Adobe's Q3: Is it a buy after the drop?

Hi reader,

Adobe reported Q3 earnings last week, and it’s fair to say that the market did not like these. The stock sold off 8% the following day, probably caused by what many deemed to be “soft guidance:”

I’ll review guidance and what might have freaked out the market in this article, but I think it’s also important to zoom out. There’s no denying that Adobe has seen a rocky three years. The stock is down 17% over this period, which contrasts with my returns. I took advantage of the different selloffs to add to my position, and with a cost basis of around $366, I am up around 46%. This equals an annualized return of around 17%, which is pretty outstanding (terminal risks aside), considering it has been achieved on a stock that’s down 20% over the past three years. Volatility is the friend of the patient investor, and I think this is a good example of why. The only caveat is that volatility is only useful when an investor understands the value of an asset.

Without further ado, let’s get on with Adobe’s earnings.

The summary table and some comments

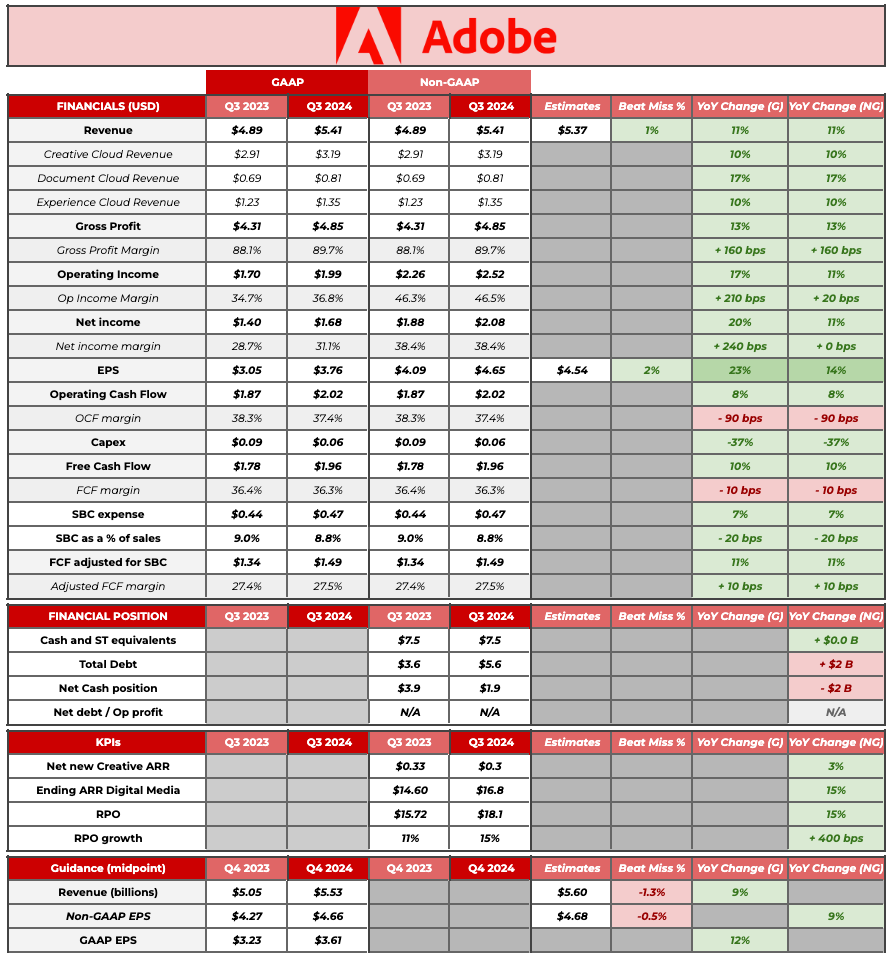

Here’s the summary table with Adobe’s Q3 financials, its KPIs, and the guidance: