A Nuanced View on the AI/Capex Dilemma (NOTW#66)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

The market was pretty much flat this week, which I don’t know if that’s good or bad news, considering that a good chunk of the index reported earnings! (Big Tech). In the brief market commentary, I’ll share some thoughts on the current AI-spending environment and aim for a more nuanced take than what you read out there.

Without further ado, let’s get on with it.

Articles of the week

I published one article this week: Amazon’s Q3 earnings digest.

Is Andy Jassy a good CEO again?

Amazon reported good earnings yesterday, with the stock up significantly today:

The company reported excellent earnings on Thursday and (as expected) proved the naysayers wrong. Next week will be very busy for the Best Anchor Stock portfolio, with 5 companies reporting (2 on Tuesday, 2 on Thursday, and 1 on Friday).

I also want to publish a brief article on a company I’ve looked at that’s a “special situation,” though I’ll try to lay out the risks in a way that helps you understand that it’s not really a “high-quality” company as I understand these. Don’t expect it to be a deep dive or anything!

Without further ado, let’s see what the markets did this week.

Market Overview

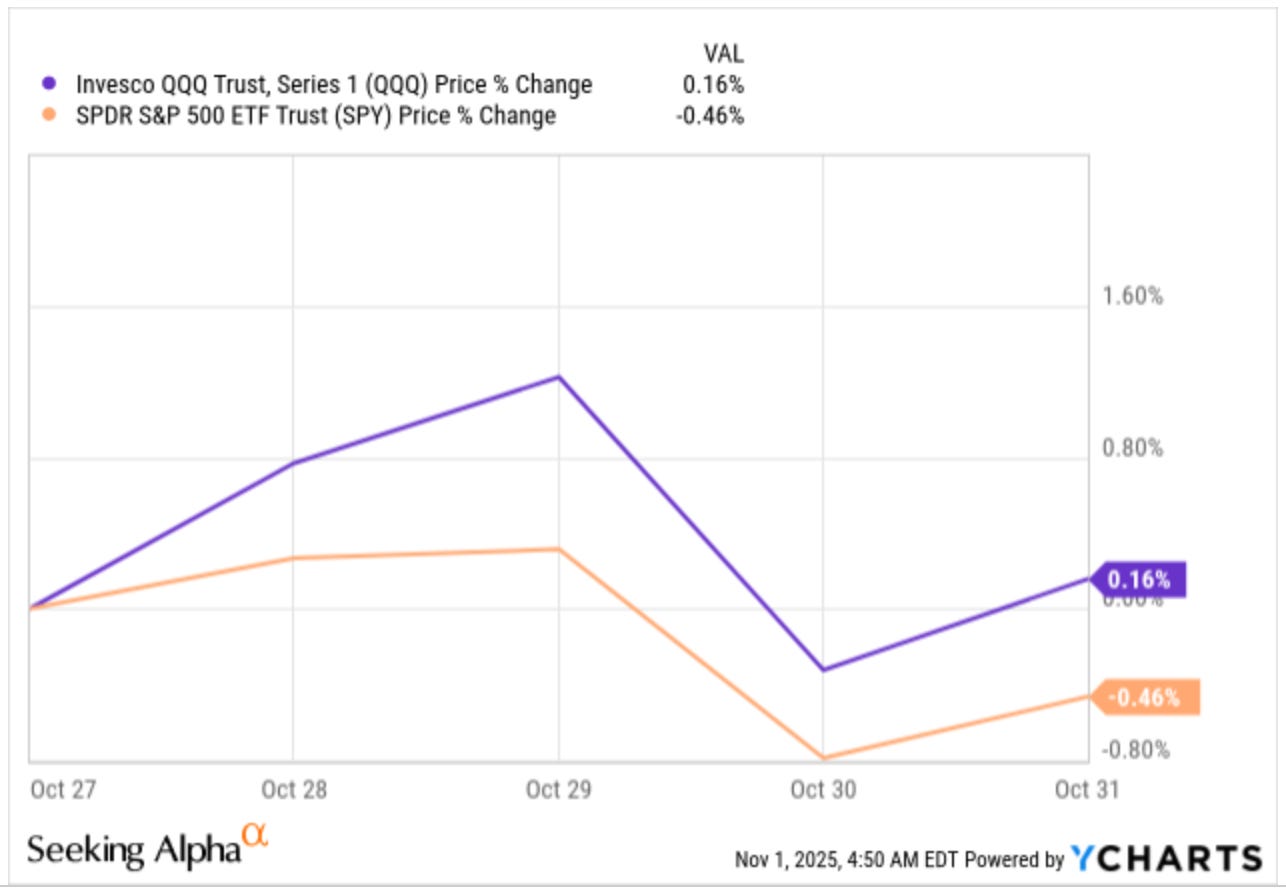

Both indices were pretty much flat this week:

It was a relevant week for financial markets, as pretty much all Big Tech companies reported (Meta, Amazon, Google, Apple, and Microsoft). Earnings were good overall, but they all had something in common:

Strong revenue growth for the most part

Weak Free Cash Flow due to high Capex

Signaling that Capex spending will go on for a while

Some people are getting a bit spooked by all the CapEx these businesses are spending. These people’s view is that the returns on this spend will be terrible (you only get spooked by higher Capex if you think returns will be bad) and that earnings will suffer the consequences for a long time. I don’t claim to see the future (I would love to, though), but I believe there are certain caveats we must be aware of. The first is that this spending is discretionary, meaning that if demand starts to falter and/or there’s greater visibility into go-forward returns that aren’t great, these companies can scale down spending and generate massive amounts of Free Cash Flow again (the business-as-usual scenario for these companies is pretty good, to say the least). In short, the low current Free Cash Flow is a self-inflicted “wound.” Many will claim that this is true, but that everything that happens between today and this “realization period” is time through which they “burn” shareholders’ money. This is something I agree with, but that I don’t believe is as critical, so long as the problem is not existential. Could their stock prices suffer if this happens? Most likely, but it’s not like these businesses will suddenly “go to 0.”

Another thing to consider is that there’s currently a demand-supply imbalance in the industry, with most of the Big Techs seeing their capacity monetized as soon as it goes online. It also helps that three of these (Microsoft, Google, and Amazon) have some sort of captive customer (OpenAI, Gemini, and Anthropic) that gives them more visibility into the capacity they will need going forward. With this, I am not trying to claim that all the Capex being spent is inherently high-vissibility and high-ROIC, but that the solution, if the ROIC is bad, is not as terrible as many people believe it will be. A lot of people (it always happens during periods when things go up) have taken the “bubble theory” a bit too personally and are ignoring some of the caveats. Others who believe we are in the early innings may have assumed AI demand can’t falter. The truth, as always, is likely more nuanced and resides between those two extremes.

A good proxy of what might happen going forward was Meta in 2022. Back then, Zuckerberg decided to go “all-in” (tongue-in-cheek) on the Metaverse, spending significant amounts of Opex that weighed on the operating margin. Granted, these also came at a time when revenue growth decelerated significantly, but the argument back then was that “Zuck was burning shareholders’ money” and that this burn would never stop:

This was discretionary spending, so Zuck soon realized the ROIC wasn’t there (at least not yet) and cut back. The market’s reaction was to look forward and value Meta based on future cash flows, not on the money that had been burned in this endeavor. Will see what happens this time around, but it does seem the ROIC visibility is significantly higher for AI than it was for the Metaverse.

The industry map was mixed this week:

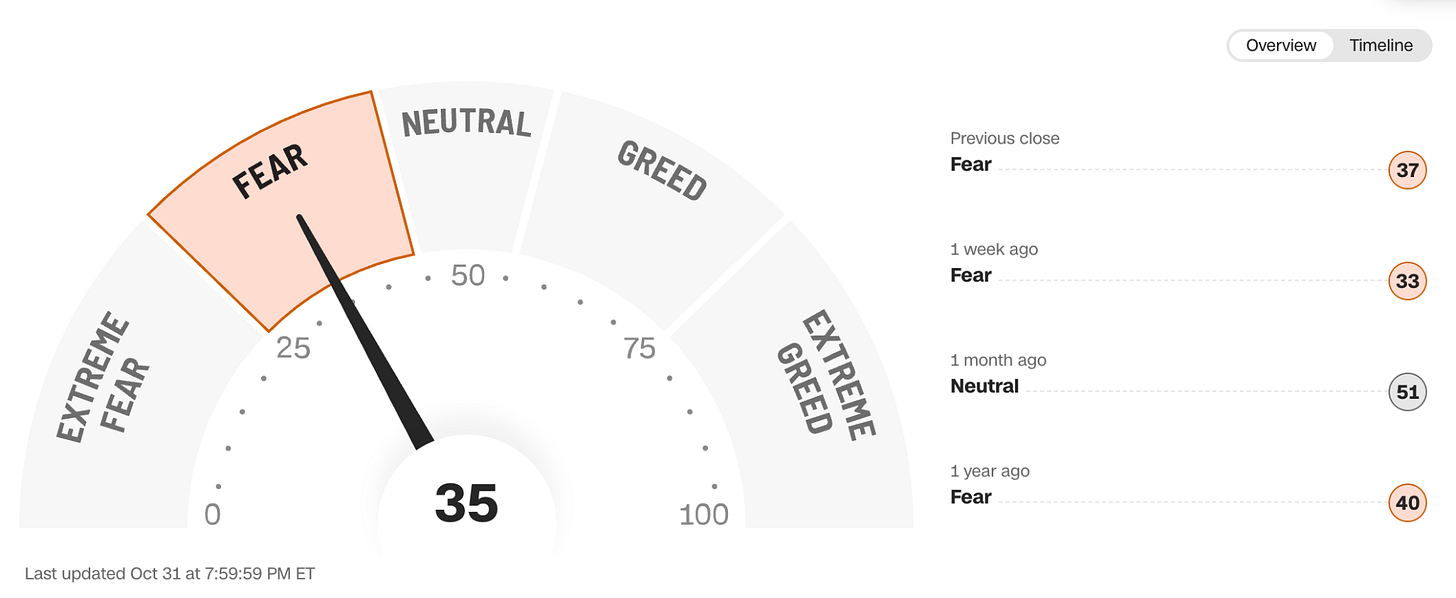

The fear and greed index improved slightly but remained in fear territory and honestly doesn’t seem consistent with what we are seeing in the market:

Several buys, one sell

I took advantage of the weakness in some of my positions this week and added to several of them. To raise funds to add to these positions, I also decided to sell out completely of a position I’ve held for more than 2 years. I still believe it’s a high-quality company, but it had become a tiny portion of my portfolio, and I didn’t see myself adding at current prices.