Is Danaher's Buyback Good Capital Allocation?

Earnings summary and thoughts on the buyback and the valuation

Hi reader,

This is a long overdue article since Danaher reported earnings three weeks ago. Earnings season is always hectic, and I try to prioritize those earnings digests that are more relevant due to…

The weight of the companies in my portfolio

A thesis change/shift or some relevant news

One could argue, though, that Danaher could well be included in the first group as it currently makes up 8.5% of my portfolio (it’s my fourth largest position). Anyway, better late than never!

The market seemed to like Danaher’s results, and the stock is currently trading around 8% above where it was before reporting earnings:

This might sound like peanuts, but we must also consider that the broad indices have not done extremely well over the same time frame:

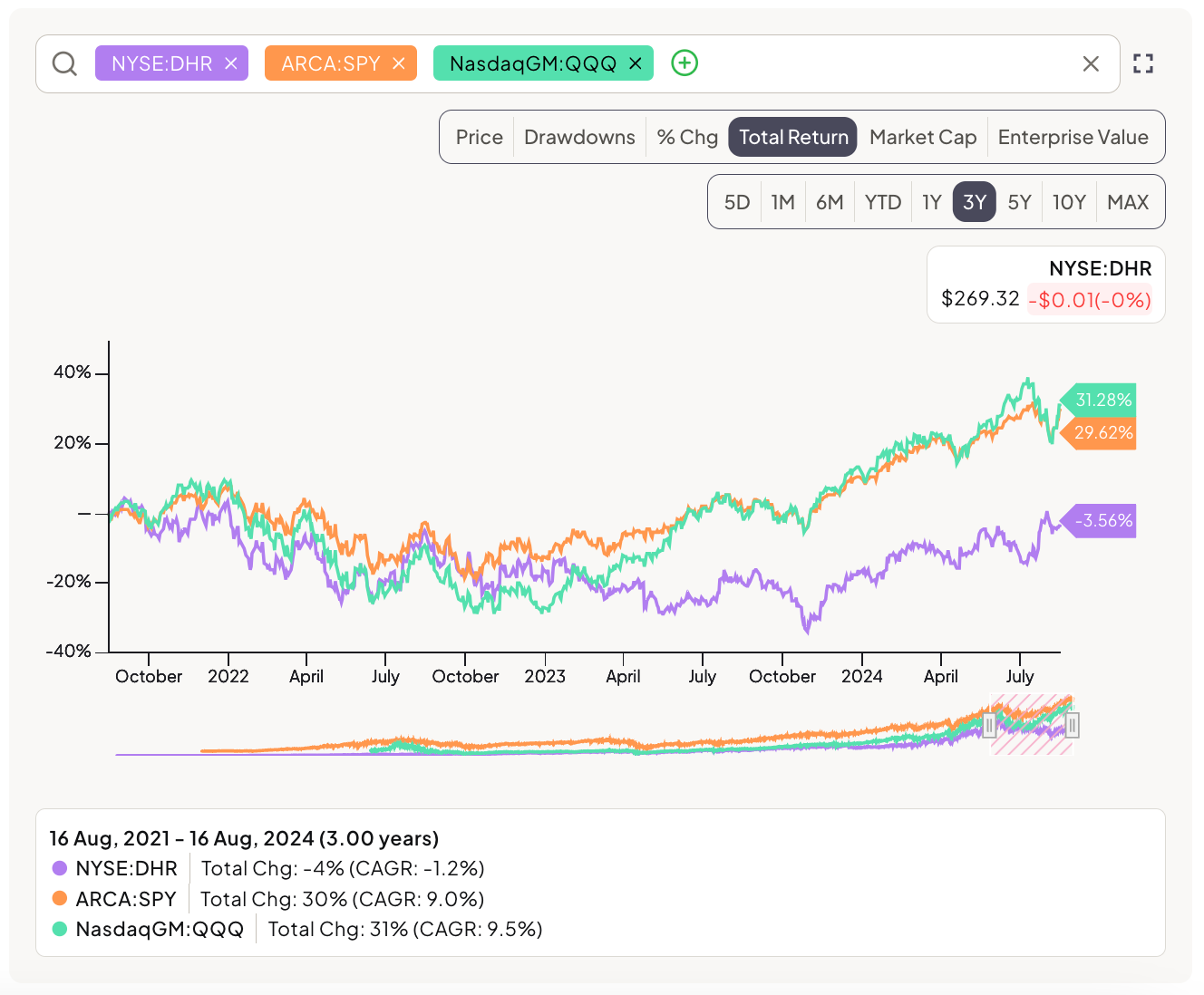

The above is an excellent example of cherry-picking, though. If we zoom out and look at the last 3 years, Danaher has severely underperformed both indices:

I don’t have a crystal ball, so I don’t know precisely why the stock has done so poorly over the last couple of years, although there’s a reasonable explanation. Like many healthcare companies, Danaher has gone through a pandemic boom and bust cycle. Investors tend to extrapolate recent events to the future (recency bias), and many might have thought that the growth rates delivered during the pandemic were sustainable going forward, either because we were entering a “new paradigm” or because the pandemic would last forever. With the benefit of hindsight, we now know that none of these happened, so Danaher has seen its financials normalize from highs, and the market seems to have reset expectations. Not many well-run companies remain significantly off-highs, but Danaher is one of them (which doesn’t automatically make it cheap). The stock is currently 20% off highs:

Note that, to the non-recurring nature of most COVID revenue, we must also add the inventory dynamics we have seen in many other industries. Due to the supply crunch during the pandemic, many customers built up their inventory to build resilience into their supply chains. With supply chains now normalizing and higher interest rates across the board (which make holding inventory less appealing), many of these customers have chosen to wind down these inventories, further exacerbating the bust cycle. Now, with several headwinds coming the company’s way, recency bias can play in the favor of long-term investors. The long-term secular trend is still there irrespective of these headwinds, and to the extent that investors forget about it, the setup becomes more appealing. I have shared this quote countless times, but it perfectly describes why investing in secular industries that are cyclical from time to time can be so profitable…

Now, I don’t think Danaher is extremely cyclical, but many companies have proven to be cyclical coming out of the pandemic for the reasons discussed above.

In this article, I will review the company’s numbers, discuss the highlights and the lowlights, give my thoughts about the recent buybacks, and share some comments on the valuation.