A contrarian take?

Copart's Q4 and FY 2025

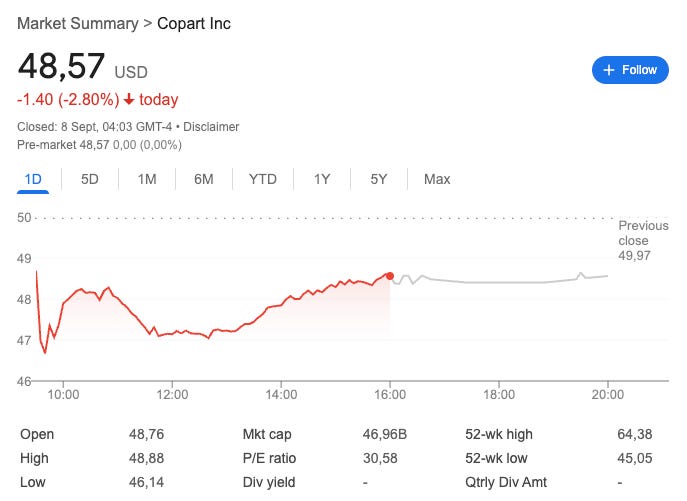

In last quarter’s earnings digest, I mentioned that Copart had done something unusual. First, it reported a relatively poor quarter in which some share losses became palpable as IAA improves operations under RB Global (previously Ritchie Bros). Secondly, the stock dropped more than 10% in a single day, marking the most significant one-day drop for Copart over the last decade (excluding the pandemic). The stock continued falling for a while after reporting Q3 earnings until reaching $45 (down almost 30% from all-time highs). The stock had recovered somewhat from that level coming into earnings, but declined modestly after reporting Q4 and FY 2025 earnings last week:

Similar dynamics were at play in Q4: Copart’s insurance volumes continued to soften (for several reasons), although management seemed to do a better job with their messaging this time around and were quick to point out some green shoots.

Copart’s earnings

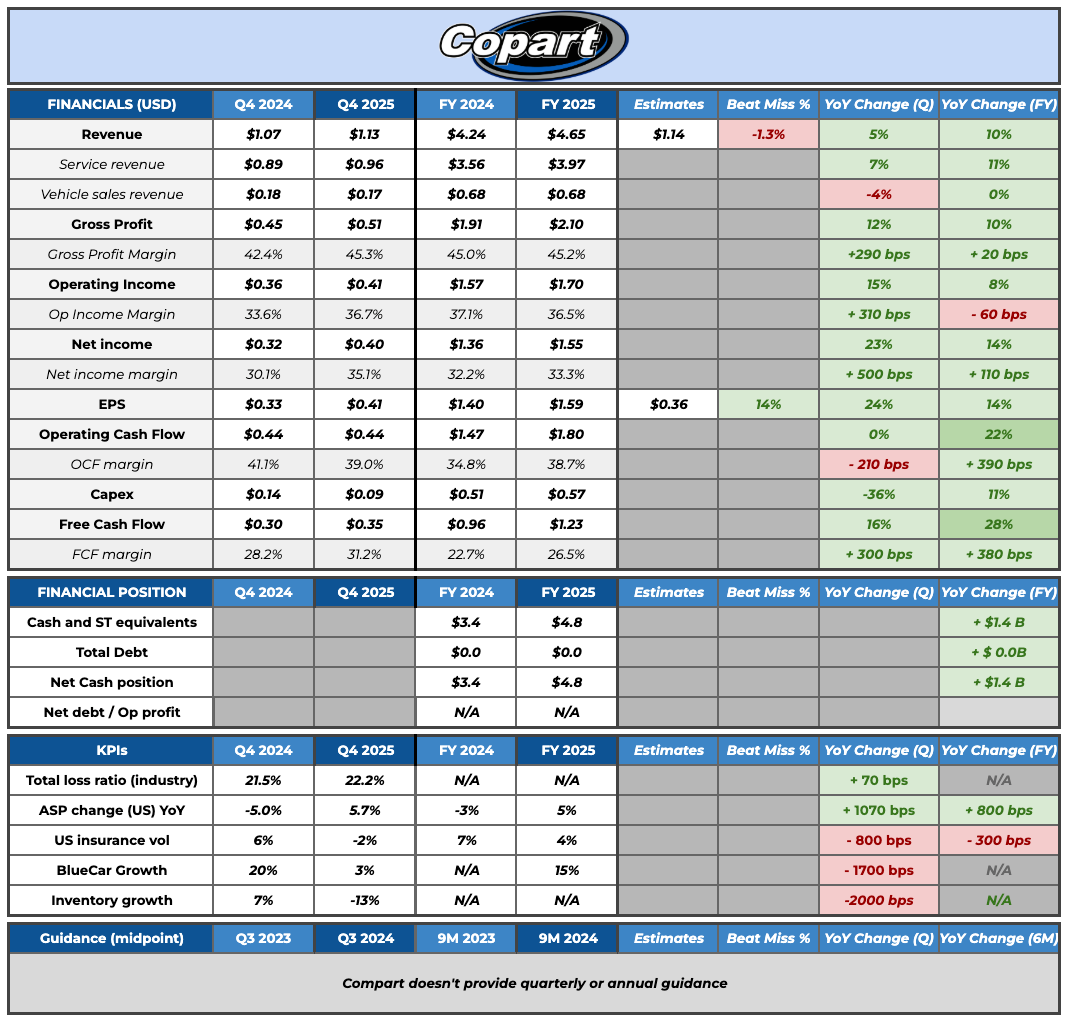

Here’s the summary table for Copart:

Before discussing the negative aspects of this earnings release, I wanted to highlight the green shoots. The main green shoots this quarter could be encapsulated in profitability and cash generation; Copart’s margins expanded considerably in Q4. This margin expansion was aided by the international segment, which saw its margins expand from 24.4% to 34.9% (a whopping 1,050 bps expansion). International gross profit margin is still far from Copart’s US gross margin of 47%, but the gap is definitely narrowing. Several factors contributed to the good margin performance of the international segment.

First, Copart continued to transition its purchase business into the consignment model in Germany, which is better for both margins and the company’s risk profile (as they don’t take ownership of the vehicles). Secondly, the UK purchase business was strong this quarter. And thirdly, but no less critical in Copart’s international scaling journey, per unit facility costs decreased 1.4% in the international segment. Margins are improving as Copart’s international business matures, and Copart should enjoy strong margin tailwinds if these converge to those of the US.

Copart also generated significantly more operating cash flow and spent less on CapEx this year. This resulted in significant cash generation throughout the year, raising the company’s cash position by $1.4 billion to a whopping $4.8 billion. The reason behind the increase in operating cash flow seems to be purely related to the higher net income (which was aided by more cash invested in interest-bearing instruments), although management also pointed out that faster inventory turnover might be a strong tailwind for cash conversion in the coming years:

You heard Leah describe that phenomenon when it comes to inventory. One of the reasons that inventory contracts is that our Title Express offering, for which we are providing the service of procuring the original titles on behalf of our insurance clients and doing so for more and more clients with each passing quarter. That is we're yielding better cycle times there in part because when we do the work it's enabled by our tech stack, our LLM deployments in ways that are more efficient than the insurance carriers before they transfer that responsibility over to us.

With cash already making up more than 10% of the company’s market cap, some investors are starting to grow anxious about the uses of said cash. Management provided their capital allocation framework, which, when connected to other data points, might signal that they don’t view the stock as being particularly cheap yet (at least not at the level that they would be willing to repurchase shares). Let me explain why I make such a claim.

Management argued that insurance assignments were down low single digits in the US and down 1% in international geographies. Right after saying this, Jeff Liaw pointed out the following:

Over the past several years, we have observed that trends in assignment volumes have proven to be a more accurate predictor of future unit sales than static inventory levels.

This makes sense considering that Copart takes a while to sell insurance cars, meaning that lower assignments should, over time, result in lower sales growth (albeit not directly). Management also claimed that the primary use of the excess cash over time would be buybacks, which, together with the fact that they did not repurchase shares in Q4 after being 30% off ATHs, might signal one of two things…

Management expects to be facing some trouble ahead in insurance volumes due to assignment declines

Management believes the stock is not sufficiently cheap

Granted, Copart rarely purchases shares, and they do so at IRRs that may be well above many investors’ hurdle rates, but there’s no denying that when one connects the dots, something really doesn’t add up.

Assignments might be a leading indicator of future sales, but volumes in the US are already starting to decelerate significantly. US insurance volume was down 2.1% in Q4, which management attributed to several things. First, the rise in the uninsured population. This is something management has discussed before: as auto insurance premiums rise, some people are opting for no insurance or a reduced level of coverage, translating into lower insurance volumes. They view this as a cyclical phenomenon and argued that we should start to see more competition in the auto insurance industry with rates already high and the industry largely stabilized. This has two positive implications for Copart. First, a more competitive environment could potentially flip the switch in terms of insured motorists who might be driven back to the industry if rates contract/stabilize.

Secondly, it could put some pressure on Progressive, which is currently a share gainer in the industry and skews to IAA. One of the reasons Copart might have been losing share to IAA (besides the fact that IAA is better managed under RB Global) might be that Progressive is growing faster. Management cautioned against focusing solely on market share, claiming this metric is a byproduct of providing the best returns in the industry. Copart’s management measures returns through ASP increases, which can be attributed to one of two reasons, or likely both.

Cars are getting totaled in a better condition (this is a tailwind for the industry at large, not just Copart). The total loss ratio continues to creep up, and management mentioned that calibrations are occurring more frequently at repair shops due to rising vehicle complexity

Copart is managing to achieve higher ASPs due to better liquidity at auction, which drives better returns for insurers

Regardless of whether it's #1 or #2, it does seem that Copart is achieving higher ASPs than the industry at large (for context, IAA’s ASPs grew 1% in the most recent quarter):

We experienced ASP growth globally of 5.4% for all insurance vehicle sold. And for our US insurance clients, growth of 5.7% for the fourth quarter versus a year ago. We know from public data and from public disclosures that our ASPs grew at a rate that eclipsed that of used vehicle value indices like the Manheim Used Vehicle Value index and grew at a rate more than fivefold that of service providers similar to ours.

This demonstrates that, irrespective of what market shares are doing here in the short term, management continues to focus on what matters long-term: delivering the best returns possible to insurance providers:

Yes, we do believe we generate superior auction returns here at Copart. We understand our number. We haven’t seen anything close to the 5.7% that we generated in increase in insurance returns this fourth quarter. We haven’t seen anything approaching that.

Whether this will result in a market share increase going forward is still TBD. However, I have no reason to believe it will not, considering that customers are willing to minimize their financial losses when selling totaled vehicles.

There was another interesting highlight during the call. Even though technological adoption in vehicles is a tailwind for Copart, some investors are worried about EVs (because they carry fewer mechanical parts and therefore could be less “economical” from a buyer’s perspective) and autonomous driving. Even though I do believe the impact of autonomous driving on Copart is still very far away, there’s no denying that EVs are already here. Management mentioned that early returns on those vehicles are very good:

In broad strokes, the returns on EVs are very strong. They total, if anything, more easily. So far, the indications seem favorable in that regard when it comes to electric vehicles and total loss frequency selling prices and so forth.

Another area of notable growth was the company’s non-insurance volume, which continued to outpace insurance volumes. Note that more non-insurance volume has several implications for Copart. On the upside, it gives the company access to a much larger vehicle population and somewhat insulates it from the potential of future technological advancements putting pressure on insurance volumes:

If we sell x cars, the actual number of auction mediated vehicles that are sold in the United States per year is multiples of that. It’s 5x or more of the volume that we sell per year.

On the downside, some might argue that it reduces the quality of the business in terms of the moat because the insurance market seems like a well-established duopoly. I believe, however, that there are significant synergies between the insurance and non-insurance industries, especially as the quality of the totaled cars increases. Copart already has much of the infrastructure in place to cater to the non-insurance industry, so the capital requirements seem fairly low, whereas the potential prize seems fairly substantial.

Purple Wave was also a highlight. The company grew GTV (Gross Transactional Value) by 9% in FY 2025, a year when the industry’s GTV was either decreasing/flat. The company still seems fairly small (we don’t know exactly because it’s not separately disclosed yet), but it does seem to be taking significant market share.

Is Copart a good buy after the correction?

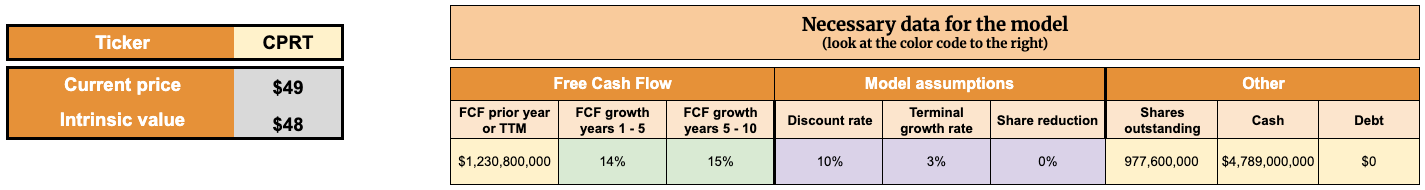

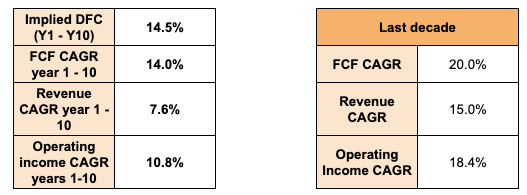

After reaching almost a 30% correction from ATHs, the above seems like a fair question. It’s not usual for Copart to suffer said drawdowns, so I updated my inverse DCF model to understand whether Copart is a good buy today. Note that the last time I added to my position was in 2023 for $35. Adding here would mean averaging up, which would be perfectly fine considering that all great stocks typically rise over time (I must improve my skills here, though).

Using a 10% discount rate and a 3% terminal rate from year 10 onwards, we can find out that Copart must grow Free Cash Flow at a 14-15% CAGR over the next decade:

I then review the income and cash flow statements to understand what assumptions I need to make across certain variables to achieve the desired Free Cash Flow growth rates. You can check my assumptions (together with my comments) in this spreadsheet. Although I will not comment on each one individually, I will make some general observations regarding the valuation.

In the particular case of Copart, I am comfortable with underwriting both significant margin expansion and significantly better free cash flow conversion. The reason is that neither of these two variables are currently normalized due to the international opportunity and Purple Wave (neither of which have normalized margins) and the fact that Copart invests aggressively ahead of demand. The latter means that growth Capex is high today but that it should moderate significantly as growth slows down (which is something I assume in my “model”).

With all this said, I don’t think Copart is particularly cheap here. Copart doesn’t need to grow either its revenue, operating income, or free cash flow faster than it did in the previous decade, but it does need to grow these at a fast clip to deliver a 10% return (assuming my estimates are ballpark correct, which they’ll most likely not be):

Now, there are some puts and takes here. Besides the fact that the valuation seems stretched, I don’t think that seeing management claim that assignments (which were down low single digits this quarter) are a leading indicator of sales while they don’t repurchase shares with the excess cash, is a good sign. Granted, they tend to be pretty conservative, and therefore, I wouldn’t take it as a signal that Copart can’t offer an appropriate return going forward.

Note also that, while I drop the terminal rate in year 10 to 3%, Copart has proven to be a much more durable company. Said differently…if I had guessed in 2015 at what pace Copart would be growing in 2025, I most likely would not have said 10%. This is an inherent limitation of DCFs, but it can be interpreted as… ”if a durable company seems to be fairly priced according to an inverse DCF that drops the terminal growth rate to a GDP growth rate far earlier than the durability the business might portray, then it’s probably undervalued.”

On the positive side, Copart has $4.8 billion in the bank that could add significant value over time if used properly. I do take this into account in my exercise, but it’s static and doesn’t assume management might find a way to reinvest this excess cash at 20%+ returns like they’ve historically done (they are currently reinvesting it at market interest rates). Copart has an excellent track record of capital deployment and, therefore, might use this cash to repurchase shares at bargain prices (they certainly don’t think we are there yet) or can use it to acquire another company (something they didn’t rule out).

All the above means that Copart is not particularly cheap (in my view) but that it has significant optionality. Even though I will not sell my current small position (should’ve done that if anything when the company was trading at ATHs, as I considered doing), I will not add either at these levels and will wait for a better entry point in case it comes!

Have a great day,

Leandro

Thanks for your work on this update, Leandro; appreciate your intellectual honesty in the valuation analysis.

Hi Leandro. at what level would you consider buying ?