A New Conflict (What a 5 years!) (NOTW#47)

Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Another week…and another significant geopolitical event! I discuss what happened this week, how the last 5 years have been like a master's degree for any investor, and why forecasting the market is so hard.

Without further ado, let’s get on with it.

Articles of the week

This week, I published my in-depth report on Trupanion (TRUP). The company has multiplied its revenue 36-fold over the past 14 years, achieving a 31% compound annual growth rate (CAGR), while still having significant growth opportunities ahead. This said, there are certain things that an investor should be skeptical about. As a company that’s not widely followed (despite its impressive growth), I was surprised by the engagement the article received in terms of people reading it and sharing their thoughts privately with me.

Trupanion (TRUP)

Welcome to a new Best Anchor Stocks in-depth report. This month I decided to look into Trupanion (TRUP), a pet insurer that operates primarily in North America and has multiplied its revenue by 36 over the last 14 years (31% CAGR)

Subscribers to Best Anchor Stocks now have access to 12 in-depth reports (two of which can be read for free):

Deere $DE (free)

FRP Holdings $FRPH

Five Below $FIVE

Diageo $DEO

Hermès $HESAY

Atlas Copco $ATCO.B

Stevanato $STVN (free)

Keysight $KEYS

Zoetis $ZTS

Judges Scientific $JDG.L

Medpace $MEDP

Trupanion $TRUP

For my next in-depth article (not a report per se), I will likely write about an industry that has performed well in the US and what we can learn from it when applied to another country where the industry is much less developed (in some sense similar to Trupanion).

Next week, I will publish an earnings digest on Adobe (ADBE), which reported earnings on Thursday.

Market Overview

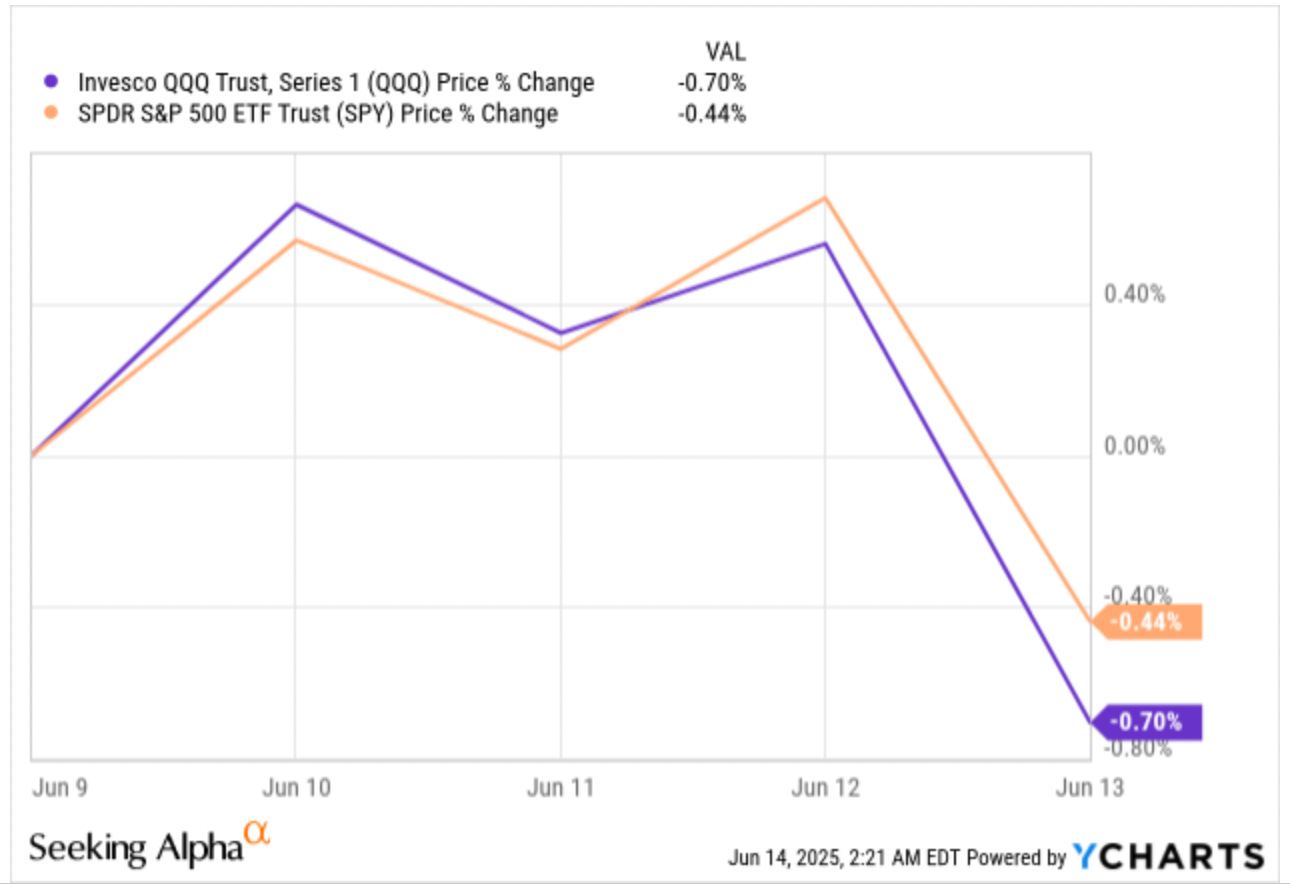

The indices were slightly down this week, with most of the drop happening on Friday:

So the question is: what happened on Friday? Surprise, surprise, another geopolitical conflict. Israel and Iran have declared war on each other, which caused oil to spike materially and brought back fears of a broader conflict in the Middle East and inflation down the line. While witnessing geopolitical conflicts is never good, this is yet another bump in the road for investors over the past five years. Since 2020, investors have suffered…

A global pandemic

A post-pandemic bubble in financial markets

Rampant inflation following unprecedented monetary expansion

The Fed being able to control rampant inflation without the US entering a deep recession

The Russia/Ukraine conflict

The Israel/Gaza conflict

A global trade war

The Israel/Iran conflict

Three bear markets in 5 years

Many of these things have been unprecedented, which means that even though the past might be a good proxy of the future, it’s not perfect. The most interesting thing of all is that if you had told someone at the beginning of 2020 that we would face all of these events, they would have probably stayed away from the market or might have even considered shorting it! That would have been a terrible idea, since the market rose 85% during this period, illustrating once again how challenging it is to time the market, even if you get your forecasts right.

What these events created was a significant amount of volatility, which could have resulted in a lot of portfolio shuffling in many investor accounts, leading to subpar outcomes. Let’s not forget that many people who simply buy index funds (a very respectable strategy) fail to keep up with the market because they end up buying/selling at the wrong times. I was having a conversation with a friend this week about volatility, and I told him the following:

Volatility is such an interesting topic, because you look at your stocks one day and say “wow” only to forget about it the coming days. I only remember volatility because I can re-read my articles.

It’s interesting how what seems extremely relevant any given day and creates significant volatility tends to be a “nothing-burger” when looked at over a longer time frame. There’s definitely a signal in short-term news, but an investor should never forget that most of the short-term news ends up being noise! I have no idea what will happen with the Israel-Iran conflict, and even if I did, I would have no idea what it would mean for markets (the only thing I know is that there will be volatility). Many people will tell you they understand its implications, but these individuals are probably the same ones who told you that the market was doomed at the April lows and were completely wrong-footed when the markets started recovering.

If I have learned one thing over the past five years (and I think every investor has learned a great deal), is that it’s very easy to have an opinion on something, but it’s much tougher to find someone with an informed opinion. This is pretty evident when discussing individual companies. A lot of people will simply come up with a bear thesis “cliché” like “China will copy ASML’s EUV over the next 5 years” or “the Switch 2 will be a flop,” but this bear thesis is not important; what’s important is if it’s a well-reasoned bear thesis. If it is, then an investor should pay attention to it. If it isn’t, then an investor should disregard it as engagement bait. I’ve discussed the bear thesis for many companies in my portfolio with numerous individuals who clearly knew what they were talking about and added significant value. In contrast, I have also lost quite a bit of time with people who clearly didn’t know what they were talking about.

The industry map was also mixed, with some exceptions:

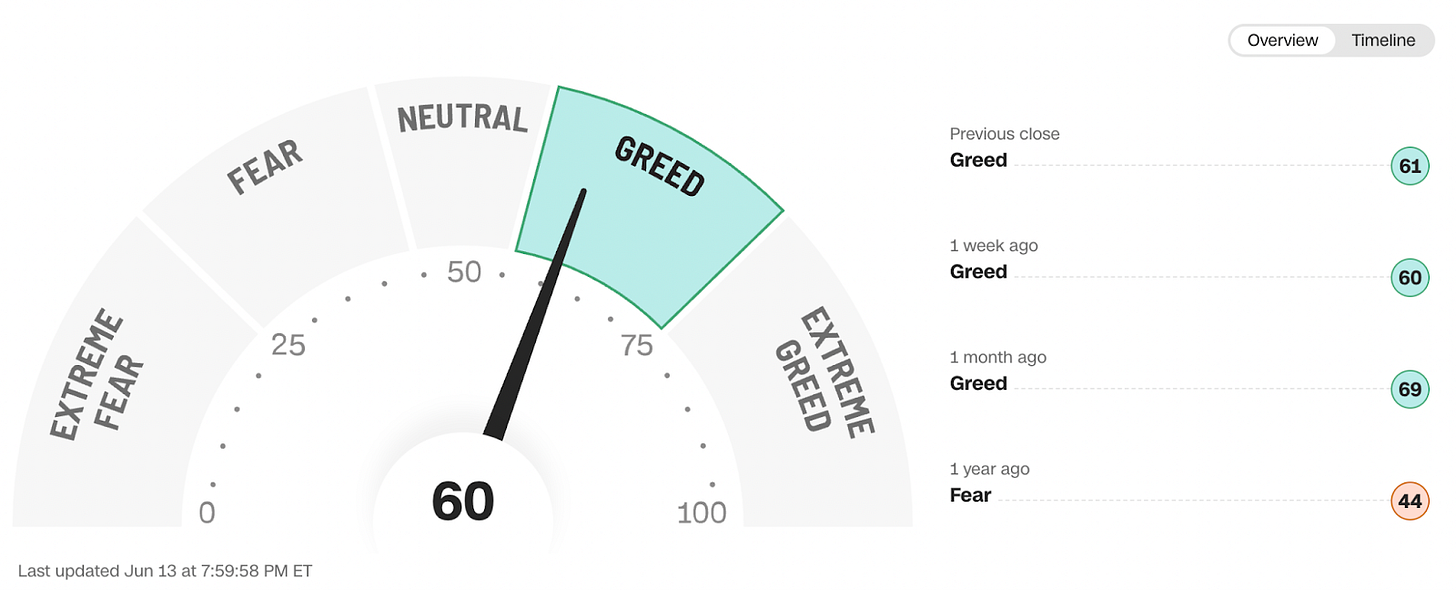

The fear and greed index remained in greed territory despite the volatility:

The rest of the content where I share my transactions (if applicable) and the news of the week is reserved for paid subscribers.