NOTW #11: The Fed's Message

The indices were up this week thanks (probably) to the Fed’s latest message: “We are ready to lower interest rates.” Well, it was not exactly like that, but you get me. The market tends to move with interest rates because they matter, but I would question their long-term importance or our ability to forecast them (similar to macro).

Without further ado, let’s get on with it.

Don’t forget the calendar for the coming weeks

In last week’s NOTW, I shared that I would be on holiday next week and relatively inactive the week after. Starting the 8th of September or so, I will be back 100% with recharged batteries. I will go into the chat occasionally, so feel free to send me a direct message if you want to.

Articles of the week

It was an intense week article-wise. I uploaded 4 articles this week, three of which were earnings digests.

The first article of the week was Danaher’s earnings digest, in which, besides the earnings, I go over the topic of the buyback. The company had not repurchased stock since 2012, and it was, by far, its most significant repurchase to date. Some people claim it’s not good capital allocation, but we need all the context to fully understand the validity of that claim.

The second article was Zoetis’ Q2 earnings digest. After a rocky post-pandemic period, the company is accelerating its growth thanks to, among others, its mAbs franchise. And yes, that’s the same franchise that the Wall Street Journal claimed was killing dogs, making the stock dump 8% in a single day. I believe management’s mAbs expectations will prove to be pretty conservative.

The third article was not an earnings digest, but similar. I brought a summary of Texas Instruments’ Off-Cycle Capital Management Update and shared some implications for the current valuation (+ the price I would be willing to add to my position).

Finally, I published Deere’s Q3 earnings digest. The company’s quarter showed that execution matters and expectations do too. I found one thing worrying about the earnings, which I discuss in the article.

Market Overview

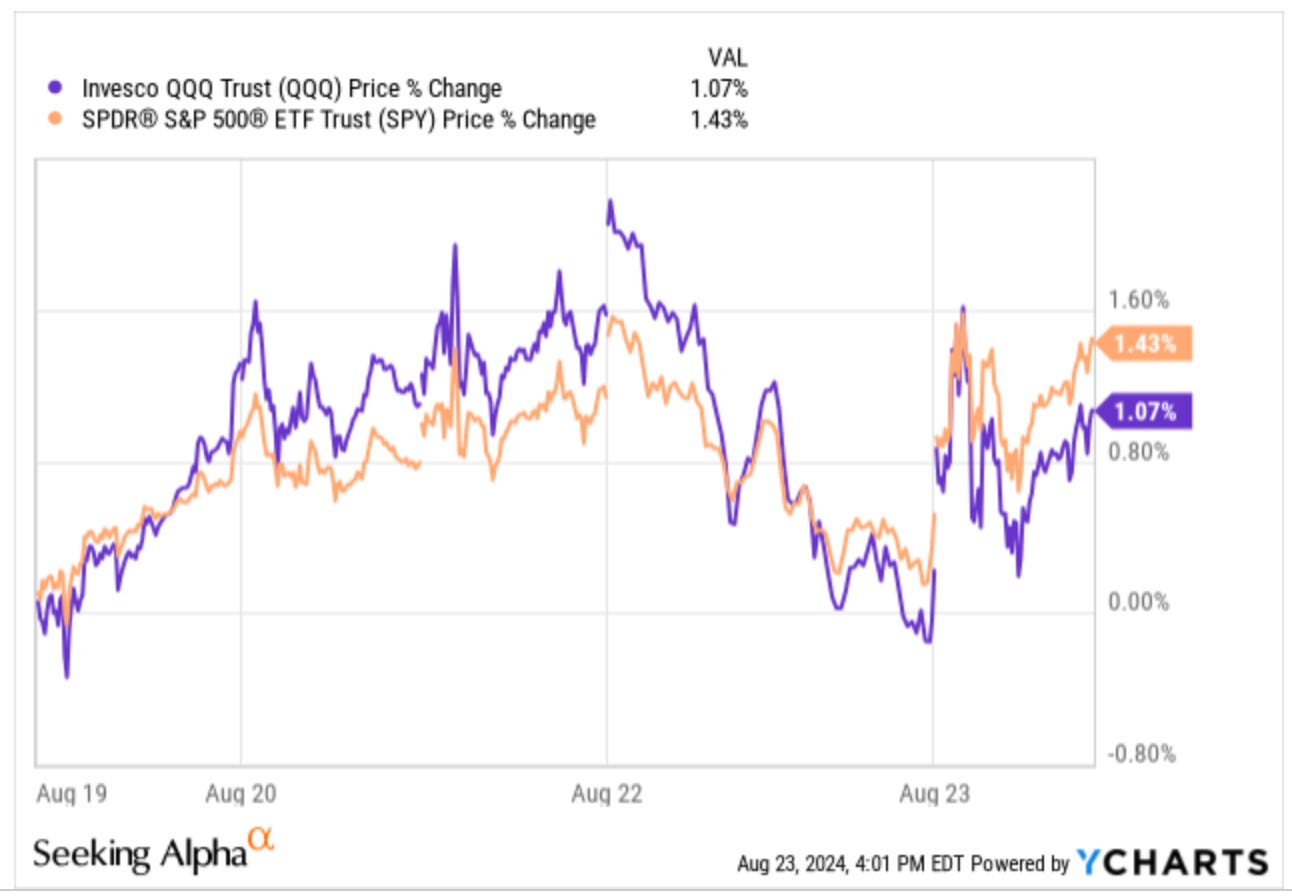

After last week’s strong week, the indices were up again this week. Both the S&P and the Nasdaq were up more than 1%:

They were primarily flat until Friday, when they rose supposedly due to Jerome Powell’s message: the Fed is ready to cut rates. I don’t know if this is the good news that people think it is. If the Fed is willing to cut rates, then this potentially means they don’t see the economy as strong as many people believe it is. I struggle to see why they would cut into a strong economy, forfeiting one of their most essential tools to stimulate the economy during bad times.

There also seems to be a lot of politics involved, as many claim it’s normal for the Fed to do this during an election year. Obviously, the Fed (like any other central bank) is technically independent of the government, but nobody really knows if that’s really the case (there are ample examples to doubt so). No need to speculate on it either way, because despite lower interest rates providing “valuation support,” I don’t think they are the most important variable that determines future stock returns or, better said, I don’t think they can be forecasted as to be a relevant long-term variable.

Something that I wanted to discuss in this NOTW is the importance of staying true to one’s investment process, which doesn’t mean that we should be close-minded. It’s normal nowadays to go into social media and see everyone making a lot of money and stocks going up a lot. There might be two reasons why we constantly get exposed to this:

People who are not making a lot of money don’t post about it

The algorithm naturally pushes this type of content forward because it tends to get a lot of interactions

It’s normal to feel “left out” when one is not the investor making the most money or doesn’t own all the best stocks; it brings some sort of FOMO (Fear of Missing Out) feeling (I believe X (formerly Twitter) has become a huge FOMO-inducing app). However, I would caution against letting this influence one’s process too much. I would 100% recommend reading about great investors and other companies that are doing great to improve one’s process, but constantly changing strategies is probably not the long-term strategy; consistency and conviction of what one is doing matter dearly over the long term. I would like to end this short discussion by saying that there are only 4 certain things in life…

Death

Taxes

Other investors making more money in any given year

Stocks that go up more than the ones you hold

Another good example of why one shouldn’t over-obsess with this is that we rarely see the best historical funds among the best-performing funds year in and year out, but they do great over the long term. In short, a fund that was only long Nvidia going into the year will be in the top charts this year, but this will not necessarily hold over the long term (especially with that risk management). There is much to learn from this, but the most important lesson is that consistency is a key ingredient in the compounding process.

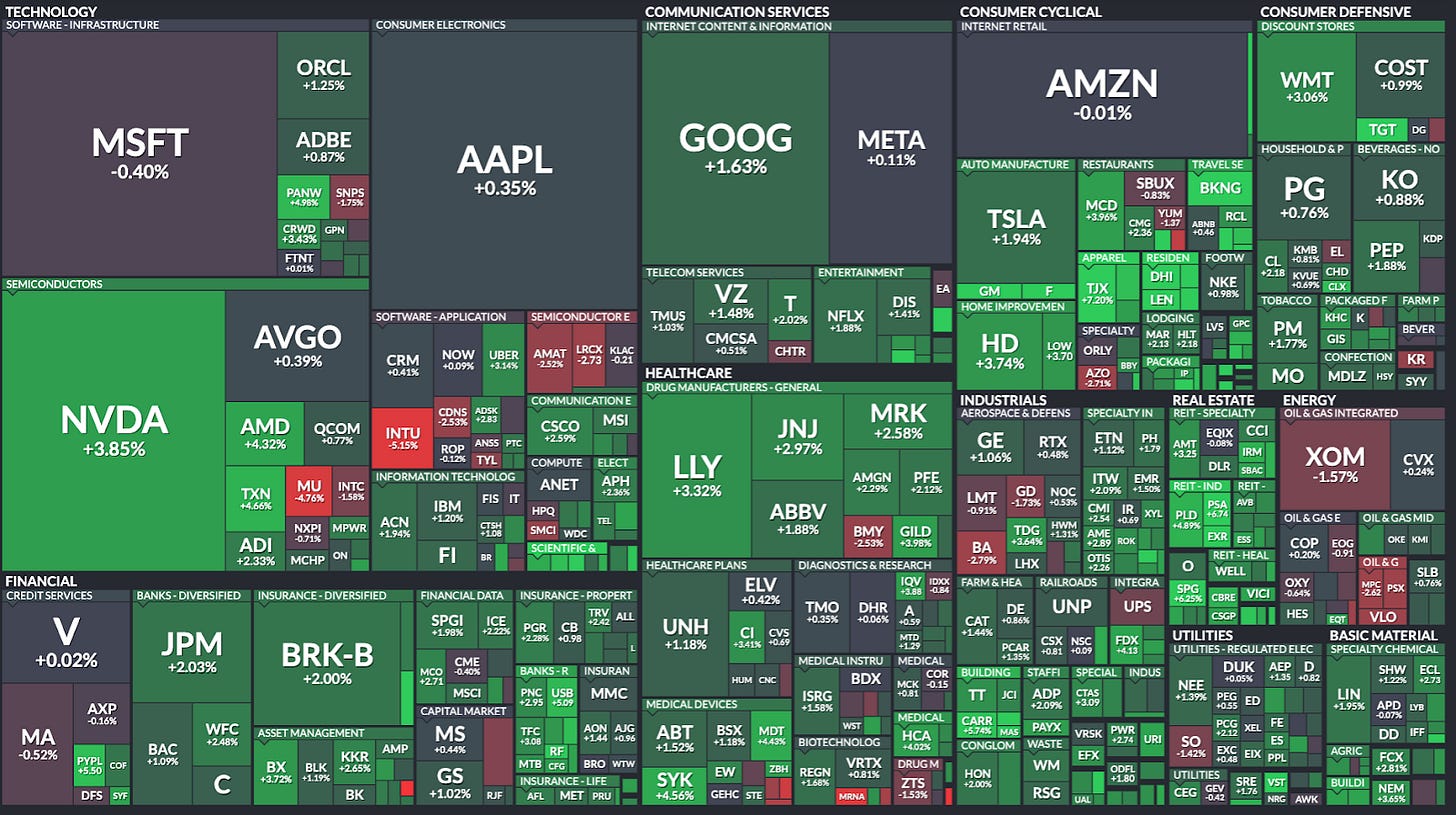

The industry map was predominantly green this week, with some exceptions. Funnily enough, one of the visible exceptions this week was Intuit:

The fear and greed index improved markedly to neutral. Maybe lower interest rates will calm people, but as discussed above, there’s always a tradeoff (although it probably doesn’t matter much over the very long term):