Is Andy Jassy a good CEO again?

Amazon's Q3 2025

Amazon reported good earnings yesterday, with the stock up significantly today:

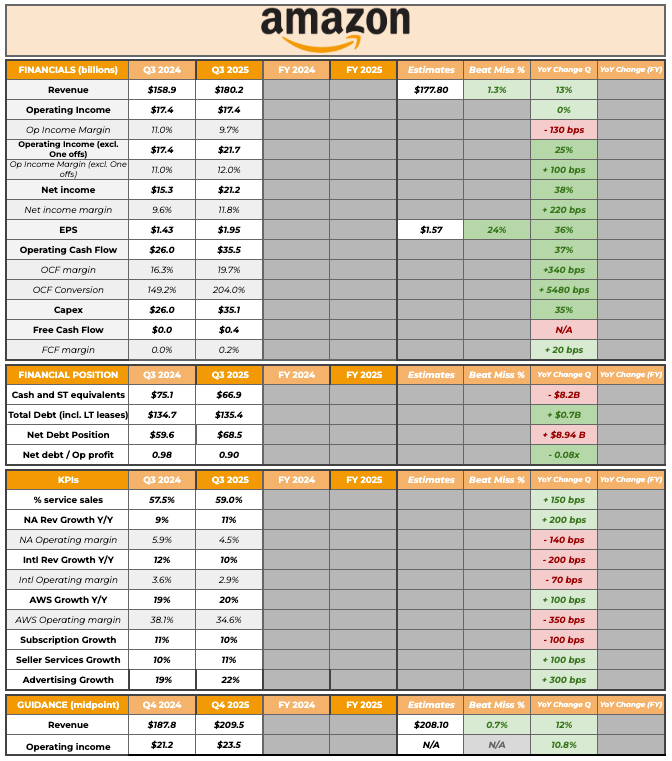

Let’s start with the headline numbers, and we’ll go more in-depth later into AWS and other highlights. Amazon generated $180.2 billion in revenue in Q3, up 13% year over year (in constant currency) and beating analyst estimates by 1.3%. This puts Amazon at a whopping $720 billion run rate, growing double-digits. This is the place in the article where I would put a screener showing that there are very few companies capable of growing at this pace and scale, but I’ll save you the time: there’s none.

There were several moving parts in profitability, so we should be careful taking the numbers at face value. I found this post on X quite funny:

The person claims that “nobody reads earnings reports,” but conveniently ignores the one-off headwinds to operating income. He even claims in one of the replies to the post that “operating income was flat YoY,” which is evidently not true when one accounts for the one-offs. This is a clear case of: “I’ll take the numbers that fit my narrative.” Operating income was $17.4 billion, but included two one-off impacts:

A $2.5 billion FTC settlement

$1.8 billion related to severance costs

Excluding both, operating income would’ve been $21.7 billion, growing 25% year over year. I sometimes love the irony on X… someone can call others stupid for not reading earnings, only to make it blatantly obvious they didn’t read them either! Now, he is not wrong. Because Amazon uses the equity method to account for several investments in other companies (Rivian, Anthropic…), net income or EPS is not the best metric. Ignoring the one-offs here, what seems evident is that Amazon continued to grow at double-digit rates while expanding margins.

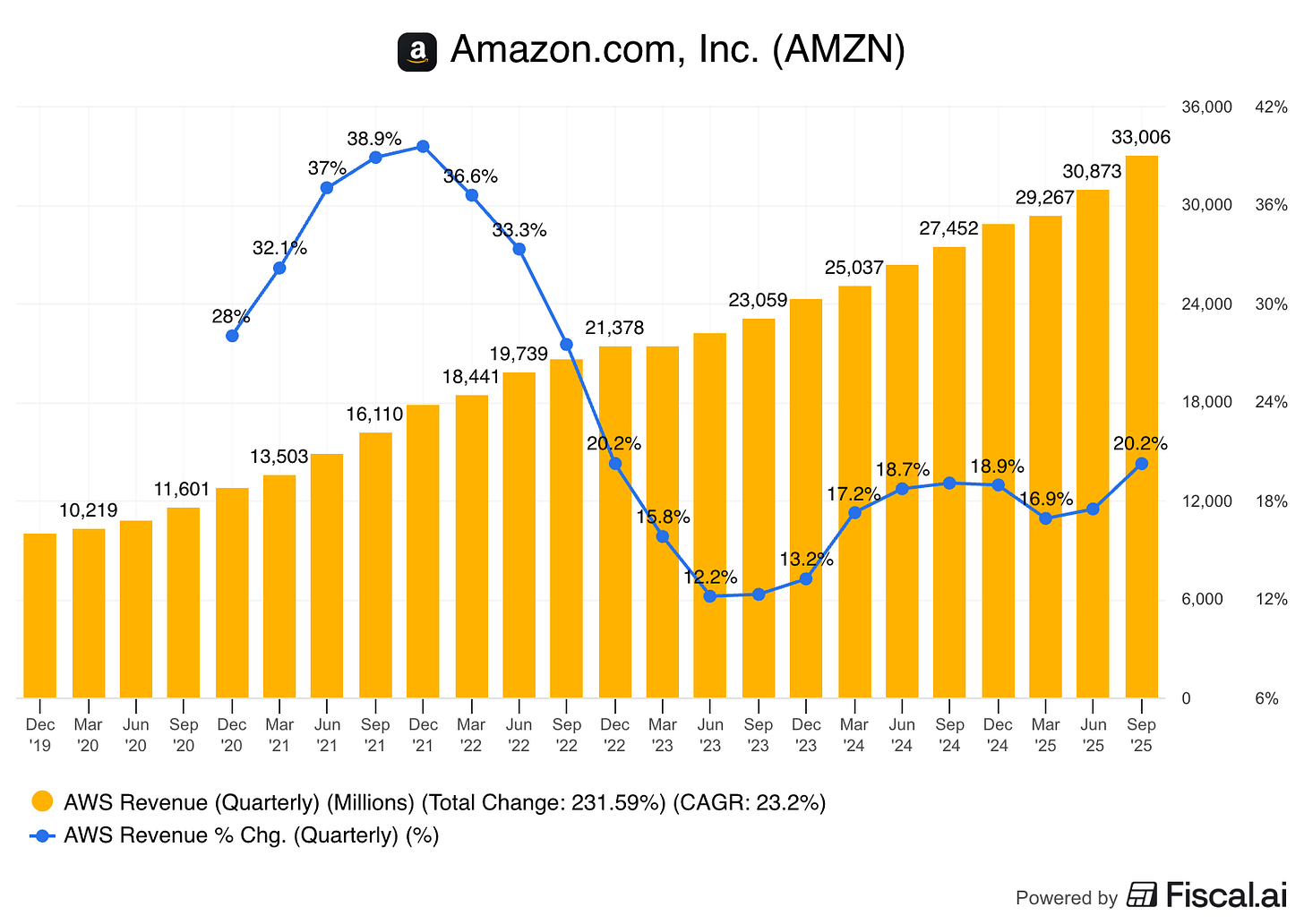

Let’s now look at the different segments, starting with what is probably driving the current market reaction: Amazon Web Services (AWS). Many (like SemiAnalysis) had projected that AWS would accelerate, driven by Anthropic; this did happen, but to a greater extent than many had envisioned. AWS grew 20.2% in Q3, accelerating almost 300 bps sequentially and posting its strongest growth since Q4 2022!

Note that AWS generated $21 billion in revenue in Q4 2022, and it’s now posting the same growth rate despite generating 54% more revenue. Andy Jassy took the occasion to somewhat “dunk” on AWS competitors and Wall Street’s obsession with constantly comparing growth rates:

“It’s very different having 20% year-over-year growth on a $132 billion annualized run rate than to have a higher % growth rate on a meaningfully smaller annual revenue, which is the case with our competitors.”

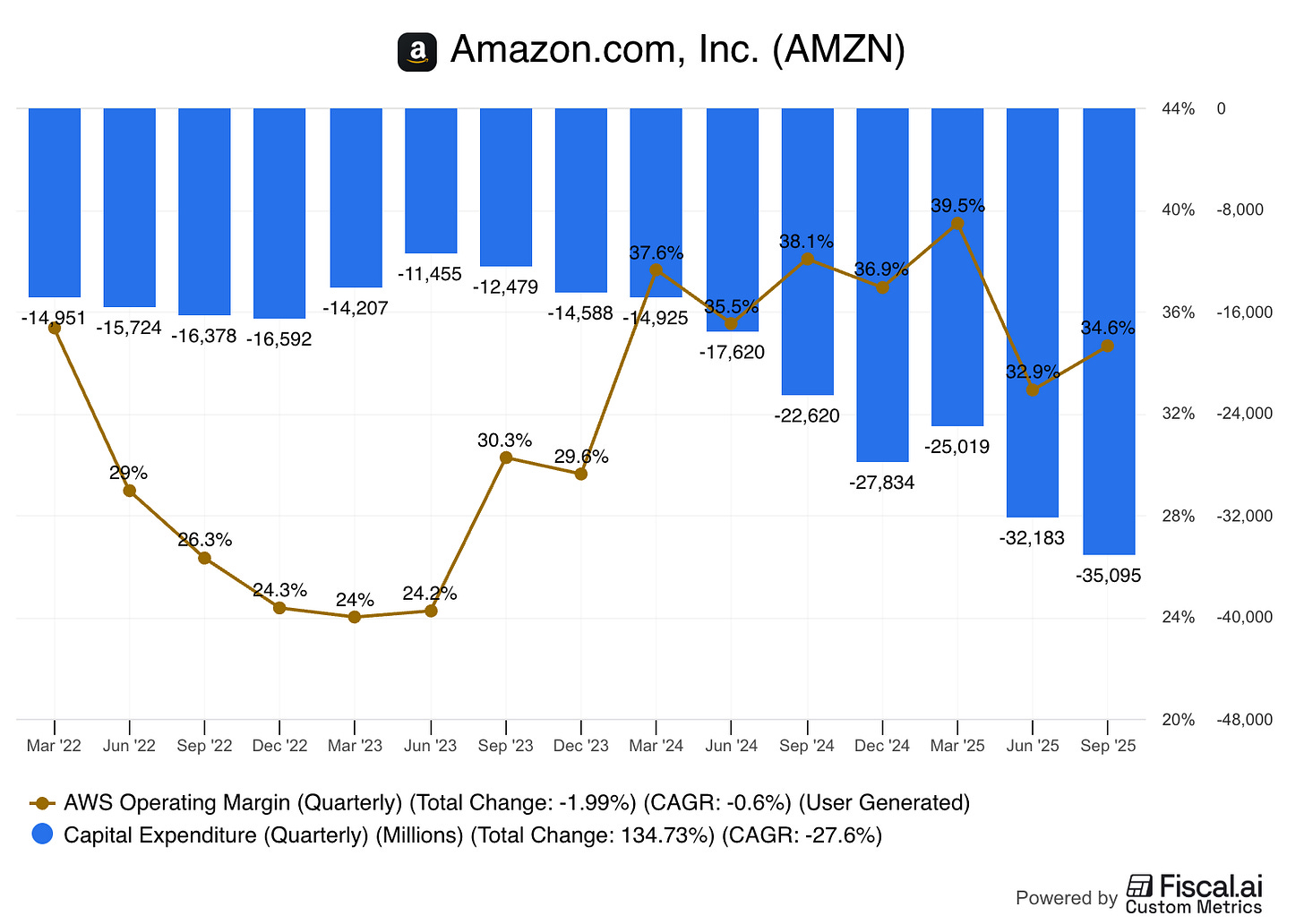

Margins for AWS dropped for the second quarter in a row, but we must not forget how useful lives have changed and how this impacts margins. Let’s take a look at the following timeline…

January 2022: Amazon increases the estimated useful life of its servers from 4 years to 5 years

January 2024: Amazon increases again the estimated useful life of its servers from 5 to 6 years

Both of these changes reduce depreciation expense and expand margins. However, in January 2025, Amazon rolled back some of these changes (reducing the useful life for a subset of servers and networking equipment from 6 to 5 years). This means that in 2025, AWS is facing a depreciation headwind to margins, which is further aggravated by an accelerated investment pace.

One can agree or disagree with 5 years as an appropriate depreciation schedule for servers and networking equipment, but what one can’t deny is that, among hyperscalers and Meta, Amazon has the most conservative depreciation schedule. This might be a blow to margins, but it might set Amazon closer to economic reality.

One thing that I believe is fair to say is that the competitive advantage of the hyperscalers (Google, Amazon, and Microsoft) might have shrunk slightly over the past few years. One still needs trillions of dollars in investment to compete with the hyperscalers, but with the current inflow of capital going into AI, these amounts don’t seem as out of reach as they did before.

All this said, contrary to the popular belief making the rounds over the last few months, AWS is doing fine. There were several highlights during the call. The first one is Trainium. Andy Jassy mentioned that Amazon’s Trainium2 chip is “fully subscribed, and is now a multi-billion-dollar business that grew 150% quarter-over-quarter.”

Even though this looks like great news (it is), we must not forget that Trainium2 is heavily skewed toward Anthropic and that Amazon has a significant stake in Anthropic (not really a very difficult customer to sell chips to!). However, there was more. Andy Jassy mentioned that Amazon expects to accommodate more customers starting with Trainium3.

“We have a lot of customers, both very large and I’ll call it medium size, who are quite interested in Trainium3.”

This is great news because it somewhat validates Amazon’s Trainium chip platform. AWS has gotten “heat” for leaning too much on its Trainium chip, but Andy Jassy claimed they also work with NVIDIA, AMD, and Intel, and that customers are free to choose among chips. Given Amazon’s considerable stake in Anthropic, the company may not be as “free” in its decision-making, which is precisely why the Trainium3 news is so positive.

Something Andy Jassy mentioned is that the current bottleneck is not chips but power. He did, however, claim that the bottleneck might soon jump to chips (something that bodes well for semicap in general). Even though I’ve been “wrong” (in all honesty, I’ve not had a strong opinion) on Nvidia for a while, I find it quite interesting that pretty much all of its long-time customers are either (1) working on competing solutions or (2) trying to lower the dependency on their chips. I don’t deny that Nvidia is best in class today, but this isn’t a place I would want to be while posting 70%+ gross margins.

Another highlight from AWS (and I promise it’s the last one) was backlog. Backlog grew to $200 billion in Q3, with Andy Jassy pointing out that it “did not include several unannounced new deals in October, which together are more than our total deal volume of all of Q3.” It seems like AWS continues to be supply-constrained despite adding almost 3.8 GW of capacity over the last 12 months and planning to add 1 additional GW in Q4. According to Jassy, AWS capacity will double by 2027.

I’d say there are certain things here that should give investors confidence in the “overinvestment” bear thesis (at least for Amazon). The main reason is that Amazon is monetizing capacity as soon as it comes online (i.e., there’s no excess capacity yet), that Amazon could, in theory, pull back investment should demand falter and start churning out FCF, and that Anthropic is somewhat of a captive customer. The three hyperscalers have “captive” customers (Azure with OpenAI, and Google with its own Gemini), but I don’t think the same can be said about certain neoclouds.

What’s undeniable is that Amazon has entered another Capex cycle shortly after exiting the last one (i.e., the company has deferred FCF generation once again). The judge is still out on whether these investments will bear fruit, but the fact that Amazon is monetizing capacity as soon as it comes online is good news for ROIC visibility (at least over the short to mid-term). Capex for 2025 will come in around $125 billion, and it will be higher in 2026 (probably a more conservative tone than the rest?)

Even though AWS was the clear protagonist this quarter, I think there were other interesting highlights, which I have listed below:

North America and International both grew double digits

Ads also accelerated its growth to 22%, now at a $70 billion run rate

Delivery speeds continued to accelerate in the retail segment (adding 3-hour delivery in some cities), which had a positive impact on several categories. Everyday Essentials grew nearly twice as fast as the rest of the business and grocery is already at $100 billion in Gross Merchandise Value (3rd largest grocer in the US), even without counting Whole Foods and Fresh

Customers are 60% more likely to complete a purchase when using Rufus (the AI assistant), which has 250 million customers with MAUs up 140% YoY

With the feature Buy For Me, Amazon is going to be able to purchase goods from other merchants for customers (i.e., on pace to become the one-stop shop)

Expanded the number of Kuiper satellites in space to 150

Think that it’s also worth listening to what Andy Jassy said about the recent layoff announcement. It seems like Amazon was slowly transitioning to Day 2, but Andy Jassy decided to go back to Day 1:

“What I would tell you is the announcement that we made a few days ago was not really financially driven, and it’s not even really AI-driven, not right now at least. It’s culture.”

All in all, great earnings by Amazon despite all the negativity the stock had seen recently (go figure). I will obviously continue to hold my position.

Have a great day,

Leandro

So glad to be a psychological long on AMZN! 😌