Annual Recap 2025

Another year, and another annual recap. You can read past annual recaps here:

In this year’s annual recap, I’ll go over the following:

An overview of Best Anchor Stocks in 2025

A quick look at the portfolio in 2025 (returns)

The 2025 podium of errors

My top picks for 2026 (exclusive for paid subscribers)

Commentary on all the portfolio companies (exclusive for paid subscribers)

I am not discovering anything when I say that 2025 was a crazy/hectic year (seems like it has been this way over the past 5 years at least). After a very strong 2023 and 2024 for the US indices, many (myself included) expected a rather weak 2025. This is what I wrote last year (at least I covered my bet by claiming that it’s unforecastable!):

Despite the lack of historical basis to claim that the third year after back-to-back strong gains will almost surely be bad, many people believe that this outcome is 100% certain. If I had to guess, I’d say that 2025 leans more into a bad year than a good year, but what do I know?

Investors experienced all kinds of emotions during the year. Markets went from greed at the beginning of the year, to extreme fear during the tariff tantrum, back to extreme greed after Trump rolled back some of his tariff and geopolitical threats. I don’t know if this is a cyclical phenomenon or not, but it does seem that the rise of social media and algorithmic trading has resulted in large emotional swings in financial markets (and the resulting noise in platforms like X). Investors can now go from thinking it’s the end of the world to thinking that we are invincible in a matter of days. Many believed that data and algorithmic trading would make markets more efficient, but maybe it went the other way around (at least for long term investors).

Fundamentals don’t change as stock prices do, which means that dislocations between price and value are becoming more common, but also more short-lived. I calculated the dispersion from high to low for the companies in my portfolio (calculated as high/low-1) and the results are staggering, albeit something I expected. The average dispersion from high to low of the companies in my portfolio this year was a whopping 74%! The tariff tantrum probably drove the increase in this metric from 44% in 2024. Even though not all drastic changes in the values of companies are unwarranted, I don’t think that such widespread volatility is normal (and I don’t own, on average, small companies).

The evolution of the fear and greed index this year is a good illustration of this dynamic:

An overview of Best Anchor Stocks in 2025

It was a pretty good year for Best Anchor Stocks in terms of readership and reach (I’ll talk about the returns of the portfolio later). Free subscribers did not double like last year (+44%), but ARR (Annual Recurring Revenue) did double (+110%). I focused on providing more value to paid subscribers, so I think it’s normal to see ARR up considerably more than free readers (albeit I must say there’s considerable value for free subscribers as well).

I published 176 articles in 2025 and I tried (and hopefully succeeded) on focusing more on quality than on quantity. If you are a long time Best Anchor Stocks reader, you’ll know that I usually publish three main types of articles:

News of the week: weekly updates published on Saturdays were I share some brief market commentary and also share news related to the companies in my portfolio

In-depth reports: I consider this to be the core of Best Anchor Stocks

Follow-up (and other) articles on companies I follow: even though I don’t consider this to be the core of Best Anchor Stocks, there’s considerable value to be found here as they nicely complement the in-depth reports

I’ve profiled the following businesses this year:

Resmed (not really an in-depth report but a good overview)

Note that profiling a business doesn’t necessarily mean that it makes it into the portfolio. My objective is to profile good businesses that have a high chance of making it into the portfolio, but this is rightly not always the case. I expect to profile a new business in January that might or might not make it into the portfolio (still undecided). Remember that I’ve published two in-depth reports for free that should serve as a sample: Deere and Stevanato Group.

Several articles performed exceptionally well in terms of views and engagement in 2025. In case you want to re-read these or in case you missed them, here’s the top 5 (not considering the in-depth reports):

I’ve also done two things to make all the content more “findable.” The first one was creating a 132-page comprehensive PDF with my most popular investment-related articles. This should serve as a guide to how I think about investing.

The second one is tagging the entire website so one can easily navigate to any company that I’ve covered or written about:

Over time, I’ve covered the following companies:

AAON

Adobe

Amazon

ASML

Atlas Copco

Copart

Constellation Software

Deere

Diageo

Danaher

Five Below

Shift4

FRP Holdings

Intuit

Judges Scientific

Keysight Technologies

Medpace

Nintendo

Resmed

Stevanato

Trupanion

Texas Instruments

Zoetis

You can expect many more in 2026. Let’s talk about the portfolio now.

The portfolio in 2025

The Best Anchor Stocks portfolio (i.e., my personal portfolio) did not do particularly well in 2025 (no sugarcoating it). The portfolio returned 5% in 2025 (in dollars) significantly lagging both the S&P 500 (+17%) and the MSCI World (+22%). I believe the MSCI World is a better benchmark for my portfolio due to its geographical exposure. The portfolio ended the year with the following weights across geographies (countries of listing):

United States: 47%

Canada: 12.7%

Italy: 9.1%

Japan: 7.2%

UK: 4.5%

Sweden: 3.9%

France: 2.1%

It’s pretty diversified geographically but this is not something that I strive for but an outcome of the companies that I have come to like over time.

My 2025 returns were heavily impacted by several things. First, I am not heavily exposed to the AI-trade which drove markets this year (especially in the US). This is not an excuse but actually the admission of a mistake: I should’ve been more exposed. Now, I do believe there are other sectors that are more appealing right now, and this belief resulted in underperformance this year.

The second thing that impacted returns was that three of my largest positions got swept into narratives that significantly impacted their returns during the second half of the year. One could also argue that this was a mistake on my part (“should’ve seen the narratives coming”), but I believe these narratives do not hold themselves (and I’ve explained why in the past). Just for context, these three positions went from (returns from my cost basis)…

+42% to flat (this company is, in my opinion, significantly undervalued)

+100% to +24% (this company was fairly valued at the top and is undervalued today)

+144% to +45% (this company was somewhat expensive at the top and is now undervalued)

These sharp reversals obviously weighed on my 2025 returns. The fact that there’s an arbitrary cut at the end of the year (and maybe the fact that there was some tax loss harvesting involved) makes 2025 returns look bad, but I believe that the portfolio is pretty cheap coming into 2026 and I expect this to be a pretty good year (albeit there are many things that I can’t control). I am pretty frustrated with the performance this year, but very confident in go-forward returns.

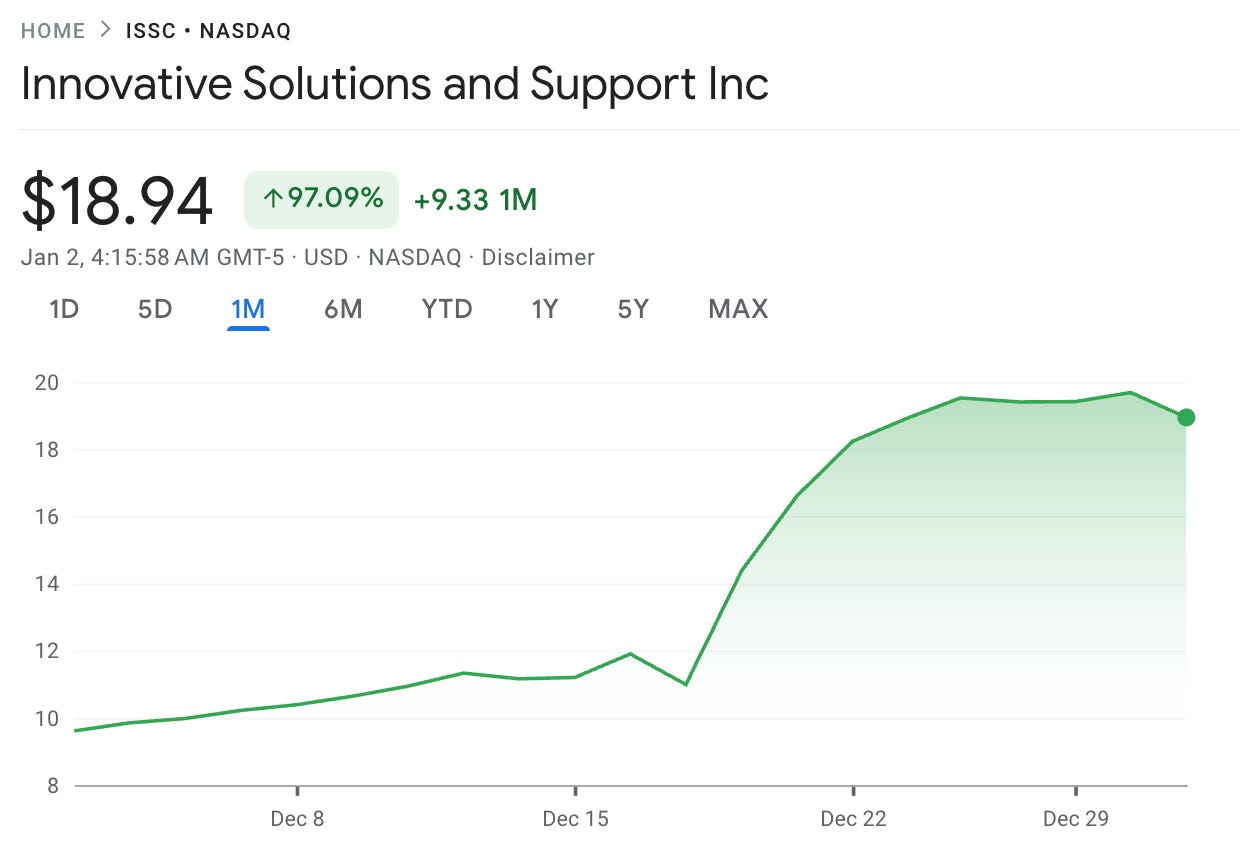

To end the year on a more frustrating note, at the end of November I started looking into a company called Innovative Aerosystems (ISSC). Despite not being the highest quality company I have ever encountered, it was the first time in many months that I was liking a lot of what I was seeing. Instead of buying a small position as I continued my research, I decided to finish it before, thinking that the stock would not skyrocket and that I might even get a better opportunity down the line. Turns out it did skyrocket!

These things are unforecastable and there’s a lot of luck involved, but it added to my frustration this year. Nevertheless, I gain comfort knowing that I was close to finding something like this because I’ll eventually profit from it if I continue to look in these ponds.

Since I started Best Anchor Stocks, the portfolio has underperformed the MSCI World, but it has also had periods of significant outperformance. Funnily enough the portfolio was strongly outperforming in June but what I discussed earlier sent it into underperforming territory. Things can swing very fast:

This is not a bug but a feature of my portfolio; it’s the outcome of concentration. For context, my top 5 positions currently make up 40% of my portfolio and the top 10 make up more than 70%. I’m fine with suffering periods of underperformance if I believe the portfolio goes into these being very cheap (which I do). Of course, I’ve also made mistakes, and this resulted in a pretty interesting podium of errors in 2025.

The podium of errors

The 2025 podium of errors is somewhat special. This was the podium of errors in 2024:

Gold medal: TSMC (omission)

Silver medal: Five Below (commission)

Bronze medal: IBKR (omission)

I learned a very important lesson from the performance of these companies in 2025: one can make the same mistake twice (and in opposite directions!). We should always reconsider past mistakes and never rule them out just because (a) we’ve “missed” them in the past (omission), or (b) we apparently made a mistake of commission. My 2024 mistakes considerably outperformed the indices in 2025:

TSMC: +51%

Five Below: +90%

IBKR: +41%

I never thought that I would be standing here today saying that the podium of errors of 2025 would come from not looking closer into the podium of errors of 2024! I honestly thought I was too late with TSMC and IBKR (I wasn’t) and believed the problems Five Below was facing were structural (they weren’t). Investing is a continuously humbling experience and I found out again this year. These mistakes, by the way, hurt more knowing that I got a very good opportunity to buy all three of these during the April tariff tantrum (although in fairness there was no shortage of opportunities then).

In the following section I want to go over what I hope will be the podium of successes in 2026.