NOTW #17: Long-term thinking and market multiples

Don’t forget that Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Hi Anchors,

It was quite a rocky week in the markets, mainly caused by the differing (not really) signals given by two semiconductor companies: ASML and TSMC. It’s earnings season, so it’s also normal to see some kind of heightened volatility, but I definitely did not expect that from ASML. I share some thoughts regarding long-term orientation and historical comparisons in the market overview.

Without further ado, let’s get on with it.

Articles of the week

I published two articles this week, both pretty relevant. The first one was ASML’s earnings digest. You might have already seen that the market reacted pretty badly to these so I go over everything that’s important. I also share some brief comments in the news section about litho intensity (reserved for paid subscribers).

The week's second article was part 1 of a brand new addition to my portfolio (I’ll buy my first shares on Monday). I share a brief investment thesis, its history, and what the company does. Probably one of the best (some would say worst) things about the company is that it’s not reachable for many funds due to its tiny float. If you want to have access to these two articles and all the content library, don’t hesitate to join Best Anchor Stocks:

I will also continue uploading free content from time to time, so you don’t have to worry about that.

Market Overview

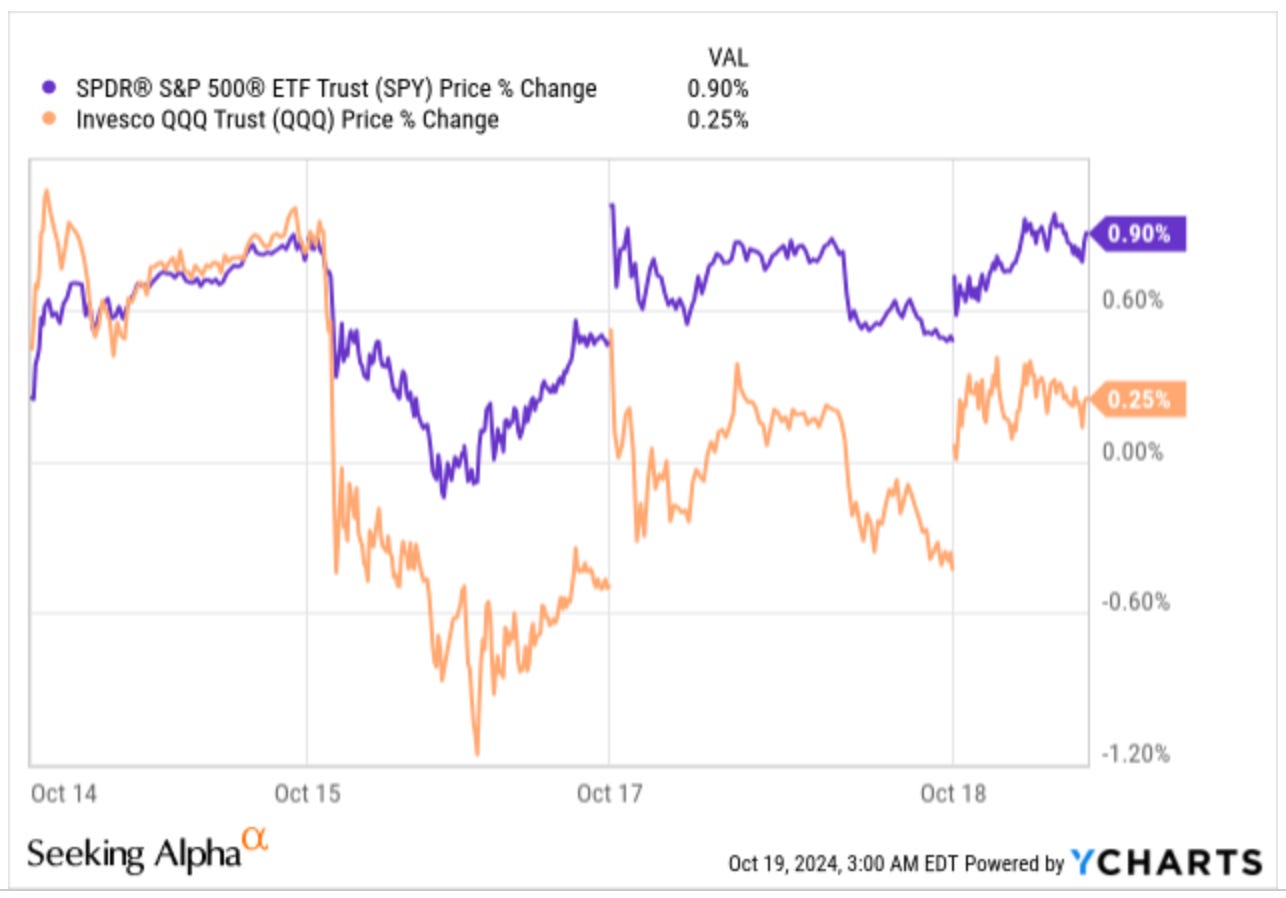

Both indices were up this week, but not without significant volatility (once again). The S&P 500 rose 0.9% whereas the Nasdaq rose 0.25%:

The reason behind the volatility might be something I’ve talked about this week: ASML’s earnings. The company’s earnings leaked one day ahead of schedule and took the market by surprise with very weak bookings and a downward revision in guidance. As ASML is one of the most critical players in the chip industry, many tech stocks suffered, which was probably why we saw a divergence between the performance of the S&P 500 and the Nasdaq this week (remember that the Nasdaq is more “tech” heavy).

A few days later, TSMC reported stellar earnings, surprising many after ASML’s earnings. There should be little surprise here, though. Both companies are exposed to the same industry and should trend in a similar direction long-term, but their cycles can be markedly different occasionally. The reason is that ASML needs Capex expansions to thrive, which take time to go online. In contrast, TSMC can pretty much directly benefit from the AI wave (especially if other parts of the market are not doing well, and they can use that capacity for AI-related chips). Additionally, TSMC has beaten (for now) its competitors, which is also a headwind for ASML as it has benefited from the technological race.

I shared on Twitter this week that TSMC has probably been one of my most significant errors of omission this year, not because the stock has gone up a lot but because I closely followed it when it was trading at a ridiculous valuation. There were fears that China would invade Taiwan at the time, and we were in a semiconductor downturn. The former could’ve potentially zeroed TSMC’s equity at that point if it took place, but the risk-reward seemed favorable considering the probabilities. Then the AI wave (unknown at the time) appeared, and TSMC’s multiple expanded considerably, which makes sense as it will benefit quite a bit from it.

Of course, investors should never kick themselves for missing those stocks that go up because it’s virtually impossible to have studied every company and there are two certain things in any investor’s career:

There will always be stocks going up more than the ones we hold

There will always be someone doing much better than us during certain times

This “someone” might be the index, which is happening to me this year. I’ll give more details when I share my annual recap in January, but it has been a tough year for the portfolio as it has significantly underperformed the indices year to date. This has been due to a combination of factors. A mistake I 100% own is Five Below, and I also hold several companies I don’t feel are appropriately valued by the market yet. This might be happening mainly because they are swamped with opportunity costs as they are going through (what I judge to be) temporary headwinds.

I’ve discussed several times that, as an individual investor, I am perfectly fine taking opportunity costs when this reduces the risk of permanent capital impairment (I am not the one who is going to time inflection points). Returns will indeed look lower if the “inflection” takes time to play out, but I am much more confident in managing my portfolio this way. I don’t have to (fortunately) fall prey to the incentive structure many professional investors suffer.

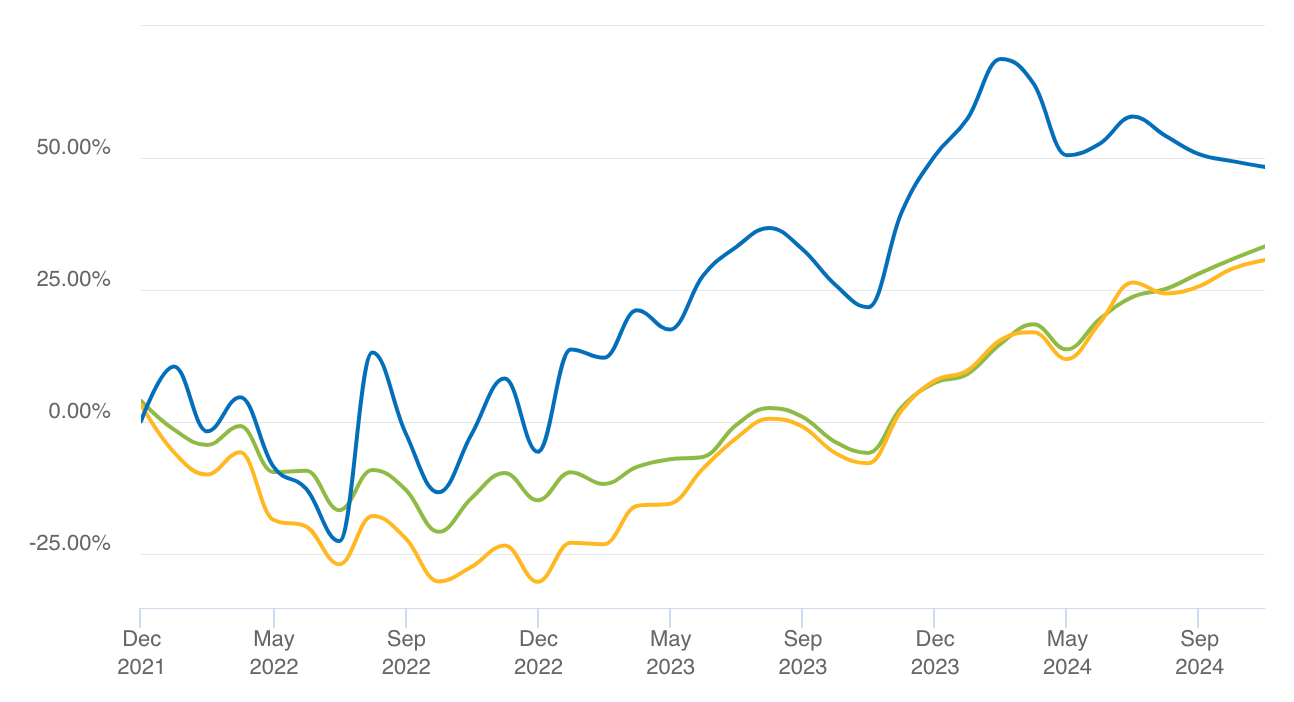

There’s good news, though. Despite significant underperformance this year, the portfolio has outpaced the indices since inception (January 2022), achieving a 14.7% money-weighted return CAGR against the S&P 500’s 10.5% or the Nasdaq’s 9.74%:

To this, I must add several statistics related to the positions in my portfolio and how this return has been achieved. Out of the 16 stocks included in the portfolio at some point (I’ve sold one)...

There’s one bagger (the largest position) and two +90% stocks

14 have delivered positive returns since they were added (of course not all have beaten the market even though the portfolio has overall)

One was sold at a loss (Five Below), and the other losing position is down around 5%

I am only saying this because temporary underperformance should not matter much so long as one feels comfortable with the strategy and the portfolio looks well-positioned for the long term. In times of noise, psychological pressure, and underperformance, it pays to zoom out and look at how the strategy is playing out over a longer time frame.

The most challenging part about investing is the long feedback loop. You might be right in the long term, but the market will not necessarily show you over the short term that this is true. This means you’ll need to trust what you are doing until it plays out as expected. Outperforming over every time frame is very tough (some would say impossible), and loss aversion is real: it’s natural to feel much worse when one doesn’t outperform than how good it feels when one does. I hope I didn’t bore you with some portfolio musings (more to come in the annual recap where I’ll share a comment about every company in the portfolio).

The other thing I would like to comment on is related to this chart from JP Morgan:

The “study” compares the different valuation multiples of the S&P 500 through history to claim that it’s currently trading on the expensive side even when ignoring the Mag 7. While I think this claim could be valid, we must also understand its limitations. Comparing valuation multiples over such long periods is “worthless” unless we know how the underlying drivers have evolved. To claim that the index is today more expensive than it has been in the past, we should also know…

The evolution of the growth expectations

The returns the index companies generate today

The profitability of the underlying constituents

The cash conversion of such companies

…

Without this, it’s basically impossible to measure the validity of that claim. Why should the index trade at the same level as 20 years ago if the companies that underlie it are of much higher quality and have higher growth expectations? The answer is it shouldn’t, but I don’t know if the constituents are of higher quality today or if they are not (maybe something worth looking into).

The industry map was pretty mixed although it was pretty much green:

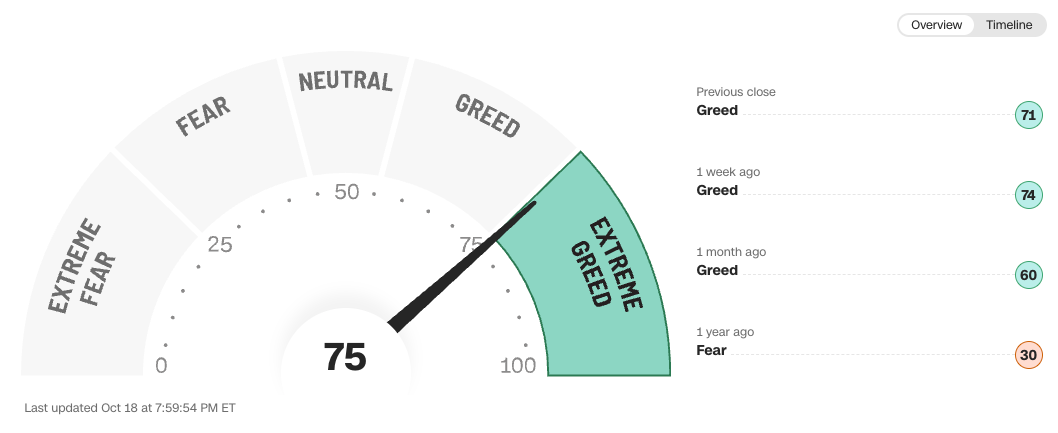

The fear and greed index rose to extreme greed, which seems logical seeing that indices are at ATHs and that people expect they will continue to climb higher:

The rest of the content where I discuss the news of the week of portfolio companies and my transactions is reserved for paid subscribers.