Why isn't Adobe's stock working?

Not much has changed for Adobe over the last 3 months. Despite delivering yet another beat-beat-raise quarter, the market remains skeptical regarding the company’s role in an AI-driven world. After initially shooting up in after-hours by almost 6%, the stock is now trading below where it was before reporting Q3 numbers and remains down 50% or so from its ATHs:

This is kind of a crazy stat, but…over the past 5 years, the stock has declined by 26% despite Free Cash Flow per share roughly doubling (16% CAGR). While it’s undeniable that the stock might have been expensive at the start of these 5 years, there undoubtedly seems to be a disconnect between fundamentals and the stock price. The reason behind the “disconnect” is easy to pinpoint: many investors and the market at large believe that the rise of generative AI has permanently impaired Adobe’s business. While this is a fair concern, we must not forget that the first generative AI models were launched in 2022, and Adobe has continued to grow at a good pace as these have been improved and iterated. Many are now wondering what Adobe needs for the stock to “start working,” which is a topic I’ll discuss in more detail later.

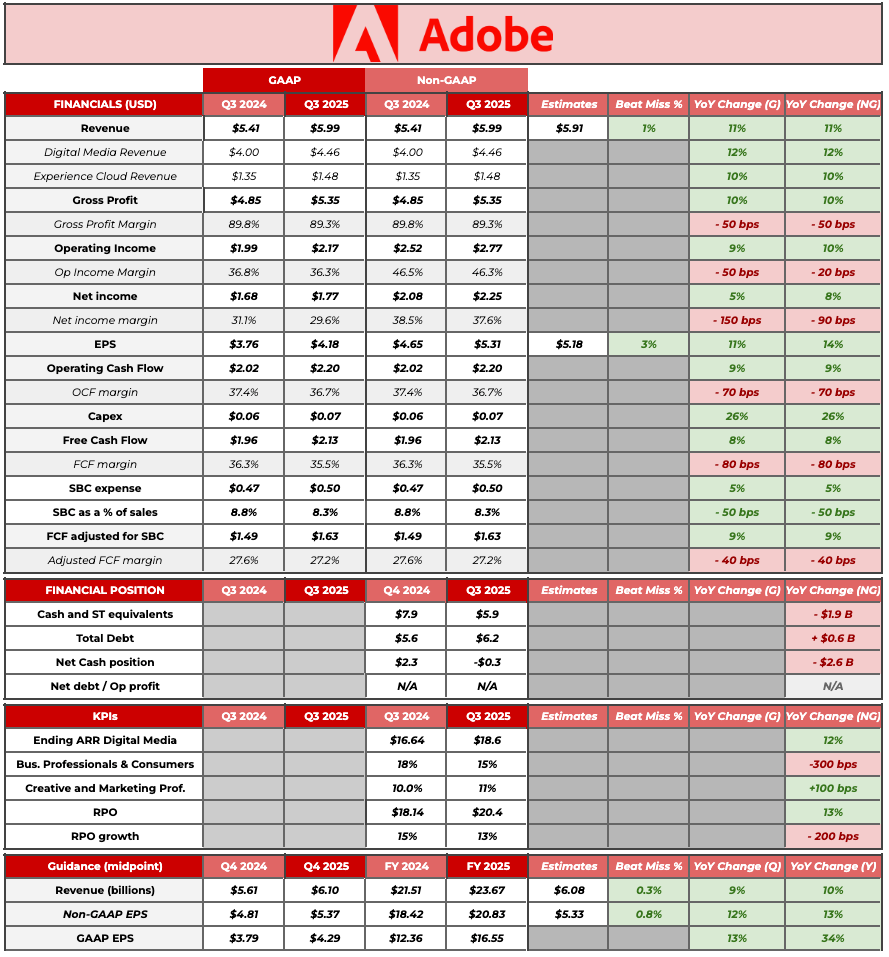

Before that, let’s look at some numbers. This is Adobe’s summary table:

Several things stood out to me from the financials. The first (and good) one was that Adobe continued growing at a double-digit clip despite the “noise.” Growth fell below 10% in Q3 2023 but has remained above double digits since. An analyst pointed out that this quarter might have been an inflection point for Adobe in terms of growth, as net new Digital Media ARR did not decrease:

I would say, a turning point quarter for you guys. It was the first quarter, I think, where Net New DM ARR actually was flat to maybe even growing for the first time this year on a tougher comp.

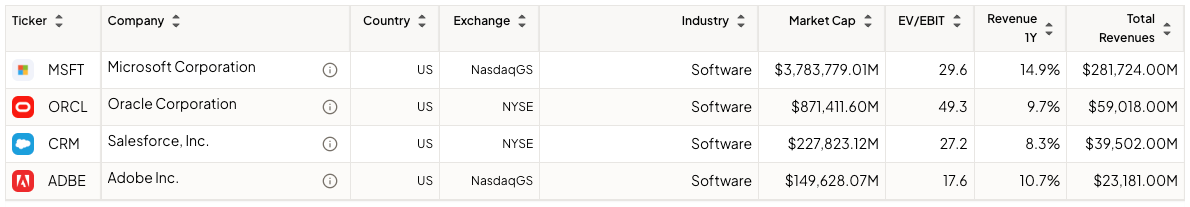

Just to contextualize this feat…Adobe and Microsoft are the only IT services software businesses that are generating more than $20 billion in revenue and are growing double digits across the US and Canada. There are numerous differences between the two companies, such as the valuation. Adobe is trading at an EV/EBIT of 17x, whereas Microsoft is trading at 29x (I am not implying this is entirely unfair). Lowering the growth rate brings more players to the table, such as Oracle and Salesforce. Both are currently growing slower than Adobe while trading at meaningfully higher valuation multiples (further portraying that the market believes there’s a terminal risk to Adobe’s business):

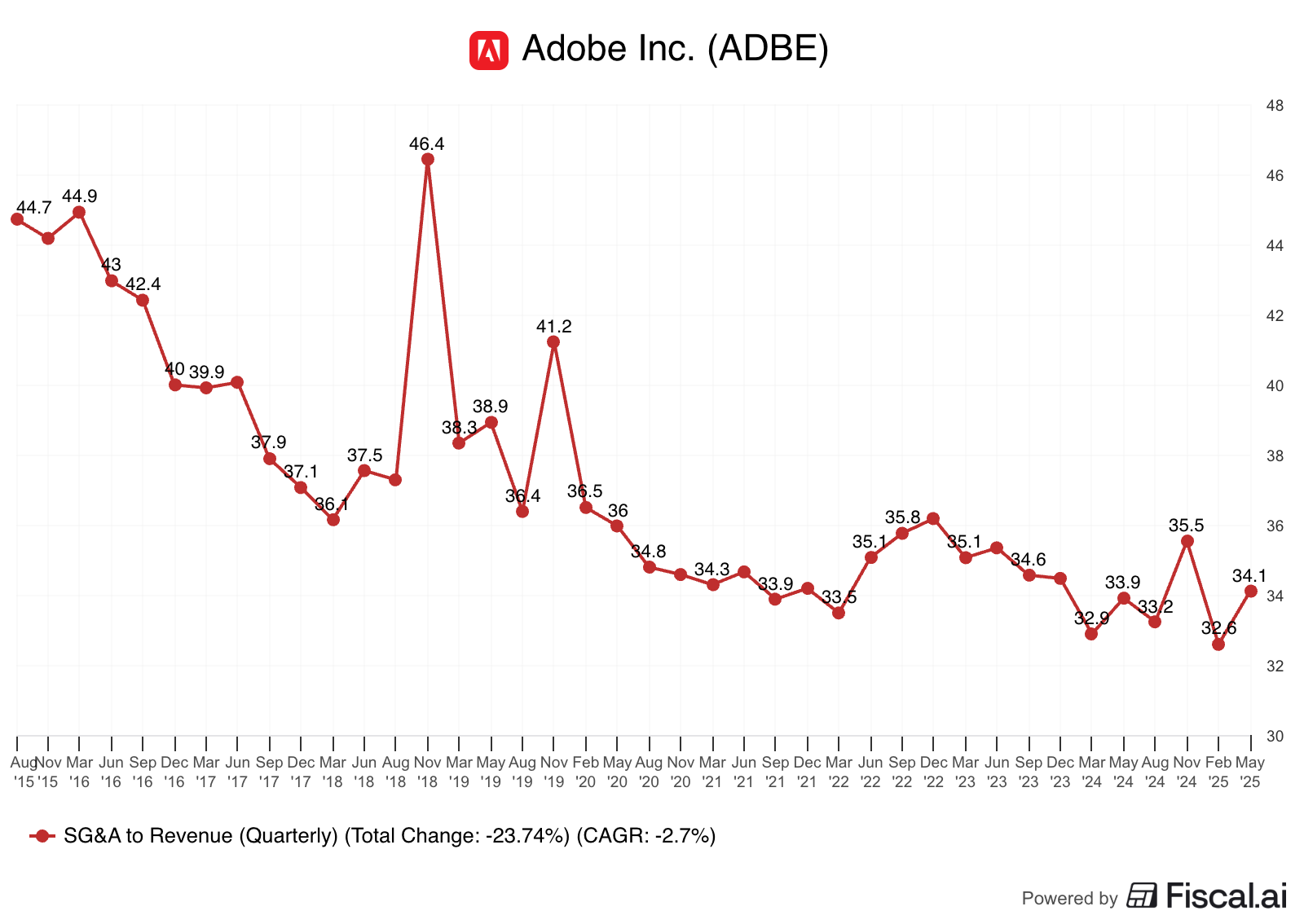

Now, when we go down through the income statement, we see that the operating margin actually decreased slightly in Q3. This margin contraction was related to a 15% increase in sales and marketing. At first glance, I would’ve said that this is somewhat worrying because it might signal an increase in competitive intensity, leading Adobe to spend more marketing dollars to achieve one additional unit of revenue growth. However, before rushing to this conclusion, I decided to take a look at what S&M has done lately to see if there’s a trend.

The increase in sales and marketing is much more measured over the first 9 months of Adobe’s fiscal year: +12.5%. This might portray that it was more related to timing, but it’s still ahead of revenue growth. If I were to plot out SG&A to revenue, I would “conclude” that what happened this quarter was more of an outlier than a general trend (albeit it’s definitely something to monitor):

I believe there are a couple of plausible explanations for the higher sales and marketing expenses. The first one that comes to mind is AI and the fact that Adobe is still in the early phases of driving its adoption rather than its monetization. This obviously means that Adobe might be spending marketing dollars that are not generating equivalent revenue dollars (at least not yet). The good news here is that adoption seems to be going well:

Over 14,000 organizations added Express in Q3 alone, a 4x increase in the quarter versus a year ago. Express usage within Acrobat nearly doubled quarter over quarter.

Consumption of Firefly services and custom models grew 32% and 68% quarter over quarter, respectively.

Firefly App continues to attract next-gen creators with first-time Adobe subscribers through the app growing 20% quarter over quarter.

There are definitely reasons to be optimistic about AI usage, as well as about monetization. During MAX 2025, management estimated around $250 million of direct AI revenue this year. They shared that they had already achieved this in Q3 (although they did not share the exact number), so even though AI monetization is not where the market wants it to be, it’s definitely showing some green shoots.

Another reason why S&M might be growing ahead of revenue is that the customer mix and the nature of Adobe’s business are shifting in favor of large enterprises. As these deals are more multi-year in nature, it might occur that Adobe is spending today's S&M dollars to realize more revenue in the future. Total RPOs continued growing ahead of current RPOs, which might signal that contracts are indeed becoming more long-term in nature. This is good because it’s where Adobe has a “right to win”:

Strong 60% year-over-year growth in cross-cloud deals, demonstrating the value of the Adobe integrated platform, including Gen Studio.

Intuit is an excellent example of the value that Adobe can bring to the table. Let’s not forget that Intuit is an “AI-first” organization that has been investing in the technology for at least 7 years. If there’s someone who can take full advantage of AI or look for cheaper alternatives, it’s probably Intuit. Now, from following both Intuit and Adobe, I found something interesting. Intuit has been mentioning for a while that they’ve “changed and improved the way they do marketing thanks to AI” (I’m paraphrasing here). This might be a coincidence, but Adobe has, over the past few quarters, mentioned Intuit as both a creative and digital experience customer win. The “One Adobe” value proposition seems to be resonating with enterprises. The stat below refers to Digital Experience, but we should not forget that Digital Experience is simply another step in Adobe’s value proposition for Enterprises:

Over 40% of our top 50 enterprise accounts doubled their ARR spend since the start of FY 2023.

It’s also worth noting that custom Firefly models (those where the customer is training Firefly with their proprietary assets) are growing at a tremendous pace (68% QoQ). These models likely resonate with enterprises and likely increase switching costs to third-party models quite significantly.

Management once again tried to explain why they don’t view third-party generative models as a threat to the whole ecosystem and used the example of Nano Banana:

All the demos that are out there that people are using Nano Banana with Photoshop, they’re doing in it in a way that they’re building the precision and the control you get with Photoshop and combining it with the generative capabilities of Nano Banana.

This quote is quite literally the Adobe “thesis” when it comes to AI: third-party models are not a threat because they can’t replace the E2E value proposition, but they can potentially be a tailwind because more digital content ends up making its way through to Adobe’s interfaces. There may be hints of this showing up in the data, as Adobe’s customers don’t seem to care much about the third-party model but about having control once the model has generated something:

Certainly within the product, the majority of generation continues to be Firefly, given the commercial safety and the underpinning of what that is.

The thing that we have seen is a direct correlation between increased use of AI and retention.

There’s also the argument that AI will make designers much more productive and therefore Adobe will suffer “seat headwinds.” I wouldn’t say this is an immediate concern for two main reasons:

As enterprises make up a larger portion of Adobe’s pie, pricing will likely transition to being value-based rather than seats-based (i.e., it’s unlikely that One Adobe deals are based solely on seats)

Other companies are already flagging that, rather than doing the same with fewer people, they are doing more with the same people

Out of these two, I’d say that the first one is more likely to play out than the second one.

Why is Adobe not moving?

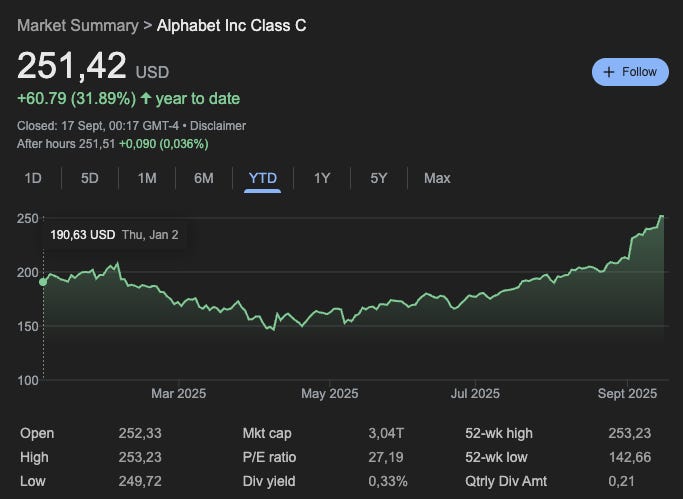

The question any investor/market participant is asking themselves is…if Adobe is trading at one of the lowest valuations it has traded in years while delivering double-digit top and bottom line growth, why is the stock not “working”? The reason may be that Adobe might need a catalyst (even if minor) for sentiment to improve, and Google might be a good precedent here.

For many months, Google was seen as an AI loser. The argument was that LLMs would completely disrupt search and, therefore, that Google would forfeit significant revenue and profits. This was the dominant narrative until a few weeks ago, when a judge ruled that, despite being a monopoly, Google would not have to divest Chrome. This, together with the growing recognition that Google’s LLMs are better than those of the competition and that Google is not losing the AI race, was enough to shift sentiment on its head completely. Google’s stock is now up 31% year to date and a whopping 72% from the April lows (so much for “there is no alpha in large caps”). Of course, the narrative has now shifted (following price), and Google is now seen as an AI winner:

I believe Adobe’s shareholders might be feeling similarly to what Google shareholders were feeling a while ago. Fundamentals are going in the right direction, but the stock is languishing…until something suddenly changes. Now, the natural follow-up is…what will be Adobe’s inflection? I don't have a direct answer, but I believe it might be revealed during the Q4 earnings when management shares its FY 2026 guidance. Up to now, AI has not had a noticeable impact on Adobe’s business, but the market is likely waiting to see what management thinks about next year.

Note that markets are very pro-cyclical and sentiment tends to shift on a dime. Many people wait until the inflection arrives to jump on board, but the reality is that timing inflections is pretty much impossible, and you’ll probably be left behind when they happen. I’m sure that happened to a lot of people with Google. Now, I am not trying to imply that Adobe is free of risk and that the inflection to the upside will definitely happen. AI has indeed made the future murkier, but Adobe is trading at a pretty low valuation for a double-digit EPS grower (the lowest in its peer group), and management is retiring around 4-5% of the shares outstanding every year. I don’t know what the outcome will be, but I do believe the risk/reward is favorable here (or else I would not have a position).

Note that the time from today until the potential inflection is the period during which Adobe must continue repurchasing shares. There are still around $8.4 billion left in the repurchase program, and management is basically spending all operating cash flow (and some more) on buybacks. This has resulted in Adobe’s financial position “worsening,” but this is a very recurring business with extremely low levels of net leverage.

I don’t know what Adobe will have in store for us going forward, but I do believe that it’s becoming sort of a coiled spring to the upside. Nobody expects sentiment to shift…until it does and then everyone becomes a follower. That, in my opinion, can happen next quarter.

Have a great day,

Leandro

First of all, this was very good. I'm biased, but this mirrors much of my thinking when I added $ADBE to my watchlist. You said "what will be Adobe’s inflection?...it might be revealed during the Q4 earnings when management shares its FY 2026 guidance". That's my guess too.

Also, the Google comparison feels spot on. The earnings multiple has contracted and is staying low because investors doubt the future. With each earnings release, if earnings hold up, then the stock will be forced to re-rate. Adobe could easily be on the "Best of 2026" lists a year from now.

I agree with your thesis, I started a position last week following two posts of mine. I also think it's worth mentioning Adobe is integrating external Gen-AI models into its product suite. Adobe has the distribution (750 Digital Media MAUs) and so AI businesses go to Adobe for customers.

In addition to that, Adobe's CEO has mentioned numerous times that Gen-AI expands the addressable market instead of eroding it. It lowers the barriers to be creative and it serves as the first step in the creative process (ideation), which is now possible within Adobe's suite.