DeepSeek's New Model and What It Might Mean for Markets (NOTW#30)

Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

The indices were up again this week despite the poor performance of one of their largest constituents: Apple. Some news shook the investment world this week: China might have made significant strides in AI at a much lower cost. I explain what I mean by this and what it might mean for AI-related stocks.

Without further ado, let’s get on with it.

The resources library

I have added a item to the navigation bar called 'Resources' where you can find a list of my favorite investment-related articles and books. You can also find a link to the article or the PDF:

Articles of the week

I published two articles this week. In the first one, I discussed my ideal investment scenario and the kind of opportunities that I have been gravitating towards. I share how one of the latest additions to the portfolio complies with the characteristics I currently search for.

The second article of the week was Texas Instruments’ Q4 earnings digest. The company reported an okay quarter, but it did not amuse the market due to the continuation of the downcycle.

Texas Instruments Q4 2024

I titled my last Texas Instruments earnings digest “Light at the end of the tunnel,” but it seems the tunnel got slightly longer this quarter. The company’s revenue decreased sequentially in Q4, and management guided for another sequential decrease (although a year-over-year increase) for Q1

Without further ado, let’s see what the markets did this week.

Market Overview

The indices enjoyed yet another great week. The Nasdaq was up more than 3% whereas the S&P 500 was up more than 2%:

The week did not end on a great note, and the reason might be related to Deepseek. Deepseek is a Chinese AI startup that has unveiled a model with similar capabilities to OpenAI’s latest model but at a (theoretically) fraction of the cost (around $5 million compared to the tens of billions it took to develop OpenAI’s). If the cost part of the equation is true (the performance part seems to be undoubtedly true because it’s available for use) and there has been no evasion of US sanctions, this would mean that China has managed to outpace the US’ developments in AI at a significantly lower cost.

There are (unsurprisingly) many skeptics who don’t believe anything that’s coming out of China and claim that the cost has been much more significant. With OpenAI’s latest model theoretically costing billions of dollars to develop, Deepseek claims they have been able to train theirs for just $5 million, although they have excluded certain costs from this estimate…

Note that the aforementioned costs included only the official training of DeepSeek-V3, excluding the costs associated with prior research and ablation experiments on architectures, algorithms, or data.

There can be much speculation about why they have decided not to share all the costs, but it might be related to the fact that actual costs are much higher. China might want to send a message to the US claiming that current sanctions are not slowing down its progress. The thing is that there’s also speculation around DeepSeek owning 50,000 Nvidia H100s, which would mean they have evaded sanctions and that the cost of training the model runs in the billions, not millions. This was shared by Alex Wang, CEO of Scale AI, in a recent interview with CNBC. Is this true? I don’t know.

I honestly have no opinion here yet, but I am leaning more toward the skeptical side. Note that when these things come out, it is customary to see many people share their takes; humans almost always want an immediate opinion on everything. Some people are claiming that if this is true and Deepseek managed to develop AI for this low cost then the Nasdaq is “screwed.” I don’t see how this is true when what this would potentially mean is that hyperscalers would need to invest significantly less Capex to support AI applications going forward. This wouldn’t be good for Nvidia or for semiconductors in general, though. The story is still TBD (To Be Defined).

The industry map was pretty much green, with some exceptions:

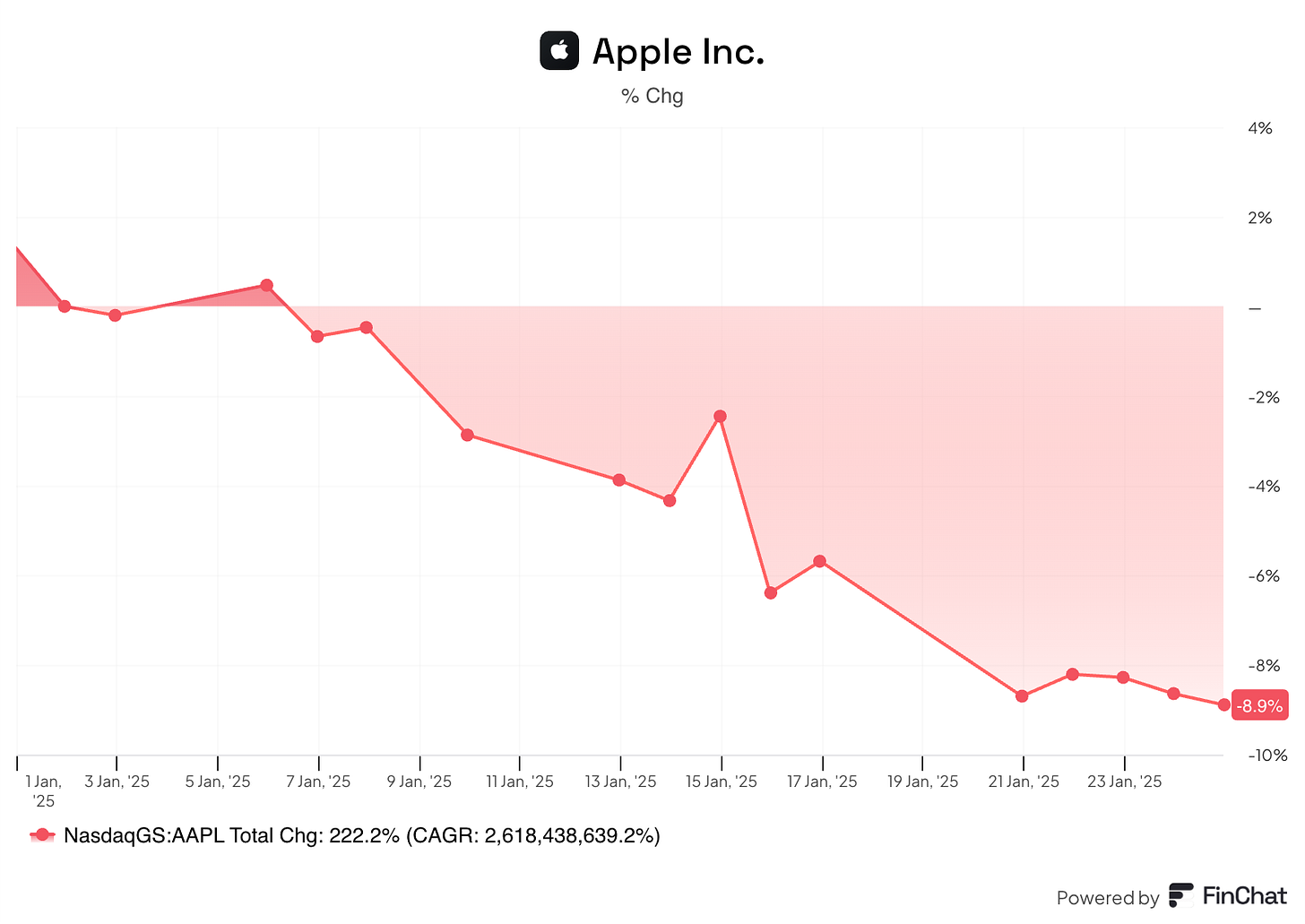

Apple has not had a great start to the year; it’s down 9%:

It’s still soon to know if Buffett was right on this one, but Apple has undoubtedly been a headwind for the performance of the indices thus far this year. This shows that concentration can go both ways and is a preview of what can happen to indices if the largest stocks start to “falter.”

The fear and greed index improved markedly and is now in neutral territory:

This is all for this week, paid subscribers also have access to my transactions and all the relevant news for portfolio companies.