2021 all over again (?), Intuit’s earnings, and Nintendo’s dominance (NOTW#57)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

The indices were flat/down this week despite dovish words by the Federal Reserve’s chair, Jerome Powell. Many people think it’s 2021 all over again…I explain why I don’t think that’s the case, but also why I believe a similar scenario could play out (there are always plenty of possibilities in the market). I also talk in this article (reserved for paid subscribers) about Intuit’s earnings and why Nintendo is set to gain significant share in the video game market.

Brief update…I will take next week off. I feel it has been a hectic earnings season (and year in general), and I have to take a week to disconnect entirely from financial markets. I will continue reading about a company that I am liking quite a bit, but I won’t be actively writing or looking at the markets. This also means there will be no articles or news of the week next week.

Without further ado, let’s get on with it.

Articles of the week

I published one article this week: Keysight’s earnings digest.

The market just doesn’t care

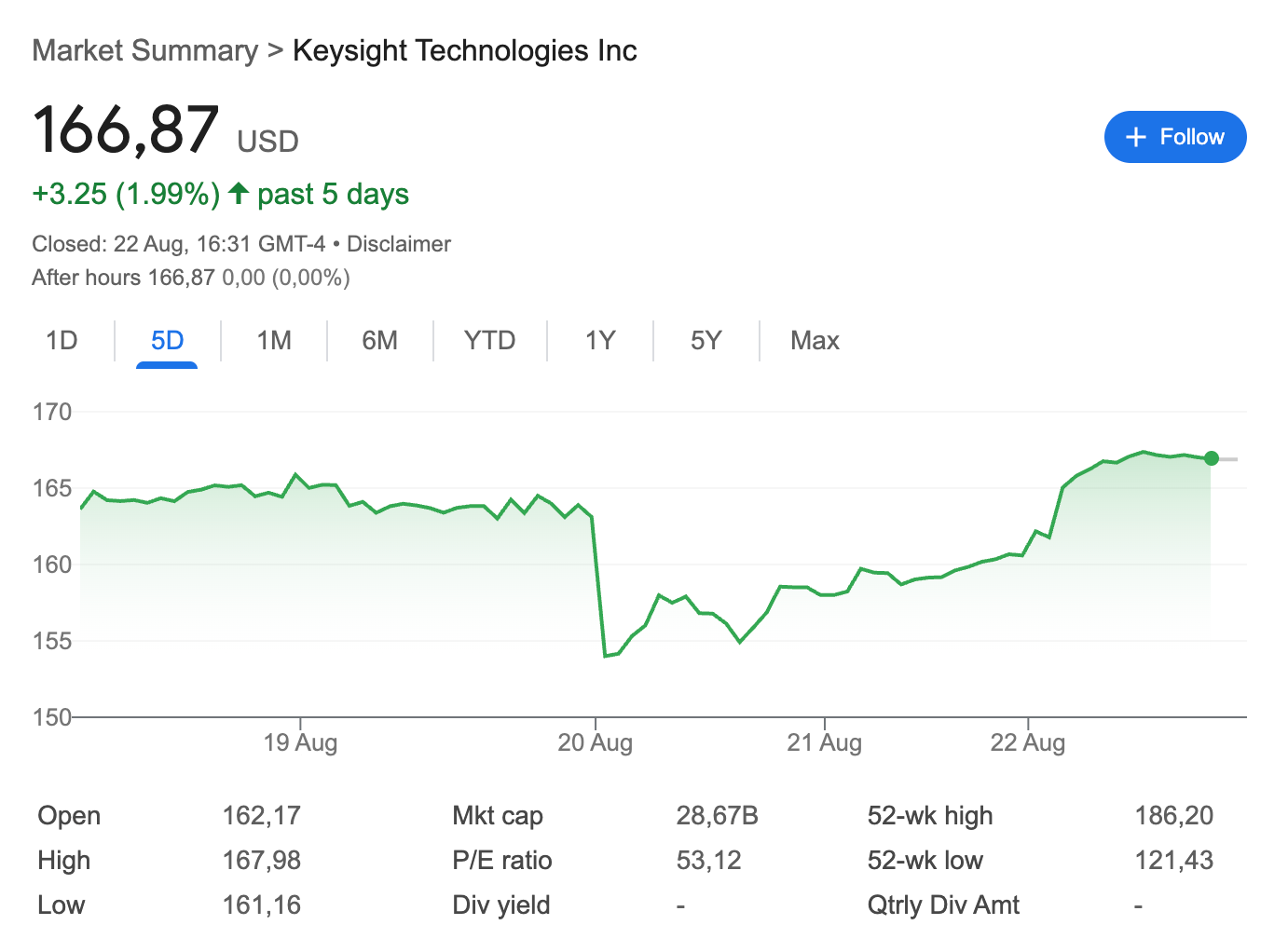

Keysight reported (again) excellent quarterly earnings, particularly in light of the current context. The company continues to outperform market expectations in the current geopolitical environment despite being exposed to the CapEx of its customers and with a supply chain that is mostly Asia-based. If you had told me that in the current climate, a CapEx and tariff-exposed company would be accelerating its growth, I would’ve probably called you crazy, but here we are!

The company reported excellent earnings (no surprise), but the market didn’t seem to like these much, and the stock dropped more than 5% the following day. In a great example of stock market volatility, Keysight recovered all of its post-earnings drop (and some more) the following days:

Intuit also reported earnings this week, and I’ll share some brief thoughts about them in the news section of this article.

Market Overview

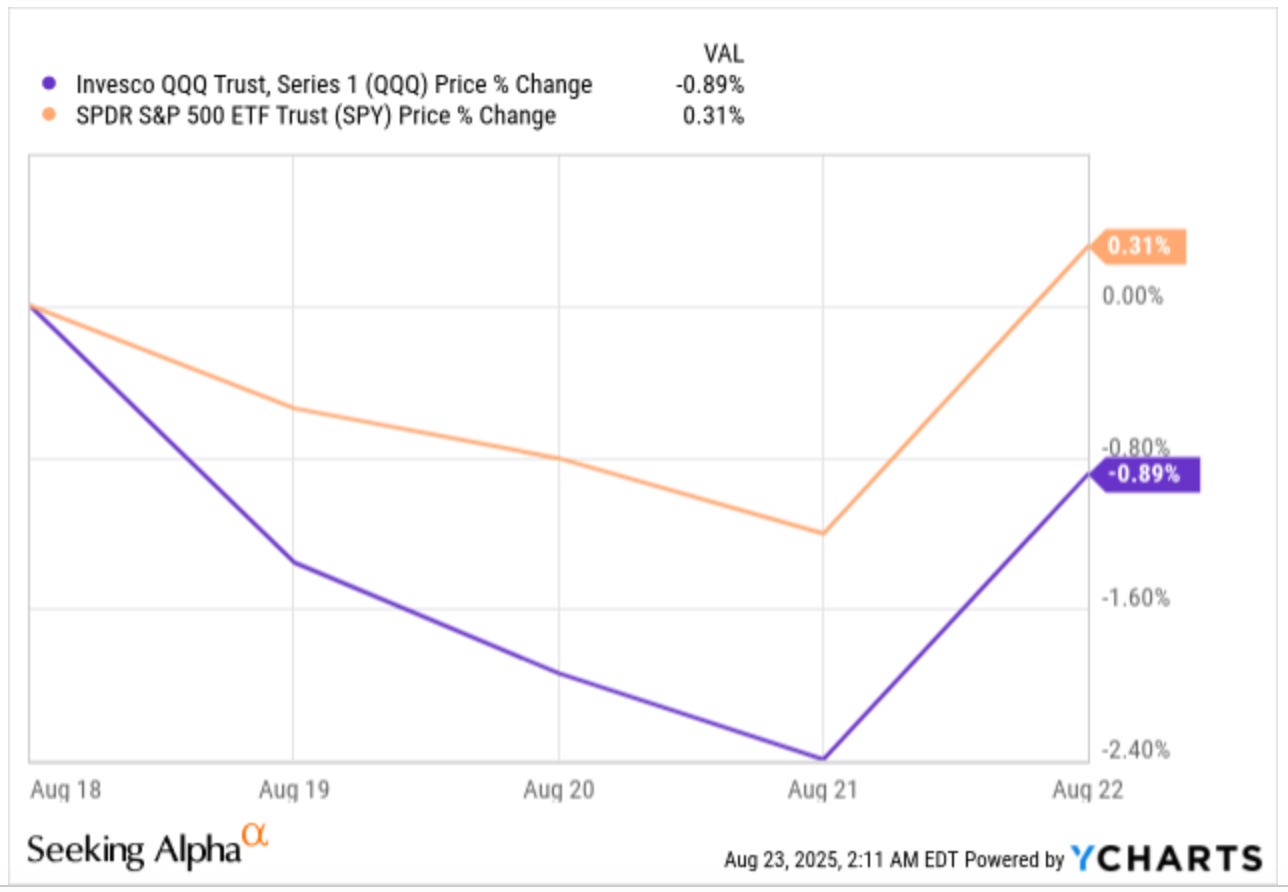

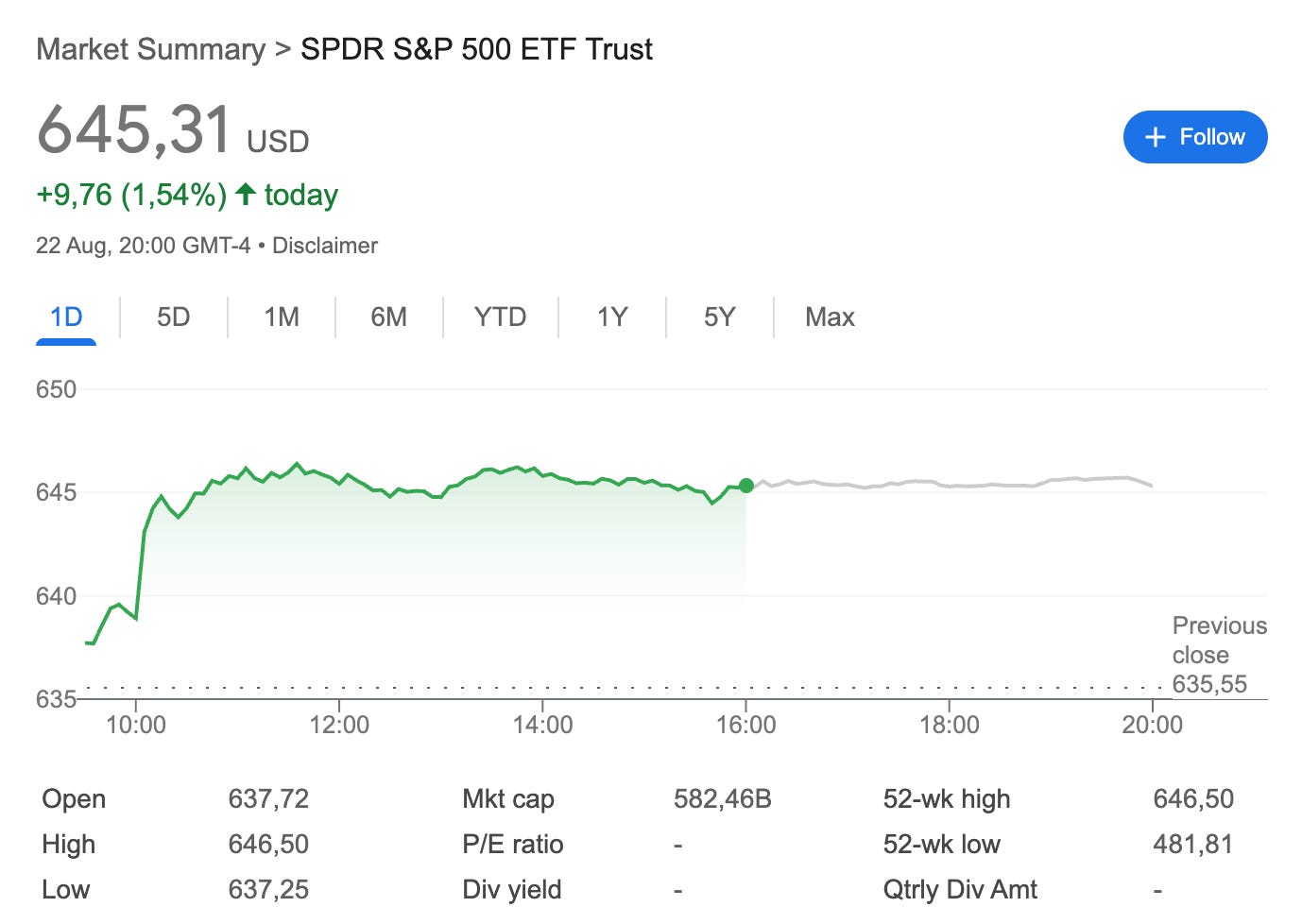

Despite the words of a dovish Jerome Powell, the indices were flat to down this week:

A lot of people (myself included) felt a heck of a lot smarter on Friday when markets soared as Jerome Powell left the door open to rate cuts and “moved” the inflation target. Both indices (and pretty much every stock in the market) shot up significantly as rate cut expectations adjusted:

I echo the words of Warren Buffett when he said that he wouldn’t change a thing he did if he knew what the Fed would do in advance. In my opinion, if the fate of your portfolio depends on what Jerome Powell decides to do with interest rates, then you are either…

Invested in highly leveraged companies

Invested in meme stocks driven by speculation

This doesn’t mean that the interest rate level doesn’t matter; it evidently does. The fact that interest rates matter for any company is very different from a 50bps change in the interest rate making or breaking an investment thesis. It’s “funny” because it seems like many market participants right now can’t take a drop, even if minor. Indices have been literally 2% off all-time highs, and people have started to claim that we are in for a very nasty pullback and that it’s 2021 all over again. While I have no clue if it’s 2021 again, I will tell you why I think it’s not and why I think it may be.

I believe two things converged back in 2021, coming out of the pandemic:

Highish valuations

Arguably inflated earnings due to the post-pandemic spending surge

Both things really meant that there were many companies (not just meme stocks) trading at absurdly high valuations, not only due to high multiples but also because growth rates were not really sustainable and therefore those multiples were based on somewhat inflated earnings. I don’t think any of these two things are present today in the broad market (they might be in some pockets). For the most part, COVID spending levels have normalized, and many companies have gone through a post-pandemic downcycle that, if anything, has derisked their earnings. At the same time, these companies are trading at below average valuations of what seem to be trough earnings. Some multiples might look highish, but the caveat is that many top lines are accelerating rather than decelerating like they were at the start of the 2021 crash. The bottom line is that (and this might be something specific to my portfolio) when I look at the top positions in my portfolio, I actually think they are pretty cheap. This is something one doesn’t tend to see when broad market valuations are elevated.

Now, this doesn’t mean we can’t have a 2021 scenario all over again. There’s no denying that some pockets of the market are dominated by speculation, with everyone wanting to jump aboard “the next big thing.” This week, I even saw a video of a guy who went to Drake’s house to “make him” buy a share of Opendoor (OPEN). The worst thing of all is that I believe this person manages outside capital. Should this frothy part of the market start to crumble, then we might see it carry over into the broader market, as many investors might go “risk off” mode.

If the speculative part of the market starts to crumble and this jumps into the broader market then valuations won’t probably matter for a while (but this time to the downside). With this I mean that even if you hold reasonably valued companies (like I think I do), we will probably see significant drops if the broad market drops. When the tide goes down some boats will go down more than others, but few will be left levitating! The fact that not many people are prepared for a crash also speaks trouble, as it will be tough to find a floor when people start to panic. Note that valuation is always a safety net, but it’s full of holes over the short term as panic (not rationality) leads the market. So, are we going to experience a 2021 scenario again? I have no clue, but there are reasons to believe that we can have one (everything is possible in financial markets), even if the environment is (imho) very different to what it was back then. An investor should always be prepared for what can happen in financial markets and shouldn’t take too much of a strong view on general sentiment because it can shift fast and in unexpected ways.

Despite Friday’s rally, the industry map was somewhat mixed this week:

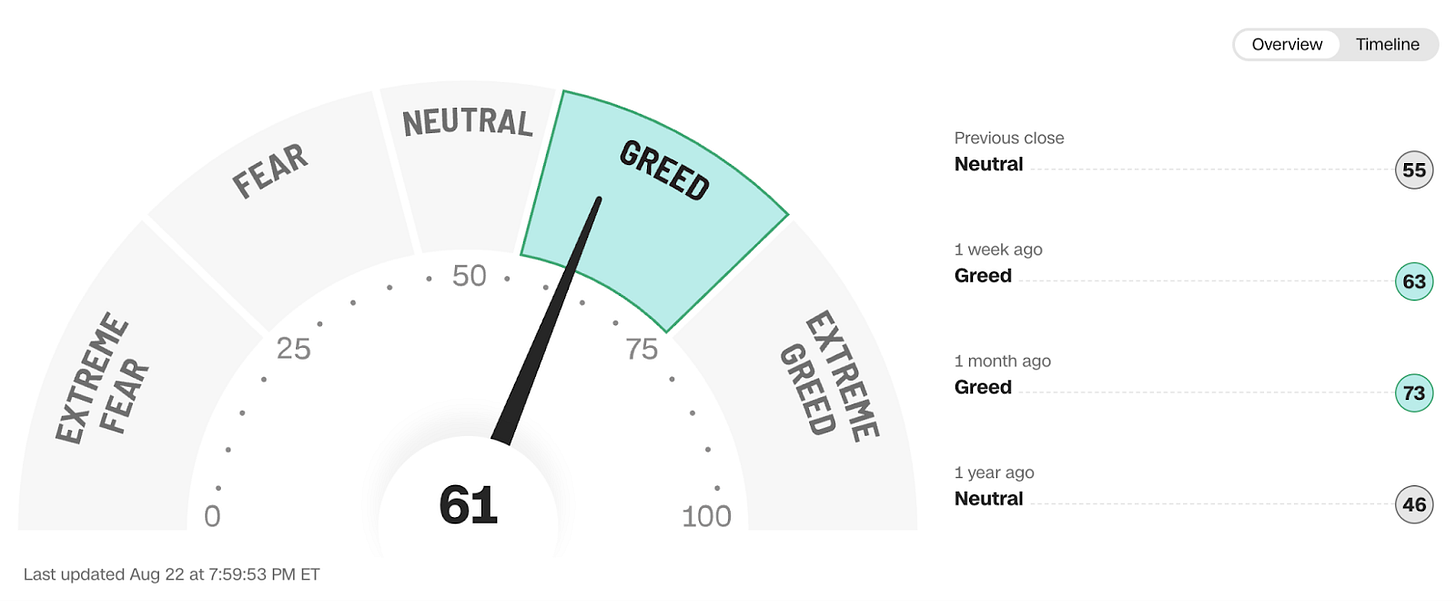

The fear and greed index dropped a bit but remained in greed territory:

The rest of the content where I share my purchases and the news of the week for portfolio companies is reserved for paid subscribers.