A Recessionary and Tariff-driven World

What it would mean for my portfolio (Part 2)

Welcome to part 2 of this two-part series to understand how my portfolio (i.e., the Best Anchor Stock portfolio) would perform in a recessionary and tariff-driven world. If you want to understand what I will look for in this exercise and why I am doing it, please refer to part 1. In that article, I explained the exercise and gave an overview of the first 8 businesses in the portfolio, ranking them on a scale of 1-5 regarding resilience. I’ll review the remaining 9 businesses in this article and share some conclusions.

Without further ado, let’s start with Adobe.

9) Adobe

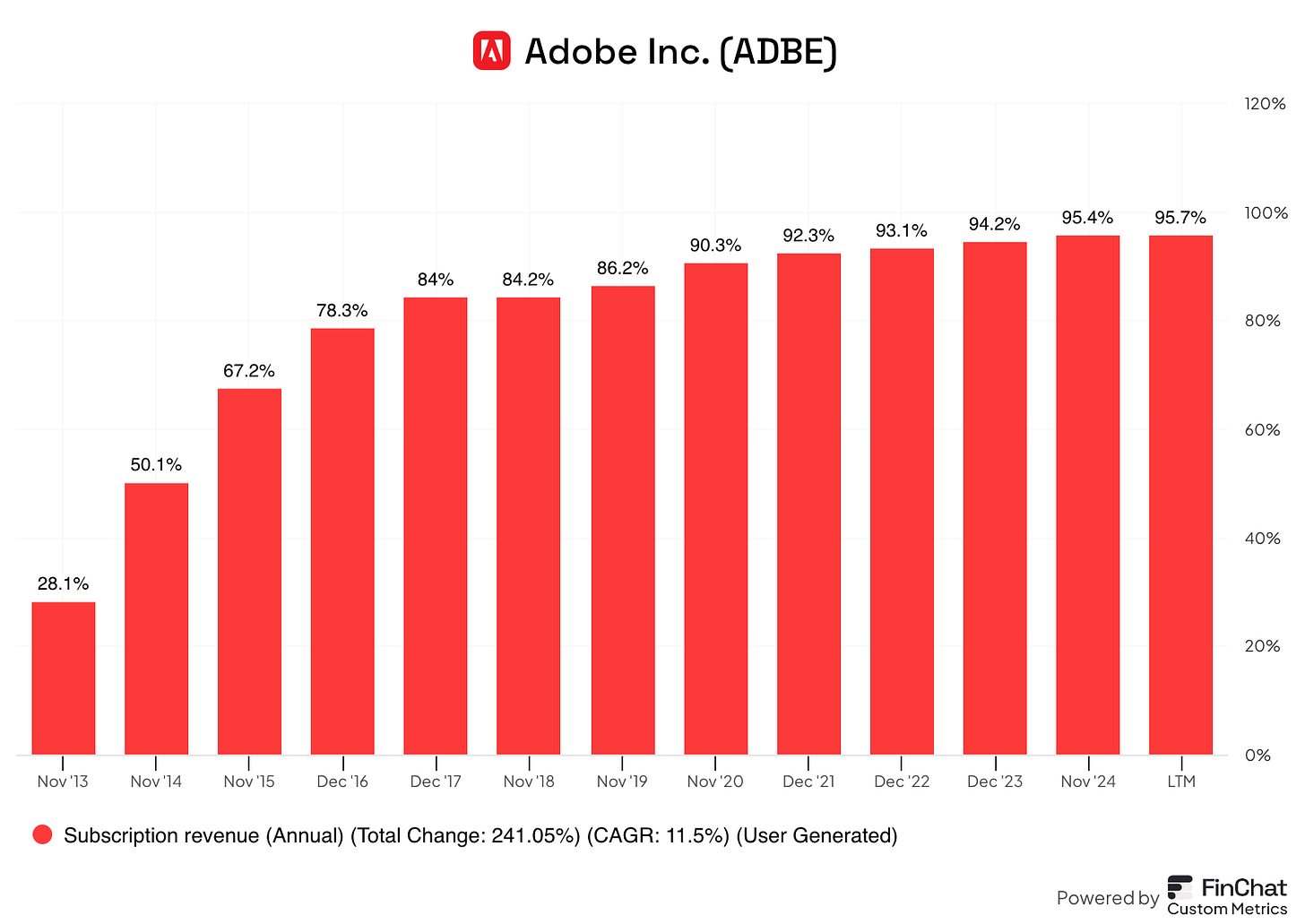

Adobe is an interesting case because there’s no precedent in terms of the company or industry. Let me explain this a bit further. Adobe was publicly traded during the Global Financial Crisis, but the business was entirely different from what it is today. Two things have changed. The main one is that the company has transitioned from a product-based company to a SaaS (Software as a Service) company. Using Finchat’s custom metrics (you can grab a 15% discount off any plan here), we can see that subscription revenue has gone from pretty much 0% in 2008 to 96% today:

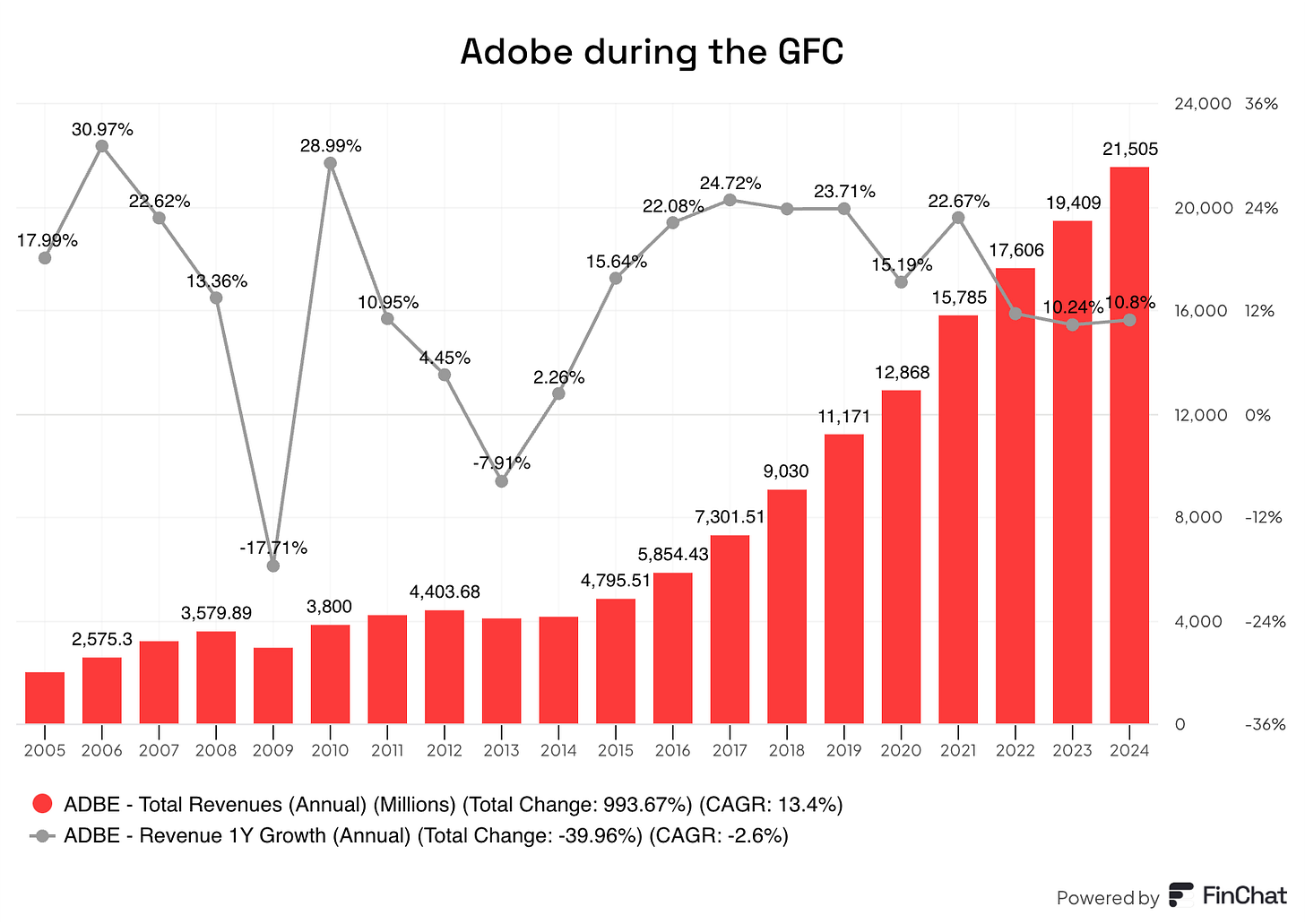

This “SaaS transition” was actually recession-induced. Adobe’s revenue dropped almost 18% in 2009:

This drop led CEO Shantanu Narayen (current CEO) to start this transition that would help the company remain resilient through tough times and would open a world of opportunities. Despite the skepticism at the time, it turns out he was right, and Adobe accelerated its growth and became much more predictable thanks to its newly constituted SaaS business model.

Having this transition in mind is essential when thinking about the next recession because subscription revenue is presumed to be more resilient through recessions than product-based revenue. Even though we have not yet had a recession to prove this, the rationale makes sense. When products like Photoshop were sold on a product-based nature, customers could defer the purchase of a new version so long as the existing version was “good enough.” This is simply not possible under the SaaS model, as not paying the subscription would mean losing access to the product customers need to operate.

If we think about the industry…Adobe is mainly linked to the digital advertising industry. The digital advertising industry has grown significantly and is now much more prevalent than it was during the GFC (as a proportion of ad dollars flowing through digital platforms). In the US, digital advertising makes up 72% of total ad spend today compared to 13% in 2008. This trend has propelled companies like Adobe and Meta forward, but in this context, it means the following: digital advertising has never gone through a deep recession. While it’s logical to think that advertising would not be resilient through a downturn as marketing budgets would get cut first, the reality is that we don’t know what will happen until it does. There’s a reason to believe, though, that Adobe’s business might be more resilient than other ad business models through a recession. The reason is that most of the company’s revenue is non-consumption, meaning that customers need the subscription regardless of how much content they generate (albeit marketing teams can get reduced, and seats might decrease).

All this said, I think there’s no sugarcoating it: Adobe’s business would most likely be impacted during a recession. There’s some good news, though: the company’s financial position. Adobe currently enjoys a net cash position of $900 million and has a pretty resilient business model, so I don’t think survivorship is in question here. To this, we must add that Adobe would most likely remain cash generative through a recession and could probably take the opportunity to repurchase shares.

Another positive that Adobe might take from a recession is that money (Private Equity and Venture Capital) currently going to “competing” start-ups (including AI-related stuff) might dry up. This would be good for Adobe because (although I believe the company has significant competitive advantages against these players), it’s definitely best to have less competition, not more.

I don’t think there’s much to worry about regarding tariffs because the direct impact is non-existent. Adobe sells software and therefore it’s not subject to tariffs, although some of its customers/marketing budgets might be indirectly impacted.

I’d give Adobe a grade of 3.5/5 regarding resilience against a recession and tariffs.