Earnings Volatility, ASML Insiders Buying, and the Company I Added to this Week (NOTW#59)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Indices were up significantly again this week in the face of several macro news. It does seem we’ve reached a point where not much can derail the performance of the indices (always a worrying sign!). There was plenty of company-specific news this week, and I also added to one of my positions, taking advantage of the recent weakness.

Without further ado, let’s get on with it.

Articles of the week

I published one article this week: Copart’s earnings digest.

A contrarian take?

In last quarter’s earnings digest, I mentioned that Copart had done something unusual. First, it reported a relatively poor quarter in which some share losses became palpable as IAA improves operatio…

The company reported apparently good earnings, but I decided to give them a spin and discuss what I found worrying. Quite a bit of negativity is starting to be baked into the price (some lawsuits related to Copart’s HR practices), but I don’t think the valuation is where I would feel comfortable adding yet (I discuss why in the article).

Market Overview

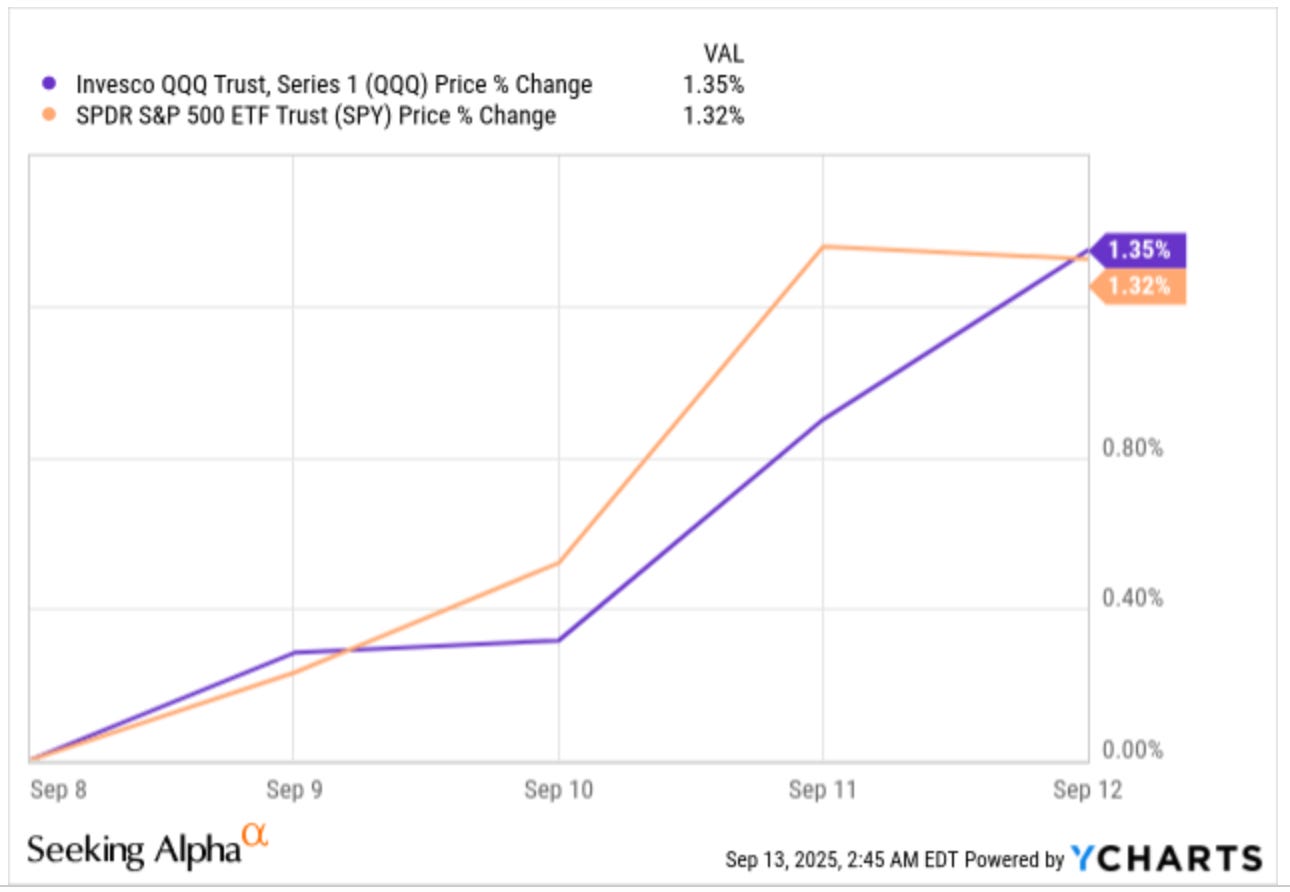

Both indices inched up this week again and were up more than 1%:

There have been a lot of discussions about the AI “bubble”, geopolitical events, and macro over the past few months (noise is always a constant in financial markets), but indices are close to ATHs despite all of it. There’s a lesson in here somewhere, but we should never forget that drawdowns are normal and an investor will most likely experience a few of these during their investing lifetime. Just for context, since 2020, the S&P 500 has suffered two +20% drawdowns and one +10% drawdown. That’s 3 significant drawdowns in less than 6 years. These drawdowns have had one thing in common: everyone thought that the world was ending and that markets would drop for much longer. These people were wrong, albeit they’ll be right sometime statistically.

One thing that I’ve noticed is how much volatility there is around earnings. I know that volatility is not new in financial markets, but we're reaching extremes. Let’s take a look at two examples. Oracle reported earnings this week, and while the numbers of the quarter were not spectacular, the company surprised the market with more than 300% growth in RPOs (Remaining Performance Obligations) and shared the following incredible stat:

“We expect Oracle Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year—and then increase to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years.”

The stock rose around 40% the following day (this was a $700B business, FYI), and yet some people still believe that markets are efficient. Note that it’s commonly believed that it’s “impossible” to have an edge in the short term because companies are “widely” covered by professional analysts. Still, somehow, analysts fell $300 billion short in their RPO estimates. I don’t blame them as things like these are unforecastable and will always be, which is why an investment thesis should not be based on the timing of the business but on the underlying business per se.

I won’t comment on the earnings per se because I don’t follow Oracle closely, but I will say that it’s a tad worrying when companies start to pop on future business. Note that a day later, OpenAI and Oracle announced a $300 billion deal for Cloud infrastructure. This might seem great on the surface (and it might end up being great), but we should not forget that RPOs are realized many years down the road and that OpenAI currently generates around $12 billion in revenue and might not even be alive when they have to merit this agreement. Only time will tell what will happen with AI and all these RPOs.

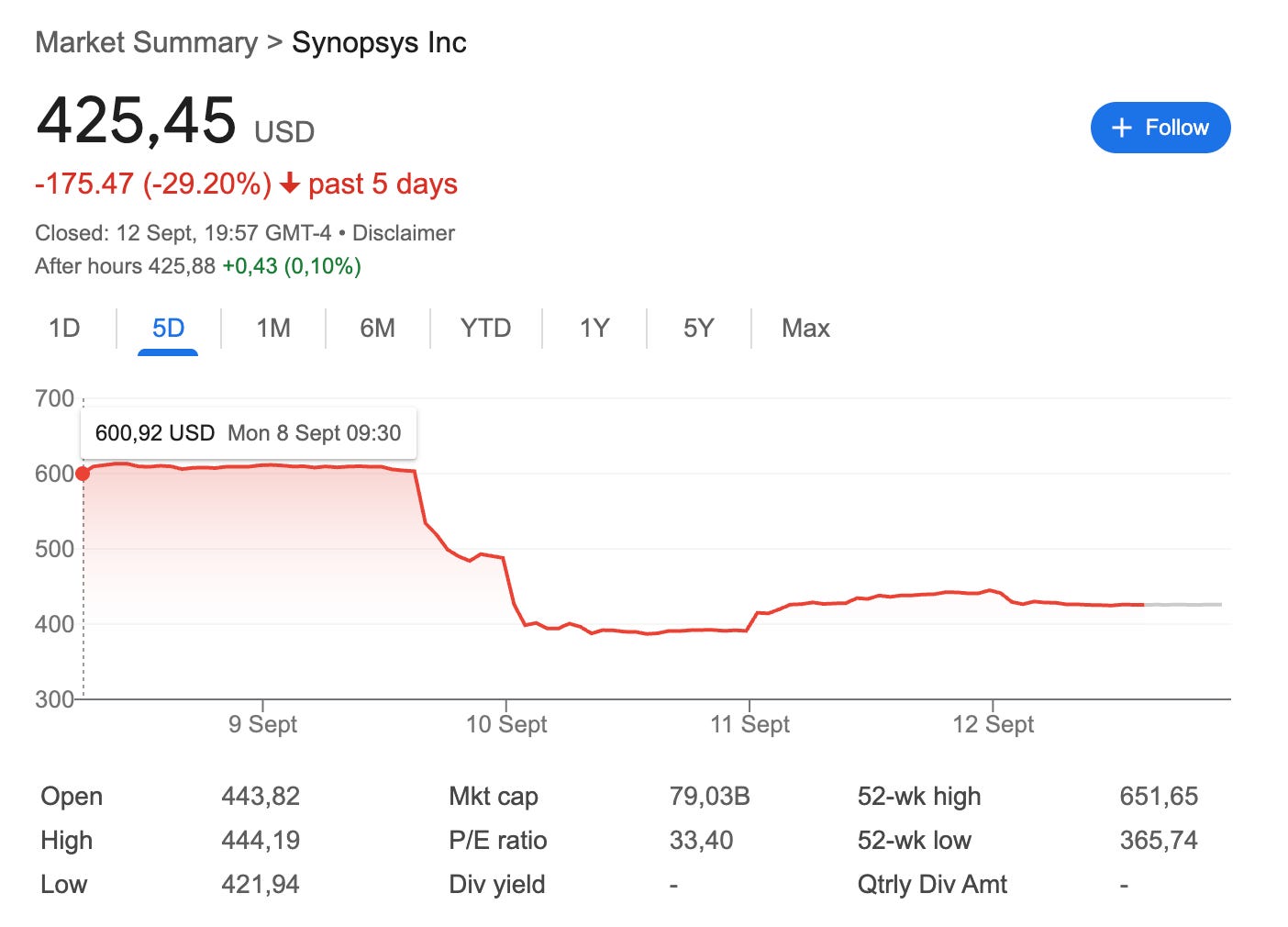

On the flipside, we had Synopsis. For those who don’t know, Synopsis is an EDA (Electronic Design Automation) player in the semiconductor industry. It’s a key tool for chip design and only has one credible competitor: Cadence. The company apparently reported poor quarterly earnings (from what I have read, the problem was more related to terrible expectations management than to poor earnings per se), and the stock dropped more than 30% in a day:

I don’t know if the drop is warranted or not because I don’t follow Synopsis closely, but I was nevertheless surprised by the magnitude of the drop. Has something changed so much that a company's value can fluctuate by 30% or more in a single day? There might be exceptions, but we might be going a tad far! It’s interesting because I believe people would be surprised if they calculated the differential between the highs and lows of the companies in their portfolios in any given year. Take, for example, ASML. The difference between its 52-week high and 52-week low is more than 50%. For the investor who knows what they are willing to pay for the company, this differential seems like a gift from God!

The industry map was mixed this week:

Source: Finviz

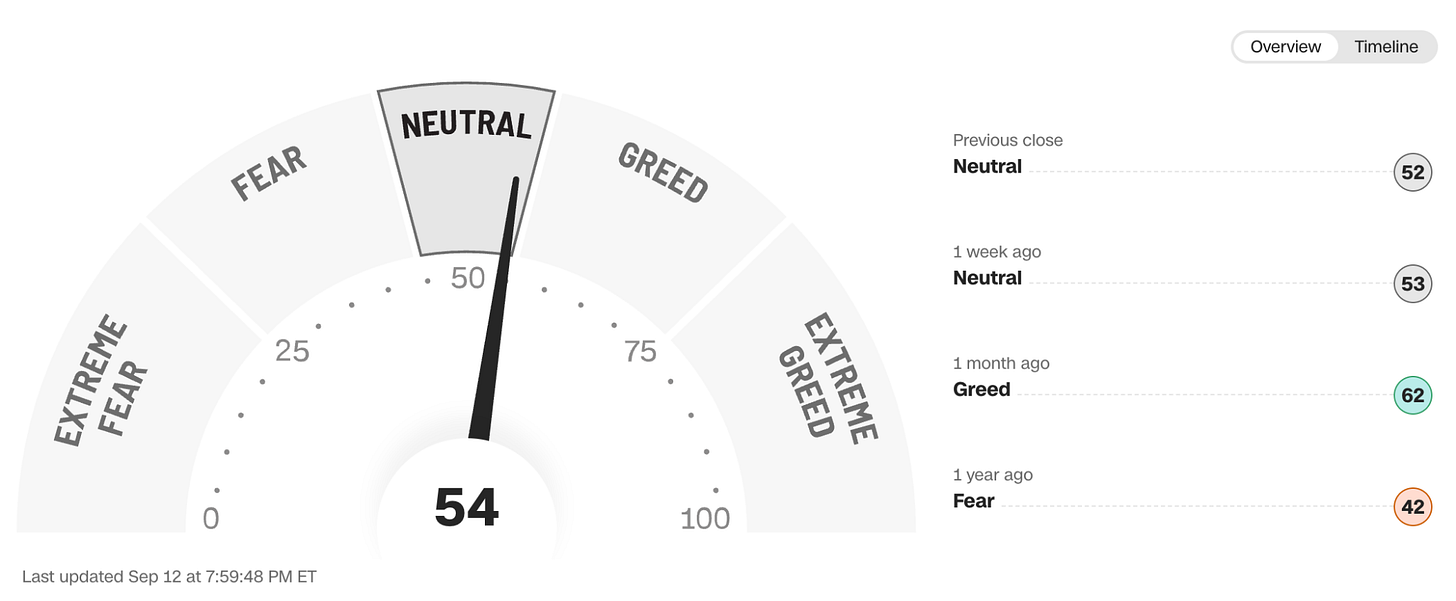

The fear and greed index remained in neutral territory:

Source: CNN