Don’t forget that Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Hi reader,

The indices were up again this week and extended their magnificent run over the last decade, 5 years, 3 years, and 1-year time frame (despite being sort of flat for the last 3 months). This excellent past performance has led many people to believe that beating the market is impossible, which is a fair doubt, but it exhibits recency bias.

Without further ado, let’s get on with it.

Articles of the week

I published three articles this week. The most “important” one was my sixth deep dive: Atlas Copco. I go over all there’s to know about the company and share why I decided to add it to my portfolio in 2022:

Atlas Copco: The Only Three Things That Matter

I also uploaded Intuit’s Investor Day highlights. Nothing was thesis-changing, but there were several interesting comments about the company’s strategy around AI and disrupting the mid-market. Both can turn out to be pretty significant opportunities for Intuit.

Lastly, I published what I believe to be an interesting investing topic: hidden costs. Many people tend to share their gross returns but tend to ignore that how these are achieved matter dearly when computing net returns.

Two things matter when comparing gross returns:

The risk assumed to achieve that return

The costs associated with achieving that return

This article reviews #2 and how such costs matter dearly in the compounding process.

Market Overview

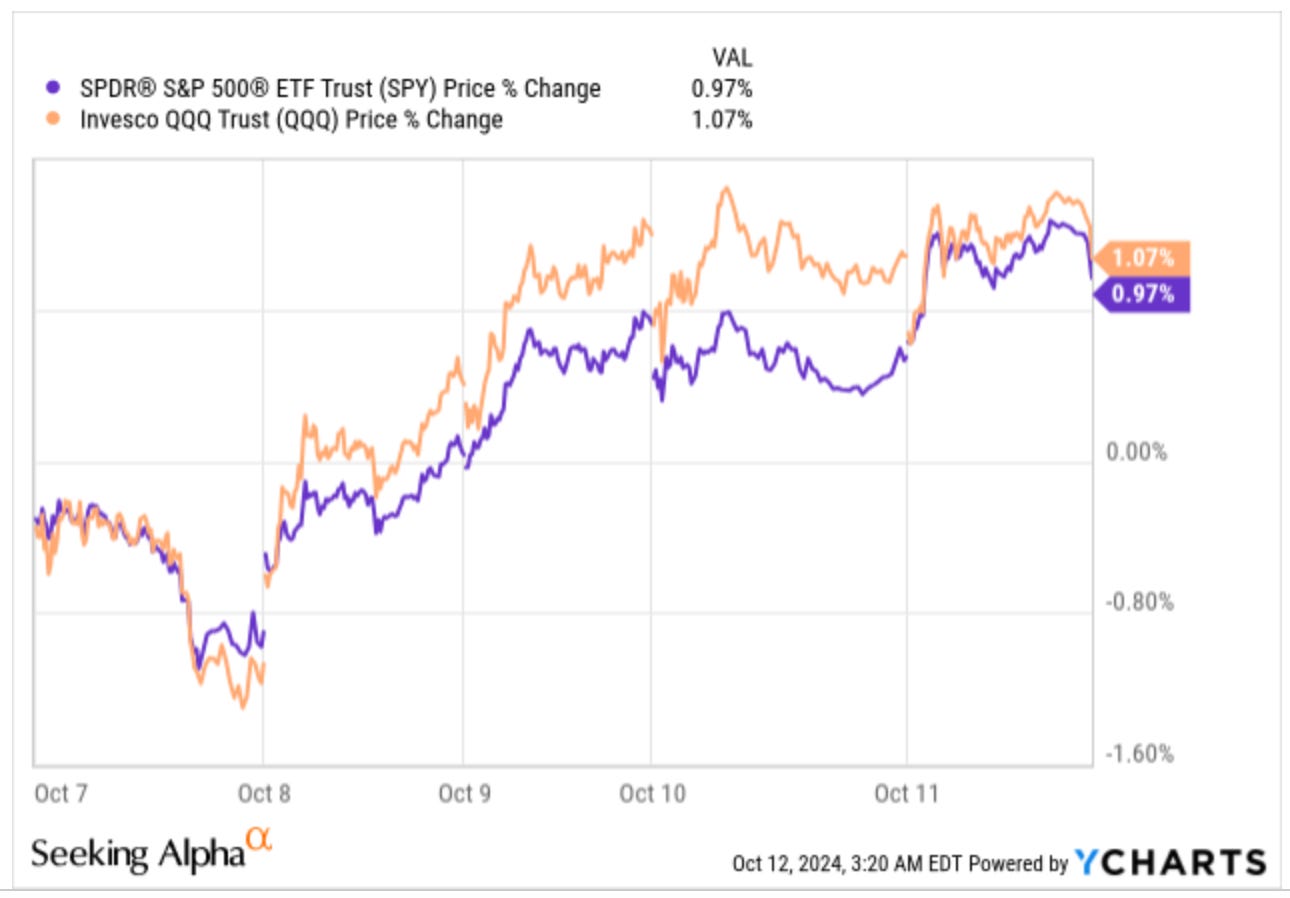

Both indices were up around 1% this week:

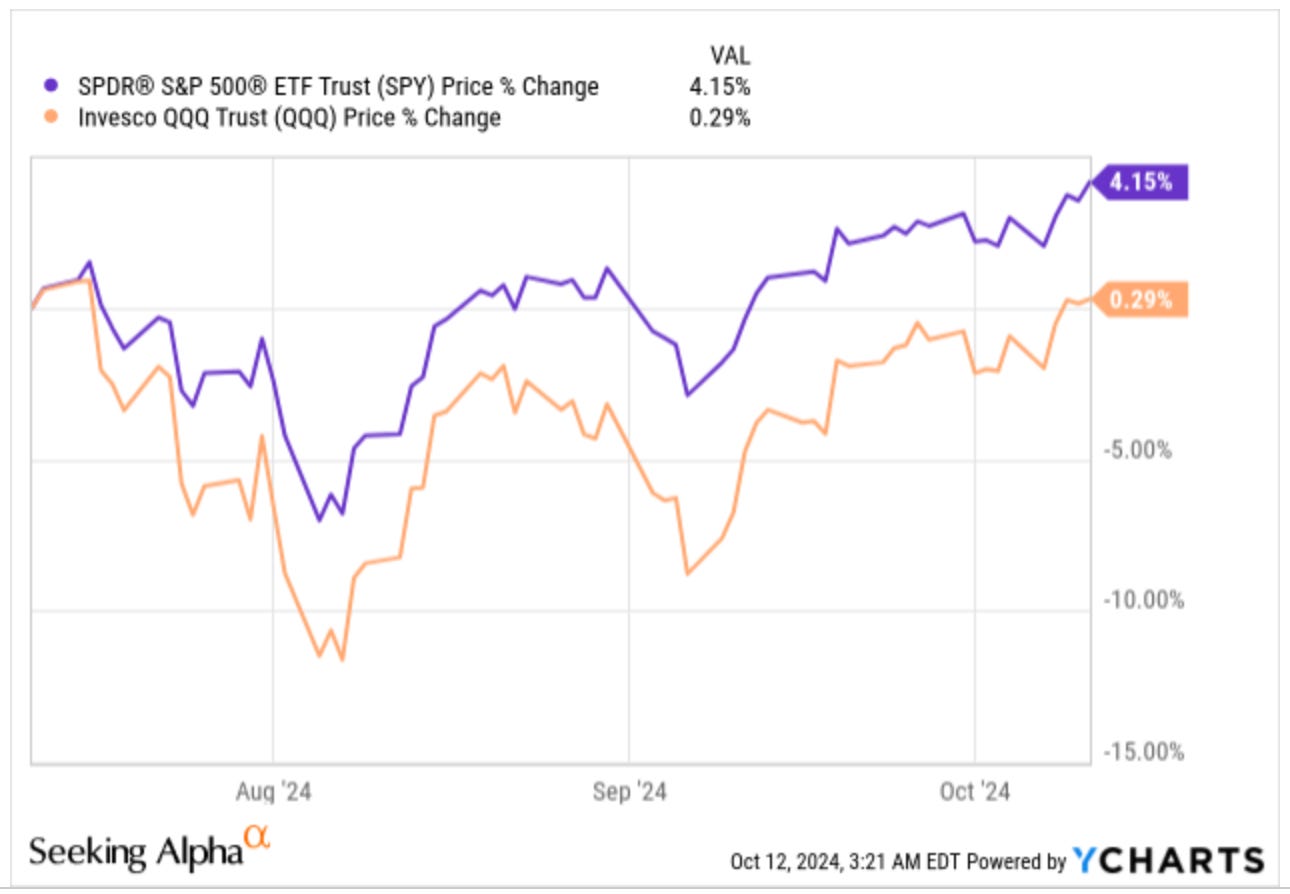

It was again a volatile week, but this is not news anymore! Both indices are up around 30% over the last year, but it has been a relatively “uneventful” three months, with the Nasdaq flat over that period:

There’s no denying that the performance of the indices has been outstanding, which has gotten many active investors to switch back to “passive” investing. They argue that it’s very tough to beat the index. This is undoubtedly true, but I think there’s a bit of recency bias here.

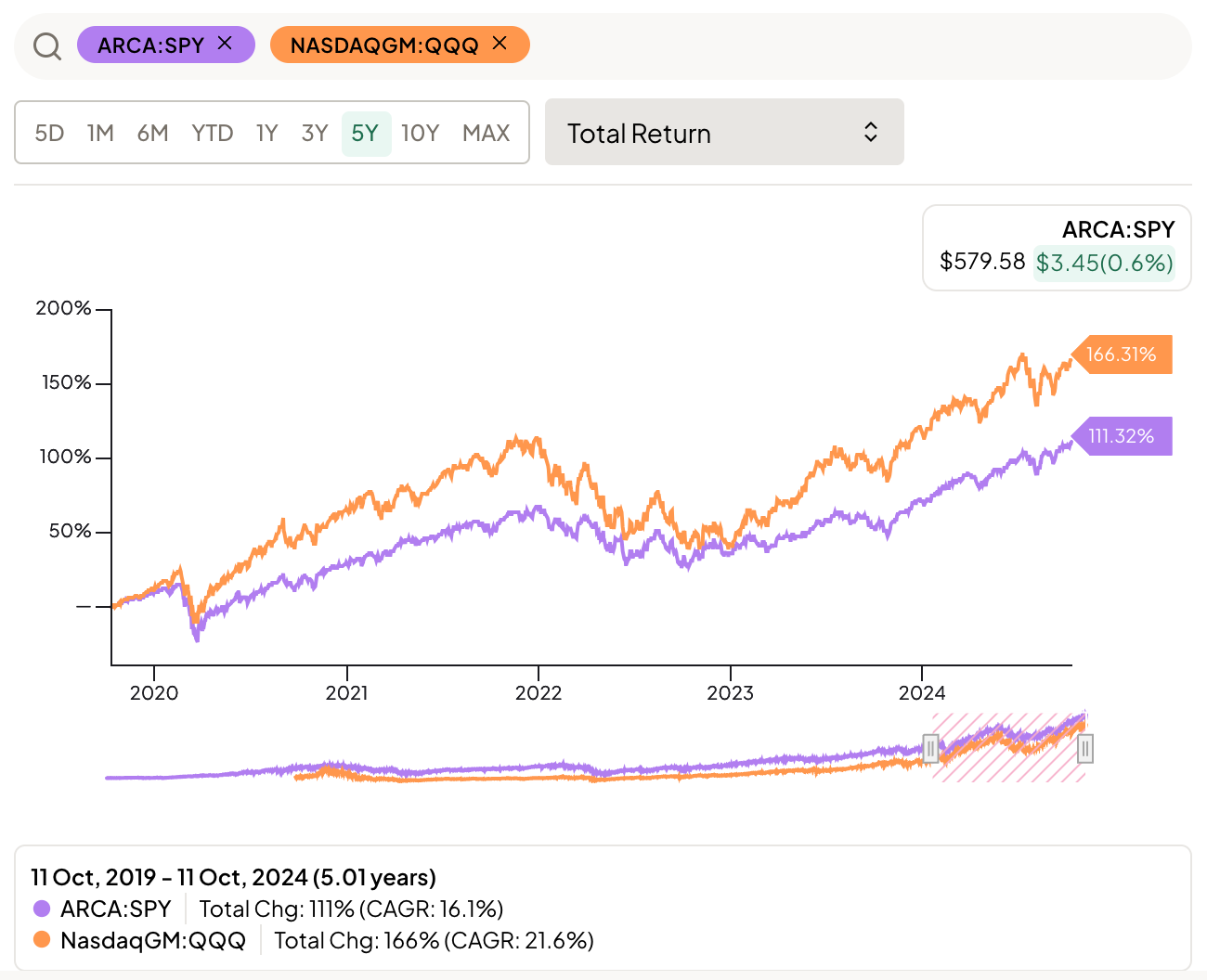

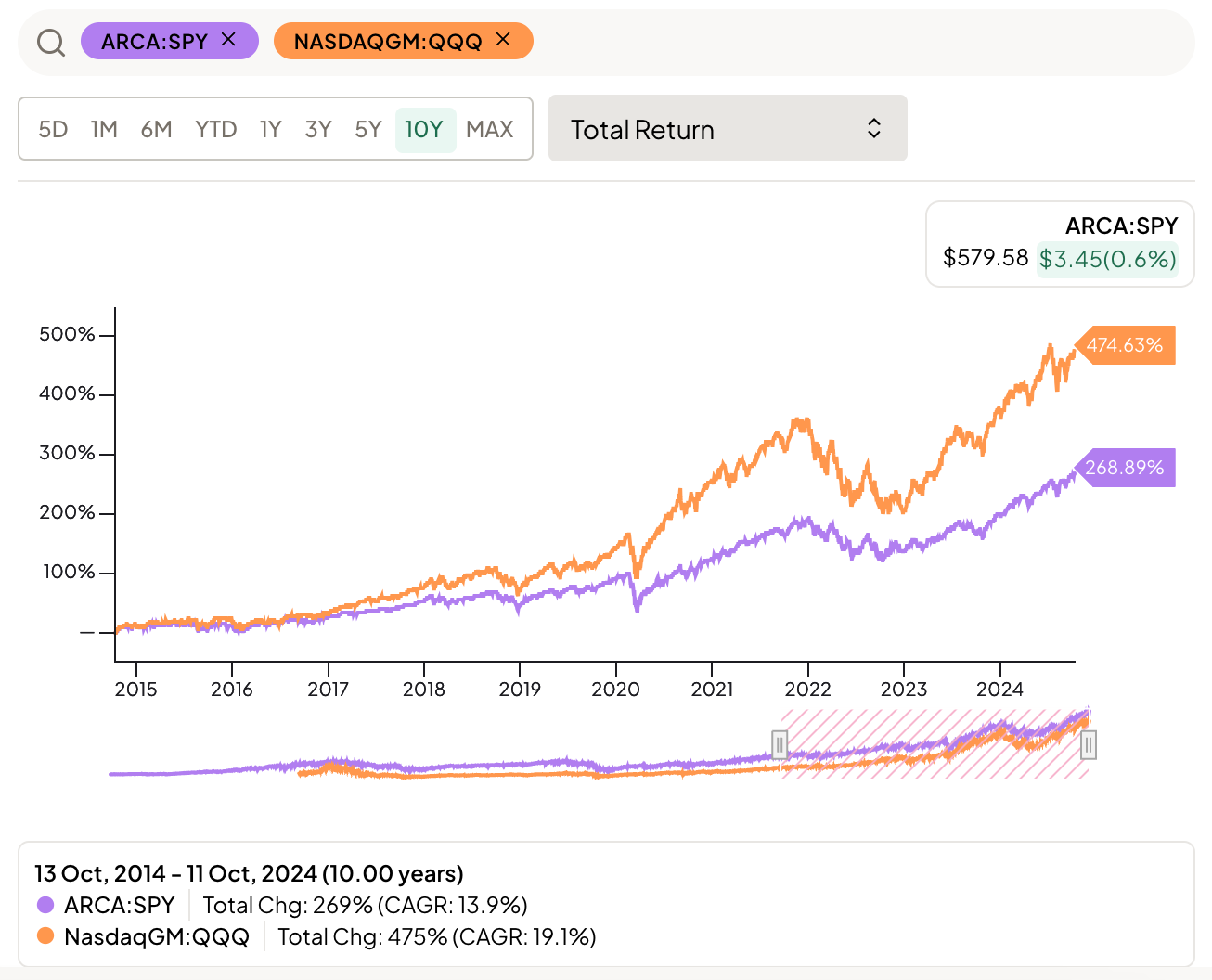

The indices have done very well over the past 5 and 10 years. Over the past 5 years, the S&P 500 and the Nasdaq have achieved a CAGR (Compounded Annual Growth Rate) of 16% and 22%, respectively:

This is impressive, but the results are pretty remarkable too if we zoom out 5 additional years. The S&P 500 has CAGRd at a 14% clip, with the Nasdaq compounding at a 19% clip over the last decade:

I highly doubt many active investors (even the most famous ones with the best track records) have been able to beat such returns over these time frames. When one looks at the returns of famous funds, it’s evident that they’ve been underperforming for some time but are “living” from the outperformance created in the initial years (post-GFC mainly). There’s nothing wrong with this, by the way. What I want to say with this is that these are not normal index returns, and I think that investors who believe they will be sustained for an extended period are in for a rough awakening. Trees don’t grow to the sky.

It would be somewhat normal to see some sort of a pause (I don’t know when) so that index returns approach their long-term averages. Since 1999, both the SPY and the QQQ have compounded at an 8% and 10% CAGR, which is much more in line with what I would expect over the long term. Maybe indices do CAGR at a 20% clip over the next 10 years (who knows), but I wouldn’t bet all my money on it. Another thing that strikes me is that many people tend to argue: “I am here for the 8%-10% CAGR, I don’t care if it doesn’t achieve 20% going forward.” While I understand this argument, and these people are definitely closer to reality than those who think it will compound at a 20% clip, they must be aware that the 8%-10% CAGR does not come in a straight line. If the indices have CAGRd at double that clip over the last decade, they would have to perform significantly below the 8% to 10% benchmark so that the average returns to that level. Don’t take this as a prediction; I have absolutely no clue what will happen, just sharing some thoughts.

Another thing passive investors should consider is that investing in an index might not be a passive decision anymore (unless one invests in an equal weight). Both the S&P and the Nasdaq are today “dominated” to a great extent by the Mag 7, so by investing in these indices today, one is (maybe unknowingly) pouring around 40% of their money into 7 companies. I don’t think that’s a passive decision. For the indices to produce such spectacular returns as they have in the past, these companies have to do pretty well from here on out, and not all of them are trading at valuations that justify a 20% IRR going forward.

Anyway, I said all this to claim that there will always be periods when it seems impossible to beat the index (the Nifty Fifties is a good comparison), but an active investor should not obsess over this. They should focus on maximizing their risk-adjusted returns (whatever these are) over a very long period by staying loyal to their strategy (which doesn’t mean being blind and not adapting if necessary). The index should obviously serve as a benchmark, but obsessing with it over the short term is undoubtedly a good recipe to underperform over the long term. Recency bias is very real, and the media and investors are constantly subject to it.

The industry map was pretty much green, with the primary lowlight being Tesla. The company hosted an event, and the market did not like it. I do not follow the company closely, but from what I’ve read, no data was shared about the viability of FSD (good for Copart), and it seems that humans teleoperated the Optimus robots (this is just speculation, and we’ll have to wait and see what Tesla says):

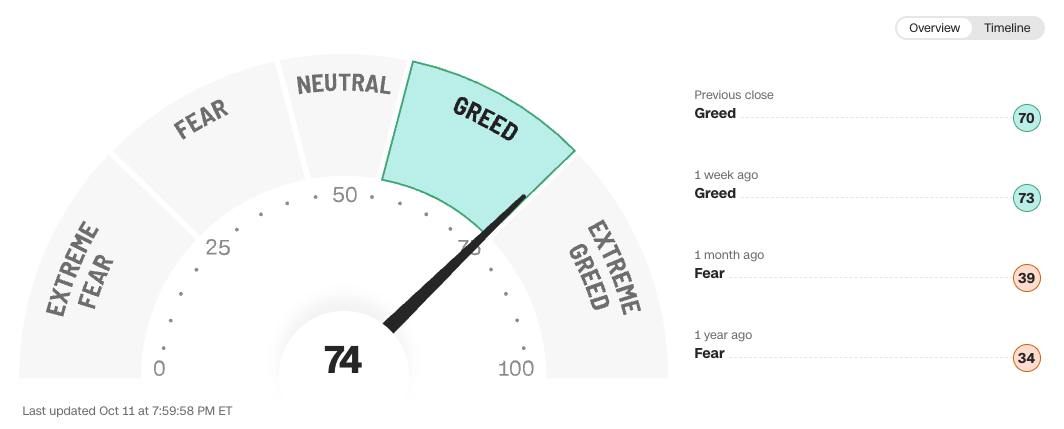

The fear and greed index remained unchanged compared to last week:

This is all the free content this week.

Have a great one!