Another WOW! for Medpace

Q3 earnings update

This was the second earnings release I’ve owned Medpace for, and the company again reported outstanding earnings. The stock initially jumped 20% in after-hours trading but ended normalizing after the call:

This normalization might be related to management’s commentary around 2026. I’ll go over their comments and a stat that I believe is key and was ignored, but let’s start with the numbers.

Medpace grew Q3 revenue 24% to $660 million (a 3% beat). Medpace has delivered three consecutive and sizable beats this year: +6% in Q1, +12% in Q2, and +3% in Q3. The best thing about how Medpace has managed expectations this year is that management took advantage of the market’s skepticism after the first beat to repurchase 10% of the outstanding shares before delivering the following two beats (with Q2 being the real surprise).

Medpace didn’t disappoint either on the EPS front. The company delivered $3.86 in earnings per share in Q3, for a 10% beat. I prefer to focus on EBITDA for Medpace (D&A are relatively minor and non cash expenses). EBITDA grew 25% to $148.4 million, resulting in an EBITDA margin of 22.5%. If you’ve read my in-depth report, you’ll know that I was a bit of a skeptic regarding further margin expansion for a very simple reason: productivity (i.e., revenue per employee) is already at all time highs and significantly above that of its peers. Management did attribute the higher profitability to a higher portion of pass-through costs in Q3, but also claimed that they expect to continue improving productivity next year (this was surprising). Worth noting that AI can be a significant productivity boost going forward.

Medpace also shares four other non-GAAP metrics to help investors gauge how the business is doing:

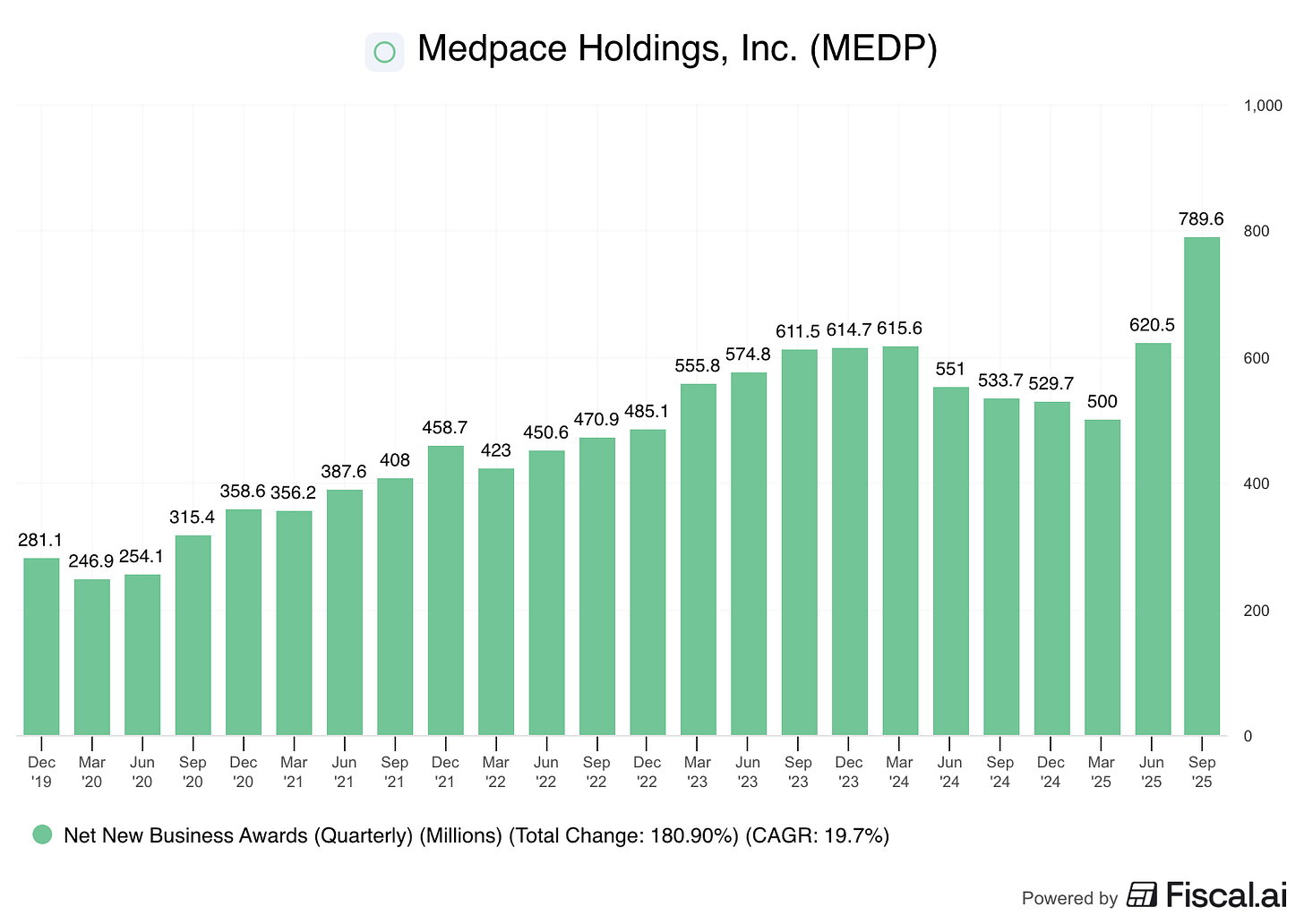

Net new business awards,

Backlog

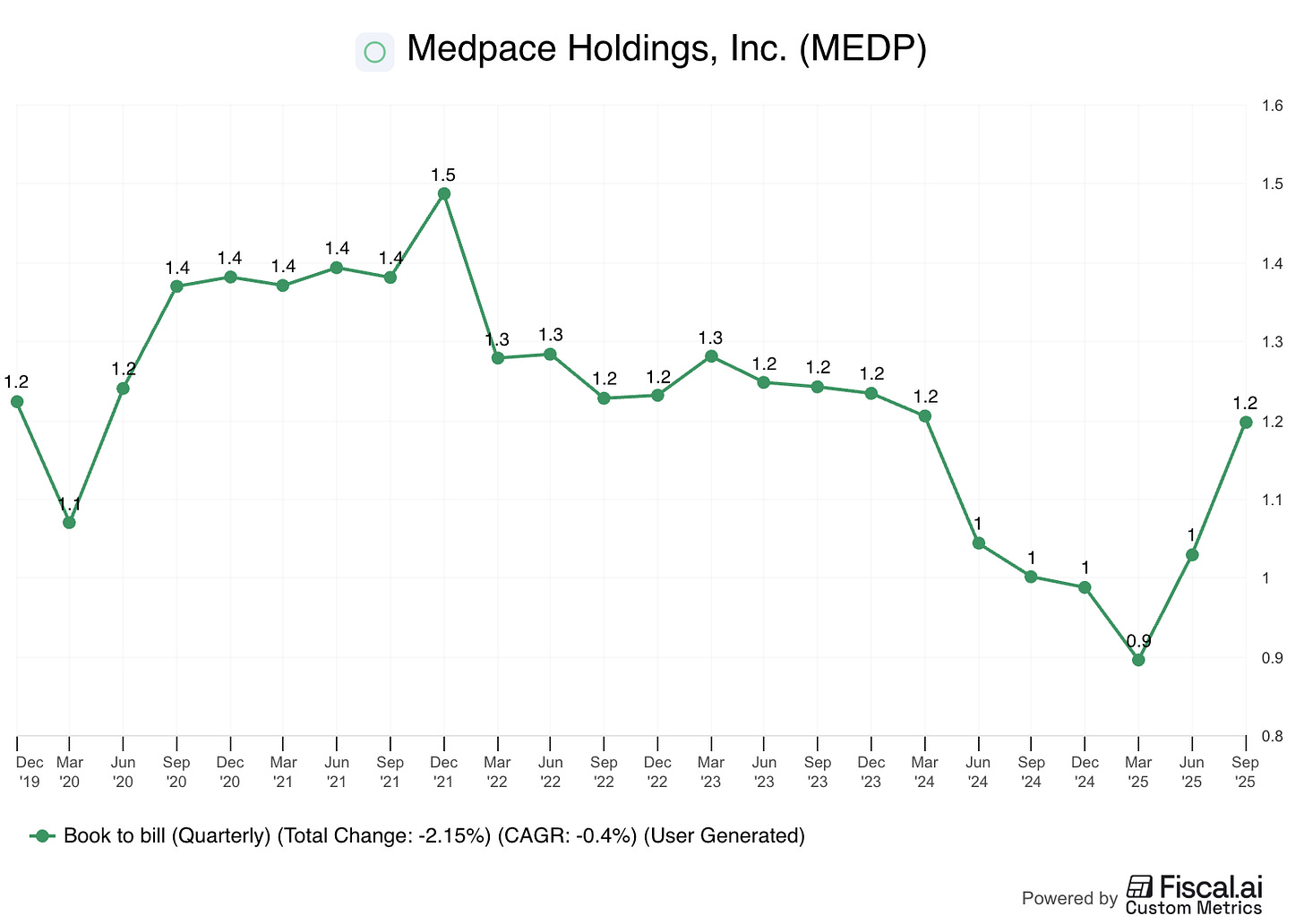

Book-to-bill ratio

Pre-backlog (more context on this last one in a bit).

Net new business awards grew a whopping 48% to $789 million. This metric shows the business that was contractually awarded, net of cancellations:

With net new business awards and revenue, we can calculate the book to bill, which came in at 1.2, the highest it has been in a while:

Backlog is an interesting metric and source of controversy and/or misinterpretations. One would’ve thought that the difference between net new business awards and revenue should go to backlog, but this is NOT the case. The bottom line is that business can appear in net new business awards while completely bypassing the backlog figure. This would go into what management calls the “pre-backlog”:

Initial award notifications were strong, and our total dollar value of awarded work not yet recognized in the backlog was up approximately 30% in Q3 on a year-over-year basis.

Management explained that they need to be very sure that an award will convert to revenue relatively soon to include it in the “official” backlog figure:

There has been some concern that, you know, our burn rate has gone up quite a bit. You know, our backlog hasn’t grown much this year. So, you know, it’s low single digit. You know, a couple percent up over the past year. But I wanted to let people know that, you know, that the overall pipeline of awarded studies I mean, I’m not just talking about the pipeline of opportunities, awarded studies.

We’ve got a fixed scope of work. We’ve negotiated the price on it. They’ve, you know, you know, given us a written award for that. And it just hasn’t gotten to the first patient in yet. So we may be working on it. Etc.. And it just hasn’t gotten to you know, the first patient enrolled. And that’s in our, you know, this bucket pre backlog. And that is up 30%. And you know this pre-book this pre backlog bucket of awarded you know firm award work is larger than our backlog itself. And is up 30% over the year. So I think that puts us in a good position for refilling our backlog over the next year. And not having you know what a number of people have described as, you know, some sort of air gap in, in, you know, our revenue growth and, you know, things will stall. And we run out of backlog kind of, you know, so we really are. Improving our, our, our opportunities for backlog conversion in 26 and revenue generation.

This has bigger implications than it might seem. The official backlog metric that Medpace shares is around $3 billion, growing 3%. However, when considering this pre-backlog in our calculations (management shared it was larger than backlog but lower than $4 billion and growing at a 30% clip), it ultimately means that Medpace has a “real” backlog of somewhere between $6 billion and $7 billion and that it’s growing somewhere around mid-teens. This changes the story quite a bit because, as August claims above, this completely discredits the bear case that Medpace will soon lose steam due to slow backlog growth. Note that we are talking about clinical trials here and therefore we can expect this “real” backlog figure to convert over many years, not over the short to medium term.

There are two other common “bear” cases for Medpace. One is that, with large CROs wanting to play in the SMID biotech space (i.e., Medpace’s bread and butter), competition is about to get intense. Management mentioned that the win rate inched up this quarter despite the higher competition, but that it’s fair to assume that something has to give if more companies are coming into the RFPs (Request for Proposal):

Yeah, they’ve always been there. I don’t know about the additional effort or tension there. Certainly there’s a lot of talk about it, but we see the same players and it is the large, large providers that were often competing against, you know, you know, win rate has, has has been okay. You know I mentioned last quarter it was actually down a little bit. Awards were actually good because the total decisions were, you know elevated . Our win rate did come back up this quarter. And you know, some fewer number of decisions. But again, you know, good awards. We don’t see a trend towards. You know, greater competition causing our win rate to deteriorate.

There has been some movement over the last year or so to bring more providers to the opportunity. So instead of, you know, what you often see was three. You know, maybe four CROs now it’s often six. Or even more. And so that obviously reduces the win rate a little bit for everybody. But you know, I think you correct for those situations and I think our competitive position is is very strong.

Pricing is also typically cited along this bear case: more competition means lower pricing. Medpace isolated the impact of lower pricing to large pharma because they have more leverage, but claimed that they’ve not seen a change in pricing dynamics. Another bear case that Medpace typically gets is that they “lose Phase III work to larger CROs.” Management gave fewer details here but claimed that they also do Phase III work:

But, you know, usually we can. Guess from phase 2 to 3. But you know, there’s is. There’s a lot of times that, products in our clientele are sold or, you know. Move, move to someone else. And, and sometimes we also just don’t, don’t win the phase three. We’re considered not strong enough in a particular market or something. So I don’t know that that’s changed at all.

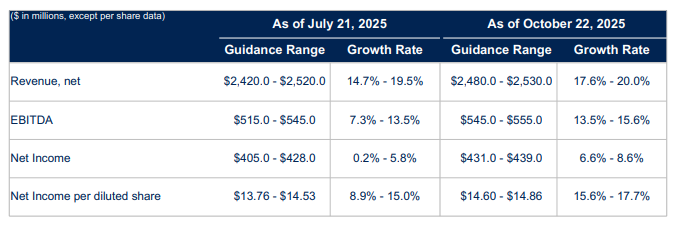

All of the above already screams great earnings, but management decided to top it off by raising guidance:

The midpoint of the new guidance implies that Medpace generates revenue of $678 million in Q4, or an acceleration to 26% growth. Coming into the year, Medpace expected to grow mid-single-digits, and the midpoint of the forecast is now for 19% growth (incredible).

The 2026 “preliminary” guidance

August Troendle began the call with a bomb: giving some initial thoughts on 2026. The founder and CEO said that they expect…

Revenue to grow in the low double digits (from the 2025 guidance baseline)

EBITDA to grow high single digits or more

We shouldn’t forget that Medpace’s management tends to be pretty conservative and that, therefore, these estimates might be bumped up in Q4 or maybe during the year (who knows). Management helped further contextualize the 2026 preliminary numbers:

Margins are expected to contract because pass through costs are expected to be lower next year (they expect pass through costs to “peak” in Q4 and normalize in 2026). However, they did mention that they plan on improving productivity further.

They also mentioned that cancellations are the wild card for 2026, but for the rest they have visibility thanks to their backlog. They are assuming that cancellations can be higher than they were in Q3/Q4 but that they don’t jump to Q1/Q2 levels

From what I see, market expectations called for 16.8% growth in 2025 (will most likely be higher), and 8.2% in 2026 (high probability that it’s higher). This means that, despite the expectations of decelerating growth, Medpace was still ahead of analyst estimates.

What to do after the run?

Valuation is always a relevant topic, but I would say that getting worried over the valuation after a stock has almost doubled in 5 months is a great problem to have! Now, even though Medpace’s stock is up significantly in just a couple of months we must not forget that growth expectations are also up considerably. Coming into the year, estimates called for mid-single-digit growth, but that’s now closer to 20%. By the looks of it, it also looks like Medpace is ahead of 2026 expectations. So, the question here is:

Is Medpace expensive after the run?