China fires against Texas Instruments

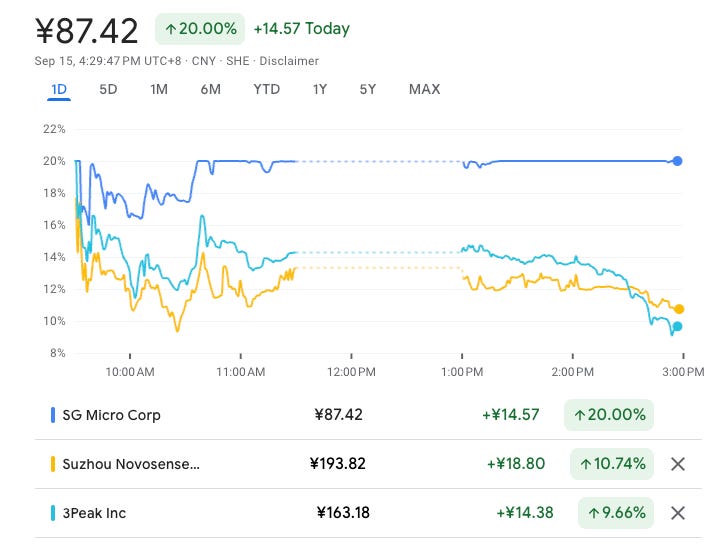

You might have noticed that Texas Instruments’ stock is falling in the pre-market, together with those of its analog peers. Their Chinese peers, however, enjoyed quite a different market reaction in Beijing:

Although I touched on the reason behind these diverging moves in the most recent News of the Week, I decided to elaborate on it a bit further today to provide some additional context. Let’s start by explaining what exactly happened during the weekend. China’s Ministry of Commerce announced on Saturday that it had begun investigating US analog players for dumping practices. I found it quite ironic/funny that China conducts dumping investigations, considering that the country is a notorious example of global dumping (nothing in politics should surprise us at this point).

The complaint was issued to the Ministry of Commerce by the Jiangsu Semiconductor Industry Association, which claimed that US producers have gained significant market share in China from 2022 to 2024 by substantially reducing the prices of their products (I will not go into too much detail about the case, and if you want to do so, you can read all the relevant documentation here). Although the complaint targets all US analog players that export to China, the documents clearly indicate that Texas Instruments is the primary focus (as evidenced by the numerous screenshots from TI’s website included in the PDFs).

Let’s assume the outcome of the investigation is not favorable to TI (something that we could honestly take for granted). What would the result be? Let’s take a look at some precedents. As you would’ve likely imagined, it’s not the first time that the Chinese Ministry of Commerce has conducted dumping investigations on US corporations. The outcome was similar in all other cases: tariffs on imports of said products. The Jiangsu Semiconductor Industry Association is requesting the government to implement tariffs on US imports equivalent to the “dumping margin”, thereby making the prices of TI’s products in China comparable to those in the US.

This would obviously hurt Texas Instruments’ business in China, but it’s not a black/white type of scenario. It seems that TI saw it coming and was ahead of the curve, primarily due to the geopolitical tensions that ensued from Trump’s recent trade talks. Note that China was close to setting significant tariffs on semiconductor imports just a few months ago. Fears of these tariffs had led companies like TI to accelerate the diversification of their supply chains. Considering that the outcome of this investigation might be similar to the one feared a few months ago, the actions started back then should prove to be useful (more on this later).

Examining TI’s pricing actions over the last couple of years kind of demonstrates that (1) TI indeed lowered prices in China and (2) management anticipated retaliatory measures from the CCP. In 2023, Chinese media reported that Texas Instruments had initiated a price war in China to “pressure local rivals.” TI’s pricing strategy is quite interesting because it allows the company to engage in price wars while remaining very profitable. The key lies in its product breadth. A couple of years ago, I spoke to a 26-year TI veteran who actually took part in designing this pricing strategy. This is what I wrote back then:

His discussion on pricing was also interesting. As discussed in one of my NOTW, Texas Instruments has supposedly begun a price war in China. Many investors (myself included) are a bit cautious here, but according to him (he designed TI’s pricing system btw), it’s the logical thing to do for TI. Let me explain why.

It’s well-documented that TI is the lowest-cost producer in the industry. This means that one can’t win a price war against TI, at least not for long. If a competitor decides to lower prices to take TI’s business, TI can match or even lower them while remaining profitable. According to the expert, in a situation of oversupply, TI will probably engage in price wars to filter out the weaker players. That seems to be at play here in China.

Part of the reason why TI can engage in these price wars without suffering a significant impact on margins lies in its product breadth. As the company has so many SKUs and many other players are niche, TI can lower the price of the entire system and take the competitor out of business. Let me develop further.

Let’s assume that a system needs 10 parts, and TI manufactures all of them. A competitor fighting for one of these parts decides to price it significantly below TI to encourage the customer to switch. Note that to convince customers to switch, the competitor must price it significantly lower than TI, probably at their breakeven. To avoid engaging in a price war, TI lowers the price of the remaining 9 parts so the customer has a better price overall for the system, thereby discouraging the switch. This way, the customer won't switch, and the competitor will be taken out of business.

It was likely this strategy that TI followed in 2023 in China, resulting in significantly lower prices for certain parts. Now, based on recent events, it seems pretty obvious that management sort of expected some retaliatory measures in China. Texas Instruments conducted its most significant price hike in China (according to the media) in August. The company allegedly raised prices 10% to 30% across 60,000 products, effective August 4th. Although I doubt this will satisfy Chinese regulators, it is a first step towards meeting their expectations.

Let’s recap. What we know today is that the Chinese government will most likely implement tariffs on US semiconductor imports as a response to the investigation. As investors, our objective should be to estimate the impact that these measures would have on companies like Texas Instruments. Let’s start with some rough numbers and work our way from there. China-based companies account for approximately 20% of TI’s total revenue. However, management argues that some of these customers have global operations and make use of TI’s geopolitically dependable capacity. The argument by management here is that if you win a socket for a global product you are likely going to fulfil that socket in China and elsewhere. This ultimately means that the maximum impact would theoretically be lower than 20% of TI’s revenue. This, however, would still be pretty significant.

Now, we must also account for TI’s supply chain diversification. As discussed above, TI has been diversifying its supply chain after the events precipitated by Trump’s trade disputes. The goal was to requalify ex-US fabs to serve ex-US demand, in case tariffs were implemented on US imports. Note that the outcome of this case would be quite similar to the one TI’s management feared just a couple of months back. According to the management team, this dual qualification actually started after the earthquake in Japan, but they argue that “most” US-manufactured parts can also be manufactured in ex-US fabs today (albeit at lower margins) and that they are still working on being able to serve China with ex-US fabs. I’ve compiled some extracts from recent earnings calls and conferences where management explains what they’ve been doing on this front:

(Q1 2025 Earnings call): And we have four fabs outside of the US. We have two in Japan, one in China, one in Germany. And we have most of the part that we have running on in the US also running there. Right? So maybe these fabs are not as cost efficient as our three-hundred-millimeter wafer fabs, but they are competitive. And this is where the of our technology allows us to ship some of our supply into these faster needed.

(Q2 2025 Earnings Call): First, I mean, I think we just talked about it. China consumption is around 20% of, of all semis, and, I'm talking about what stays in China. And in that sense, we have more than enough on our non US manufacturing. We have a manufacturing site in China. It's an end to end.

In Chengdu, we have a full turnkey almost. That's the only place in the world that can do full turnkey from substrates all the way to finished goods.

Analyst: Is that used primarily to serve like China demand?

Mainly China, but you know, it can support everything else. We also have two fabs in Japan, a fab in Germany, and we also have our foundry partners. Think about our embedded business. Embedded can be built in in Lehi now, but also, of course, in Singapore and Taiwan with our with our partner. So we we have enough tonnage to support China.

(BofA 2025 Conference): To your point, what happens if China puts tariffs as it threatened to do in April for a couple of weeks? Well, we have four factories and foundry partners outside of The United States.

Have two factories in Japan, One in China, One in Germany. And again, we have foundries outside of The United States, foundry partners that can support us in shipping products that are non US made into China as needed. We also have there's some trade agreements between Malaysia, Philippines and China that also allow products that even though they were built in The United States, they were fab in The United States. If they're 18 in those countries, they enter China as country of origin for The Philippines and Malaysia. So there we have plenty of flexibility to satisfy our customers with bars that they need while minimizing or even entirely avoiding tariffs.

(Goldman Sachs 2025 Conference): Today, we can support China from the U.S., but I have to be ready for a case we cannot. This is where we have the rest of the footprint of our capacity. We have a fab in Europe. We have two fabs in Japan. We have a fab in China. We have learned a little bit, we have tuned our machine in April because we got a little bit of a dry run. What happens if there are U.S.-based tariffs on whatever? We had a good answer to our customers. We are now making it even better. Some of the cases for technologies that were only built in one fab, we are now requalifying. We own our technology. We own our destiny. We are moving them into places like Japan, like Germany. We have our assembly and test houses in China and in Malaysia, in the Philippines.

(Bernstein 2025 Conference): We, today have all the back end, of course, out of The US. The front end, it depends. You know, it depends on the part. What we are doing right now is to prepare, in the case of a tariff coming back, also in China, I have to requalify some of our parts that are in The US into Japan, into Singapore, into China. So we are doing it.

Embedded is already ready because they are coming out of Singapore and Taiwan and they are going into The U. S. So they are already ready. On the analog side, I do have to make some re qualification because the rules have changed. It used to be based on the COO or country of origin.

It used to be on the back. Now it's a front end. So I have to now take some of our parts that are running in The US and requalify in Japan. But we have time. So this is something that we are doing.

This requalification of the supply chain should technically help Texas Instruments bypass any measures established by the Chinese government. It’s highly likely that once said measures are implemented, TI will be serving a non-trivial amount of its China volume with ex-US fabs. We will never know the exact percentage (because it’s not disclosed), but it seems pretty obvious that all the trade disputes that took place a couple of months ago sort of prepared TI for the investigation that is now ongoing.

Even if it ends up having a non-trivial impact on TI’s financials, this complaint does portray that China is a risk (not just for TI but for any company). I do, however, also believe it portrays TI’s strengths in terms of geopolitically dependable capacity.

Have a great day,

Leandro