“We are retooling the business for AI-driven growth.”

Adobe's Q2

Adobe’s shares dropped considerably on Friday despite the company reporting a beat-beat-raise quarter on Thursday:

It’s undeniable that investor sentiment remains poor due to concerns about AI potentially disrupting the business. I’ll explain in this article why I don’t think the numbers portray that Adobe is a dying company, but it definitely won’t be easy for sentiment to improve. This is what I wrote in last quarter’s earnings digest:

It seems like the market will need one of two things to look through this AI “risk”:

A significant beat in the company’s numbers in any given quarter

A prolonged period of the AI risk not playing out

Due to Adobe’s predictability, I believe #1 is unlikely. #2 will take time, but I think it’s the most likely scenario here. The company suffered a similar scenario when it transitioned to a SaaS model over a decade ago. The market believed this transition would be a net negative for Adobe as it would lower switching costs without a significant TAM expansion to compensate for it. The stock price was flat from 2010 to 2012 as revenue decelerated following the transition, while the S&P 500 was up around 20% during that time frame.

My “hunch” has not changed: I still believe that (if anything) we will see #2 play out because the judge will probably take some time to reach a verdict.

Adobe’s quarter

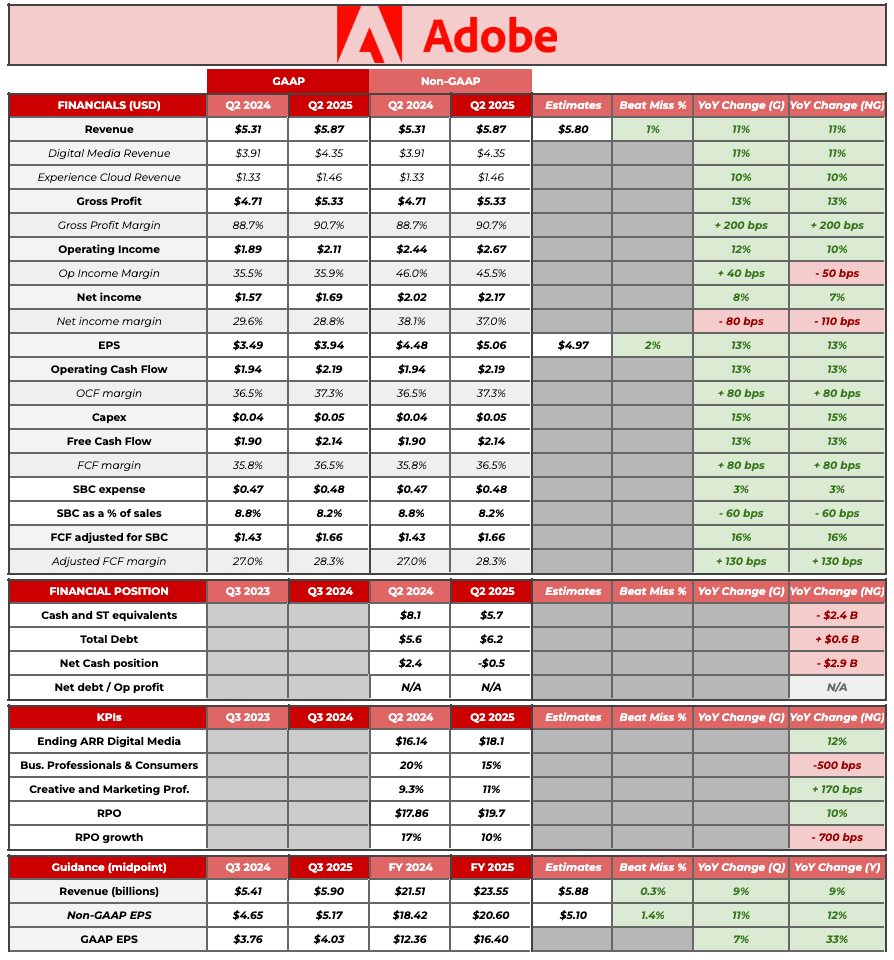

This is Adobe’s summary table: