The Mystery Behind Silent Compounders (NOTW#23)

Just a heads up, I am currently running a Black Friday 30% (forever discount) at Best Anchor Stocks. This means you can get the subscription for less than 80 cents a day (or $274/year).

The discount runs through December 2nd (Cyber Monday), so there are barely three days left to take advantage of it:

The discount gets you…

Access to all the content

Access to all past deep dives

Access to my portfolio and transactions

Access to a private community

+ more to come in the future

My friends at Finchat are also offering a Black Friday discount, so you can use my affiliate link to take advantage of a 25% discount off any plan (previously 15%). Finchat is the platform I personally use for all my needs and I find it not only quite comprehensive but also easy to use!

With that, let’s jump right into the article!

Hi reader,

It was an “uneventful week” for the market due to Thanksgiving. Indices barely did anything, and there was very little (if any) “breaking” news. I wanted, however, to use this Thanksgiving NOTW to talk about an interesting topic: silent compounders. I discuss this topic, among others, in the market overview.

Without further ado, let’s get on with it.

Articles (and podcast) of the week

I published two articles this week, both earnings digests and pretty much with all the content for free. The first one was Deere’s Q4 earnings digest. The company continues to be immersed in the agricultural downcycle, but it’s pretty evident that the next peak (whenever it comes) promises to be a much more profitable one. The market seems to be waking up to this fact.

The second article of the week was Copart’s Q1 2025 earnings digest. Copart reported exceptional earnings, aided by two large hurricanes in Florida (Helene and Milton). There were many other highlights (especially around the non-insurance business), and the stock reacted very positively despite an already hefty valuation.

I also published a new podcast, this time a special one because it was on a specific company: Palantir (PLTR). I was lucky to have Arny Trezzi come on the show to discuss what the company does, its competitive advantages, and its valuation (among other things). You can listen to the episode on Spotify or Apple Podcasts or watch it on YouTube:

Market Overview

Both indices were positive during Thanksgiving week. The S&P 500 rose 0.8%, whereas the Nasdaq rose slightly less:

It never is an uneventful week for the market, but this week might be as close as it gets. Few companies make “important” announcements during Thanksgiving week, and trading volume tends to be pretty low. Yes, algorithms also go on a break from time to time!

News and trading flows fuel short-term market movements, so it’s normal to have a relatively calm week when both are absent. Thanksgiving week might be the closest we’ll ever get to what a market filled with long-term investors might look like!

Noise is always a given in financial markets, and investing in companies out of the spotlight is an advantage that’s not widely discussed. A long-only-fundamental investor’s gains will come from two sources:

Finding winners

Holding on to these for a long time, allowing compounding to do its work

Many focus on #1 but tend to disregard #2 (even if unconsciously), believing that they can easily weather noise and volatility and, therefore, hold on to their positions for many years. While the ability to remain emotionless toward volatility is an excellent trait for any long-term investor, it’s probably something one is born with. For those people who are not born with it, there are a couple of ways they can make it easier on themselves.

The first way is evidently not looking at one’s portfolio every day. The second and probably most effective one is investing in companies that are not subject (at least not to the same extent) to the constant news flow and the noise that’s inherently tied to financial markets. It’s inevitable that if an investor chooses a winner, the stock will eventually become popular (that’s just how human nature works), but you’d be surprised how many long-term winners have been able to remain out of the spotlight for years (even decades). 3 or 4 years ago, not many (myself included) knew about Constellation Software despite the company having compounded at a 30% clip for over a decade. Despite Constellation appearing popular today, this is by no means the reality when one moves out of the “X bubble.”

Another good example is Texas Pacific Land Corporation (TPL), which has compounded at a 43% clip over the last decade! Have you ever heard of this company? You might’ve, but the average investor has not.

Copart (CPRT) is yet another good example here. The company has CAGRd at a 30% clip over the past decade despite not constantly appearing in financial magazines.

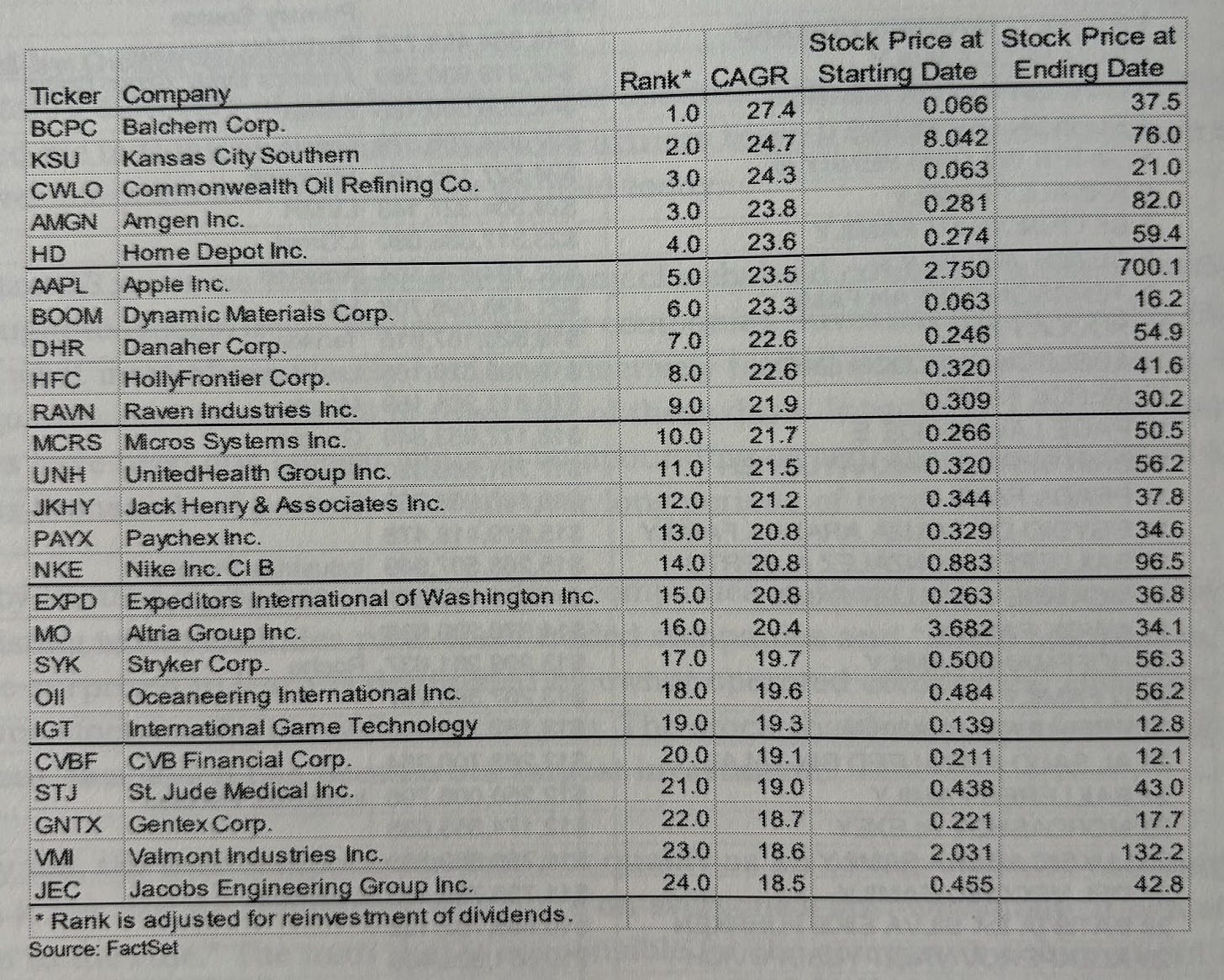

There are hundreds of examples in financial markets just like these, and the most extreme example is probably Balchem (BCPC). I came across Balchem while reading Santa Monica Partners’ letters and discovered it had been the best-performing stock for over 26 years (1986-2012), compounding at a 27.4% CAGR. This is the complete list in case you are interested:

2012 took place a while ago, and while the rate of compounding has certainly slowed, the company has managed to compound at a 16.3% CAGR over the last 12 years.

I like to call these kind of companies the silent compounders (I’m sure I am not the only one!). As a side note, it’s funny how the word “compounders” now enjoys a negative connotation on X when it’s what basically every investor is trying to find/achieve: compounding of their wealth. Why would a company that does that for you be viewed negatively? No clue, but that’s what seems to be happening.

An investor holding Copart, Texas Pacific Land Corporation, Constellation Software, and Balchem would’ve done spectacularly well over the last decade. The better news is that they would’ve probably been able to hold these without much hesitation, as they were not constantly exposed to controversy and noise (TPL might be an exception among these due to several corporate governance issues). The even better news is that, despite this lack of noise, Mr.Market always ended up giving opportunities to purchase these stocks at attractive valuations and, most importantly, recognizing their value over the long term.

The question here is:

Why does this happen?

My straight answer is that I don’t know, but there might be some commonalities across these companies that make them stay out of the spotlight while delivering spectacular returns.

The first commonality is they tend to operate in boring industries. There’s nothing exciting about buying “shitty” VMS companies on the cheap or on owning land or processing salvage yards. Try talking about these topics with an average individual investor or friend, and wait till they start rolling their eyes or changing topics (it usually doesn’t take long!). In short: these are not “story” stocks, so the media tends to avoid them like the plague. To this, we must add that there are rarely noticeable innovations in such industries, so there’s an absence of relevant topics to discuss (something that definitely doesn’t hold true in the “tech” industry).

The second commonality might be non-promotional CEOs who refuse to play Wall Street’s game. The companies above (except Balchem) do not…

Provide guidance

Attend many investor conferences

These are two Wall Street sins that might not fit well with appealing to the analysts of the big firms, but what does this even matter over the long term? Uncoincidentally, these companies’ management teams are focused on generating shareholder value over the long term, something they’ve done quite well in the past. Is the fact that they don’t play Wall Street’s game what allows them to outperform over the long term? There are surely more variables in the mix, but this does seem like a pretty important one!

Another reason behind the existence of these boring compounders might be Wall Street’s incentive system. Many fund managers are driven by AUM (Assets Under Management) and many clients want to see these managers invest in companies they know, not in companies they don’t know. This might drive some “overinvestment” in the most popular stocks, leaving the silent compounders out of the spotlight. Of course, this does not apply to all managers. In short, one can’t be left not owning Nvidia when it’s all over the news!

As usual in the investment world, there’s a trade-off when investing in silent compounders: you’ll unlikely have the best performance or spectacular returns in any given year. François Rochon wrote once (I can’t recall where or when) that funds that outperform over very long periods rarely make it to the top list any given year, and what I am saying here is somewhat similar. You are unlikely to achieve a 300% yearly return by investing in silent compounders, and it’s almost guaranteed you’ll be underperforming many people and the indices on any given year, but what counts here is the long-term, and that’s where silent compounders stand out.

By not investing in “hot stocks” or stocks positioned to perform the best during any given year (good luck identifying these beforehand), an investor can surely miss mouthwatering gains during any given year. Still, they should ask themselves how repeatable this process is. My hunch is that it’s not a very repeatable process, at least not for the average investor.

Understanding that I might get some pushback on this, I want to clarify that this doesn’t mean that silent compounders will always do well, and hot stocks will always do poorly over the long term. Investing is a complex endeavour, but it seems to be the case that you can build a very respectable long-term portfolio by investing in companies that the media does not care to write about. Not only will this be a fulfilling experience, but it will probably also be a relatively calm experience as you’ll manage to reduce the noise-to-signal ratio.

The industry map was mostly green, with the clear lowlight of the week being Nvidia. The “problem” with the indices being concentrated around certain companies is that when these do “poorly,” the index suffers. Of course, this is a very opportunistic comment, as the indices have done great this year precisely because companies like Nvidia are up 187% year to date!

The fear and greed index remained in greed territory:

This is all the free content for this week!