A New Market Structure? (it ain't like it used to be) (NOTW#74)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

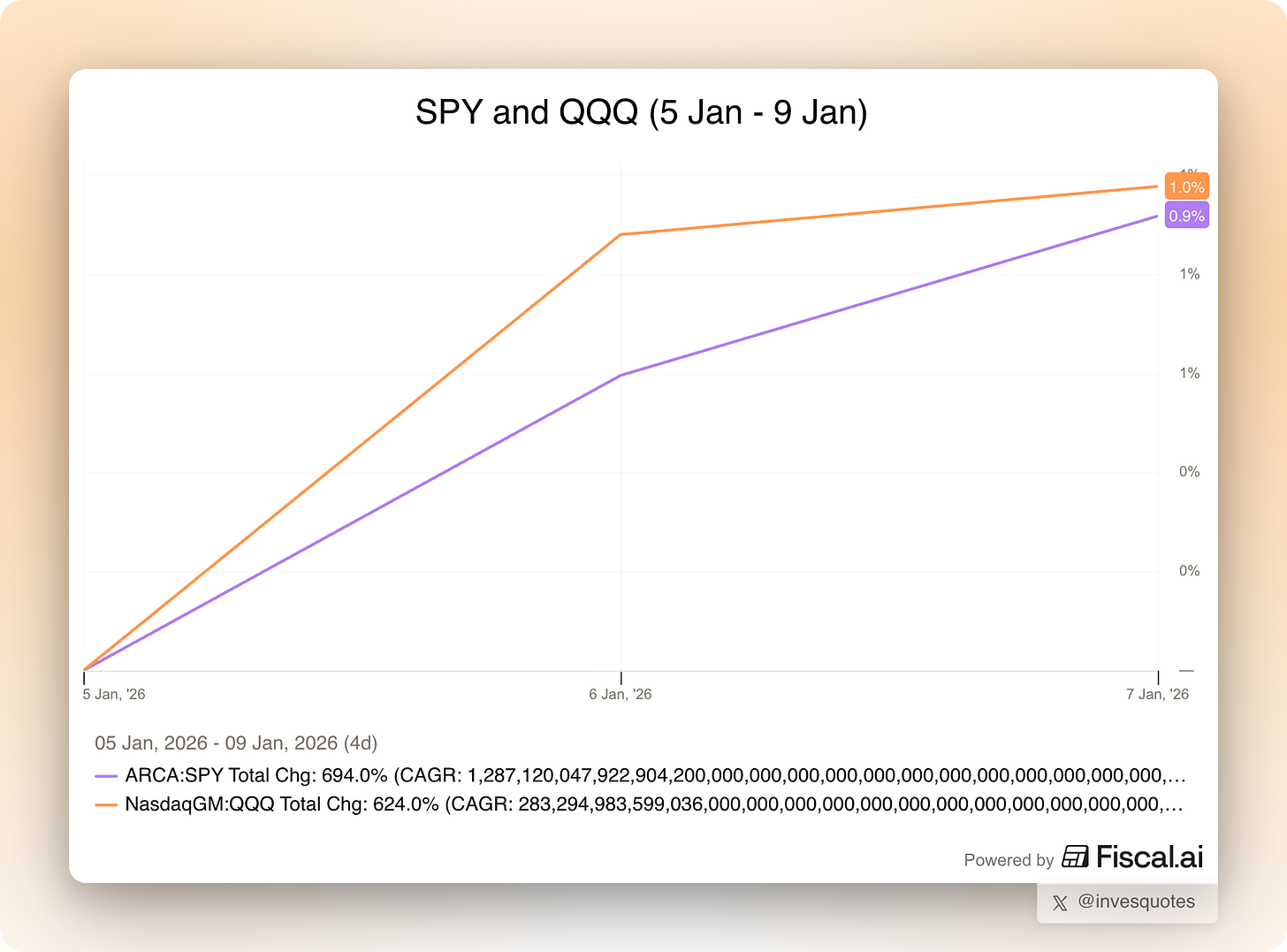

Both indices were up this week while investors remain undecided whether 2026 is a year to be long semis/AI, or if it’s a year to benefit those sectors that did not work last year (still TBD!). I share some comments on current markets in the brief market commentary.

Articles of the week

I published one article this week: the 2025 annual recap.

It was a weird year, but I believe it has positioned both Best Anchor Stocks and the portfolio for a great 2026. I go over several topics such as:

An overview of Best Anchor Stocks in 2025

A quick look at the portfolio in 2025 (returns)

The 2025 podium of errors

My top picks for 2026 (exclusive for paid subscribers)

Commentary on all the portfolio companies (exclusive for paid subscribers)

2026 is off to a great start, but of course several trading days say nothing about how the year will unfold (and if it did, it’s irrelevant). I’ll go over this topic in more detail in the next section.

Market Overview

Both indices were up this week, with investors still undecided about whether AI is going to be the topic of this year or maybe it’s a year for those sectors that have lagged to shine:

It was an interesting start to the year. The markets (and many stocks, which is not the same thing judging by how concentrated markets have become) were off to a great start. I must say that I was very surprised to see so many people start posting screenshots with their 2026 YTD returns after (checks notes) 4 days. Investing is a marathon, not a sprint, but surely some people try to run as fast as they can. Not claiming that’s bad, fyi!

There’s a famous quote in football (it shouldn’t be called “soccer”, by the way) that claims that 90 minutes in the Bernabeu (Real Madrid’s home stadium) are very long. The author of this quote was Juanito, a famous Real Madrid player who after coming back against Inter Milan in the Bernabeu decided to coin it in italian: 90 minuti en el Bernabeu son molto longo. I would paraphrase this quote for the investing world: one year in Wall Street is very long!

If the past few years have proved anything is that the market can humble investors (or conversely, invigorate them) pretty fast. Narratives seem to be the sole driver of returns over the short to medium term (in the long-term, that’s fundamentals) and these narratives, far from being based on conviction and deep research, are typically based on false illusion and momentum (which is also not surprising considering that markets are forward looking). In 2025 we were able to experience how quickly multi-hundred-billion companies like Alphabet or ASML went from the wrong side of the narrative to the “correct” side of the narrative, all despite their fundamentals not changing one bit! This, by the way, is not a “complaint” but rather the admission that markets might have changed (and that, as long-term investors, we should be aware and adapt). What once was driven by fundamentals is now driven by momentum and flows. Momentum and flows are not new, but it does seem that they are having an outsized impact over the last couple of years.

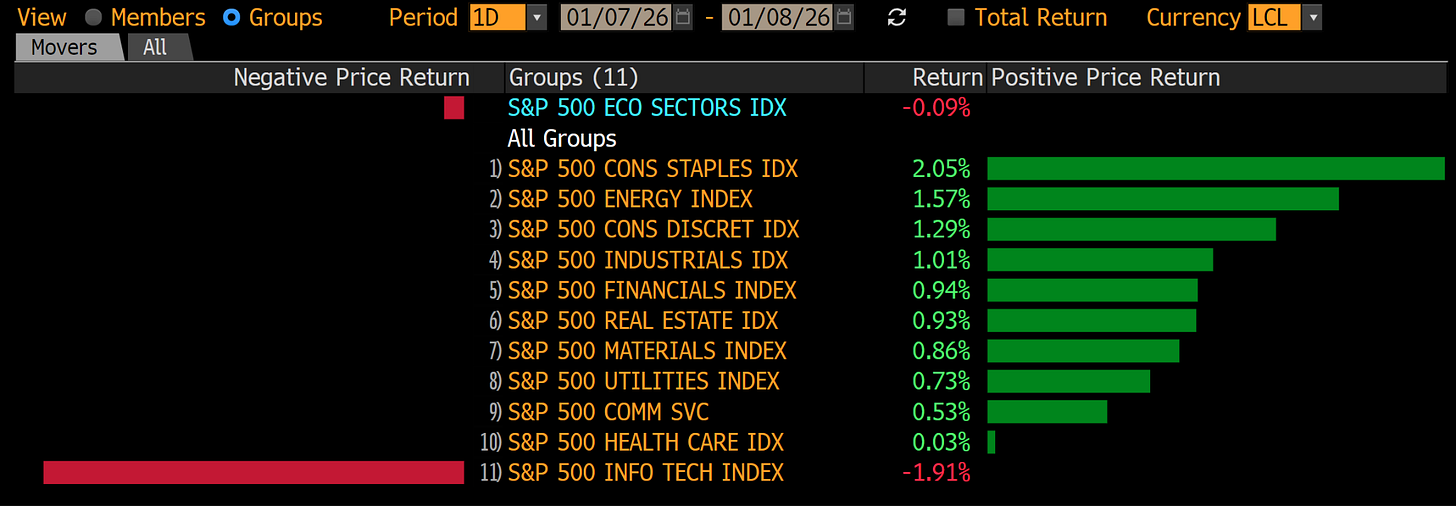

Should investors adapt by changing their investment style? The quick answer is “no” because fundamentals end up mattering sooner or later, but it doesn’t hurt anyone to be aware of how markets have shifted. The goal should be to try to make this new market structure become a tailwind rather than a headwind. A quick look at the daily performance across different market segments should help us understand that stock prices over the short term are driven by all but fundamentals. 2025 was a year in which tech (understood as AI and semis) was up pretty much all the time and pretty much everything else was red or weak. We have had one day this year in which it was the opposite (signs of what’s to come? we’ll see):

How are both things related? I mean, why should a healthcare stock’s “intrinsic value” decrease when Nvidia’s “intrinsic value” increases? This is obviously a rhetorical question because I don’t think they are related, but there might be an algo that has learned that a good Nvidia performance is bad for healthcare. Should this algo try to catch “what is going up,” then it’s logical to think that it would sell “what’s going down or not working.” Tell anyone that a rise in Nvidia’s stock price is bad news for Stevanato and they might call you stupid. While I would agree with their categorization, it seems hard to deny that this is how things work nowadays in the market. Does this mean that Nvidia and Stevanato can’t both do well over the long-term? Not at all, but it should help contextualize short-term movements and maybe not overobsess with them.

The industry map was mixed this week although it was predominantly green:

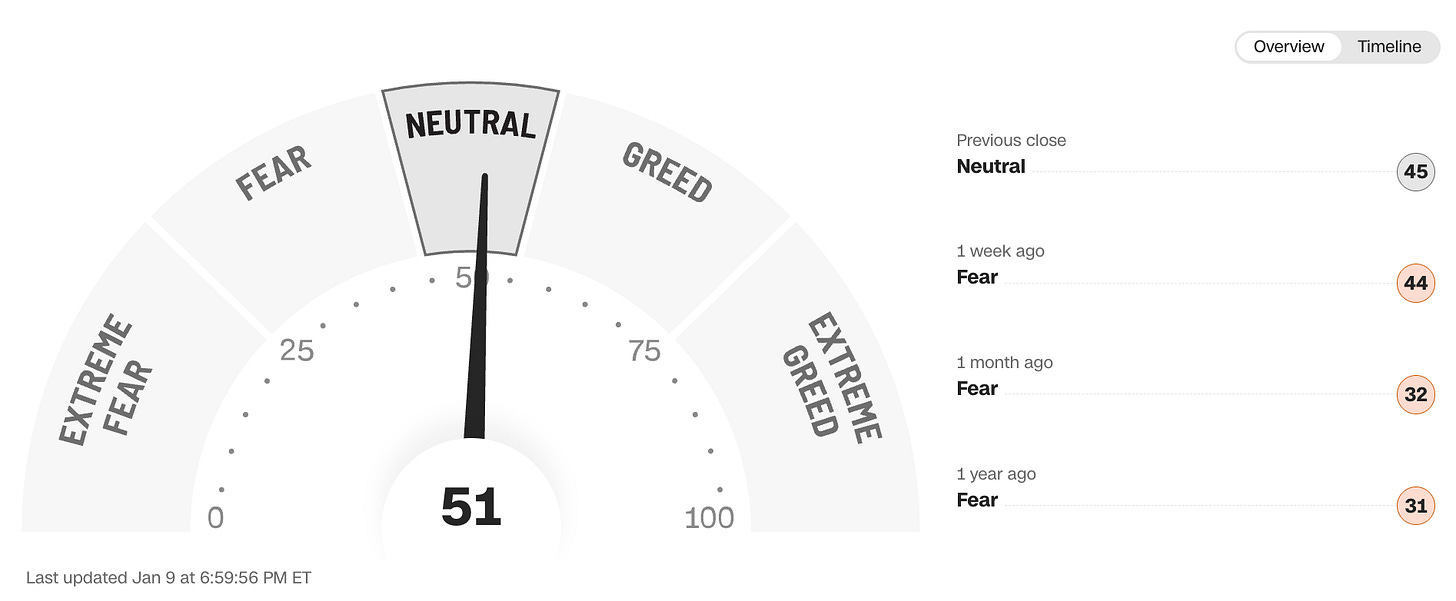

The fear and greed index remained in neutral territory this week, which is strange considering that I’ve seen at least 20 to 30 accounts already sharing YTD performances one week into the year!