather than an outperformer. Secondly, when they do go up, they don’t do so linearly. A stock can remain flat for 5 years, only to skyrocket in years 6 and 7, providing a decent return even to those who bought it 6 years ago. This happens quite often, which means that investors shouldn’t overobsess with what’s working and what’s not working at any given time. It’s fine to hold things that are not working at all times so long as you believe that they’ll eventually work. A lot of people stay on the sidelines waiting for the inflection, basically trying to time WHEN stocks start working. The problem with this strategy is that (a) timing inflections is tough, and (b) the stock is likely to start moving even before the inflection you are trying to time happens.

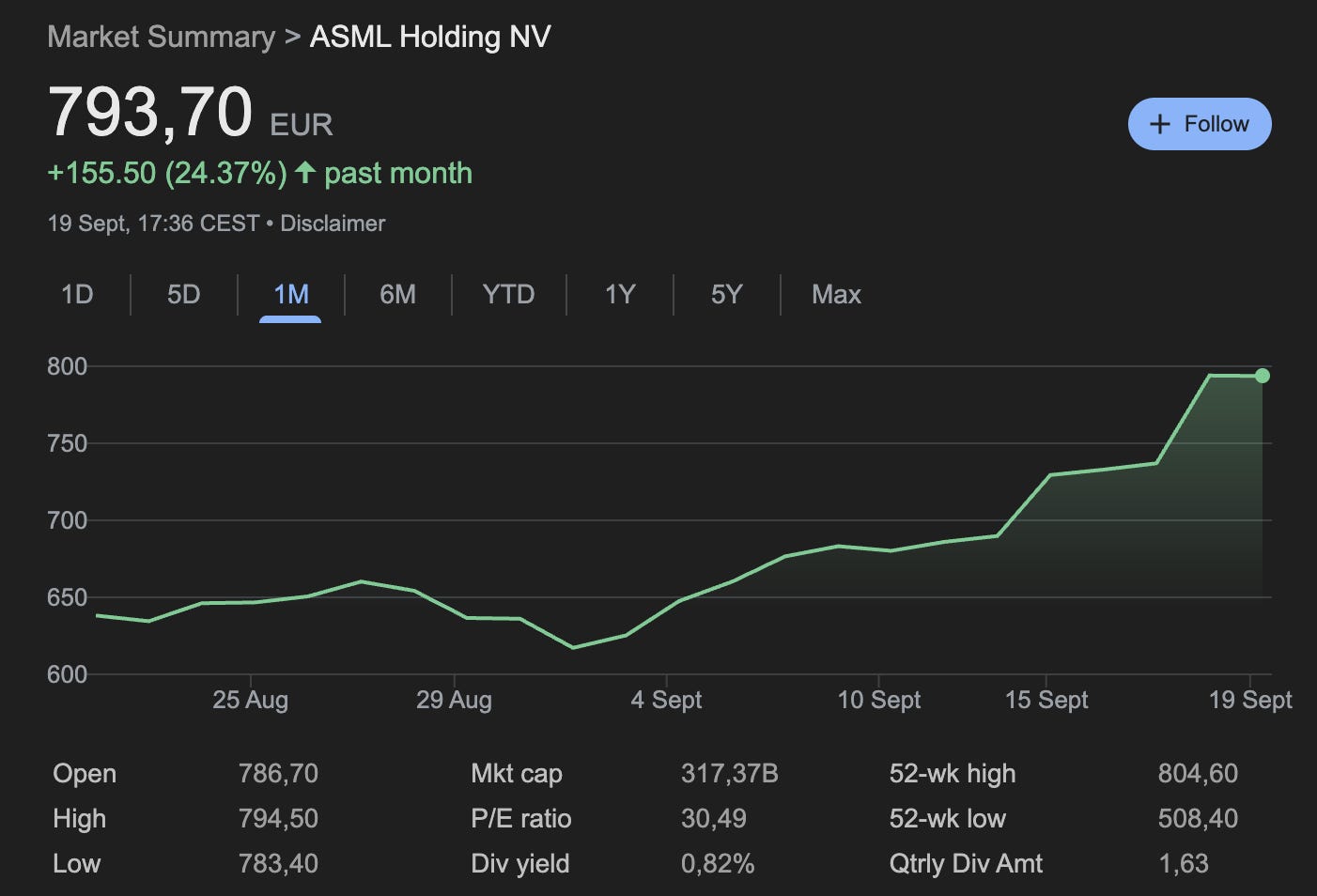

The fact that many people are trying to time these inflections is probably a result of the short duration of their capital. Many fund managers can’t afford to hold a non-performing stock while their investors are constantly asking about performance. This is an excellent advantage for those who have duration (primarily individual investors). As I manage my own capital, I can wait for something to start working so long as I am confident that it WILL start working. A good recent example is ASML (ASML). The stock had been dead money for many months as people waited for what they believed to be the inflection: the receipt of orders from TSMC. Those who believed that these orders would eventually come and that their exact timing was not critical for the thesis could wait with a position, whereas those who were waiting for the inflection have missed a 25% run in a month:

And this is without the confirmation that ASML has received any sort of orders. This said, the company has received incrementally positive news in the last few weeks:

The admission that the US will not allow the death of Intel

Nvidia supposedly ramping up a new node with TSMC

Memory customers acknowledging they’ll use more EUV layers in the next DRAM node

Insiders buying for the first time (at least) since 2013

…

The morale of this story is that timing inflections is challenging and likely impossible. If you have duration of capital, you are better off by making sure that the inflection will eventually happen rather than WHEN it will happen. Google, by the way, is yet another recent example of how waiting can be very profitable. Both Google and ASML are, by the way, multi-hundred-billion-dollar companies, and even then, there’s an opportunity simply by being patient. If you know how the industry is incentivized, you’ll probably understand that this advantage for the individual investor is unlikely to fade away soon.

The industry map was mixed this week:

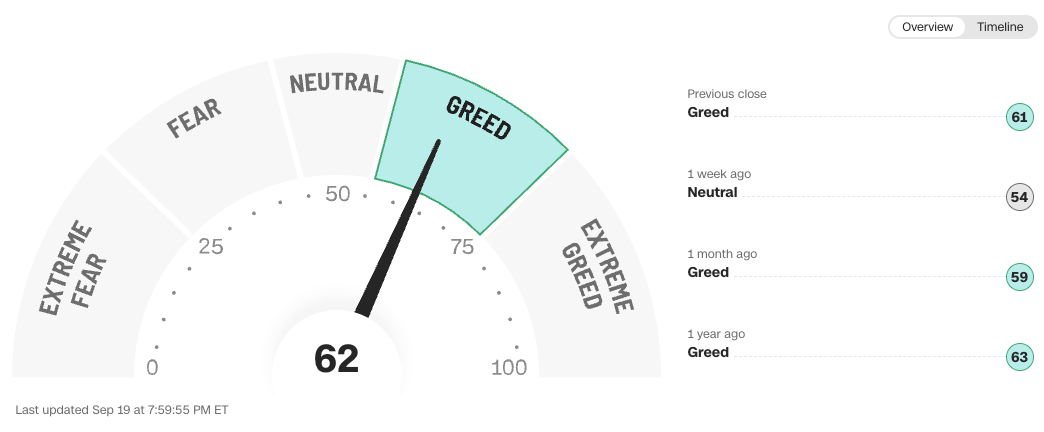

The fear and greed index jumped to greed territory:

First time I have added to this position since 2022

I added to one core position in my portfolio this week for the first time since 2022.