Don't Focus on Quarters

ASML's Q4 2024

ASML had been on the chopping block since reporting Q3 earnings. The company not only saw these earnings leaked ahead of time but also reported very weak net bookings, something that spooked the market (it always does).

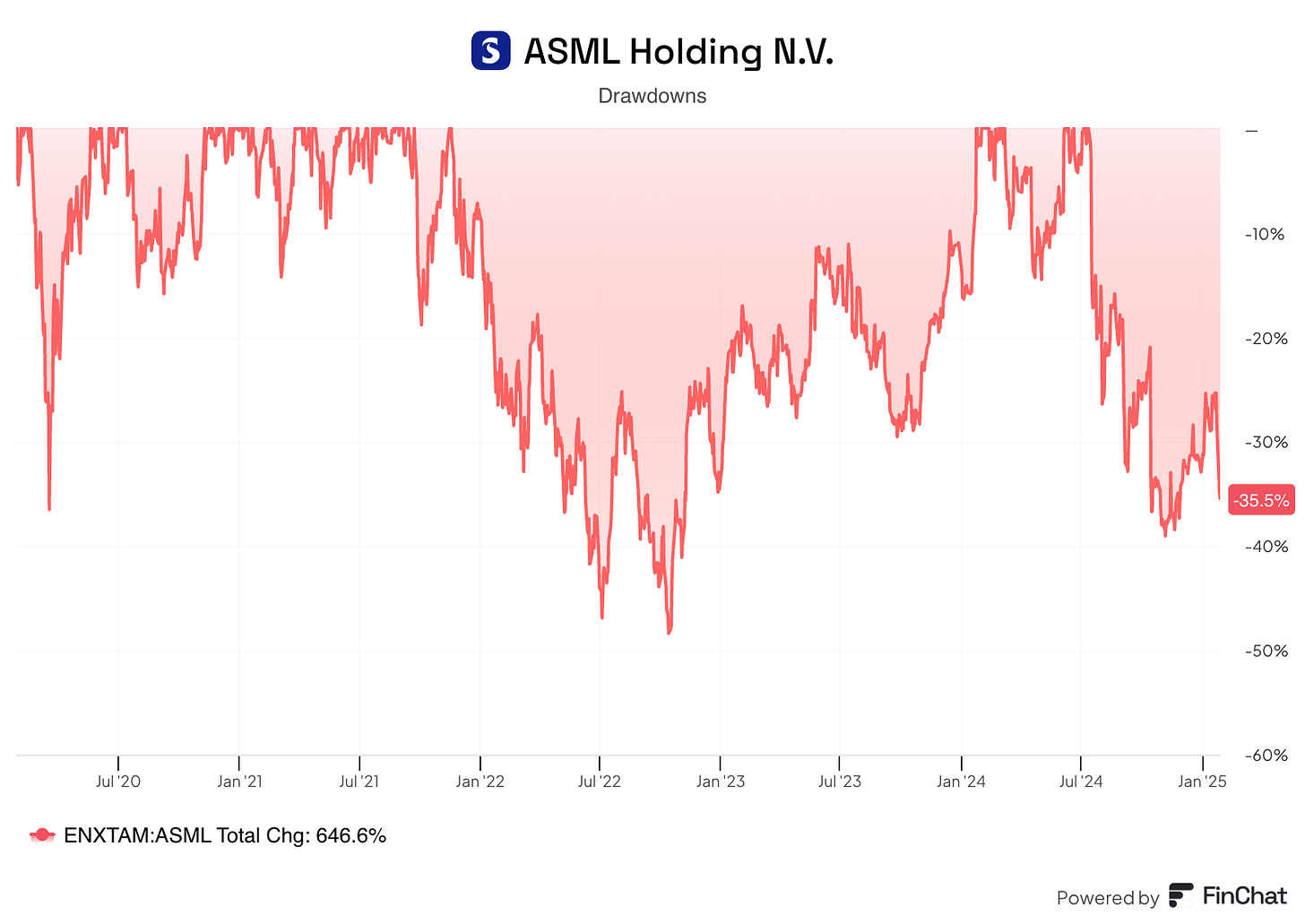

Before reporting Q4 earnings, the stock was more than 35% off ATHs and had been almost 40% off at some point. The recent Deepseek news did not help:

Sentiment seems to have changed after the company reported excellent Q4 earnings. I will say something obvious here, but short to medium-term stock movements happen purely on sentiment as the fundamentals slowly catch up over the long term (there are, of course, exceptions). What a difference a quarter can make, especially for a company that sells products with tickets in the hundreds of millions. Throughout all my articles on ASML, I have tirelessly said that quarterly numbers are a tad misleading for the company because timing matters dearly. I’ve said this when earnings were bad and when earnings were great. Back in Q4 2023, ASML reported a huge net bookings number (€9.2 billion) after a quarter (Q3 2023) of muted net bookings (€2.6 billion). This is what I said back then:

First, we should never focus on ASML’s quarterly numbers. The company’s quarterly sales are typically made up of a limited number of systems with a high price tag, meaning that deferring several systems to other quarters can significantly impact quarterly numbers without this being a warning sign.

The contrary is also true: a substantial net bookings number in and of itself is not a leading indicator of anything, so we should not get too excited. Pretty much any quarterly number is lumpy for ASML, and we would be doing a disservice to ourselves by thinking we are brilliant when they come above consensus (and stupid when they don’t). It reminds me of this famous Jeff Bezos quote:

When the stock is up 30% in a month, don't feel 30% smarter -- because when the stock is down 30% in a month, it's not going to feel so good to feel 30% dumber.

I think we can use this quote and apply it to ASML:

When net bookings are up significantly in a quarter, don’t feel significantly smarter, because when they are significantly down in other quarters, it’s not going to feel so good to feel significantly dumber.

Today’s situation mirrors almost perfectly that of 2023: after a weak Q3 bookings number, the company blew past expectations (€3.5 billion) in Q4 2024, delivering €7.1 billion. This has potential implications for the 2025 guidance. Management had mentioned in Q1 2024 that the company needed an average of €4 billion in net bookings over the next three quarters to “secure” the midpoint of its 2025 guidance (which at the time was €35 billion in sales). The company exited Q3 with an average of €4.1 billion in net bookings (Q2+Q3 net bookings divided by 2), so €4 billion was all that was needed in Q4 to, theoretically, secure this midpoint; as discussed, they delivered €7.1 billion.

Despite this higher number, management refused to return the lowered guidance (€32.5 billion at the midpoint) to its previous status (€35 billion at the midpoint); i.e., they refused to raise guidance. I don’t blame them for this because there’s little upside in doing it. The market has already anchored its expectations to that €32.5 billion midpoint number and if one is not 120% sure they will beat it, it’s better to keep it as is. In short, it’s better to underdeliver and outperform.

ASML ended the year with a €36 billion backlog, which, assuming lead times of under 1 year and that all orders are scheduled for delivery in 2025 (big ifs), should mean that the company is positioned to deliver on the high end of its guidance (€35 billion in sales). Christophe Fouquet, ASML’s CEO, claimed that there are reasons to believe that the high end can be achieved but that not everything is rosy…

There’s still quite some uncertainty on the other customers and this also justifies the lowest part of the range.

What seems to be out of the question at this point is that ASML will deliver something above the low end of the newly issued guidance, especially since the guidance includes the new export restrictions issued in December. We must be aware that these export restrictions were pre-Deepseek, a development that might bring a new wave of export restrictions (this is just pure speculation at this point). Another way of interpreting this is that Deepseek might actually lead to fewer restrictions and more domestic investments by the US to stay ahead. China is already retracing to a more normalized portion of ASML’s revenue due to these restrictions, something that’s expected to continue in 2025 and that is also considered in management’s guidance.

I believe the launch of Deepseek will likely be positive for ASML over the long term. This is something I touched on in a recent article, but let me share my thoughts here.

ASML has always been an advocate of Moore’s Law being the primary driver of “ever-increasing” semiconductor content. The reason was straightforward: lower costs led to more technological penetration, which led to more creativity, which ended up resulting in more technological advancements. This virtuous cycle is what ultimately has allowed the development of modern society and is the reason why ASML tended to fall short of go-forward expectations. This is how Peter Wennink (ASML’s former CEO) described these dynamics two years ago:

And it's still a challenge today to keep connecting all the dots, but it's the value of Moore's Law, which basically reducing the cost per function, Yes. That will drive our business and will create these building blocks for growth and for solving some of humanity's biggest challenges, and we are a strong believer in this. And Moore’s Law is alive. It's still alive and kicking, And it's about the cost per function.

And we all know if the chip gives you more functionality, more value, then it decreases cost. We're going to create applications and solutions, and that's happening. I mean, things are actually happening across the globe.

It’s this concept of doing more with less that has driven humans to try to do even more than they previously anticipated, not to conform to what they had previously envisioned. Another way of seeing this is that if you had asked someone 20 years ago if we would be close to having self-driving cars and AGI in 2024, the answer would’ve likely been “no.” The lower cost per function enabled the tech industry to achieve things that previously seemed unimaginable.

There’s no reason to believe (I can change my opinion as I continue learning) why this would be different this time around with a more efficient AI. Lower costs will most likely make the use of AI proliferate, leading to more technological advancements and finally resulting in more demand for semiconductors. You might have heard the term Jevons Paradox over the last few days. This term describes a situation in which a more efficient use of a given resource actually results in more demand, helping to offset the anticipated lower demand caused by increased efficiency. You can call it however you want, but this is what has happened in the semiconductor industry for decades. When fewer chips were needed to run a faster computer, humans didn’t just stand there; they built more and faster computers and made them cheaper, leading to more semiconductor content over the long run.

Another thing worth noting is that ASML has claimed several times that they had yet to see the benefit of AI flow into their order backlog. While companies like TSMC and Nvidia have benefited almost immediately from the rise in AI-related demand, ASML had not. This means that while a more efficient demand might lead to lower demand for ASML’s tools over the medium term, there seems to be lowish risk to the current backlog (because it has not been inflated by this demand in the first place). It’s also worth noting that the 2030 guidance was shared before AI was a “thing.”

ASML’s management has also realized that the market cares too much about quarterly numbers when it shouldn’t. As discussed in other articles and at the beginning of this one, many people are fixated on quarterly numbers, even though they can be very misleading for ASML due to the high-ticket nature of its products. For this reason, this was the last quarter when management shared the quarterly booking numbers. From now on, only the backlog figure will be shared. Less transparency is never good, but I do understand why management would do this. Quarterly bookings is not a great leading indicator; the backlog is. It’s also true that so long as the backlog figure is shared quarterly, we will be able to calculate the quarterly bookings number using a simple formula:

Starting Backlog - Equipment revenue recognized during the quarter + Quarterly bookings = Ending Backlog

What I did not quite understand was whether the backlog number would be shared every quarter or just at the end of the year. If it’s the latter then the above calculation will not help us, but if it’s the former, I guess quants will need to add a new formula to their algos.

Enough about orders, let’s take a look at the quarter at large.