NOTW #13: The Most Trustworthy Macro Indicator

Don’t forget that Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Hi reader,

The markets were slightly up this week after receiving the most anticipated news in history: the Fed is starting to lower interest rates. As in everything macro-related, there are puts and takes for the bulls and the bears, but nothing changes for macro-neutral investors. I go over this in more detail in the market overview.

Without further ado, let’s get on with it.

A new podcast

Just a quick reminder, I released a new podcast this week discussing the Picks & Shovels of the Bioprocessing Industry with Peter Mantas, partner of Logos LP. It’s my best-performing podcast to date and I think it’s worth listening to if you are interested in the space:

The podcast also breached 1,000 followers on Spotify this week, so thank you for that! If you want to keep up to date with upcoming episodes don’t forget to follow the podcast.

Articles of the week

I published two articles this week. In the first one I discussed Adobe’s recent earnings (which the market did not like) and its valuation (most of this article is reserved for paid subs):

The second article of the week was free to read and I was surprised to see how well received it was. I shared some musings around investing in undiscovered stocks using the example of Saker Aviation (SKAS):

Market Overview

After a somewhat “unexciting” past three weeks, it was an “exciting” week. Both the Nasdaq and the S&P 500 were up more than 1%:

I don’t think I need to tell you the news this week: the Fed dropped interest rates by 50 basis points. It was pretty obvious to everyone that the Fed would drop interest rates, with the only doubt being if the decrease would be 25 bps or 50 bps. It was the second that the Fed chose.

Many expected that the market would take this two-step decrease as good news (you know, interest rates are like gravity to asset prices), but obviously the market is a discounting machine and did what nobody expected it to: it went down after initially going up following this news. I don’t think macro indicators are all that helpful, but if there’s one, that’s betting against what everyone thinks will happen. One can confidently take the other side of the consensus when it’s macro related and probably be more right than wrong. The reason is that if everyone thinks something will happen, there’s a high chance it’s priced in.

Interest rates are like gravity to asset prices, yes, but it’s very tough to know the impact they will have on asset prices over the long run because there are many moving parts, and they are unlikely to be the most determinant factor in future returns. The reason is that interest rate movements can have many interpretations that fit many theories. There’s always something for the bears and the bulls. For example…

Bulls claim that lower interest rates are great for asset prices because higher multiples can be justified under a lower interest rate level. They also claim that the fact that the Fed is lowering rates with the US economy not in a recession signals they have achieved something unprecedented: hiking rates at the fastest pace in history while achieving a soft landing (some would claim that we are in a “no-landing” scenario).

The bears, on the other hand, claim that a two step decrease in interest rates signals that the Fed is worried about the economy and that we will be going into a recession soon enough. I think they’ve been saying this for the great part of the last four years, and it’s quite ironic how they believe the Fed can forecast the economy now that it fits their theory after claiming for the past four years that they were clueless (this said, they will eventually be right). Bears also claim that lower interest rates will create again rampant inflation in due time, something that seems strange considering that interest rates are still 5% and the fact that they were the same people claiming that inflation was here to stay for very long (tells you something about their forecasting ability).

As for me, I consider myself no bull or bear in this argument. I obviously acknowledge the impact interest rates and the economy can potentially have on the businesses I own, but that’s precisely why I aim to own companies where neither the economy nor interest rates can make or break the thesis. Owning several companies with significant cash positions, lower interest rates are not great news to be honest!

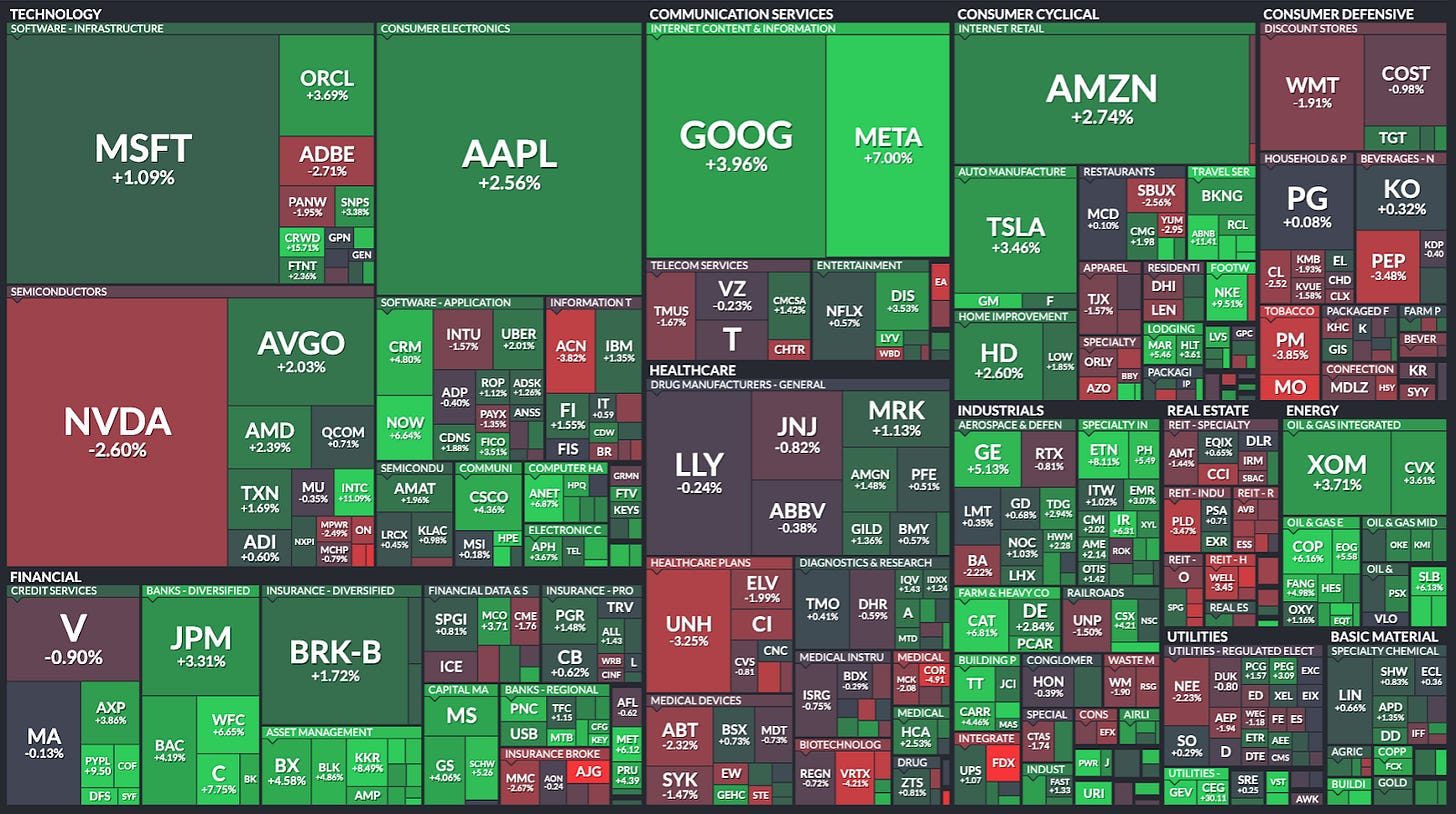

The industry map was probably not how you would expect it to be during a week of a two-step decrease in interest rates, but that’s precisely how the market works!

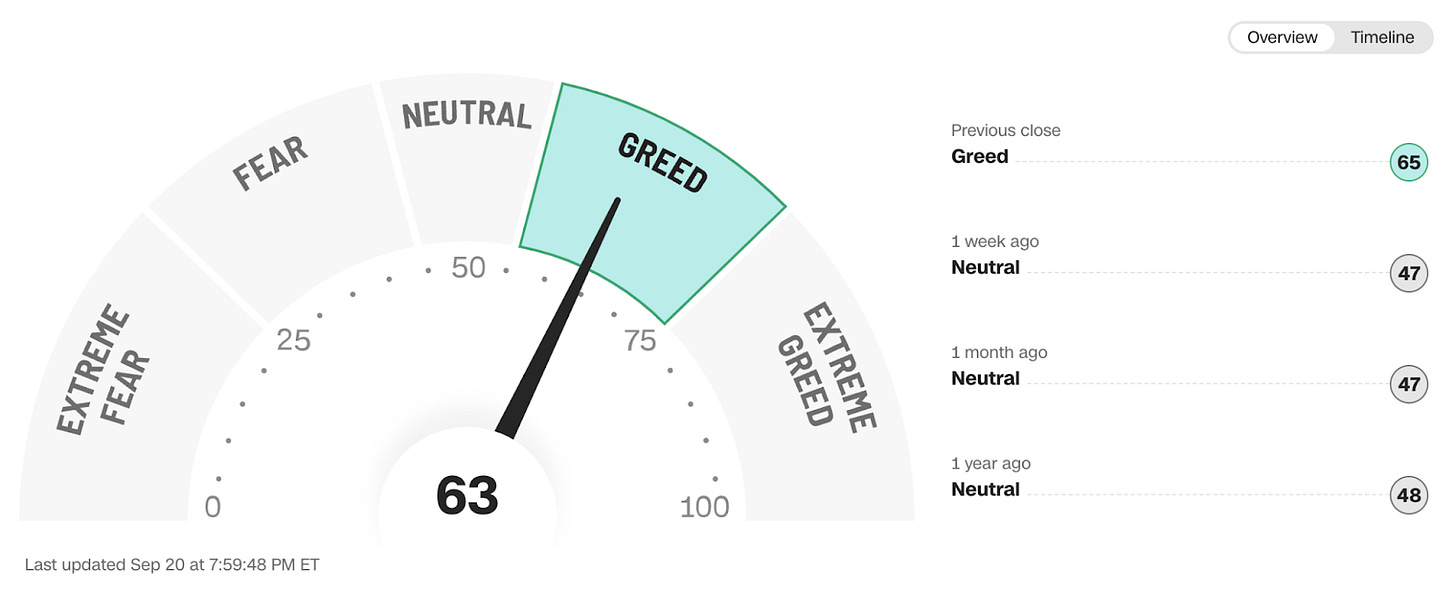

The fear and greed index jumped to greed territory, which is not surprising to be honest:

The rest of the content where I provide my transaction activity and the news of the week for the company’s in my portfolio, is reserved for paid subscribers.