What is the market worried about?

Zoetis' Q2 2025

Zoetis reported a beat-beat-raise quarter this week, but the market portrayed a version of its bipolarity. Zoetis’ stock was up almost 10% in the pre-market, but ended the day 3% down! I’ve been investing for a while, and (outside of meme stocks or stocks with very tight liquidity) I struggle to remember experiencing a 13% fade on a $60 billion+ company. This is one of the things I “love” about the stock market: you never know how it’s going to surprise you.

The company’s stock is hovering around 52-week lows and has been dead money for more than 5 years. Barring purchases at the pandemic peak and considering dividends, the stock has not been a disaster for investors in terms of permanent capital losses, but it has definitely resulted in significant opportunity cost:

Zoetis’ valuation was very stretched at the pandemic peak, but due to continued growth and multiple compression, it’s currently trading at an LTM EV/EBIT of 19x and a NTM EV/EBIT of 18x (both significantly below the company’s LT average):

Something that adds insult to injury is that, after following a similar pattern to that of Zoetis, IDEXX (one of Zoetis’ public “peers”), reported outstanding earnings and saw its stock pop significantly on those. IDEXX might not have beaten the market over the last 5 years, but it has definitely not been dead money either!

Now, what we must understand here is whether Zoetis being close to 52-week and 5-year lows is warranted or whether the market might be missing something. Before understanding what might have caused the 13% fade, let’s take a look at the numbers.

Zoetis delivered a pretty good quarter, beating top and bottom line estimates and slightly raising its organic guidance after a strong first half:

Zoetis reports both organic-operational and reported revenue growth because it’s exposed to currency (derives a significant chunk of its revenue in international markets, so a weaker dollar is a headwind), and it recently spun out its MFA business. The company reported organic operational growth of 8% in Q2, which ignores the impact of FX and the divestiture of the MFA business (livestock in the US was down 21% on a reported basis due to said divestiture, but only down 2% on an organic operational basis). On a global basis, however, livestock is outperforming expectations (not the case in Companion).

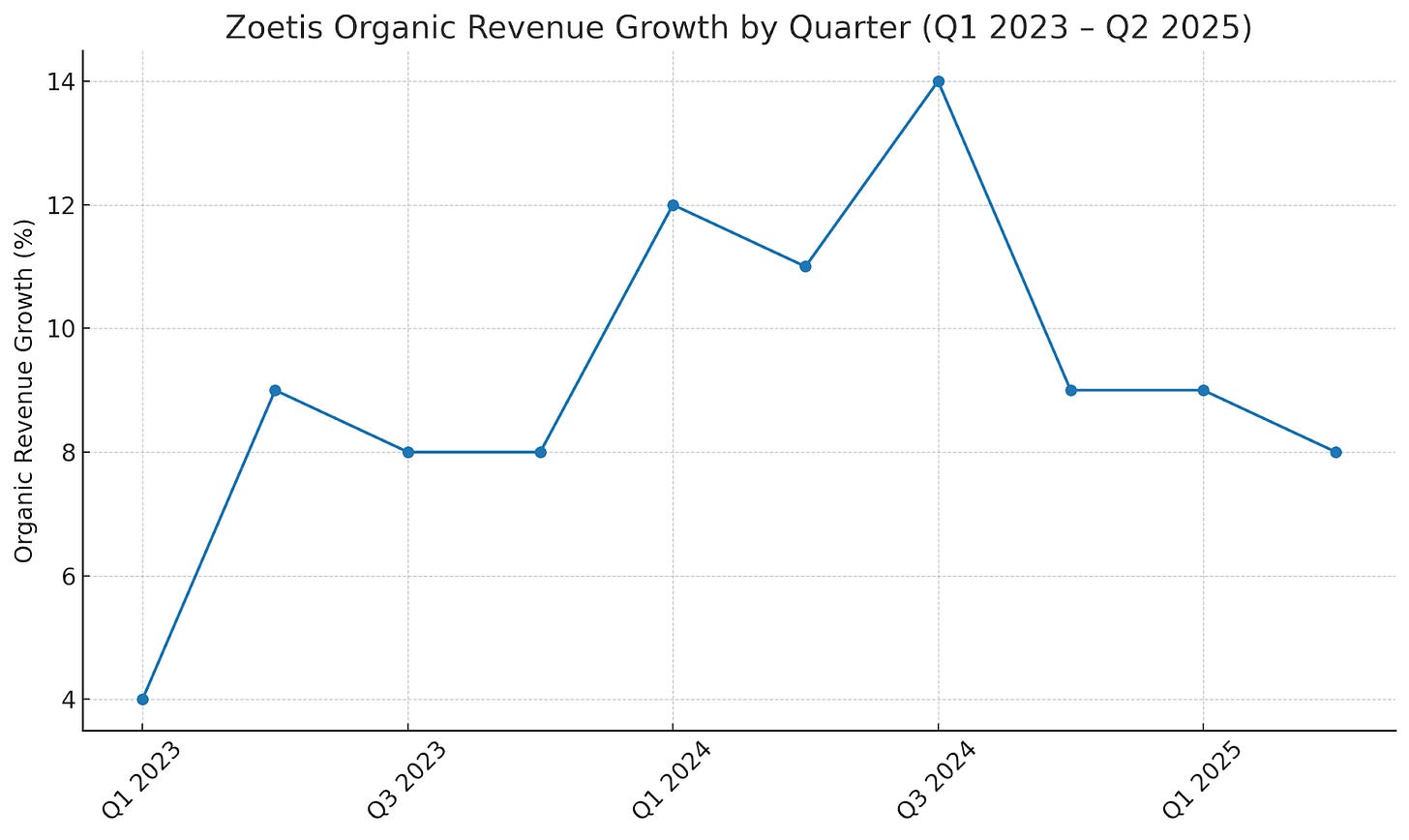

If we zoom out to look at Zoetis’ organic revenue, we can see that growth has remained at a good level despite pain MABs going from a tailwind to a headwind (I’ll discuss this in more detail later). This has probably been aided by an outperforming livestock segment and the continued growth of key franchises (ex-OA pain Mabs):

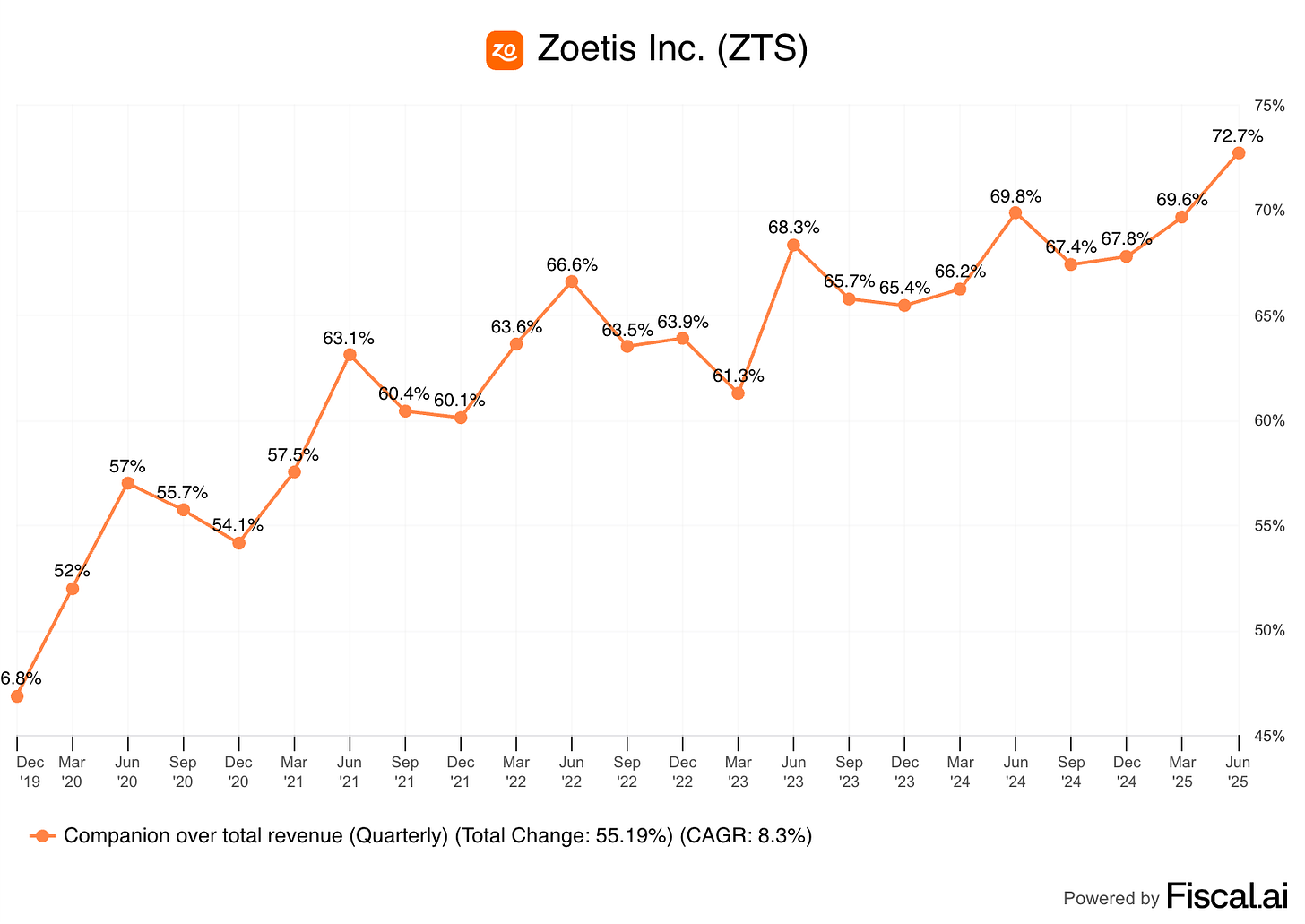

Despite being a headwind to revenue, the MFA divestiture is a tailwind to margins. The simple reason is that it was previously dilutive to gross margins. Companion now makes up almost 73% of total revenue, and these products tend to come with significantly higher margins:

Another thing worth pointing out regarding margins is that some of the margin expansion might be temporary. The reason is that R&D growth has significantly dropped over the past couple of quarters:

Management claims timing issues caused this drop. This explanation makes sense because quarterly R&D growth is pretty volatile, but it’s definitely something we should take into account when looking at quarterly margins.

So, if the company reported apparently good earnings delivering a beat-beat-raise and good organic growth, what did the market dislike? I have no clue if this is what investors are truly worried about, but it makes sense to me! Let’s take a deeper look at the growth drivers.

The market’s worries

As discussed above, I don’t know exactly what caused the market’s concern, but I do feel it’s related to Librela and competition. More so, I believe the topic that underpins the market’s worries is “just” competition, which also somewhat includes Librela. So, a couple of quarters ago, the market (myself included) was pretty optimistic on Librela due to a straightforward reason: it was a much better solution for OA pain than the alternative (NSAIDs), and it would have virtually no competition for a prolonged period. This ultimately meant that Zoetis was poised to take pretty much 100% of the incremental growth of the OA Pain MAB market.

Now, as I’ve discussed in other articles, Librela has suffered some headwinds related to social media backlash. Some people claim that “Librela kills dogs.” This has resulted in weak performance for Librela, with sales down 7% globally and down 16% in the US this quarter. So, this ultimately means that sales of a product where Zoetis currently has a virtual monopoly are suffering due to factors beyond competition. Note that Zoetis is not standing still and is doing several things to change course. The first one is that it’s working on new data around Librela so vets can make a more informed decision. Secondly (and probably most importantly), management reiterated their expectations to get approval this year for a new OA Pain MAB with a lower dose that would be more long-acting than Librela. Zoetis typically takes around 3-4 months from approval to launch.

Neither of these things are likely to impact revenue in 2025, but we might see things change in 2026. Now, even though Zoetis will suffer this headwind in 2025, management reiterated its expectation for double-digit growth across its key franchises (dermatology, parasiticides, and OA pain MABs). We already know that OA Pain MABs will most likely be a significant headwind to double-digit growth this year, which ultimately means that dermatology and parasiticides have to “step up.” This is where I believe that the market is a bit skeptical.

The reason is that Zoetis’ parasiticides franchise has been suffering competition for a while, and dermatology (Apoquel) is expected to suffer competition this year (first timer). This means derm and parasiticides are not “monopolies” and therefore visibility is lower. Zoetis argues that competition is not as relevant as people think for two reasons: incumbency and white space. The rationale is that, because markets are mostly underpenetrated, competition helps Zoetis drive awareness and define a new standard of care where Zoetis is the incumbent. They gave several examples of how increasing competitive intensity in the past has not impaired growth and has helped them grow the category:

“Our Simparica Franchise, for example, grew 17% operationally even after nearly two years of competition. With new entrants, the overall category continues to expand, fueled in part by increased promotional activity that is raising awareness of the benefits of triple combination protection. These efforts are often reinforcing our leadership.”

“More than 10 years since launch and with over 12 million dogs treated, our key dermatology franchise continues to deliver growing 11% operationally.”

“And as expected, our business continues to grow above the market despite increasing competition across two of our key franchises.”

“Despite intense competition, Simparica Trio has not experienced year-over-year patient share loss since competition launched almost two years ago.”

“We continue to see minimal patient share impacts due to competition.”

Management doesn’t believe that it will be different this time, but there’s no denying that competition is intensifying. Under a scenario where the market was crowded (doesn’t seem to be the case right now), I would definitely be worried. For example, in Apoquel, Zoetis has already converted a significant portion of its customers to Apoquel Chewable, which will remain differentiated against new entrants. To this, we must add that a good chunk of the market is still using collars and not solutions like Apoquel or Cytopoint, so there’s still a lot of whitespace to go after.

The historical data shows that competition has been a non-issue for Zoetis in the past, but I can understand why the market would be worried here. In a couple of quarters, we have gone from:

No expected competition in the near term for Zoetis’ derm franchise

Strong Librela sales (which Zoetis takes full advantage of due to having a monopoly)

To…

Expected competition for the derm franchise

Soft Librela sales caused by issues other than competition

I would say that the environment and visibility are worse now, so I kind of understand the skepticism. Now, my POV here is that this is likely to be more related to perception than facts. Zoetis has shown over the years that it can “fence off” competition thanks to its incumbent position and “ever-expanding” markets, and I don’t see why it would be different this time. In addition to this, we must not forget that there’s a new OA Pain MAB in the pipeline and that current treatments (NSAIDs) remain inappropriate solutions.

We’ll see what happens in the second half of the year, but I believe it’s pretty impressive that Zoetis slightly raised its organic growth guidance in the face of these headwinds. Management also reiterated that guidance takes into account the impact of competition in the second half, although there’s no denying that this impact is likely to be more noticeable in 2026. To this, we must add that we don’t really know when the new OA Pain MAB approval will happen, and therefore, we don’t know how much of an impact it will have on 2025 (guide doesn’t assume any new approvals) and 2026 numbers.

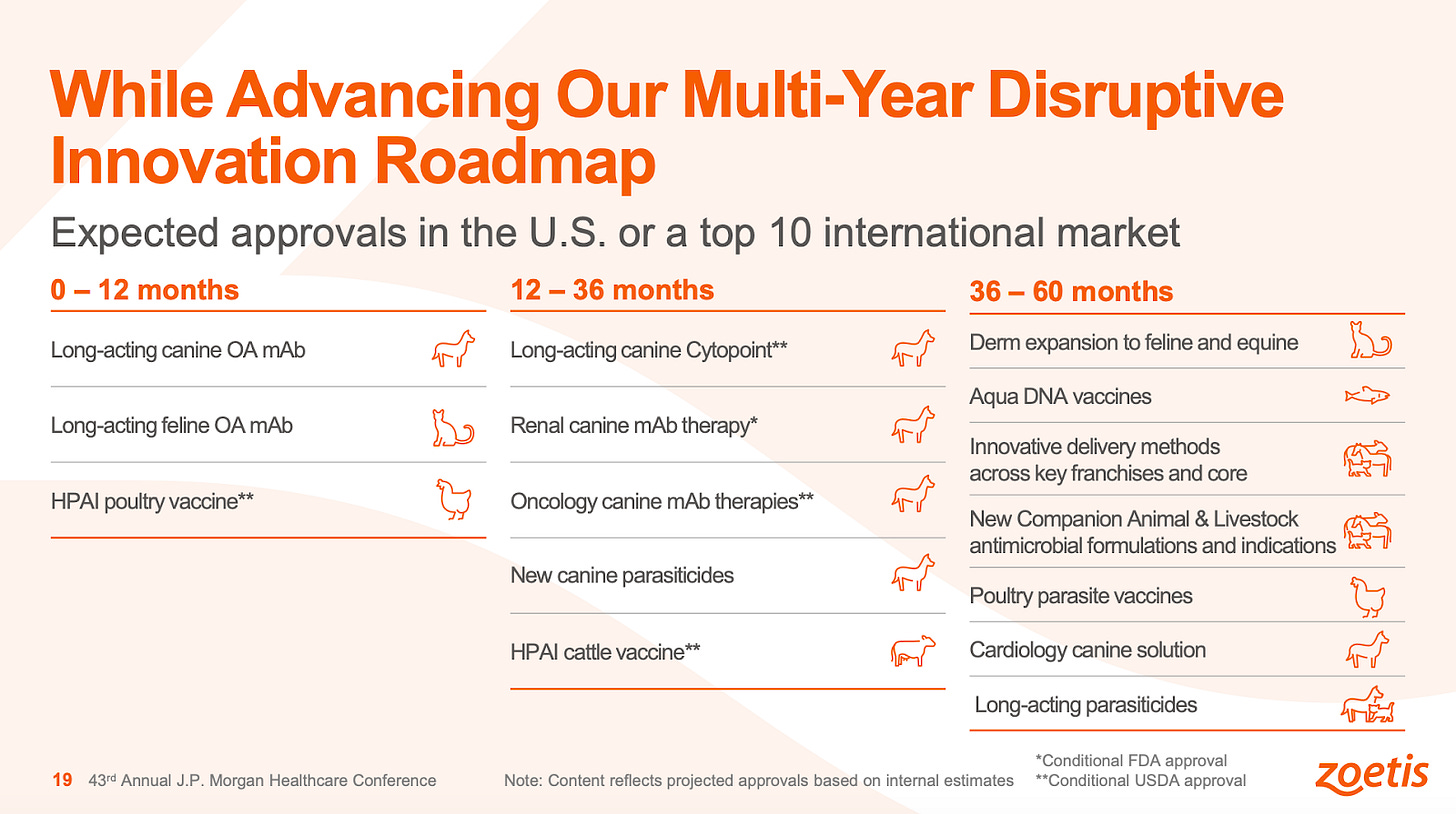

While there’s uncertainty around 2025/2026, at least we know that Zoetis still has a pretty rich pipeline of products coming to market over the coming years:

These are unlikely to have a significant impact over the short to medium term, so Zoetis needs to dissipate (again) the doubts regarding competition for the market to regain confidence.

Now, with all this said, I can’t say I am happy with the execution here. The problems that Librela is facing today were being surfaced many quarters ago (at least some initial clues), so management should’ve been proactive rather than reactive in solving these. I suspect management knew there were some problems related to Librela, or else they wouldn’t have developed a new OA pain MAB without Librela reaching critical scale.

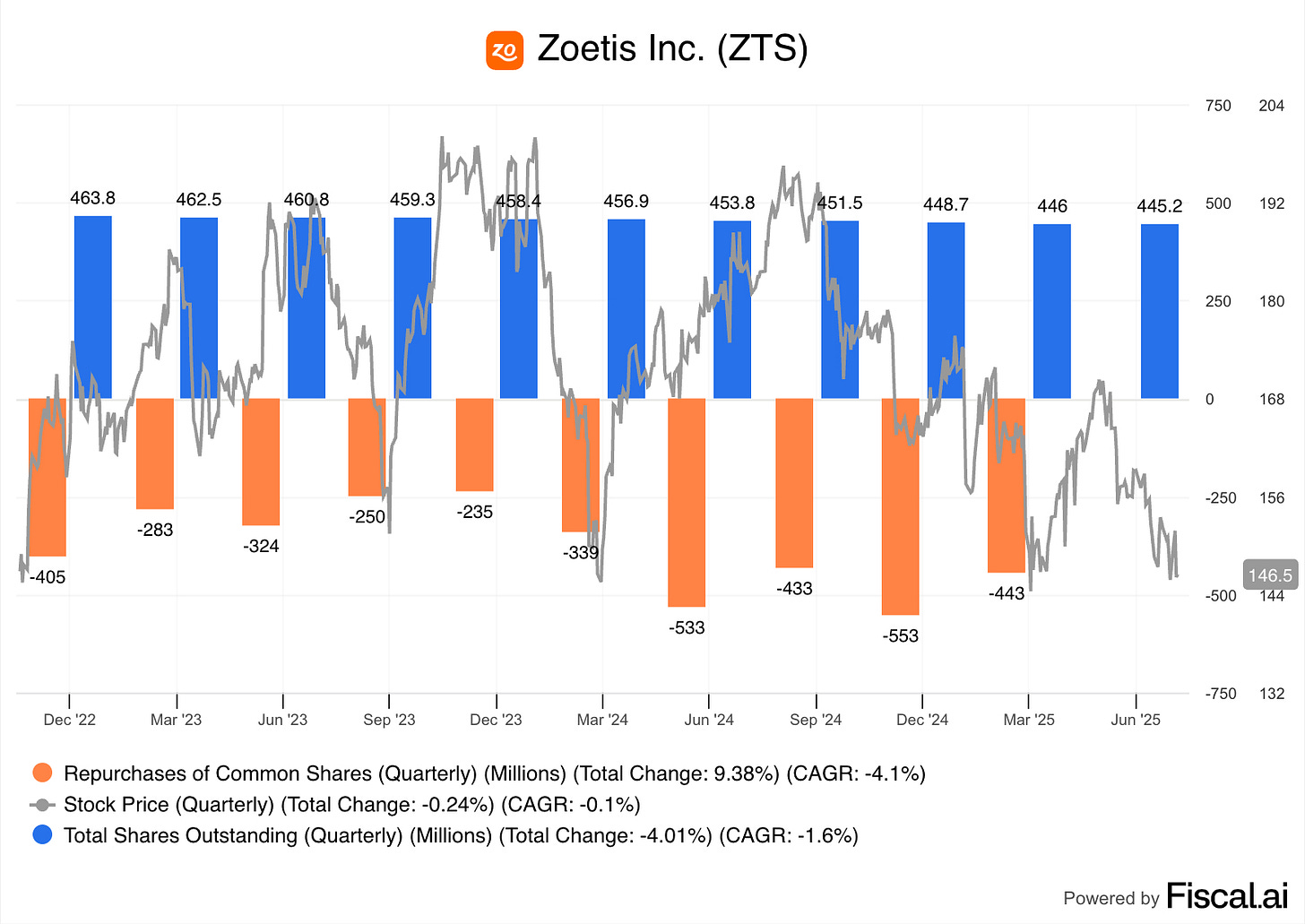

The “good” news I see from a lagging stock price perspective (if there is any) is that it is giving management the chance to continue their ongoing buyback. Zoetis has accelerated buybacks over the past few quarters and has reduced its shares outstanding by around 2% over the last year:

Taking a look at the valuation

As discussed above, Zoetis has been dead money for 5 years due to a high starting valuation, but its valuation now lies significantly below its historical average, and this is what has happened in the meantime:

Revenue has grown at a 6% CAGR (despite the MFA divestiture)

Operating profit has grown at a 7% CAGR

Shares outstanding are down 6%

While I do acknowledge that the multiple at the start of the period was likely too high and that the market might be worried about the things I discussed above, the key question here is:

Is Zoetis still a buy?