NOTW #19: Index concentration, good, bad, irrational?

Don’t forget that Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Hi reader,

Both indices were down again this week despite several Mag 7 companies reporting good earnings. Mag 7 have been the center of the debate among index followers due to their weight on the S&P 500 and the Nasdaq. Rather than thinking this concentration is good, bad, or even irrational, we should consider what it means and whether it makes sense. I discuss this in the brief market overview.

Without further ado, let’s get on with it.

Some terrible news

As you might have seen on Twitter or the news, Valencia, the city where I currently live, suffered some terrible floods this week. It’s one of the worst catastrophes in Spain’s history. More than 200 people have lost their lives so far, 1,000+ are missing, and there are thousands without access to water, electricity, or food.

I’ve set up a GoFundMe account to help the families that have lost it all. If you’d like to participate, however small the donation may be, please feel free to do so using the link below. Thank you very much for your help.

Articles of the week

I published two articles this week. The first one was Texas Instruments’ Q3 2024 earnings digest. Everything points to an inflection in the cycle, but I believe there were two other important highlights: China and profitability. I explain why in that article. The article was at first for paid subscribers but it’s now FREE TO READ for everyone.

The week's second article was part 3 of the latest addition to my portfolio, where I discussed three important topics: the competition, the moat, and the risks. This company has a low float and it’s pretty volatile (it was up 8% just this week). If you want to have access to this article and the entire article series, be sure to join Best Anchor Stocks:

Market Overview

It was yet another negative week in the markets. Both the S&P 500 and the Nasdaq dropped more than 1%:

This happened despite Mega Cap Tech reporting pretty good earnings. Five ‘Mag 7’ companies reported earnings this week: Microsoft, Meta, Google, Apple, and Amazon. Here’s how these went…

Microsoft: beat, beat, guidance below expectations

Meta: beat, beat, guidance above expectations

Google: beat, beat, raised guidance

Apple: beat, beat

Amazon: beat, beat, guidance slightly below expectations

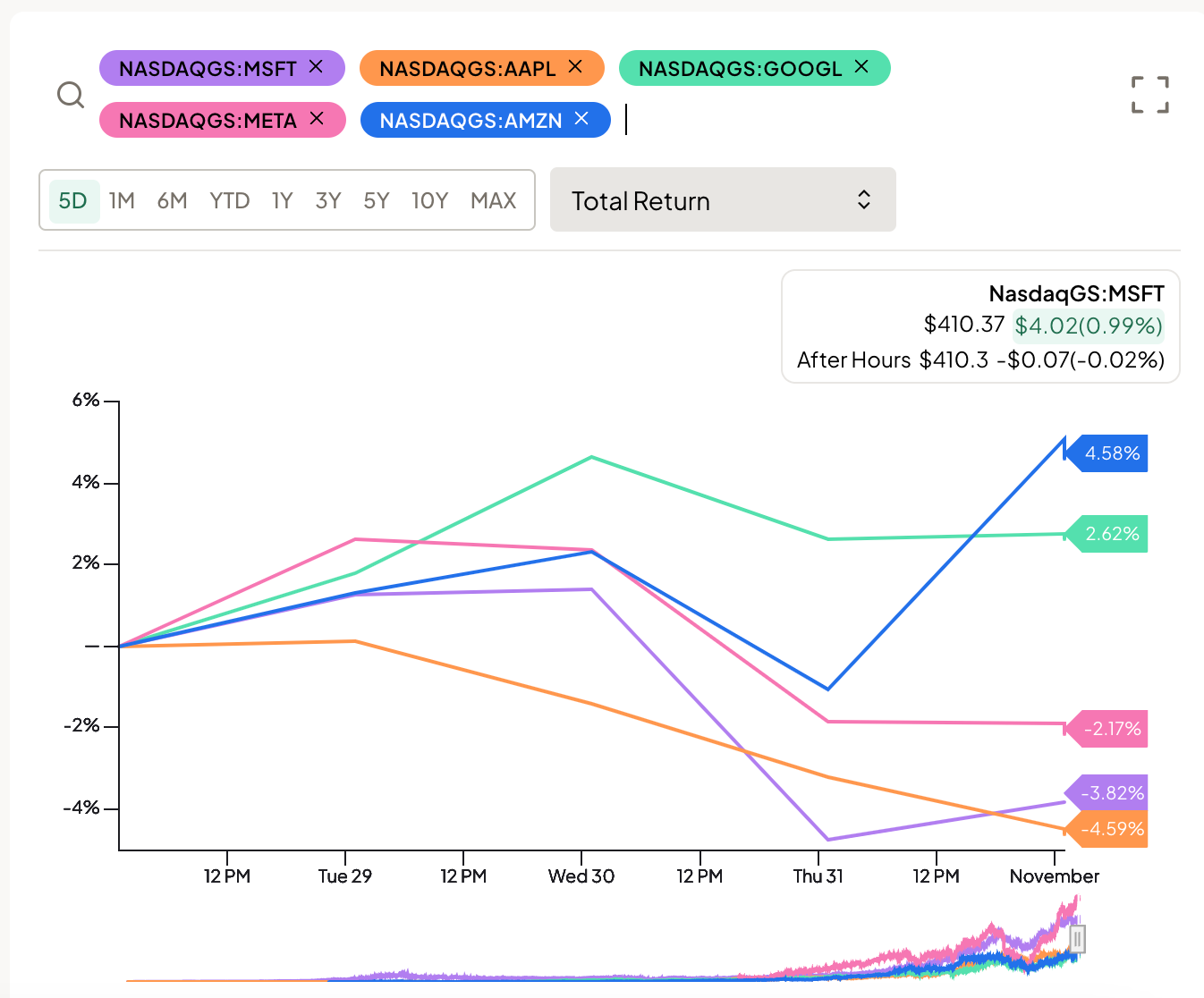

And here’s how their stocks fared this week…

As you can see, pretty mixed results stock-wise despite overall good earnings. Apple and Microsoft fared the worst, and they are the two companies that weigh the most in the index, so their negative performance probably weighed negatively on the performance of the indices. Semiconductors also make up a considerable part of the indices, and they also performed poorly this week:

I read an interesting article on index concentration this week that is somewhat related to the above. The article is by Michael Mauboussin and discusses whether the current concentration in the indices is justified or if, on the contrary, it’s irrational, as many people claim.

The first thing the article claims is that it’s tough to beat a concentrated index in a period of increasing concentration. This obviously makes sense because if one doesn’t hold the companies that weigh significantly in such index, it’s going to be pretty tough to match or beat its returns. This has been my case this year, as I only hold one of the Mag 7.

The evolution of the concentration level is also interesting. While the current concentration levels are not unprecedented, there’s no denying we are on the high end of the data set:

The current concentration level is not unheard of, but the article notes the following…

What feels disconcerting to many investors is that the rate of increase in concentration in the last decade is the most rapid since 1950.

I was honestly not surprised by this statistic. Software and “tech” business models have two characteristics that probably have enabled their rapid ascend to the top…

They tend to enjoy winner-take-all dynamics due to network effects

They are easily scalable, as they don’t tend to require new capacity buildouts

I highly doubt both of these were true several decades ago, so climbing to the top fast was probably a much more arduous task in the past. Physical capacity takes time to come online, and the current “high-flyers” have historically had low Capex needs (this might be changing).

Now, what I think the mistake is here is automatically assuming concentration is bad or that it’s irrational. The article shares some data to support the idea that the current concentration might be justified purely based on fundamentals. Over the last decade…

The top 10 stocks at the end of 2023 were 27 percent of the market capitalization and the companies earned 69 percent of the economic profit.

This means that these companies were probably underweight in the index a decade ago, which is one of the reasons why they have managed to outperform the market so significantly. It also means that the current rise in concentration we’ve seen over the last decade might not be entirely irrational but simply the case of these companies rising to a more rational weight, which the market got wrong 10 years ago.

Of course, all of what I’ve just discussed is backward-looking, and what any investor should care about is the future. I don’t know if this level of concentration is good or bad for the market (that we’ll only know in hindsight), but it seems pretty obvious that an investor pouring money into the index today should at least have an opinion of what the top 10 companies will do going forward. Many people believe these top 10 companies are grossly overvalued and in “bubble” territory, but I honestly don’t think one can claim this by looking at their valuation multiples (there might obviously be exceptions). These valuation multiples are undoubtedly lower than in the year 2000 and today’s top 10 companies are arguably more cash-generative and hold stronger competitive positions than the top 10 did back then.

I have absolutely no clue if the index will do well from here or not, but claiming that it’ll do poorly just because it’s concentrated also makes no sense (concentration works both ways). I guess we’ll have to wait and see what happens, but I 100% would want to have an opinion on the largest companies on the planet before pouring money into an index.

The industry map was pretty much red with some exceptions, which are normal considering we are in earnings season:

The fear and greed index dropped significantly and has gone from extreme greed to neutral in just two weeks:

We already know how fast sentiment can change in the market, and this should not be surprising considering we are close to the US elections. I don’t intend to forecast how the world will be in 5 years depending on what candidate gets elected, not because it doesn’t matter (which it does) but because I don’t think I can forecast it. I understand there’s uncertainty and that’s normal, especially considering how polarized politics have become lately.

The rest of the content is reserved for paid subscribers.