Minimizing Uncertainty through Investment Criteria (NOTW#50)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

The markets were up again in this short week (Independence Day) even though Trump came biting back with his threats. The future is inherently uncertain and unpredictable, but I discuss how one can attempt to minimize this uncertainty by looking for several key investment characteristics.

Without further ado, let’s get on with it.

Articles of the week

I published one article this week: ‘Cooling AI.’ Many people discuss the amount of money being spent on chips to power AI, but few discuss another key element of AI: cooling. In that article, I delve into the industry to outline how it works, the opportunities it presents, and the challenges it poses.

🤖❄️ Cooling AI

When people talk about AI, two words tend to come out of their mouths: chips and Nvidia. Jensen Huang’s company is the largest company on earth primarily thanks to the sales of GPUs (Graphics Process…

I will write an in-depth report on one company that operates in said industry. The stock has gone from a Hedge-Fund favorite to a 40% drawdown, and now some respectable funds are including it in their portfolios. The former is always a positive sign, although we should never blindly follow other investors as everyone makes mistakes.

Market Overview

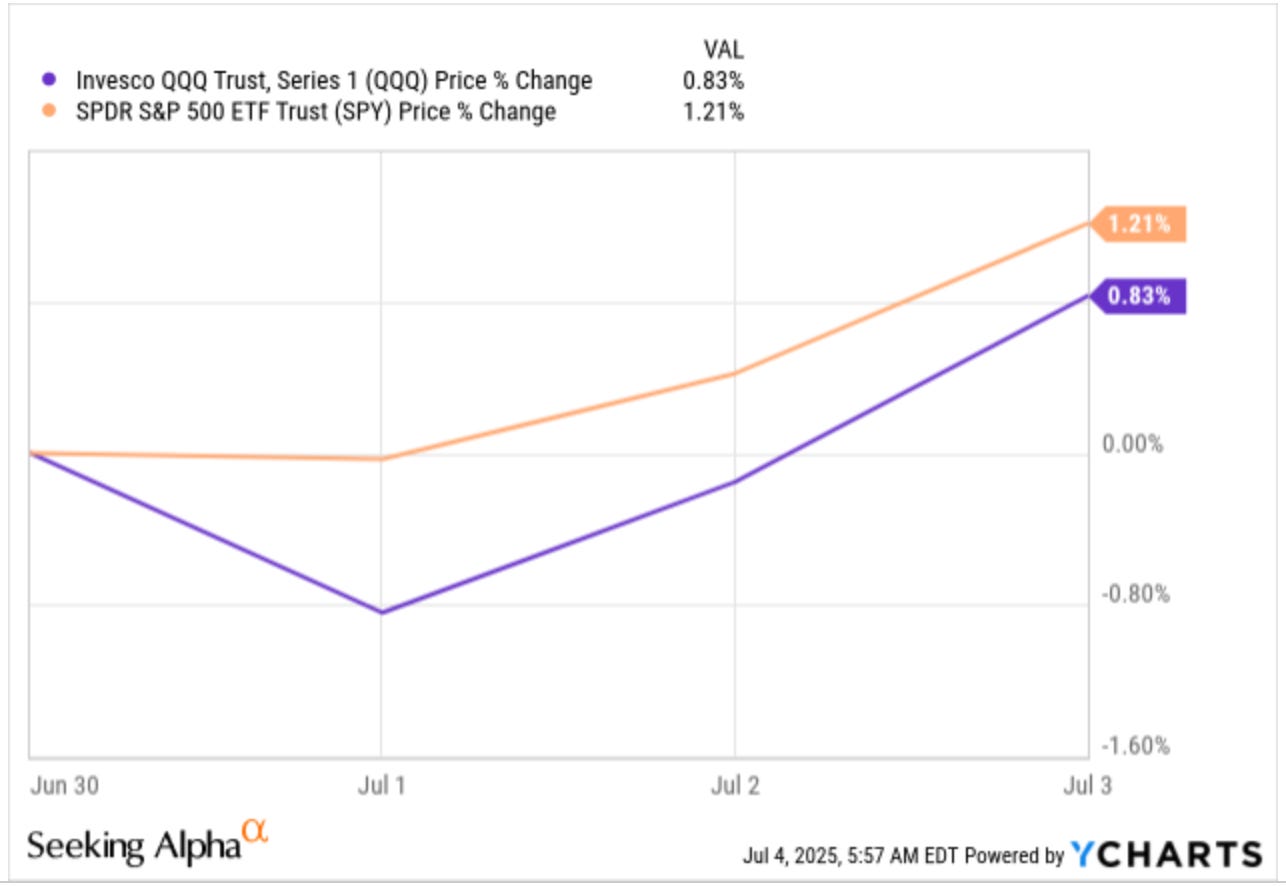

It was a short week for investors, as markets were closed since midday on Thursday due to the 4th of July (Independence Day in the United States). In an ode to American capitalism, both the S&P 500 and the Nasdaq breached new ATHs this week:

Several significant events occurred this week. First, Jerome Powell said that what had held the Federal Reserve from lowering rates was tariffs. This can be interpreted as follows: if tariffs ultimately prove to be significantly lower than previously anticipated, then the Fed is open to lowering rates. There was also news on the tariff front. Even though Bessent pointed out last week that the July 9th deadline is flexible, Trump said this week that this is not necessarily true and that they might not reach a deal with Japan (although they’ve reached one with Vietnam). I honestly have no clue what will happen regarding tariffs (probably only Trump knows), but it does seem clear that the market is not “buying” Trump’s words anymore. I discussed why this is the case in a relatively recent NOTW: ‘The Boy That Cries Wolf.’

Employment numbers also surprised to the upside, indicating that the US economy remains in a strong state despite recent volatility. Having a strong economy is always good, but of course, some people are now worried that the Fed will not lower rates so long as the economy remains strong. While I have no idea what rates will do, I do think they are at a reasonable level (it’s not as if rates are at 10%) and that their impact on good companies over the long term is likely to be limited if they remain where they are.

There’s no denying that the interest rate level and the macro play an outsized role in returns over the short to medium term. The only problem is that forecasting these variables is a fool’s game. One would think that the past 5 years should’ve been a gold mine for macro forecasters, but the reality is quite different; most (if not all) have been caught wrong-footed several times. This brings me to another interesting topic: the inherent unpredictability of the future.

My objective (although not at all times achievable because there are other things to consider, like valuation) is to invest in companies that, due to a collection of special characteristics, have more visibility into the future than others. The future will always be uncertain, but there’s no denying that some companies will be more in control of their destiny than others due to strong competitive advantages that grant them significant pricing power and a higher certainty of being able to exert that pricing power. These companies are likely to come at a premium to the market, which does not necessarily imply they are expensive. Most of a company's value lies in its terminal value, so it’s natural for companies that have more visibility into this terminal value to trade at higher multiples.

There are several companies in my portfolio that I believe meet this description, but I would like to briefly discuss two of them: ASML and Hermes. ASML holds a monopoly in arguably the most critical technology on earth: EUV lithography. The company is the sole manufacturer of this system and has significant visibility into the future due to several things:

As a requirement for investing in the development of these systems, ASML has visibility into its customer roadmaps, which typically span 5 to 10 years. This means that, even though ASML’s systems can be rendered obsolete over the very, very long term, the industry is telling ASML that its technology will be critical for at least the next decade

ASML has a monopoly and therefore has pricing power, which it can use to get its fair share of value regardless of small movements in litho intensity

More characteristics make ASML an attractive investment (in my view), but I believe that being able to purchase this quality company with high visibility for sub-30x next year’s earnings is a pretty good deal (more so when we consider where the market is trading). Of course, the above scenario playing out depends on the growth of advanced semiconductors, something that I believe was considered likely even before the advent of AI.

I believe that in the semiconductor industry, many people tend to miss the forest for the trees, likely due to the short-termism prevalent in financial markets. I don’t know what wafer demand will be next year, and I don’t exactly know where litho intensity will fall in five years, but I do believe ASML’s management has enough visibility to provide conservative guidance. I would never take management’s guidance at face value, but it’s definitely easier to believe it when a company complies with certain characteristics that grant it visibility.

Another interesting case is that of Hermès. Even though the company holds arguably the greatest pricing power (together with Ferrari) in what can be considered the luxury industry, it has not historically used this pricing power. Hermes was one of the companies in the luxury industry that raised prices the least during the pandemic period despite being the company that could’ve raised them the most. The reason is that the management team is preserving the pricing power to support the company’s terminal value (their words, not mine). Having this untapped pricing power is definitely preferable to relying on future volume scenarios. The only problem is that Hermes appears to be trading at a level that does not overlook this untapped pricing power.

I feel that investing in these types of companies brings several advantages. First, it reduces the likelihood of permanent capital loss over the long term. In many cases, the risk lies in the valuation multiple, which can create a scenario of paper losses over the short to medium term or the appearance of a quality trap, where an investor has paid too much for a great business. Secondly, it reduces the need to forecast macro and interest rates, which are unpredictable in the first place. If you feel this investment criterion is coherent with the way you invest, you can become a paid subscriber of Best Anchor Stocks. The subscription will give you instant access to…

12 IN-DEPTH REPORTS of high-quality businesses

FOLLOW-UP ARTICLES on many quality companies

Direct access to my PORTFOLIO and TRANSACTIONS

A COMMUNITY of like-minded investors

The subscription will also provide you with ongoing access to all free and paid content. Join hundreds of paid subscribers today!

The industry map was mostly green, with some exceptions (although take into account this probably takes some days from the prior week):

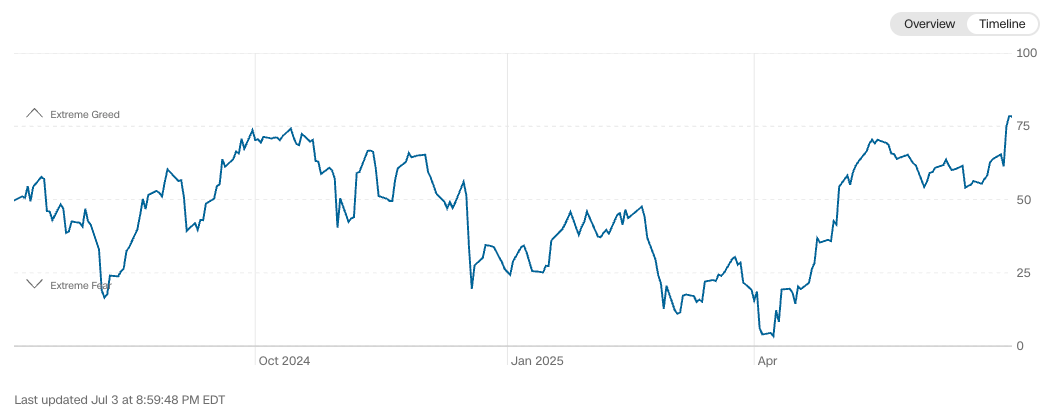

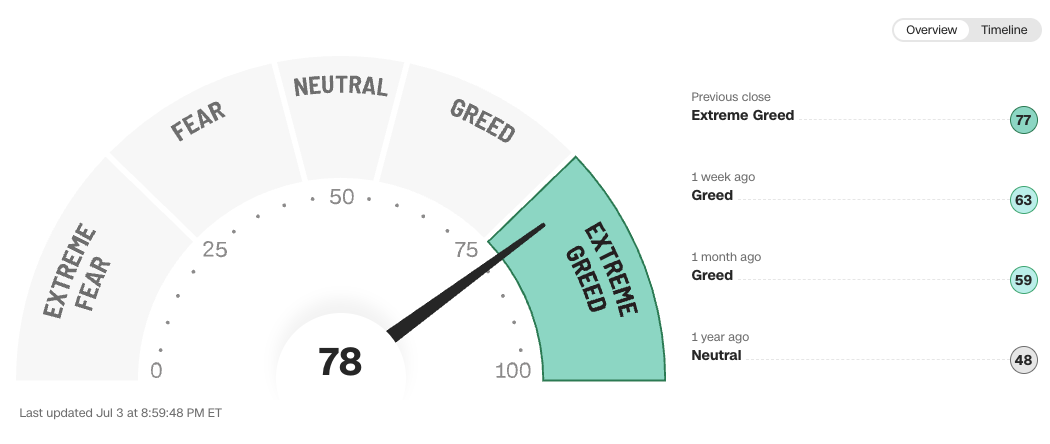

The fear and greed index is now in extreme greed.

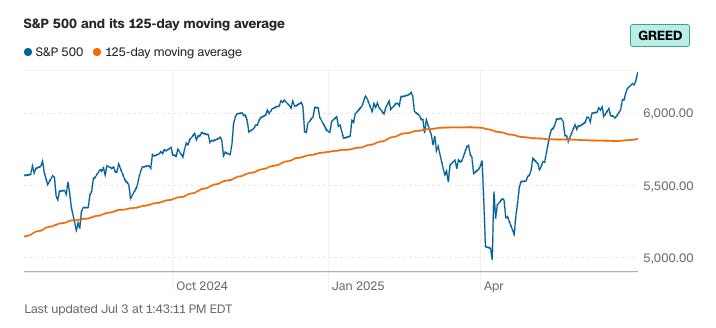

If there’s any indicator that portrays that price drives sentiment, it’s this one. This is the evolution of the S&P 500:

And this is the evolution of the fear and greed index:

Without context, these charts would be nearly indistinguishable.

The rest of the content where I share my additions and the news of the week is reserved to paid subscribers.