Hidden Value in a Liability

Constellation's Q2

(Note that this article was written before the rise in Constellation’s stock today. This means that the valuation numbers might be a bit outdated although it should not change much of the big picture.)

Constellation Software reported solid Q2 earnings on Friday. Q2 earnings surfaced several interesting topics I’d like to discuss in this article. I must say that several things took me by surprise, which demonstrate that the thesis is alive and well. Except for a lack of significant acquisitions, we could say that Constellation is firing on all cylinders. I am going to divide this article into the following sections:

Constellation’s numbers: Organic growth and margin expansion

The development of Altera and what it means for Constellation

Interpreting the IRGA liability: the hidden value

Vertical Market Software in an AI-driven world

Capital deployment

The valuation

Without further ado, let’s start with the first topic.

1. Constellation’s numbers: organic growth and margin expansion

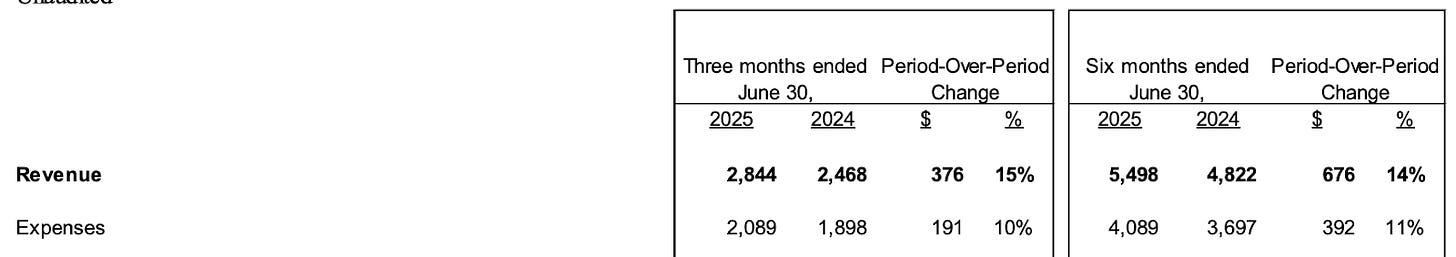

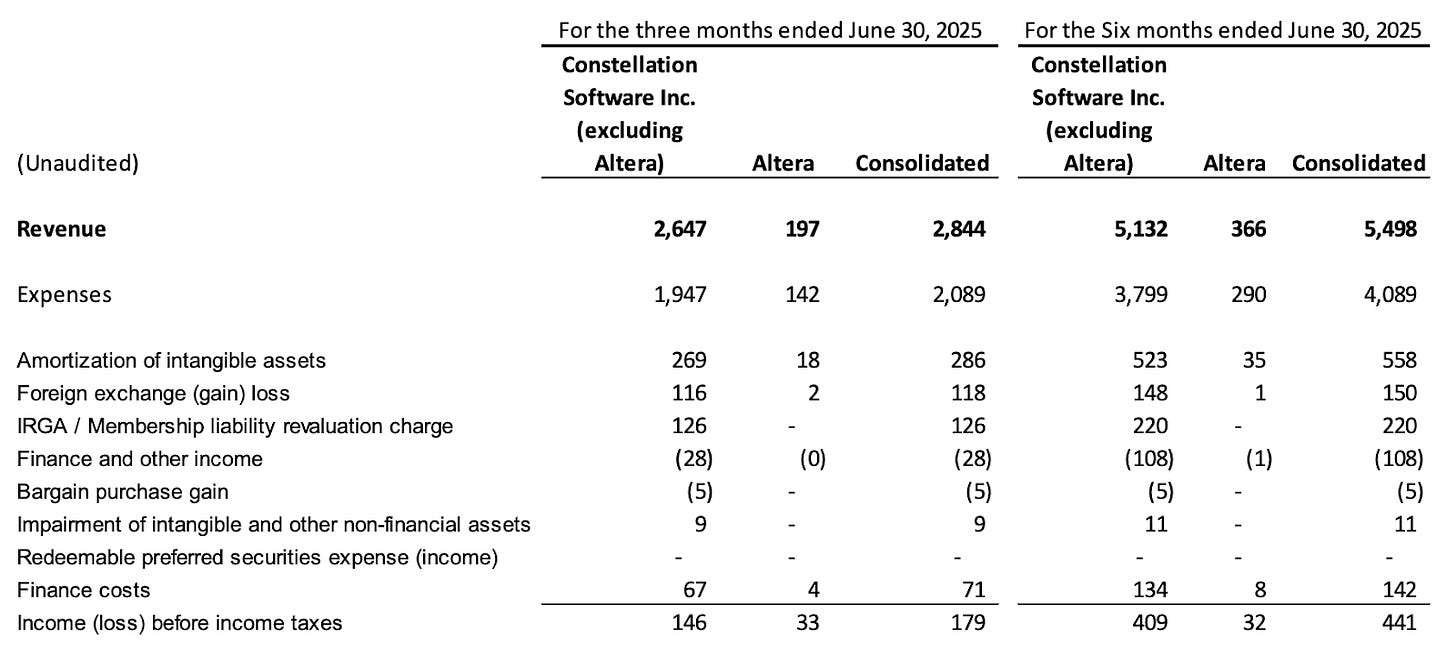

Constellation reported pretty good numbers in Q2, with the highlight probably being organic growth and margin expansion. Let’s start with the latter. Revenue grew 15% in Q2, but Expenses only grew 10%, meaning that Constellation experienced strong operating margin expansion (this was also true for the first six months of the year):

I would typically go over all the numbers in the income statement in more detail, but I will not do this this time because I don’t feel it’s necessary (no red flags), and there are plenty of other topics to discuss. The only number that might stand out in the P&L is the IRGA liability, which rose significantly in Q2 and has risen significantly over the first 6 months. This is a topic I’ll discuss in more detail later because, even though Constellation treats this as a liability, I would consider it a pretty valuable asset.

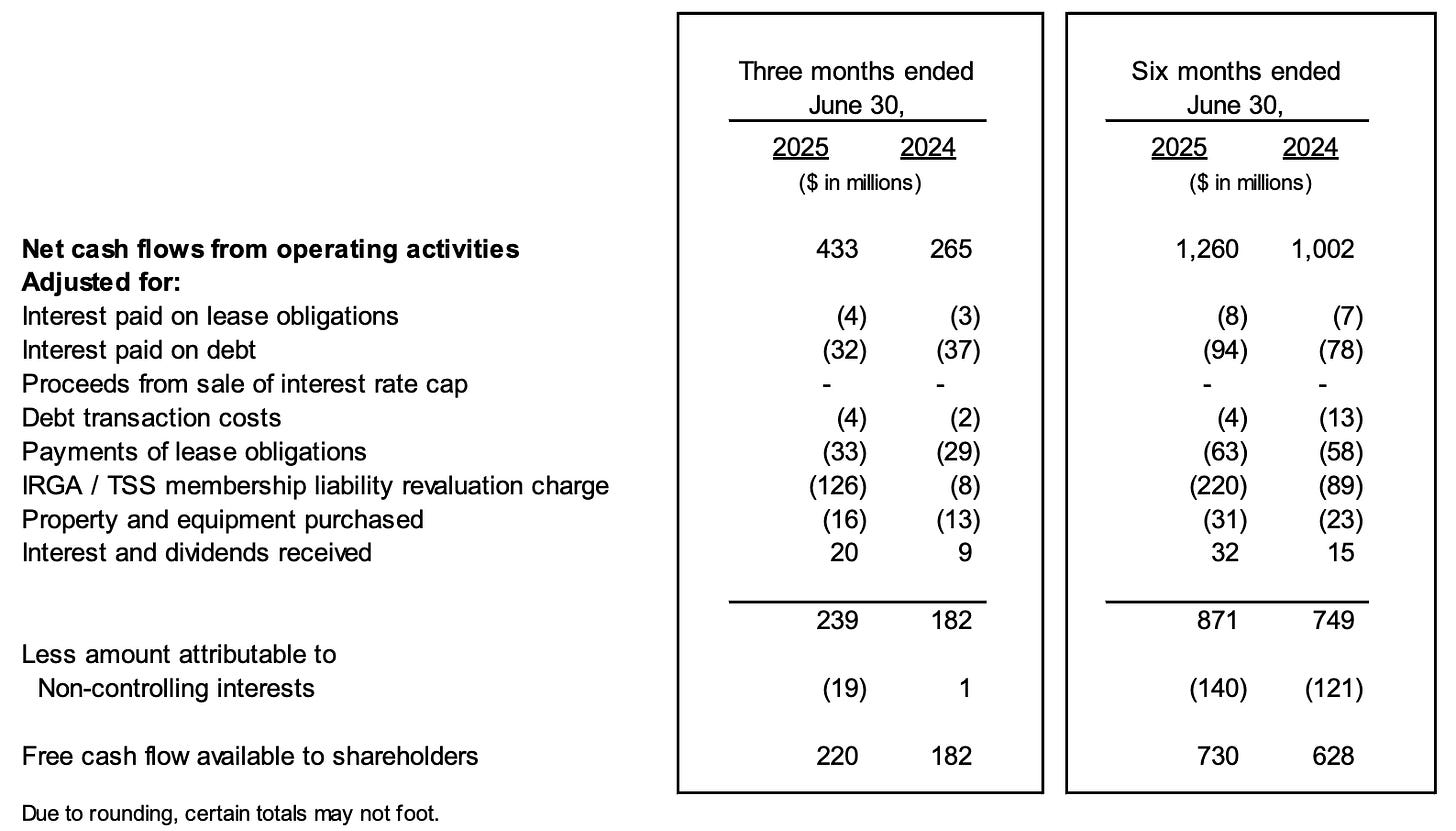

Another thing that stood out was operating cash flow. Operating cash flow grew 63% this quarter, although this seems to be somewhat related to some Q1 payments carrying into Q2 because growth over the first six months was more moderate (+26%). FCFA2S (Free Cash Flow Available to Shareholders) has not risen as much, but this is again related to the IRGA liability, which Constellation deducts from FCFA2S:

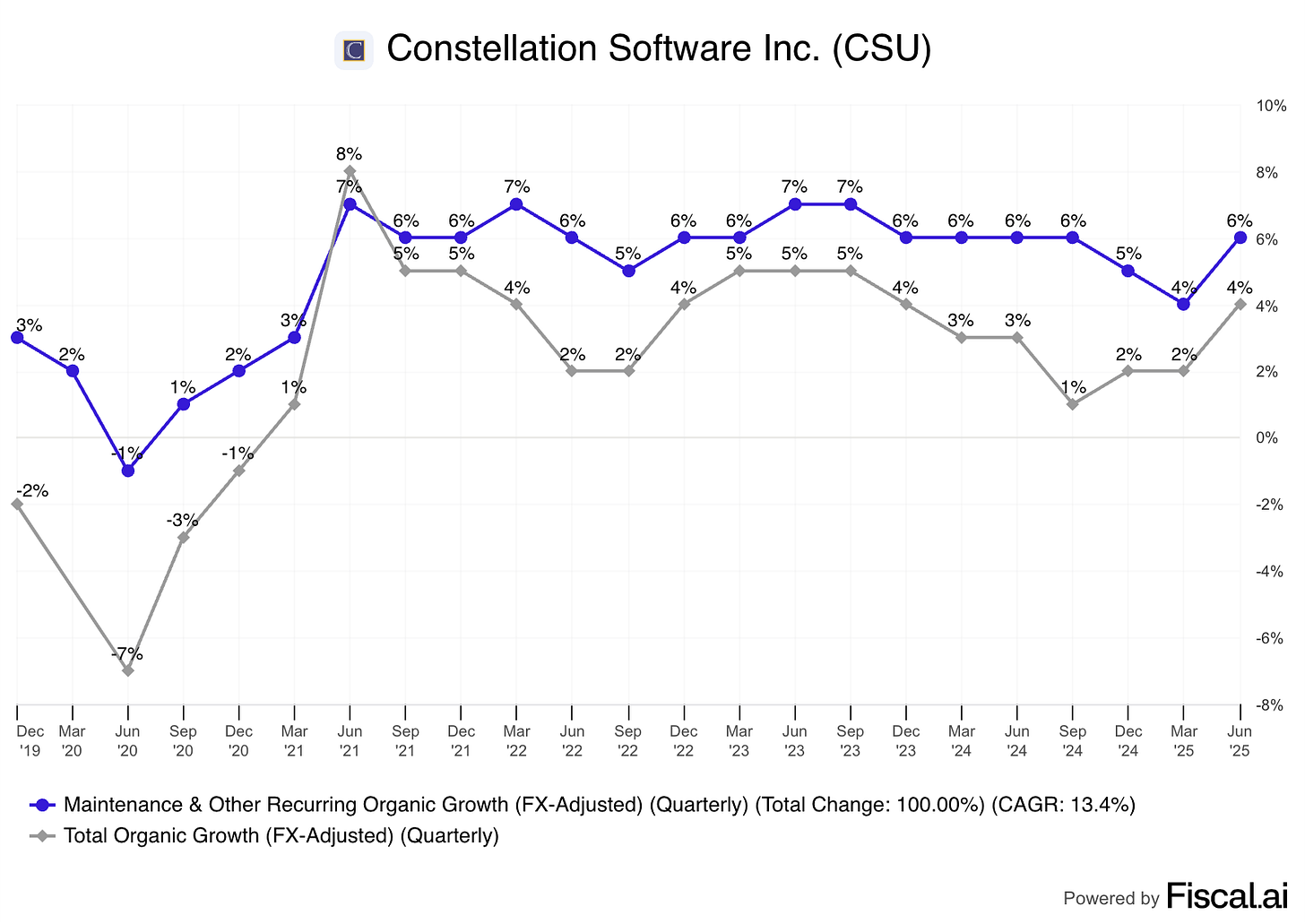

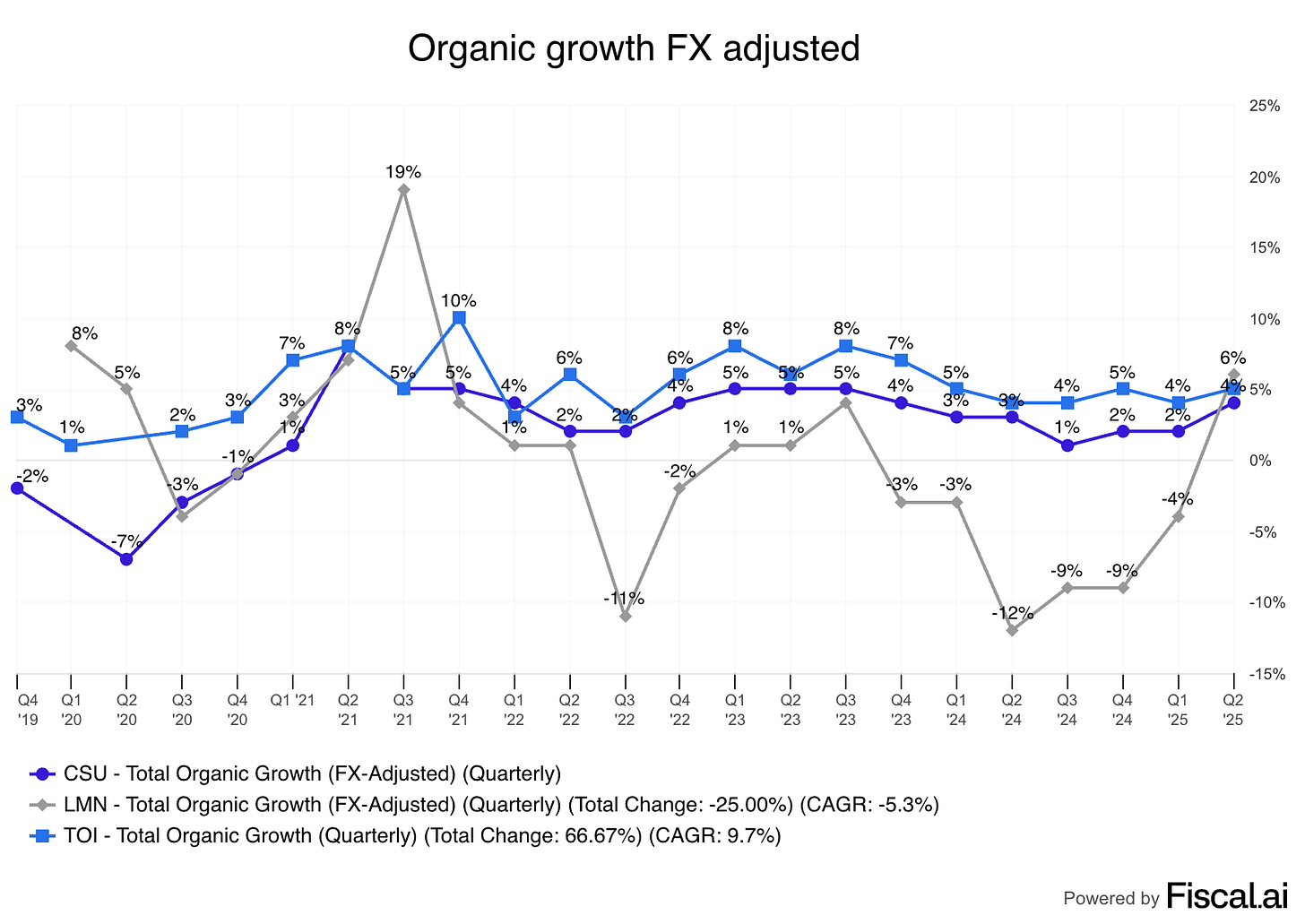

Then we jump right into the other highlight: organic growth. After a few quarters of lackluster organic growth, Constellation’s organic growth (on a neutral FX basis) accelerated, driven by strong maintenance and recurring organic growth:

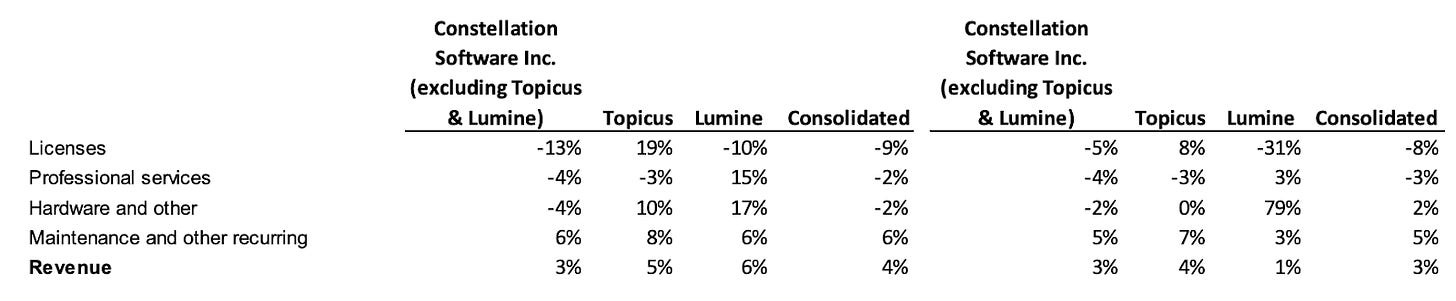

Many investors (myself included) doubted the sustainability of Constellation’s “new” baseline of organic growth after a drop in inflation, but organic growth currently stands at that new baseline, even after inflation cools down. Constellation has several moving parts to its organic revenue growth, namely Topicus, Lumine, and Altera. Topicus and Lumine were both accretive to organic growth this quarter:

While this has been the norm for Topicus, it has not been the norm for Lumine in the past. It was the first quarter since Q3 2021 that Lumine was accretive to organic growth:

I wouldn’t, however, take this as a sign of what’s to come because if the chart above demonstrates anything, it is that Lumine’s organic growth is pretty volatile (probably due to a lower proportion of maintenance and recurring revenue). As for Altera, it still detracted from overall organic growth, but as I will explain later on, there are other things that we have to look at when looking at Altera.

All in all, pretty good headline numbers from Constellation this quarter.

2. The development of Altera and what it means for Constellation

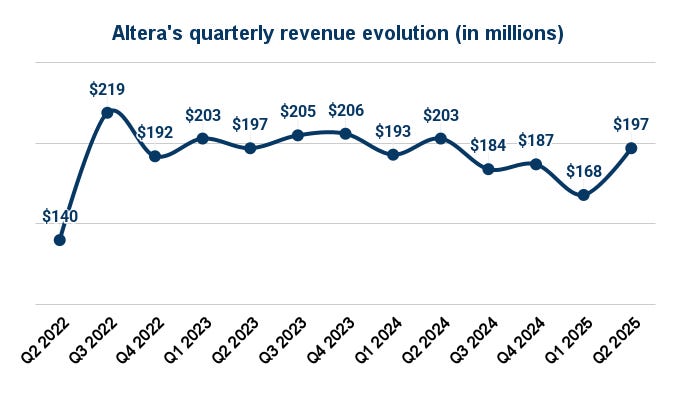

After a poor quarter by Altera in Q1, the business bounced back in Q2. Altera generated $197 million in revenue, growing 17% sequentially despite the company experiencing a 4% sequential drop in expenses:

Constellation was able to acquire Altera on the cheap because it was a declining business. However, the company seems to have been able to stabilize the business:

Now, revenue is not what Constellation focuses on. The company’s focus is on cash flow, and they also seem to have done a pretty good job on this front. Altera generated $30 million in FCFA2S in Q2, which, when added to all the cash flows generated since Constellation acquired the business (almost exactly 3 years ago), results in almost $300 million in cumulative free cash flow. Constellation paid around $725 million for Altera but only put around $360 million in cash to finance the transaction.. This means Constellation has made its cash downpayment back in three years and is left with a business generating around $100 million in Free Cash Flow every year (not bad!).

I believe there’s another interesting implication from Altera’s performance to date: Constellation seems to be doing just fine with large acquisitions. Many people trusted Constellation’s quality as a capital allocator in small and medium acquisitions, but the company was unproven as an operator in the “large” cap space. The reason is that the small companies the company acquired did not require much operating prowess to be profitable from an IRR standpoint, something that theoretically changes as Constellation pays slightly higher multiples for larger acquisitions (due to the process being more competitive). There’s no denying that n=1 in terms of large acquisitions for Constellation, but there’s no denying that the company is off to a good start.

3. The IRGA: liability or asset?

The IRGA liability is a pretty interesting subject to discuss. It consists of two different rights, one held by Constellation and one held by the Joday Group (current owner of 29% of Topicus). As part of the TSS spinout from CSU to acquire Topicus, the Joday Group retained 29% of Topicus Units that are convertible 1:1 to Topicus ordinary shares. The IRGA establishes two things. Either…

CSU has the option to purchase these shares from the Joday Group

The Joday Group has the option to sell these shares to Constellation

Regardless of which of the two you believe is more likely, the outcome is that Constellation acquires an additional 29% of Topicus. Neither has exercised their options yet, but as Constellation deems this a potential capital outflow that is not fully under their control, it reports it as a liability (the IRGA liability). Now, when we take a look at it closely, it seems more of an asset than a liability.

The IRGA determines the price that Constellation would have to pay for Joday’s stake based on the evolution of ARR and recurring revenue in Topicus. The price per share is not disclosed, but Constellation does share that the outstanding amount currently in the IRGA liability is $1.01 billion. This means that, if CSU or Joday were to exercise their option today, CSU would have to pay $1.01 billion (US dollars) to Joday in exchange for 29% of Topicus. Now, the reason I claim this is an asset is because Topicus is currently worth CAD 15 billion (or around USD 11 billion). This means that for the price of $1 billion, Constellation would be receiving around $3 billion worth of Topicus shares. This doesn’t strike me as a liability, although I do understand why it would be treated as such: it can result in a capital outflow and Constellation does not have complete control of the outcome.

Another thing we should take into account here is that Constellation’s FCFA2S is currently understated. Constellation deducts from FCFA2S any increase of the IRGA liability, even though it’s not a real capital outflow. It can result in a capital outflow in the future, but if that happens, Constellation would own 29% more of Topicus’ cash flow going forward (meaning there would be a decrease in the non-controlling interest). This means that, should any of the parties exercise the IRGA liability, the outcome for Constellation would be (at current prices)...

A $1 billion cash outflow

A $3 billion increase in the value of its Topicus stake

An increase in the FCFA2S of 29%*Topicus’ cash at the time

All in all, a nice liability to have! Note that if you are valuing Constellation on an FCFA2S basis, the outcome of your valuation is probably misleading.

4. Vertical Market Software in an AI-driven world

Something that was not explicitly discussed this quarter, (Constellation doesn’t host earnings calls) but that’s something that’s on top of many people’s minds, is AI. The key question here is: Is AI a tailwind or a headwind for Constellation’s business? If you’ve read my most recent NOTW, you’ll know where I am going. AI “promises” to lower software development costs to $0, so many are wondering if software customers will develop their proprietary software to cut off the software vendors. This is what I wrote in that NOTW:

Software “bears/skeptics” believe that in a utopian world, every business will write their own software and will not rely on software vendors. This seems somewhat of a stretch for several reasons. First, it’s not the core operation of these businesses. Secondly, it seems like enterprises would be taking a huge risk for a pretty small payoff (software doesn’t typically make a huge portion of Opex for many businesses). The judge is still out there as to what will happen with software in an AI-driven world, but I’d say it’s probably more complex than just saying that everyone will develop their own proprietary software because AI lowers development costs.

I wrote this in the context of enterprise software, but I believe it’s even more applicable to VMS. Imagine you own a golf club that pays $1,000 per month for the software that runs your business. That $1,000 makes up around 3% of your Opex. Are you going to develop your proprietary software to save 3% of Opex while risking uptime? I would say that it’s even more difficult to imagine this in the VMS space because software is even less of a priority for many of these businesses. Now, Constellation can definitely take advantage of AI to add value to customers and charge more for it, so I would consider AI more of a tailwind than a headwind today.

5. Capital deployment

We had more great news besides accelerating organic growth. It was a pretty good quarter in terms of capital deployment. Constellation deployed $469 million into acquisitions during the quarter (including deferred payments). If we calculate YTD acquisitions by adding capital deployed in Q1 and Q2 (excluding deferred payments) with the capital that has been deployed thus far in Q3, we get to $794 million in capital deployed into acquisitions YTD. This is unlikely to include the purchase of Asseco (still pending regulatory approval), which would add around $280 million to this amount and would put capital deployed close to the $1 billion mark.

It’s not Constellation’s highest year in terms of capital deployment, but $1 billion in capital deployed without significant large acquisitions (which are lumpier) is definitely a good number. To be honest, I must say that the quarter took me by surprise in a positive way and reinforced the idea that one has to let good operators run their businesses without obsessing over quarterly numbers.

6. The valuation

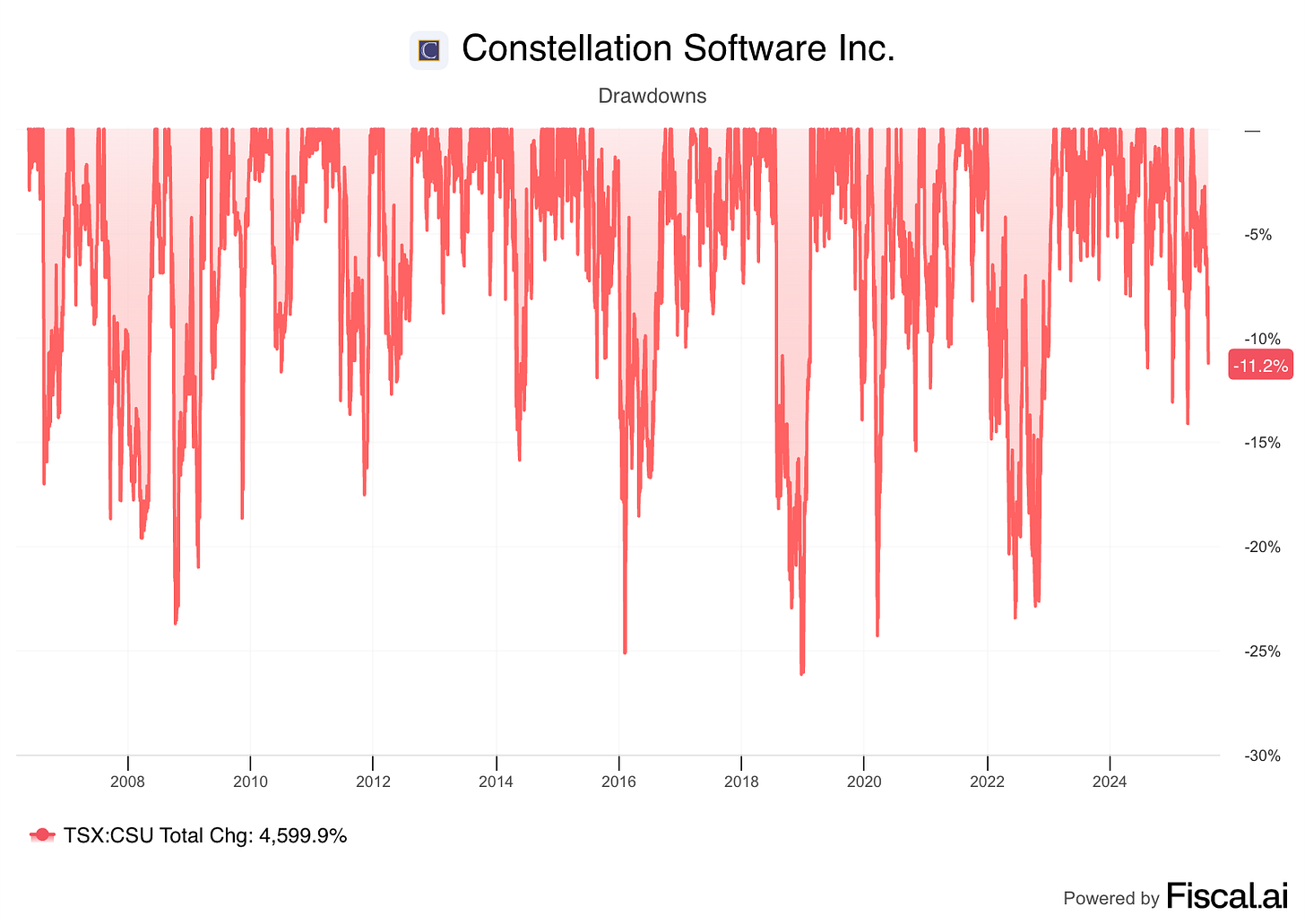

Constellation is currently around 10% off its highs, which is not a place where the stock typically lies. Throughout its history, Constellation’s stock has not been 30% off all-time highs once!

In the meantime, the stock has compounded at a 35% CAGR over 30 years. This is as relaxed as compounding can get! Now, even though the past signals something about the future, what we should ask ourselves here is whether Constellation remains a good investment at current prices.