Trump vs. Musk And Why Retail is Hard (NOTW#46)

Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Both indices rose again this week, despite the high volatility. When I started Best Anchor Stocks, I made a commitment to publish a weekly article with updates and news, but I feared that I would run out of things to discuss. Although this has happened occasionally, I must say that the Trump administration is making it somewhat easier to find topics to discuss in these weekly articles. I also discuss why retail is hard in the brief market commentary.

Without further ado, let’s get on with it.

The new podcast episode

I published a new podcast this week: ‘How JAPAN became INVISIBLE without losing DOMINANCE w/ Ulrike Schaede.’ We discuss Japan’s business transformation and how the country has managed to remain a key player in global supply chains while largely disappearing from the sights of end consumers.

You can listen to the episode on Spotify/Apple Podcasts:

Or watch it on YouTube:

Articles coming next week

Besides the podcast transcript, I did not publish any articles this week. The reason was that I continued working on my Trupanion in-depth report that I expect to publish next week. I’ll leave a teaser here…

Trupanion expanded into the US market in 2008, grew significantly in this market throughout the 2000s, and eventually IPOed in 2014. Revenue is up 36x (31% CAGR) since 2011 despite the pet insurance market in the US remaining grossly underpenetrated today. Trupanion’s historical growth trajectory and future opportunities are undeniable, but not all that glitters is gold in the business. Trupanion has (by far) the best value proposition in the pet insurance industry, but does this make it the best model? In my opinion, this is the key question to answer.

This in-depth report will be the 12th in-depth report since I launched the paid subscription on Substack (almost exactly one year ago):

Deere $DE (free)

FRP Holdings FRPH 0.00%↑

Five Below $FIVE

Diageo $DEO

Hermès $HESAY

Atlas Copco $ATCO.B

Stevanato $STVN (free)

Keysight $KEYS

Zoetis $ZTS

Judges Scientific $JDG.L

Medpace $MEDP

If you want to have access to all past and future in-depth reports, don’t hesitate to join hundreds of paid subscribers:

Market Overview

It was yet another volatile week in the market. Both the S&P 500 and the Nasdaq suffered a significant drop on Thursday but recovered toward the end of the week to end up in positive territory:

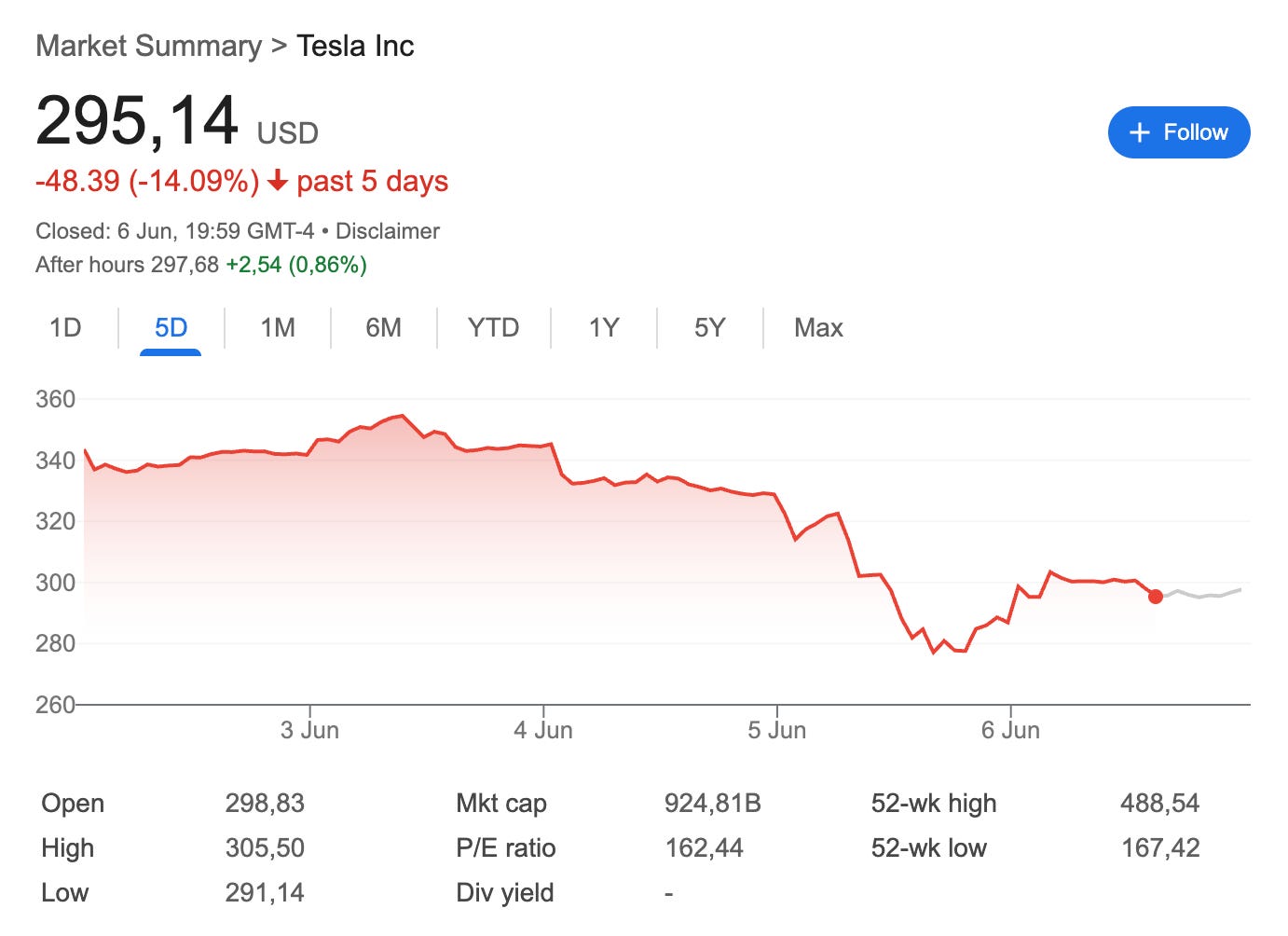

Probably the highlight of the week was the “battle” between Trump and Elon Musk (two grown-ups, by the way). Over the past few weeks, Elon has completely distanced himself from the Trump administration, and even though it initially seemed like a positive farewell, things don’t seem to have ended on a good note. Elon accused Trump of being a pedophile, while Trump threatened Elon with ending all of his government contracts. The funniest thing about all of this (IF there is something funny about two grown-ups behaving like children) is that it all took place on social media. Anyways, as expected, the shares of Tesla dropped 14% the day this battle took place, and being Tesla one of the largest publicly-traded companies, the indices suffered too:

While this might be a controversial opinion, and while I believe Elon is an outsider and likely a genius, he is the type of CEO I struggle to invest with. Investing is tough, and not knowing what the person in charge of managing one’s money will do next complicates the process further. This is evidently a personal opinion, and investors should put their money where they feel comfortable (I know a lot of investors who hold conviction in Elon Musk, no matter what he does outside of Tesla). I personally value stability and focus, and I don’t think I would be getting any of these with Elon. This doesn’t mean that Tesla won’t succeed from here, though (this is what I like about investing - there are many portfolios that will yield satisfactory returns).

Yet another place where I struggle to invest in is the retail industry. Why? The short answer is that I have some fresh scars (i.e., I lost money not long ago). The long answer is that I believe the industry, in most cases, struggles to add value over the long term (i.e., I don’t think durability is the defining characteristic of the industry). This, of course, doesn’t mean there are no exceptions, but these exceptions don’t change much: on average, it’s tough to consistently add value in the retail industry. This is actually something I discussed with François Rochon when I interviewed him:

I mean, in the retail industry it has been very hard to find permanent winners. I mean, there are some, one example I think is TJX (TJX). They've been in this niche of selling clothes at very low prices. But, that's one exception because the general experience of many retailers has been very tough.

The question here is: why? The answer is capitalism. Retail tends to suffer from low barriers to entry, and its success is largely based on customer preferences. If history has shown anything, it's that customer preferences can shift quickly, and absent barriers to entry, this means there is always an opportunity for a competitor or a new trend to emerge. What typically drives outperformance in the retail industry is a mix of a strong brand and excellent execution. The brand can be a competitive advantage, but I believe this was more the case when only the largest brands could afford mass marketing. Let’s not forget that before the advent of social media, only large corporations had the resources to invest in marketing, which was primarily done through television. We have experienced a paradigm shift over the last decade or so where any company can market their products on social media with small budgets, and if done correctly, these marketing campaigns can go viral.

On the second point (execution), I’d say this is a non-durable competitive advantage because it’s mostly dependent on a management team that comes and goes. All this said, I do believe there are two spaces within the retail industry where sustainable value creation can be long-lived:

Those were scale is an entry barrier (mostly applicable to non-discretionary retail), ideally when the benefits of scale are shared with the consumer (Amazon and Costco model)

True luxury (Hermes, Ferrari…)

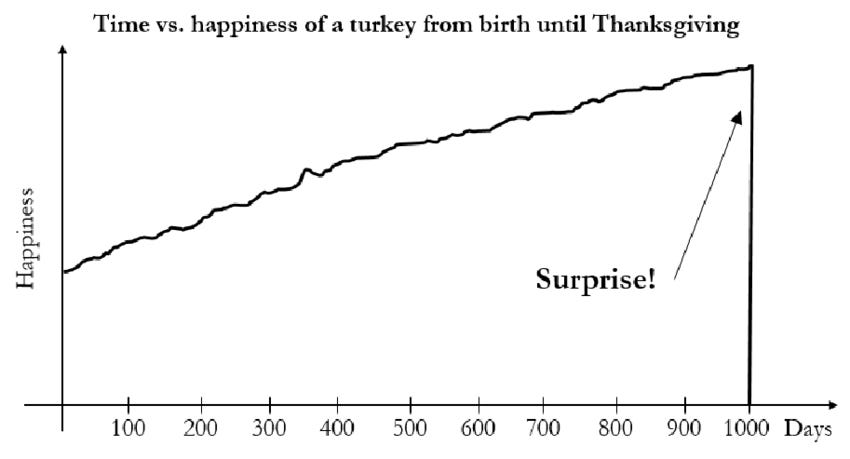

In the first case, barriers are significantly higher than for the average retail company. In the second case, brand is not a thing of access to marketing distribution channels but rather something that has been built over a century. Outside of these, I struggle to trust durable and persistent value creation in the retail industry. The fact is that there is a lot of potential reward in retail: a well-executed model can scale quickly and profitably. To this, we must add the fact that retail is very “approachable” because many investors will feel safer investing in something they know and understand. However, I do feel that it ultimately comes down to the Turkey paradox:

I always remember this quote by David Giroux, which I think is very applicable to the Turkey paradox (I have probably paraphrased it):

A company that doesn’t distribute dividends, grows its FCF per share at a 10% clip over a decade, and goes bankrupt in year 10, is worth $0 today.

The industry map was pretty much green this week, with the exception of Tesla:

The fear and greed index remained in greed territory:

The rest of the content where I discuss my transactions and the news of the week is reserved for paid subscribers