Amazon's Accounting "Tricks"

Q4 Earnings Analysis

(Reading Time: 13 minutes. Most of the article +80% is shared for free, with the rest being reserved for paid subscribers. I would highly appreciate if you show your support to the blog either through a like or sharing this post)

Amazon reported earnings last week. The market did not like these and the stock dropped more than 4% to levels not seen since (*checks notes*) the 20th of January! Zooming out is always important:

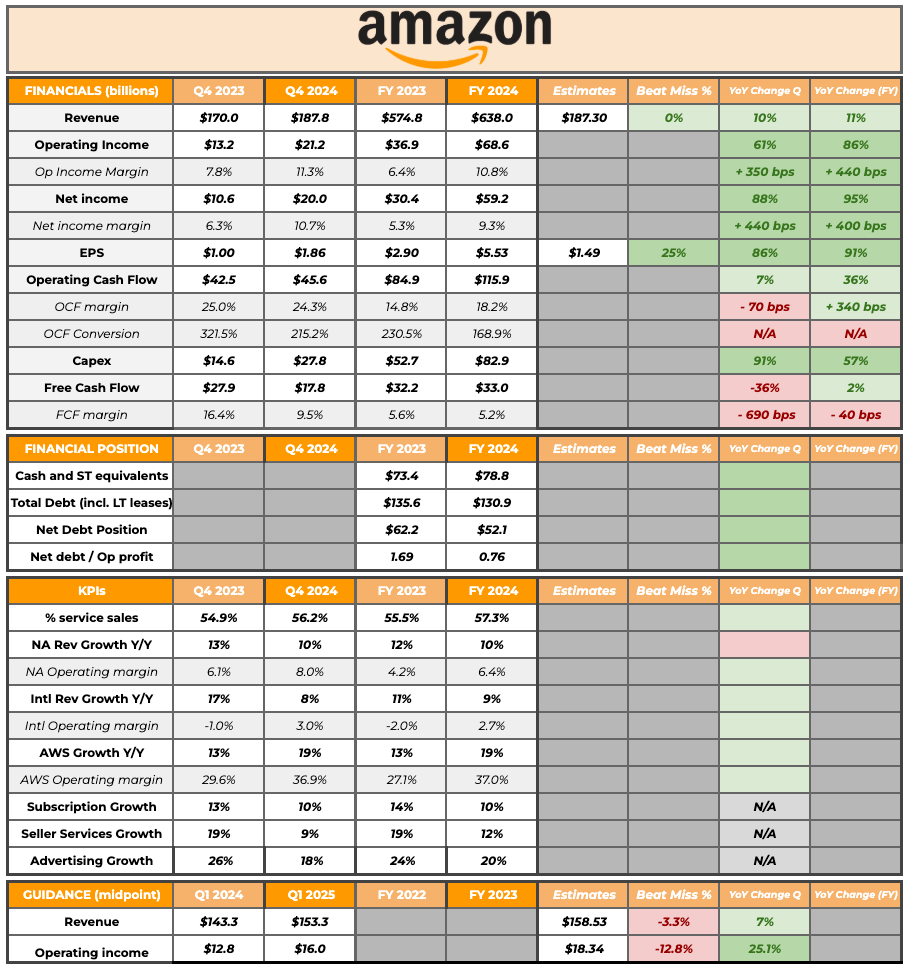

Here’s the summary table for Amazon’s earnings. As has been the case for several quarters, the company demonstrated again significant operating leverage:

The first thing I want to comment on is something I repeat in pretty much any Amazon earnings analysis (getting closer to sounding like a broken record here): investors have gotten accustomed to double-digit growth at this scale, but it’s something that shouldn’t be taken for granted. Amazon grew double digits in 2024 and ended the year with more than $600 billion in revenue. Do you know how many companies in the world have achieved such a feat? I’ll spoil it here for you: none. The only other company in the US with +$600 billion in revenue is Walmart (WMT), but it’s growing at half the rate (5.5%) of Amazon.

Growth in the bottom line continued to significantly outpace the top line because margins continued to tick up across all of the business segments. We should be careful in assuming that the entirety of this improvement comes from operating leverage inherent to the business. There’s also some sort of accounting “gimmicky” going on.

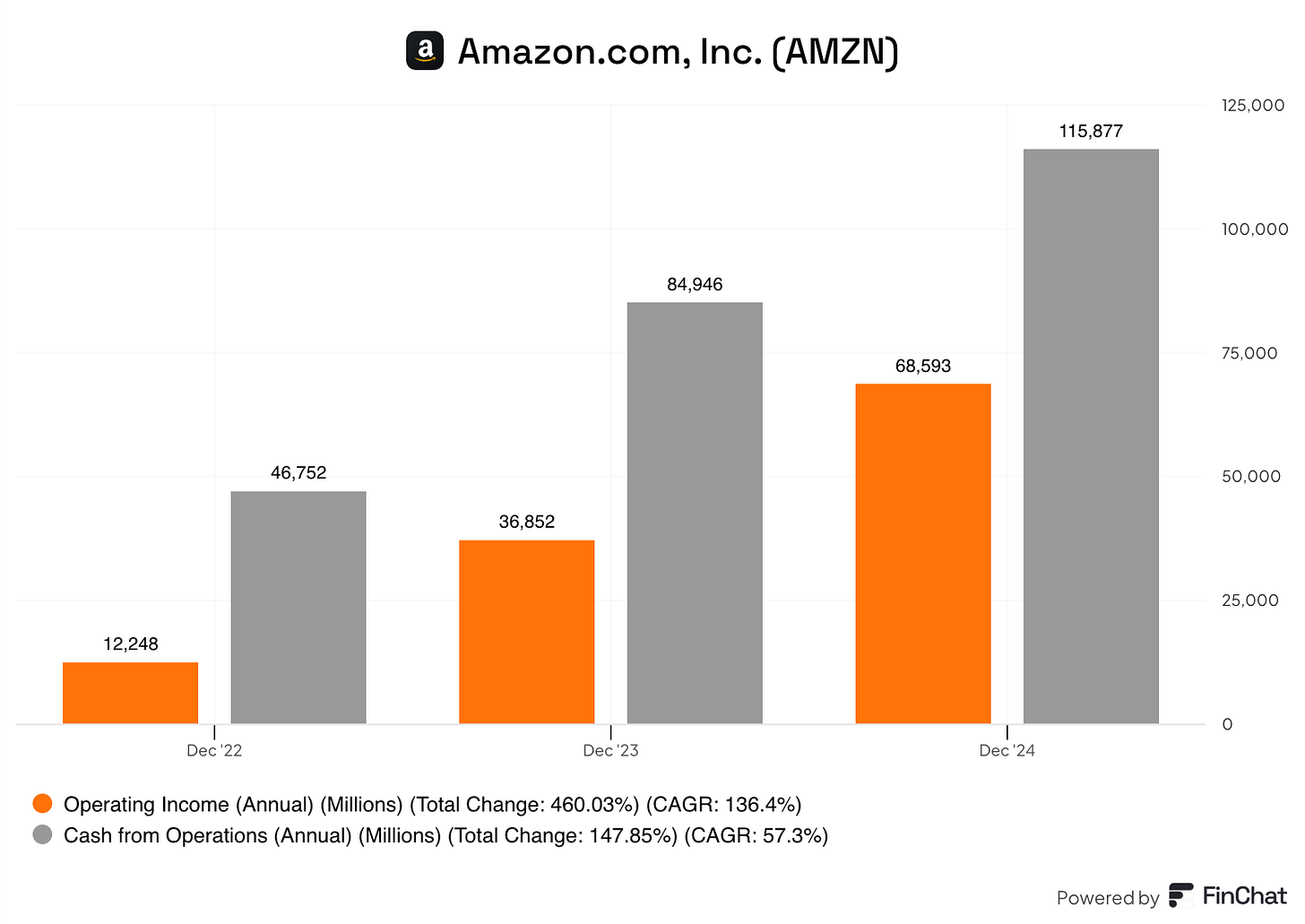

In 2024, management decided to increase its servers' useful life from 5 to 6 years. This accounting change benefits the P&L through lower depreciation but reduces cash conversion and, therefore, reduces the quality of these higher “accounting earnings.” The thing is that Amazon is seeing increasing amounts of Capex while depreciation comes down. This means that cash earnings (understood here as “cash conversion”) have actually been deteriorating even as P&L earnings rise. Since 2022, Operating Income has grown at an impressive 136% CAGR, but operating cash flow has clearly lagged (57% CAGR) despite being phenomenal:

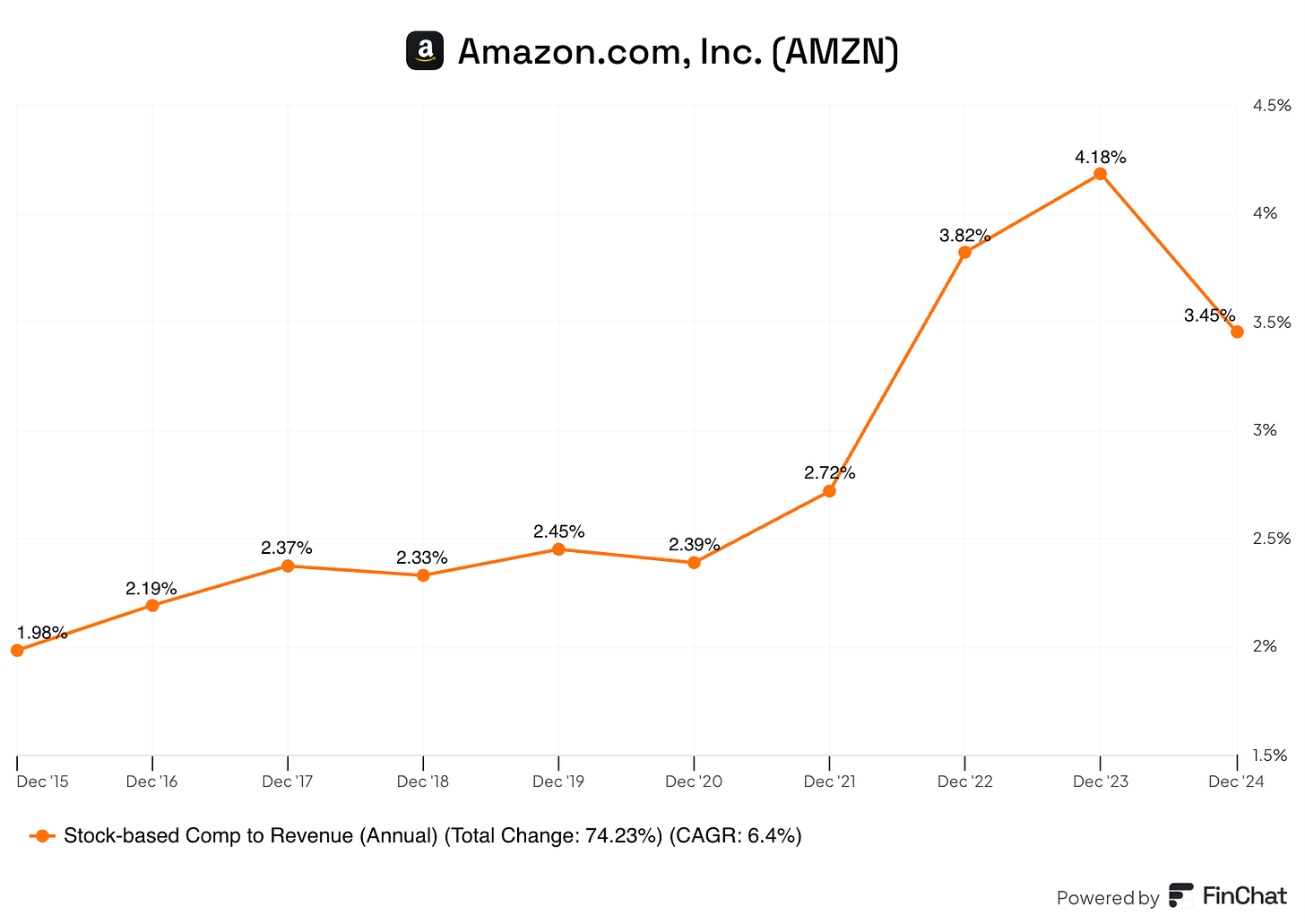

Amazon’s cash conversion (OCF/Operating Income) dropped materially in 2024 due to lower depreciation, changes in working capital, and some good news: lower SBC. Amazon’s stock-based compensation dropped from $24 billion to $22 billion. SBC as a percentage of sales is still above 3%, but there’s no denying that it’s going in the right direction:

Lower SBC penalizes cash conversion but lowers dilution, meaning that cash conversion per share is not (or should not be) materially worse off than it was before. If I had to choose a reason to see cash conversion worsen, I’d much rather see lower SBC as the reason.

A management team can change the useful life of their PP&E (Property, Plant, & Equipment) “almost” at their will (not entirely true because there’s an auditor, but there’s definitely a high degree of subjectivity). However, if the estimate ends up being inaccurate, it will show in the cash flow statement in due time. There’s no hiding economic reality from the cash flow statement for long.

In a remarkable turnaround of events, management announced that they are not only rolling back this change but also reducing the useful life of a “subset” of their networking equipment to 5 years from 6 years.

This change will result in higher depreciation down the line. To be more precise, Amazon expects a $1.3 billion headwind to AWS operating profit this year resulting from this change. This headwind will be softened by yet another adjustment to the useful lives of its assets, this time on the retail side:

Lastly, we also completed a useful life study for certain types of heavy equipment used in our fulfillment centers and are increasing the useful life from ten years to thirteen year beginning in January 2025, we anticipate this will increase the FY 2025 operating income by approximately $900 million.

This means the headwind to group operating profits will be around $400 million. $400 million doesn’t sound material, considering Amazon generated almost $70 billion in operating income in 2024, but it doesn’t impact the company’s segments uniformly. AWS will suffer the headwind, and retail will enjoy the tailwinds. There will be, however, an accounting change that will benefit the company as a whole:

We currently expense the majority of the cost associated with the development of our satellite network. We will capitalize certain costs once the service achieves commercial viability.

When Kuiper achieves commercial viability, costs will move from the income statement to the balance sheet. These costs will eventually be expensed, but this will happen over time, and therefore, it will be a tailwind to margins (management did not mention how much).

AWS ended the year with mouthwatering margins of 37%, up 1,000 bps from last year. The change in the useful life of assets implemented during 2024 was a 200bps tailwind to AWS margins, meaning underlying profitability also improved markedly.

One thing that might explain this margin uplift is that AWS seems to be operating in a supply-constrained environment. Management argued that AWS growth could be higher in a normalized supply environment:

We could be growing faster if not for some of the constraints on capacity.

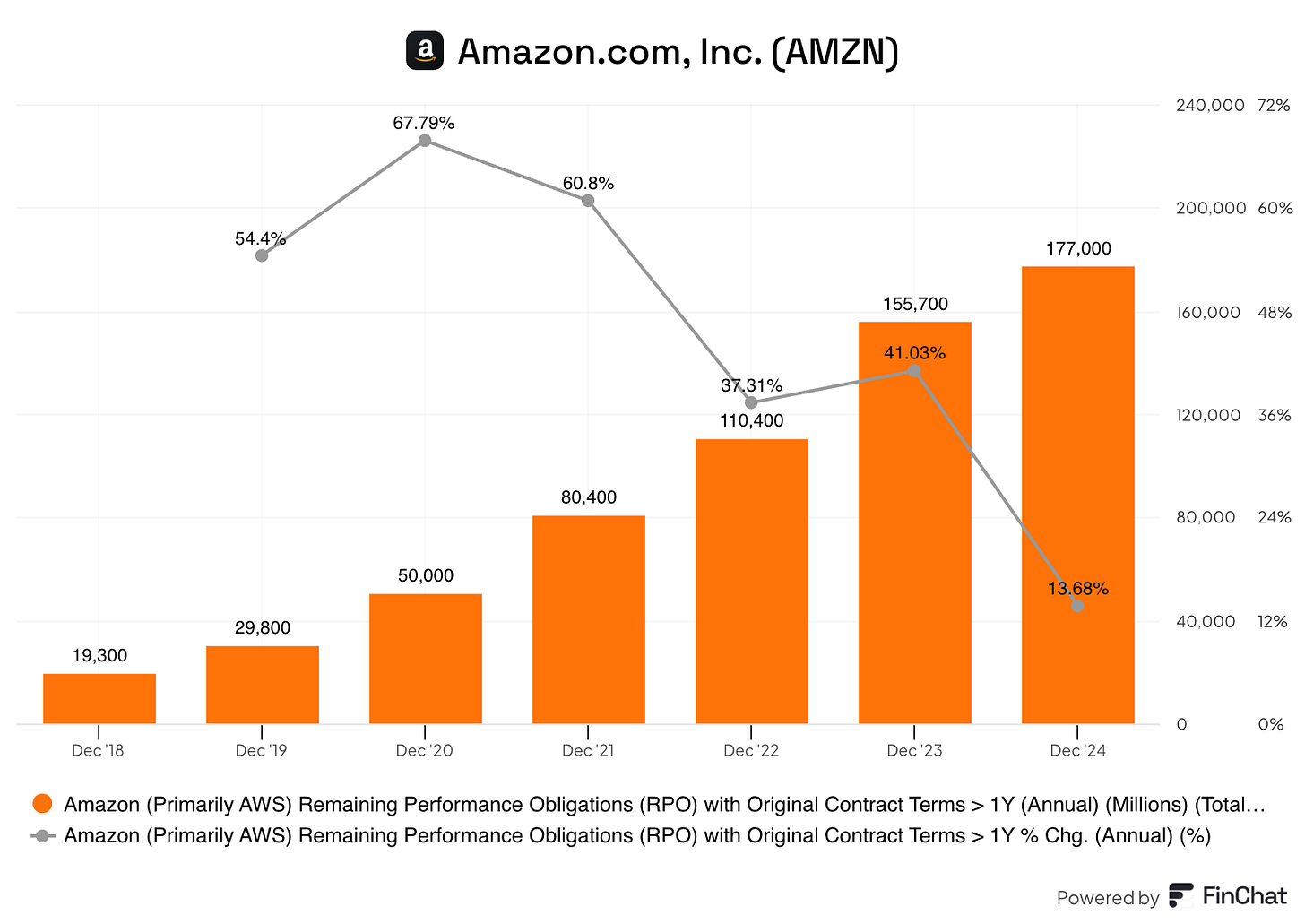

While this scenario makes sense, shouldn’t we see a significant increase in AWS performance obligations in a supply-constrained environment? These grew 14% in 2024 but decelerated quite materially compared to 2023:

The only problem with focusing too much on this metric is that it only includes the amount committed by customers but a significant portion of AWS revenue consumption-based, bypassing this backlog figure. Of course, it would be much better to see strong acceleration here, and while it’s not a great sign to see it decelerate materially, we are also missing information to conclude anything based on it.

As I see it, there are three potential headwinds to AWS margins in 2025:

The decrease in the useful life of assets

The supply-demand imbalance correcting itself as Capex ramps up

AI making a more significant chunk of AWS revenue. The AI business is currently a lower margin endeavor for Amazon, but management expects it to have a similar margin profile to the rest of the business over the long term

The key question here is: what are normalized margins for AWS over the long term? I have no clue, but AWS margins seem to be somewhat inflated and we might see them come down in 2025 (TBD). The long-term margin profile is evidently unknown, but the fact that this is an oligopolistic industry with what seem to be rational competitors and a huge growth runway ahead makes me believe that the future margin profile will most likely not deviate much from its historical trends (at least to the downside).

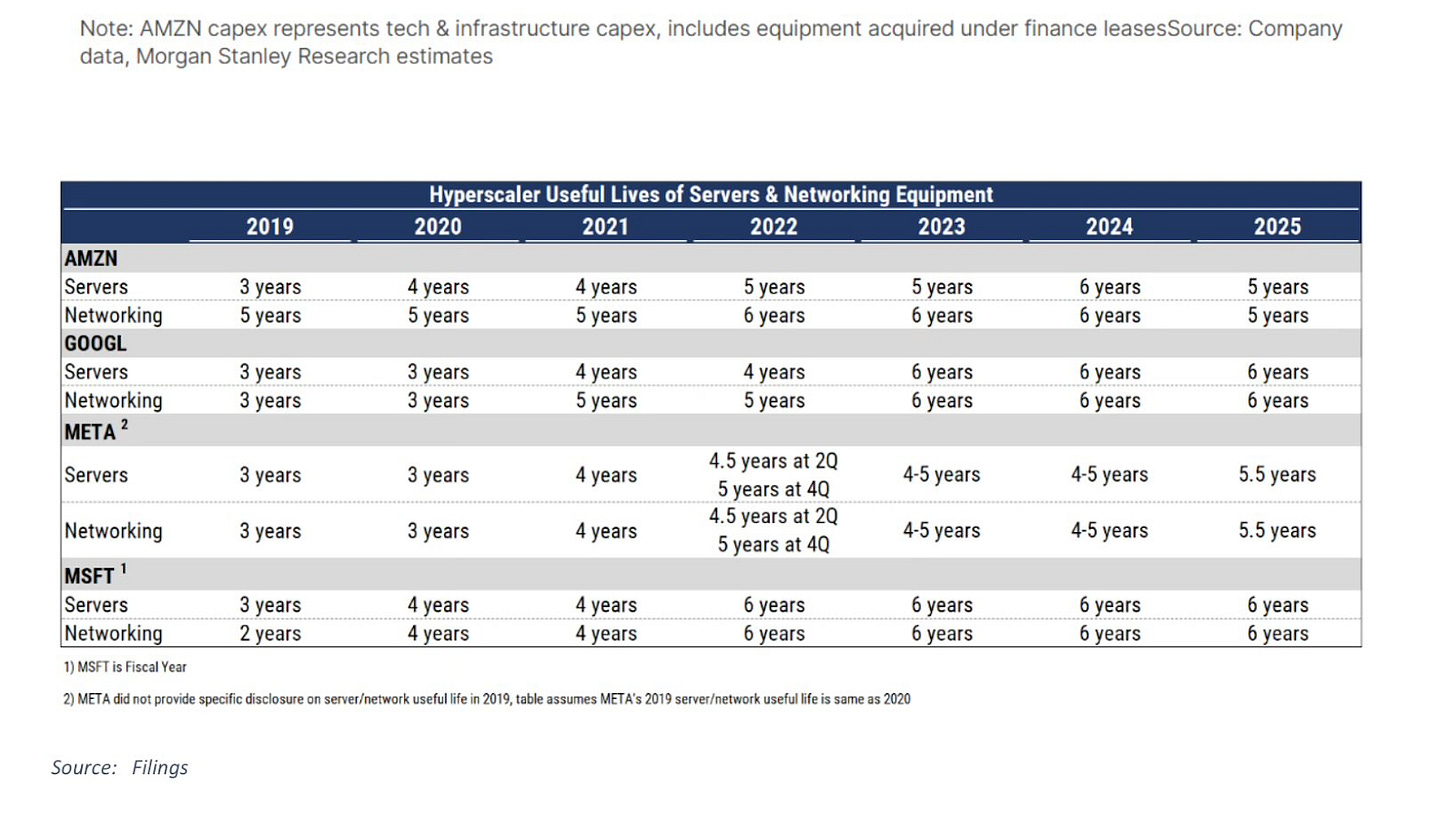

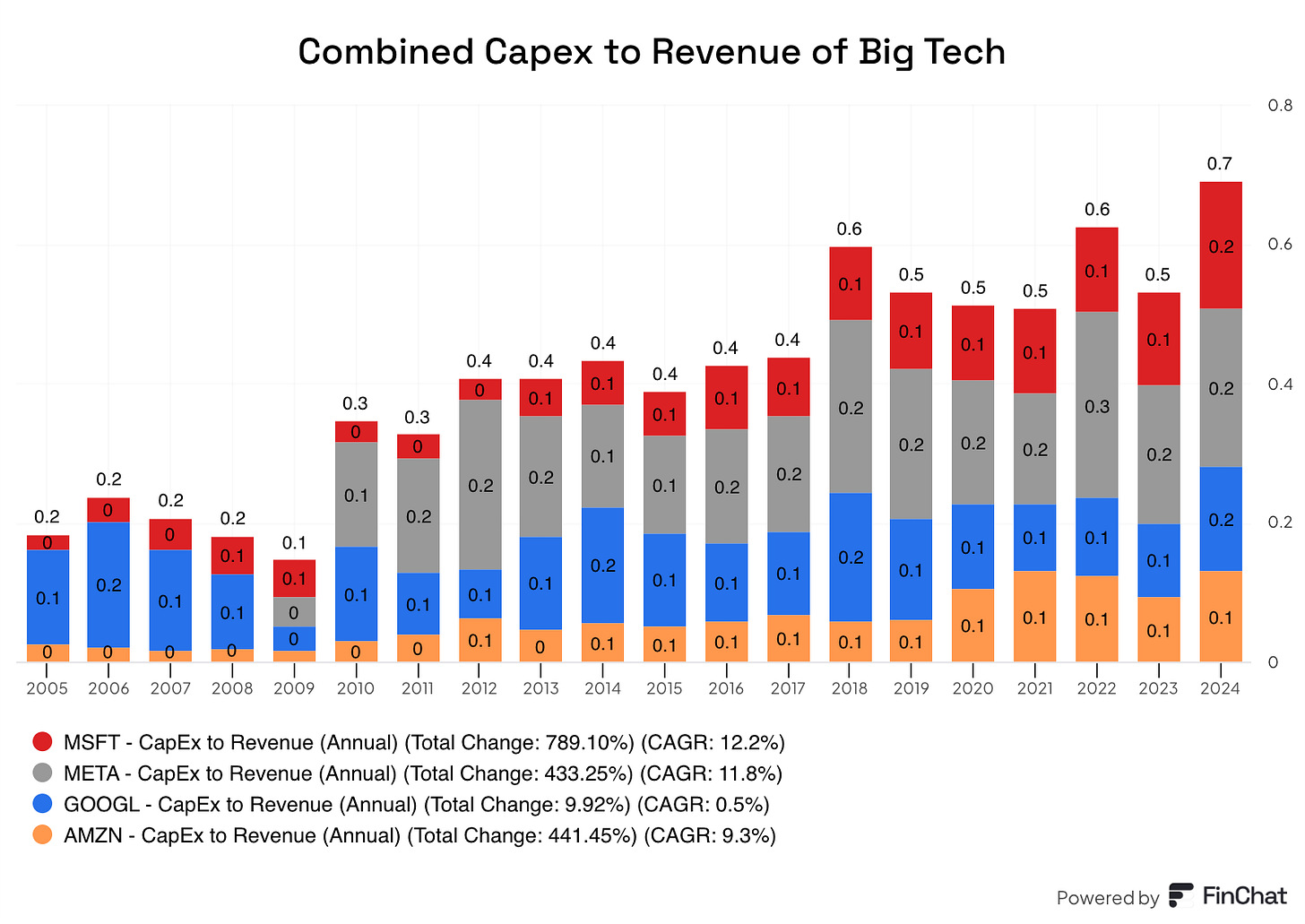

I must admit, though, that all these accounting changes leave me a bit uncomfortable. The useful lives of servers across Big Tech companies averaged 3 years in 2019. In 2025, they are expected to average around 5-6 years. With technology advancing rapidly, one can only ask himself if a 100% increase in the useful lives of these assets over the last 6 years is reasonable. Could they have been too low at the beginning? For sure, but there’s no denying we don’t have much visibility into whether these changes are justified or they are just accounting gimmicky. Whatever it is, it will end up showing in the numbers.

The question that everyone has related to AI and AWS is whether good returns will follow the huge Capex ramp that Big Tech is undertaking. Any investment is a matter of three variables: reinvestment rates, return, and valuation. The first variable is out of the question here: reinvestment rates are very healthy. Big Tech have meaningfully ramped Capex reinvestment, and these are expected to top $300 billion in 2025 (Amazon expects Capex of around $105 billion next year, up from $82 billion this year):

The reinvestment rate is assured, but what about returns? This is an unknown and what makes investing difficult. If an investor knew the returns of the reinvested capital, investing would be much easier, but we don’t know. Amazon’s management believes that the opportunity in AI is a “once in a lifetime” kind of opportunity:

AI represents for sure the biggest opportunity since cloud. Probably the biggest technology shift and opportunity in business since the internet.

Another point worth mentioning here is that the “opaqueness” of future returns is precisely why one should be comfortable with a management team's ability to allocate capital. I don’t think I will ever have more visibility into returns than Amazon’s management team, but by investing in Amazon, I decided to trust them with these decisions. I can directionally understand that the opportunity seems enormous and that the market structure allows the co-existence of outstanding returns for the players involved, but I can’t know for sure what the returns these ventures will generate. What I do know is that if one trusts the capital allocation abilities of a management team, more reinvestment is always good, not bad.

Enough about AWS; let’s talk about retail.

Retail’s great performance

When Andy Jassy was announced as Jeff Bezos’ successor, consensus commentary went along the following lines…

He is an AWS guy, he doesn’t know how to run retail.

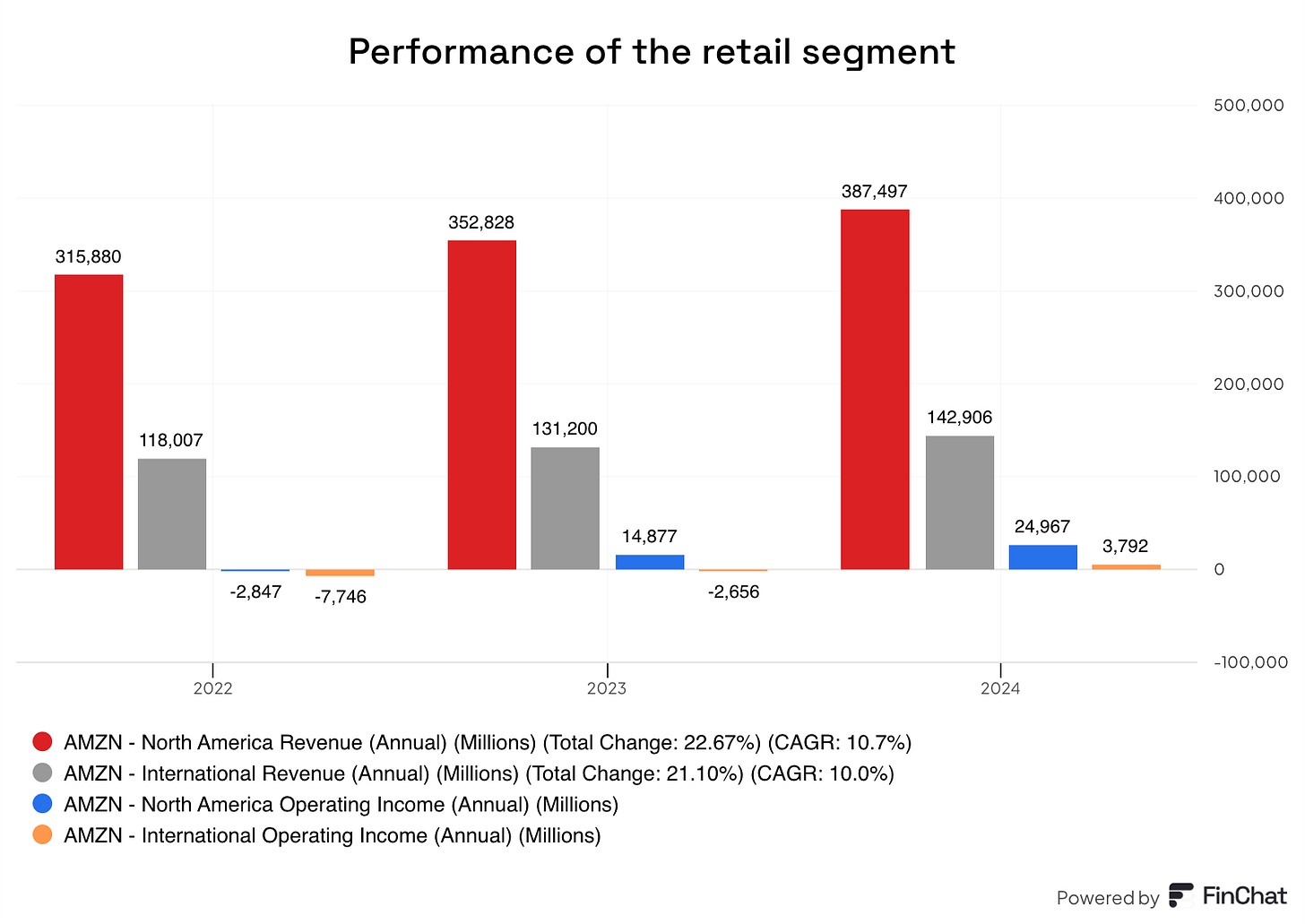

While AWS has performed spectacularly during Jassy’s tenure, retail has too. Growth has been strong, and margins have crept in the right direction. North America and International have both CAGRd revenue at 10% rates since 2022, and they are now profitable, somewhat putting to rest the concerns that “AWS is subsidizing retail:”

The best thing about this improved performance is that it has been achieved while improving the customer experience: delivery speed is up while the cost to serve is down for the second consecutive year. Management believes there’s still a significant runway to continue improving the margin profile of the retail business.

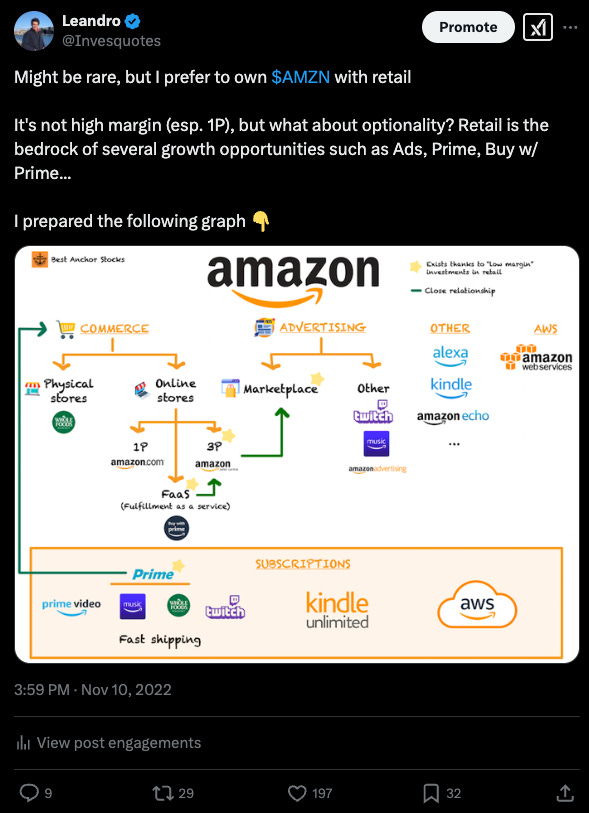

Stripping out AWS from service sales, we can see how the retail segment has gone from 40% service sales in 2019 to 49% this year. This has arguably played a critical role in the margin uplift. It also demonstrates that investors have been proven wrong disregarding Amazon’s retail business. Sure, the pure-play retail portion is a low-margin, capital intensive business, but it allows Amazon to come up with very profitable and capital-light revenue streams that are pretty much isolated from competition thanks to the pure-play part. A bit more than 2 years ago, I shared the following on X which I believe is aging well. Given the option to own retail and/or AWS, I would probably choose to own both (at the right valuations):

Some other good news in retail: it’s becoming a more integral part of Prime members’ shopping habits. Management shared that unit growth outpaced revenue growth, meaning customers use Amazon to shop for more products. This is related to the speed topic I discussed above. There was once a debate around the incremental returns of improving speed in eCommerce. Investors questioned Amazon for striving for same-day delivery as they argued that speed was not that important for eCommerce buyers. Results seem to show that it’s indeed important and management argued there’s still a long runway here:

We have not yet seen diminishing returns of being able to continue to improve the speed of delivery.

All in all, a great quarter by the segment that many Amazon investors would like to sell if given the chance to.

Deepseek: Amazon’s POV

Management evidently discussed what Deepseek means for the industry. After a $105 billion Capex guide, it’s no surprise they support Jevon’s Paradox!

And I think that is very much what's gonna happen here in AI, which is the cost of inference will substantially come down. You know, what you heard the last couple of weeks out of DeepSeq is a piece of it, but everybody is working on this. I believe the cost of inference will meaningfully come down. I think it will make it much easier for companies to be able to infuse all their applications with inference and with generative AI.

And I think it's gonna if you run a business like we do, where we wanna make it as easy as possible for customers be successful building customer experiences on top of our various infrastructure services, the cost of inference coming down is gonna be very positive for customers and for our business.

This (together with other Big Tech commentary) somewhat tames the fear of Nvidia’s demand dropping off a cliff, even over the short term. I wrote an article on Deepseek not long ago, and I believe my opinion aligns well with Andy Jassy's here.

Contextualizing guidance

I also wanted to touch briefly on guidance. Amazon’s revenue guidance came in below expectations. Management expects 7% year-over-year growth in Q1, but to understand the company's actual performance, we must remove two meaningful headwinds.

First, the strengthening of the dollar is expected to be a $2.1 billion revenue headwind in Q1. 2024 was also a Leap Year, so Amazon generated in Q1 an additional $1.5 billion in revenue that’s not expected to repeat this year (because it’s not a Leap Year). Both headwinds total $3.6 billion, and if we ignore them, Amazon should’ve guided for 9% revenue growth in Q1.

Amazon also slightly missed the operating income guidance (considering the high end), but we already know how conservative they can be here. The company is expected to grow operating income by 25% at the midpoint and 41% at the high end, but I expect the growth rate to be higher as the company will most likely beat guidance. What’s impressive is that this growth comes on top of a pretty tough comp (10.68% operating margins in Q1 2024). The company’s guidance at the high end implies a record 11.7% operating margin, which would also constitute a sequential improvement.

Some words on valuation

There’s no denying that a good chunk of the “easy money” has been made on Amazon. At $90, the stock seemed like an “obvious” investment because it was pretty clear what the market was “missing.” Due to the massive capacity investment undertaken during the pandemic, margins and cash flows were very depressed and not many people believed they would recover like the ended up doing.

With the stock at $230 today (155% higher), it begs the question…

Is there much more money to be made here?

Let’s do some quick napkin math.