The market just doesn’t care

Keysight's Q3 2025

Keysight reported (again) excellent quarterly earnings, particularly in light of the current context. The company continues to outperform market expectations in the current geopolitical environment despite being exposed to the CapEx of its customers and with a supply chain that is mostly Asia-based. If you had told me that in the current climate, a CapEx and tariff-exposed company would be accelerating its growth, I would’ve probably called you crazy, but here we are!

The market, however, was not impressed with the results, and the stock dropped significantly the next day:

This earnings season has been one of positioning (like I discussed in a recent news of the week). Companies in unfavored sectors that delivered good results were quickly repriced upwards, probably aided by short squeezes (Medpace is a good example). On the other hand, companies in “favored” sectors that delivered poor results were quickly repriced downward. I wouldn’t be able to tell you where Keysight stands across these two groups, to be honest. The company is simultaneously a “boring” company and a business that’s exposed to most of the most exciting tech innovations. Volatility has been the norm during this earnings season, and it was not going to be different for Keysight.

Without further ado, let’s start with the numbers.

The numbers

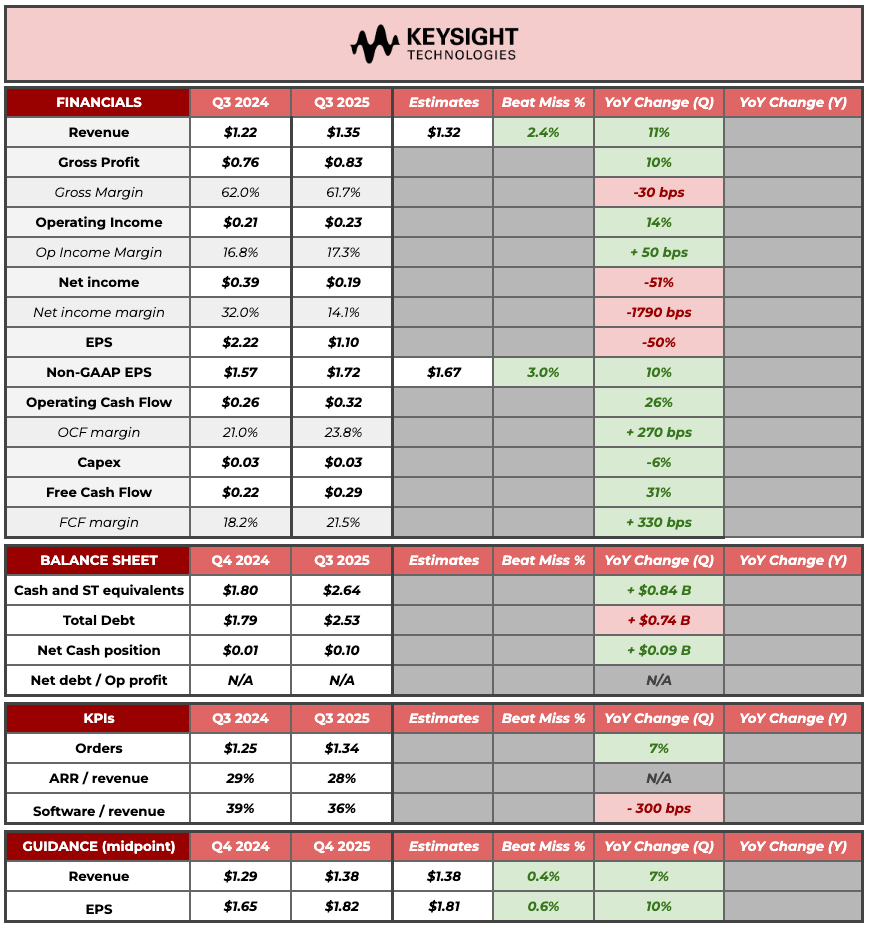

Here’s the summary table for Keysight:

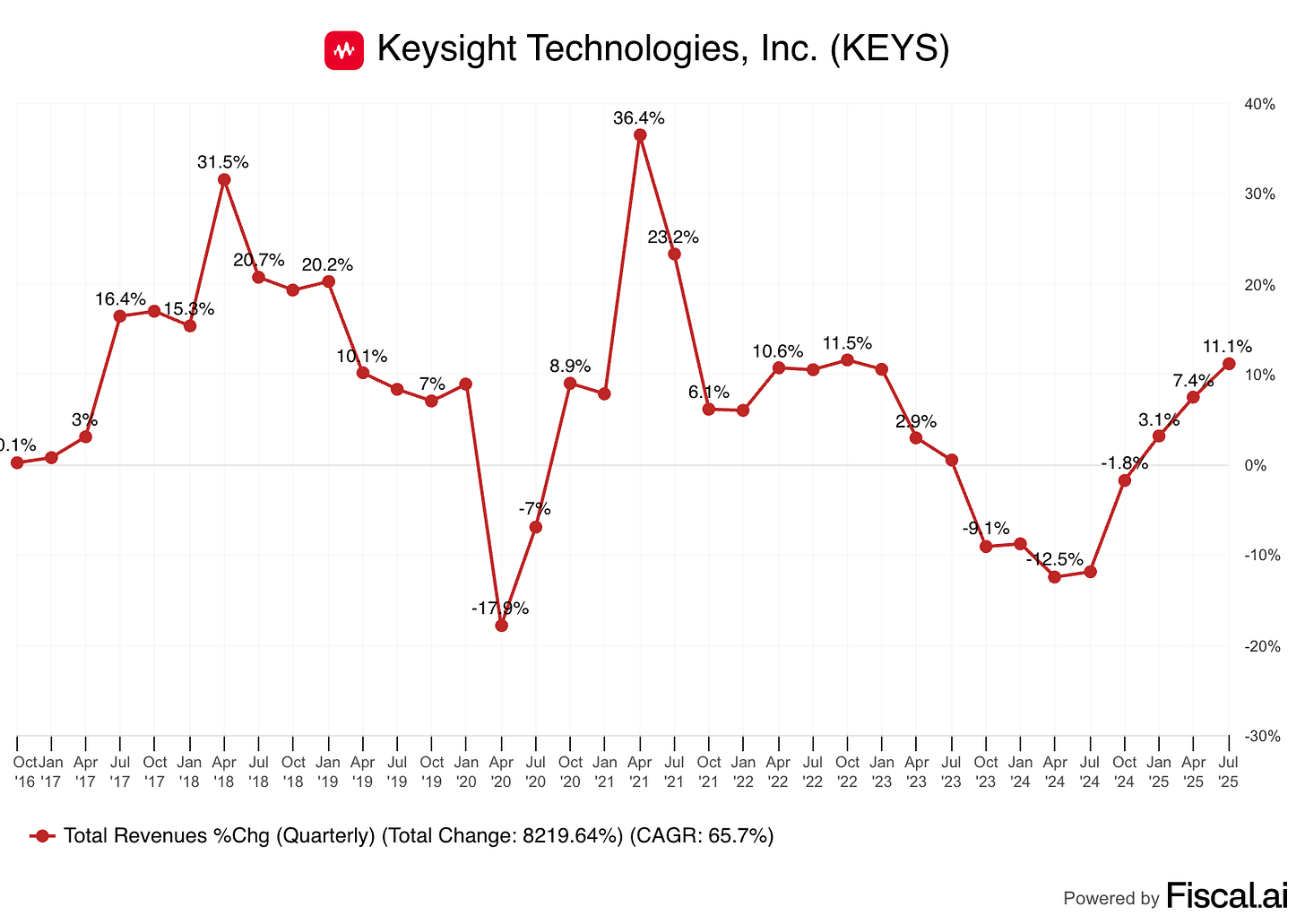

The first thing I would highlight is the state of the cycle. Revenue continued its acceleration (albeit it’s expected to somewhat decelerate in Q4 due to tougher comps and some pull forward):

What’s interesting about the current cycle is that Keysight’s growth has accelerated for three straight quarters despite two key businesses (automotive and wireless communications) not contributing much. Note that these two businesses made up a significant chunk of the company’s revenue entering the year, so the headwinds are not minor. There was, however, some good news related mainly to 6G. Management mentioned that the commercial rollout of 6G is still some years away but that they expect R&D investments to continue growing until that happens. This quote was (for me) the main highlight of the quarter:

My takeaway is that it reinforced the industry alignment from 5Gs advanced to 6Gs, which I think is a really good trend for us because it’s not a break and it’s an evolution and a flow on some of the temes we have been working with customers on.

The market has feared two things related to the arrival of 6G:

The timeline: 6G is still far away and might not contribute in a meaningful way to Keysight’s revenue anytime soon

The moat: The transition from 5G to 6G was a potentially disruptive episode for Keysight

Let’s delve into these two for a minute. The concerns were right regarding the first point: 6G will take some time until bearing fruit. This was theoretically terrible for Keysight due to its wireless exposure, but the arrival of AI lifted Keysight’s wireline business. This means that the outcome of the concerns (a growth stall) has not really materialized (i.e., Keysight has demonstrated that its business is much more than “just” 6G).

The second point was a valid concern. Keysight was not a meaningful player in 4G, and it was the transition into 5G that allowed the company to build the leading position it has today. Now…the admission that 6G will be more of a continuation of advanced 5G than a truly disruptive technology ultimately means that the disruption risk has gone down materially.

What the market might not have liked much is that, despite management now expecting to land at the high end of its mid-term growth outlook in 2025, they were pretty conservative with their 2026 commentary, alluding to the current environment. They did, however, say some positive words:

The feeling around the building is that we’re bullish going into 2026.

Note that Spirent is also something to consider going into 2026. Management now expects the acquisition to close in Q4 FY 2025, meaning that it will have a full-year impact in 2026. Recall that Spirent will most likely…

Accelerate growth temporarily

Lower margins temporarily

Another thing that might have spooked the market was the book-to-bill ratio. Keysight’s backlog grew 7% year over year, resulting in a book-to-bill ratio of 0.99. This theoretically means that Keysight is eating into its order book and might signal trouble ahead. However, management said something that might help explain the book-to-bill:

We actually had a reasonably large integration deal where we got customer acceptance literally on the last day of Q3. So that elevated and drove some of the outperformance in the third quarter, but obviously pulled that out of Q4 and muted the sequential seasonality from Q3 to Q4 versus what we would typically see.

This means that this event likely drove the Q3 beat, and it’s the reason why Q4 guidance was in line and not above market expectations. Note that all this quarterly “game” is great for headlines, but we can see how Keysight is really performing when we zoom out. Management expected 5% top-line growth and 10% EPS growth in February when the stock was trading at $173. The company now expects 7% top-line growth and 13% EPS growth (despite tariffs) for FY 2025, and the stock is trading 10% cheaper! I’ll revisit the valuation in more detail at the end of the article.

Regardless of short-term visibility and fears, we must not forget Keysight is exposed to a good chunk of the most promising innovations of the future (we should try not to miss the forest for the trees), like AI, quantum computing, Autonomous Vehicles, Robotics, 6G, non-terrestrial networks…

Understanding profitability

The topics of profitability and tariffs also deserve some attention. GAAP net income and EPS dropped considerably, but the drop was related to volatility regarding taxes (it’s much more normalized on a non-GAAP basis and on a GAAP basis over the first 9 months). Now, some analysts questioned management about the margin drop-through. Back during Investor Day, Keysight’s management claimed that, if they were within their 5-7% growth guidance, the company should experience a 40% drop-through to operating profit. That is not going to happen this year, BUT due to tariffs.

Keysight expects an additional $75 million impact to its tariff outlook from the August announcement, bringing the total to $150 million. Management argues that tariff remediation measures will start to bear fruit early next year and that if we ignore these increased costs, then they are delivering above the 40% incrementals shared during investor day. This is pretty easy to fact-check. At the end of Q1 (February) when Liberation Day had not even happened, management guided for 5% revenue growth and 10% EPS growth. After $150 million in increased costs stemming from tariffs, management is now guiding to 13% EPS growth, so it does seem that underlying incrementals are higher than the model would suggest!

Incrementals for Keysight are going to be quite attractive for several reasons. First and most straightforward, the company is coming out of the cycle and it’s a fixed cost business. Secondly, because software and services will most likely make up a larger portion of revenue going forward. Note that the proportion of software and revenue has barely budged over the last 12 months, but there’s a caveat. Over the last twelve months, the company has also recovered from the cycle, meaning that software and service have continued growing at a good pace all throughout.