NOTW #12: Block Out The Noise

Don’t forget that Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Hi reader,

It has been three weeks since the last NOTW, so I look at what the markets have done over that period. Coincidentally or not, the market taught us again the same lesson over these three weeks: block out the noise (I’ll explain this in more detail in the market overview).

Without further ado, let’s get on with it.

Best Anchor Stocks mentioned on The Investors Podcast

I highly recommend listening to this podcast on Hermes, where Clay interviews Shree Viswanathan (@SVNCapital on Twitter/X):

Shree is an outstanding investor and a good friend of mine. I was also very fortunate to see my work on Hermes mentioned in the podcast. You can read my research here:

Articles of the week

I published two articles this week. The first one was a deep dive on Hermes. Many investors are carried away by the company’s optically high valuation ratio, claiming that it’s incredibly overvalued. While I understand where they come from (it’s definitely a steep multiple), I would be careful in valuying Hermes using conventional methods (famous final words, I know). I go over every relevant topic in the deep dive, including the company’s valuation.

The second article explains the different valuation methods and their pros and cons. I typically receive a lot of questions related to valuation, and I thought it would be a good idea to explain the different methods and my preferred method (which many of you already know).

Market Overview

It’s been three weeks since the last news of the week, so let’s take a look at what the markets have done since then. It’s been pretty exciting (irony)! The S&P 500 is up 0.22%, and the Nasdaq is flat (yes, you read that right, flat):

Of course, the journey has not been unexciting. Over the past three weeks, we’ve had…

Employment data

Inflation data

Rumors around the pace of interest rate decreases

The geopolitical battle between the US and China heating up

…

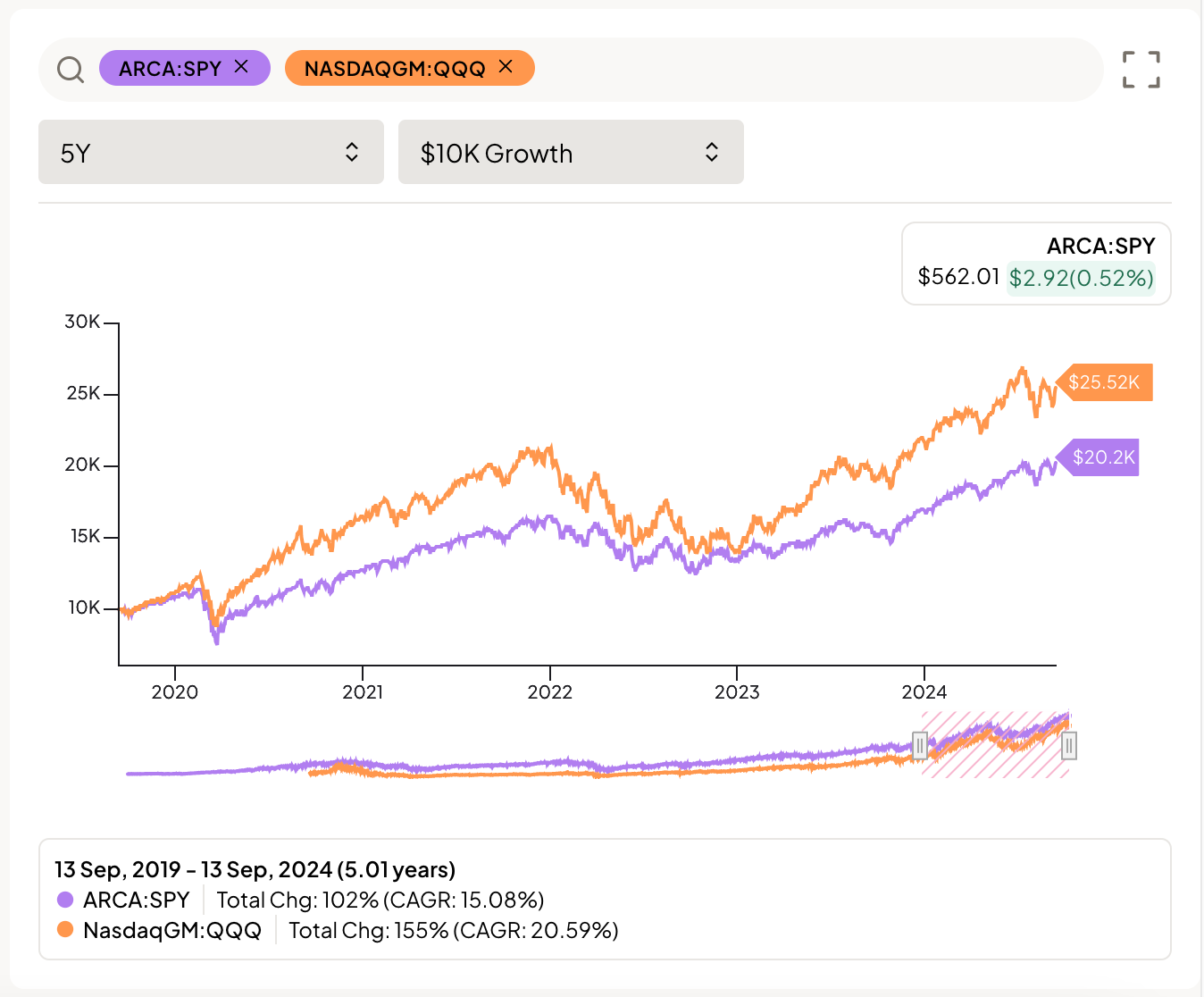

And still…flat. This reminds me of the occasional exercise I like to do to remain long-term oriented. Imagine that an investor would’ve invested $10k in the S&P 500 and $10k in the Nasdaq 5 years ago (September 2019). This investor is lazy (as a good long-term investor) and did not open his account until this weekend. They would see an account of +$45k after making an initial investment of $20k, earning an annual return of almost 18%:

They must have thought: “Wow, everything has been great!” (assuming they were not on Twitter, of course), but here’s what the world has gone through during that same period (not in chronological order)…

A global pandemic

Russia invading Ukraine

Rampant inflation

The quickest hiking rate in history

An inverted yield curve

…

Someone who could’ve predicted all these events beforehand would’ve 100% stayed out of the market, but they would’ve forfeited an 18% 5-year CAGR. There’s a lesson somewhere in this story and I think it’s so obvious that I will not dare say it myself.

There was another relevant event this week. A stock that has been touted by Fintwit countless times over the last few months, Moberg, dropped 60% in a single day after poor results of its drug from Phase III trials in the US.

As in every stock drop, there are three kinds of investors…

Those who did their work, understood the risks and did not pay a price too high or made it a single holding (i.e., managed risk accordingly)

Those who did their work but had a biased view toward the risks (i.e., thought it was a slam dunk)

Those who did not do their work and blindly copied the first two

There’s honestly been a lot of grave dancing, and in my opinion for good reason in some cases because some people got really cocky ignoring the risks (especially the #2 and #3 type of investors). It got to a point where you were basically “stupid” or “ignorant” if you didn’t own it. Many saw it as free money, but the market has demonstrated time and time again that there’s no free money. This said, I think there should be less grave dancing and more lessons learned because one doesn’t make money by grave dancing (well, some people do, but that’s not the point).

The market will humble absolutely everyone in this business. If you have not been humbled yet, don’t worry, your time will come. That said, it’s not the humbling experience that matters but how we react to it. There will be people who learn, adapt their process, and improve, and others (mainly the #3 type of investors) who probably will not invest ever again. This is how the market works and there’s nothing wrong with it, you lose some, you win some, but risk mitigation should be at the top of everyone’s mind. What’s interesting is how many people have been wrong time and time again and, despite this, feel they have the right to grave dance on others (the human being can be a mystery).

Now, I don’t have any specific views on Moberg because I have never studied the company, but I do believe that there’s a wide risk spectrum in the healthcare industry. Probably the riskiest part is investing in early-stage biotech. I read this week that someone who had been working 17 years in large pharma had never seen one of their projects commercialized. That’s pretty crazy if you think about it. Large pharma definitely can scrape some projects because they will eventually (in most cases) make it up with a successful drug, but this luxury is not available for early stage biotech companies that depend on a single product.

On the other side of the risk spectrum, we can find (as almost always), the picks and shovels. These companies are drug-agnostic (so long as volumes increase over time) and are protected to a great extent by regulatory barriers. Something that I don’t think is discussed enough is how these companies provide an asymmetric bet toward AI. Their moats are protected by regulation, so it’s arguably tough to see them competed away by AI. At the same time, AI is expected to accelerate the drug discovery process which might potentially lead to new volumes. This is what Matt Garman, AWS’ CEO, said during his latest conference:

But you talk to a pharmaceutical company that's using AI to actually invent new proteins and discover new proteins and new molecules that may be able to help cure cancer or cure other diseases and things like that. That's and at a rate that's tens of thousands of 100 of thousands more times than a person sitting there with a computer trying to guess what the next protein could look like to solve a particular disease. That is just a fundamentally different capability than ever existed before and has massive implications for healthcare.

I believe this combination is quite appealing, and it’s the reason why, besides owning Danaher, I am looking at other companies in the space. (Stay tuned to the podcast because I’ll be recording a very interesting conversation regarding this topic soon.)

The industry map was primarily green this week:

The fear and greed index is still in neutral territory, just like three weeks ago, but it has not been a smooth ride. We were at extreme fear entering august, then we touched greed by the end of august, went back to fear territory in September, and it has now improved to neutral:

This only demonstrates how quickly investor perception and emotions can change, and that’s where the advantage lies.

The rest of the content where I provide my transaction activity and the news of the week for the company’s in my portfolio, is reserved for paid subscribers.