The power of delaying gratification

A challenging topic but critical for long-term investors

Hi reader,

Over the past two weeks, I have taken the chance to rest some days with my family and friends (as most of you), and I have seized the opportunity to reflect on the first year of Best Anchor Stocks. Investing is all about the future, but looking back is crucial for any investor, as it should help us understand if we are still on the right path going forward or have deviated from it. One of the things I have reflected on is the concept of delayed gratification, and I thought it was a good idea to write a short article on it.

Without further ado, let’s jump in directly.

The choice between immediate and delayed gratification

There are many ways to make money in the stock market but finding the way that suits you and sticking to it is arguably more important than the strategy as such. We have all heard about that friend or relative who changed their approach at the bottom, thinking that they were doing something wrong, while in reality, they probably just needed patience. And I don’t blame them because the concept of delayed gratification is one of the most complex things about investing.

When we invest, we are making decisions today that we will only be able to judge some years down the road. Assuming a certain level of patience, this doesn’t sound very challenging, but what if you were to receive a constant stream of signals along the way screaming that you might be wrong? Then the story is different.

Add to this constant stream that we are not used to waiting for a long time to understand the outcome of our decisions. We are used to receiving immediate feedback on things we do, and this immediacy is even more present today than it was 10 or 20 years ago. Social media and the internet have created an immediate feedback loop, which has arguably increased the search for immediate gratification at the expense of delayed gratification. If one uploads a photo to Instagram or writes a tweet on Twitter, we expect to see people reacting to it immediately. When news about a potentially disruptive threat to a company gets to the headlines, many investors respond almost immediately too. Humans strive to shorten the time between an event and its outcome, which can have disastrous consequences for investing.

I have to be honest here; this immediacy is arguably not created entirely by social media and the internet. The search for immediate gratification is not new, it’s human nature. Take, for example, an everyday situation. If we are doing something risky and fall, our body automatically lets us know through the nervous system that it wasn’t the right choice. The same applies if you are exercising incorrectly. Your body will generate pain to let you know you are doing something wrong, and it will not take long for you to realize. Don’t get me wrong, in this case, immediacy is a blessing.

Most of you will know about Stanford’s famous Marshmallow experiment, where 32 kids faced the choice of immediate or delayed gratification. The findings were the following:

When the children thought about the absent rewards, it was just as difficult to delay gratification as when the reward items were directly in front of them. Conversely, when the children in the experiment waited for the reward and it was not visibly present, they were able to wait longer and attain the preferred reward.

The bottom line is that it's much easier to delay gratification if we don’t constantly think about the reward or if we don’t have it in front of our eyes. There’s only one problem, though: the investment industry is not of help in this regard. Stock prices are quoted daily, which means we get to continuously see what reward we would get if we were to sell our positions today.

The investment industry goes as far as to use immediate gratification as a marketing tool. Many professional investors aim to increase AUM (Assets Under Management) by trying to convince people that achieving a positive return every year is possible and that there’s a way to outperform the market consistently. I don’t blame them. The incentives clearly push you to chase performance every year, and this is precisely why remaining independent is such a critical edge.

Not outperforming the market for 1 or 2 years has little to no implication for individual investors but determines the income of many professional investors. The incentive system is just not built for long-term investing, but rather than criticize this, it’s better if we welcome it as it allows independent investors to outperform without spending millions on research.

This week I read someone on Twitter claiming that Wall Street has been “selling” buy and hold for decades, and I couldn’t help myself and chuckled. It’s precisely in the best interest of Wall Street to discourage buy and hold, as the money made through transaction fees is too large to ignore and the “AUM war” is all that matters.

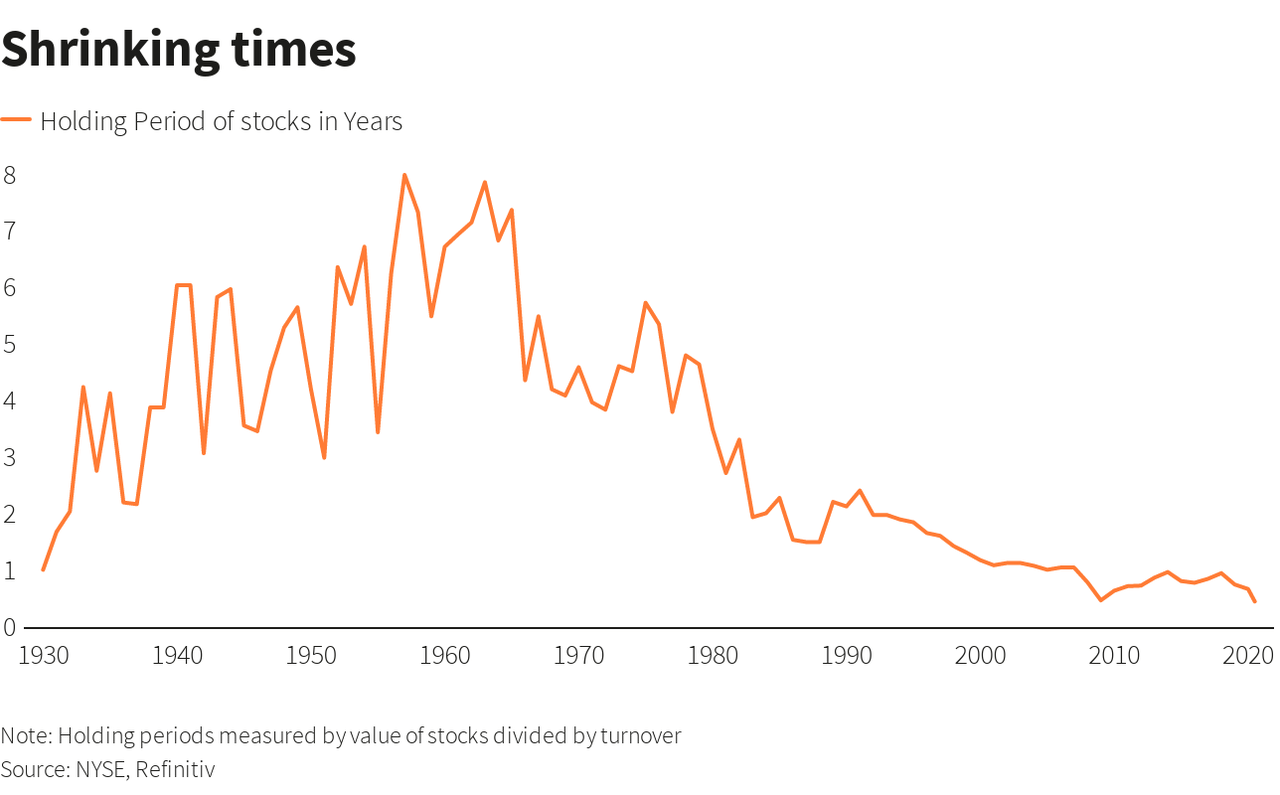

If Wall Street “sells” buy and hold, why does this chart look like it does?

Part of the answer definitely lies in human emotions but arguably a good deal of that chart looking the way it does originates from Wall Street’s incentive system. More transactions means more revenue for many financial firms, and the “AUM war” makes it almost impossible to follow a long-term investing strategy where underperformance in any given year is inevitable. I want to remark that not all is Wall Street’s incentive system, human emotion plays an important role too.

Even though Best Anchor Stocks is a research service, I acknowledge that prospective subscribers will end up making a judgment about the performance of my portfolio and that it will ultimately determine to a certain extent, the number of subscribers. Bad portfolio performance in any given year could bring fewer signups and higher churn. I’m prepared for this. Still, I try to abstract from this as much as possible, as the collateral costs of focusing on the short-term monetary incentives would arguably be much higher. Changing the strategy midway would bring not only poor long-term performance but also misaligned subscribers, and honestly, it would deviate me from the path I have chosen to pursue.

It’s pretty challenging to really invest for the long term when the industry that you have been given constantly pushes you to do the opposite. The good news is that this landscape leaves some white space for investors willing to delay gratification and behave as owners of the businesses they invest in. Of course, some professional investors have built funds that are not affected by short-termism. One such fund is François Rochon’s Giverny Capital which has compounded at 15%+ for almost three decades. His secret? Besides understanding what a business is worth and being patient, sticking to his strategy and building an aligned investor base that was not lured by the standard in the investment industry was arguably important too. Another such example is Terry Smith’s Fundsmith.

You only have to look at the Forbes list of billionaires to see that it’s flooded with business owners, not short-term speculators. With this, I am not saying that buying great companies at reasonable prices is the only way to make money, but it does seem to be the most proven source of wealth creation. It all goes back to Nick Sleep’s question:

Why is it that no one but the Walton family owned Walmart all the way through?

The answer is not one that someone should give you; it’s one you should find for yourself. My interpretation is that only those investors who behave like owners are really positioned to participate in the wealth creation of great companies. These principles guide Best Anchor Stocks, and I expect them to do so for many years to come.

It’s also very important to understand that delaying gratification is not a function of the market’s current state. Long-term investors should behave like long-term investors on the way up and on the way down. It wouldn’t be fair to expand our investment horizons (i.e., delay gratification) when we are in the red and take immediate gratification when we are in the green. Selling too early can have more disastrous consequences than selling too late.

In the meantime, keep growing!

If you enjoyed this article please take a minute to read the articles we have uploaded previously and, of course, if you like what you see, be sure to subscribe!

Great graph! There's indeed little money to be made by the intermediaries if they convince people to trade less..